NetworkNewsWire

Editorial Coverage: With the global economy booming, the

wealthy are making the most of their earnings by buying boats.

- Yacht sales are rising, with both new and pre-owned yachts in

high demand.

- This trend is creating a boom for associated services such as

brokerages, consultancies, financing, aftermarket extended

warranties, and trailer manufacturers.

- Other boat-building businesses are also profiting, including

yacht charters, boat rental clubs and other sea-based leisure

activities that offer people a break from everyday life.

Savvy companies in the boating and yacht industry are

recognizing these unparalleled opportunities and exploring ways to

position themselves to make the most of them. Victory

Marine Holdings Corp. (OTC: VMHG) (VMHG

Profile) has expanded its brokerage team and is

looking into commissioning specially designed boats. America’s

largest retailer of yachts and recreational boats,

MarineMax, Inc. (NYSE: HZO), is expanding through

the acquisition of companies in the northeast. Malibu

Boats, Inc. (NASDAQ: MBUU) is maintaining its edge as a

manufacturer through state-of-the-art design and new technology,

including its award-winning docking trailer camera, as well as its

latest acquisition of Pursuit Boats based in Ft. Pierce, Florida,

for a sum of $100 million. The sale of a wide range of pleasure

boats has led to financial dividends for Marine Products

Corp. (NYSE: MPX). And Brunswick Corp. (NYSE:

BC) has incorporated boats into a wider set of

recreational holdings, developing new boats and new technology for

a growing market.

To view an infographic of this editorial, click here.

The Popularity of Yachts

Yachts are among the world’s greatest status symbols. Luxury

items affordable only by the wealthy, yachts represent both having

the money needed to purchase them and also having the time and the

skill to sail them — bringing great prestige to the owner. Someone

who can afford a yacht can clearly afford much more.

There are reportedly almost 4,500 individuals around the world

who own high-end “superyachts,” worth an average of

$10 million each. But there are plenty of yacht enthusiasts

living on more modest budgets, and for those who can’t own their

own yachts, rentals or charters offer opportunities to spend a few

weeks at sea.

The State of the Yacht Industry

The growing success of the yacht industry is

great news for companies such as Victory

Marine Holdings Corp. (OTC: VMHG). A surge in the

global economy has put more money in the hands of the world’s rich.

More people than ever can afford to buy and run a yacht, and many

of those individuals are looking for a chance to enjoy their money.

In America in particular, a yacht appears to be a symbol of a

happy, healthy life among the nation’s elite.

The economic upturn has led to increased sales of both new and

pre-owned yachts, each of which offers a different set of

advantages for buyers. New yachts are more expensive to buy and

insure than used models but less likely to need repairs or

refurbishment, while pre-owned yachts may need work to become ocean

ready and generally require more maintenance. This makes used

yachts a natural entry point for first-time yacht owners or those

looking for a more affordable options.

Pressure on demand is also buoying up the pre-owned market. Many

boat manufacturers are currently working at capacity, with lead times of 18 months or longer to produce a new

boat. Speed of delivery as well as price favor the pre-owned

market, on which Victory Marine Holdings subsidiary Victory Yacht

Sales is currently focused. With 25 years of experience selling

yachts in Miami, the yachting capital of the world, the company has

developed a wealth of knowledge and contacts to ensure a steady

supply of high-quality yachts to a market that keeps expanding.

Investing in a Yacht

The main reason for investing in a yacht isn’t financial, it’s

quality of life. For those who enjoy the seas, yachts are an ideal

way to get away from the pressures of the world. Whether relaxing

off the coast of a Caribbean island or racing through choppy seas,

yachts offer those on board a range of pleasures from active

sporting to gentle cruising.

Making a profit from owning a yacht is difficult without the

support and expertise of a professional yacht firm such as Victory

Yacht Sales. Upkeep costs amount

to around 10 percent of the buying price per year, meaning a

steady drain of money. And like cars, yachts depreciate in value

over time.

However, there are viable ways to make a yacht pay for itself or

even to turn a profit, including purchasing a yacht and using it

part-time but offering it as a charter vessel during times when it

is not in use. This can cover costs such as maintenance, insurance

and anchorage.

A second option is to buy a second-hand boat, renovate it and

sell it at a profit. Repainting and replacing soft goods can make a

significant difference to the value of an existing yacht, much like

flipping a house after making basic upgrades.

Whether made with an eye to a financial investment or a leisure

enjoyment, buying a yacht is a complicated business. The purchasing

process itself involves a memorandum of understanding, an offer,

financing, insurance, survey, sea trial and potential renegotiation

based on the results. Knowing what sort of boats are available and

when prices will be lowest is invaluable information. Consequently,

most buyers go through yacht brokers, specialists who understand

the details of these deals and are in demand. Victory Yacht Sales

recently added veteran broker

Gary Beaver to its team, bringing his 20 years of experience

and large portfolio of yacht listings into the company, according

to a Sept. 13 shareholder update.

Yacht Companies

For those looking to invest in yachts for profit, an even better

option may be to invest in a yacht company.

The best yacht companies don’t simply act as brokerages. They

provide all the services needed to buy, sell or run a yacht. For

example, Victory Yacht Sales does this by offering brokerage and

consultancy services as well as a range of boats. And as the market

continues to grow, the company is increasing its options.

In response to the growing demand for boats, Victory Marine is

expanding beyond its current sales of pre-owned yachts into new

models with its own custom design. “Victory Marine Holdings is

currently in negotiation with several yacht manufacturers to build

and distribute our own unique, private label design, which would

allow us to deliver a superior product in the most expeditious

fashion,” CEO Orlando Hernandez stated in the shareholder update press release. “In pursuit of this

opportunity, our management team will be visiting several

manufacturing facilities in Asia, Europe and the Middle East to

continue these talks and pursue a final deal.”

The company also owns a subsidiary, Excalibur Trailers USA,

which is soon to produce and sell custom aluminum trailers for

boats of all sizes. Excalibur recently

received approval from the Society of Automotive Engineers to

produce custom trailers for recreational boats, expanding its range

of products.

With consultancy services to help with the running of yachts, a

brokerage selling both new and used models, and subsidiaries

providing equipment such as trailers, Victory Marine Holdings is

now positioned to cover all the needs of potential yacht

owners.

A Rising Tide

The saying that “a rising tide lifts all boats” is particularly

relevant for the yacht industry, where rising demand is benefiting

a range of boat-related companies.

America’s largest retailer of yachts and recreational boats,

MarineMax, Inc. (NYSE: HZO) is using the market’s

good fortune to expand its operations. Following a successful

merger with Boston’s Russo Marine in 2016, the company is now

acquiring Bay Pointe Marina in Massachusetts.

This expands the company’s ability to provide services to its

customers, including winter storage for more than 300 boats.

Storage is one of the larger expenses of owning a yacht and a

potential valuable source of income for yacht companies.

Since its inception, state-of-the-art boat manufacturer

Malibu Boats Inc. (NASDAQ: MBUU) has been focused

on using technology to provide the best possible designs in the

boating sector. Its docking trailer camera, which improves

captains’ views of what’s happening, allows safer docking and

handling, and the company won an Innovation

Award for Safety Equipment at this year’s International Boat

Builders Exhibition and Conference. In addition, Malibu Boats is

also expanding, with the acquisition of

Pursuit Boats.

Yachts aren’t the only boats doing well in the current economic

climate. Marine Products Corp. (NYSE: MPX), a

manufacturer of jet boats, pleasure boats and outboard sport

fishing boats, has been using premium brands and an increasingly

diverse product line to capture a good share of the market. Its

success has led to regular dividends for shareholders over the past

year, as well as giving the company the cash to repurchase its own shares.

A market leader in the marine, fitness and billiards industries,

Brunswick Corp. (NYSE: BC) combines an investment

in boats with other recreational and lifestyle brands. Its Sea Ray

brand is heading to the Fort

Lauderdale International Boat Show this October to show off its

latest developments in boating technology. This includes Sea Ray

Connect, a system that provides peace of mind by letting users

check the location of their boats and the condition of the

systems.

From boats and trailers to consultancy services, the continued

strength of the global economy is providing opportunities for all

sorts of yachting and marine leisure company investment.

For more information about Victory Marine, please visit Victory Marine

Holdings Corp. (OTC: VMHG)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, (5) a full array

of corporate communications solutions, and (6) a total news

coverage solution with NNW Prime. As a

multifaceted organization with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

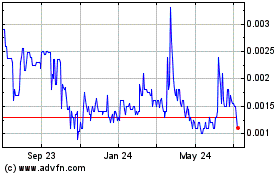

Victory Marine (PK) (USOTC:VMHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

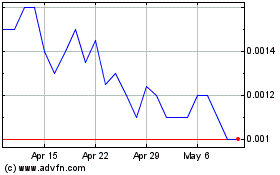

Victory Marine (PK) (USOTC:VMHG)

Historical Stock Chart

From Feb 2024 to Feb 2025