2nd UPDATE: Tokio Marine To Buy Delphi Financial In Latest Japanese Overseas Acquisition

December 21 2011 - 6:24AM

Dow Jones News

Tokio Marine Holdings Inc. (8766.TO) said Wednesday that it has

agreed to buy Delphi Financial Group Inc. (DFG) for $2.66 billion,

or Y205 billion, underscoring once again the ravenous appetite for

overseas acquisitions among Japan firms facing a strong yen and a

shrinking domestic market.

The acquisition would be the 6th biggest overseas deal by a

Japanese company this year, according to Dealogic. Under the

agreement, Japan's largest nonlife insurer by market value will pay

a 59% premium on the average price of Delphi stock held by common

shareholders over the past twelve months, Tokio Marine said. The

transaction, which would make Delphi a wholly-owned unit Tokio, is

expected to be completed in the April-June quarter of 2012, the

company said.

The acquisition, coming just days after Fujifilm Holdings Corp.

(4901.TO) announced it would buy U.S. medical-equipment maker

SonoSite Inc. for $995 million, illustrates once again how Japanese

companies are taking advantage of the yen's appreciation to

aggressively move overseas amid concerns about the shrinking market

at home. The dramatic surge in overseas interest has made Japan the

biggest cross-border acquirer behind the U.S. and U.K. this

year.

Like other sectors that are facing a saturated domestic market,

the insurance sector has been very active in overseas deals in

search of a bigger slice of market share and growth opportunities

outside of its home market in the face of headwinds in Japan, with

its shrinking population and sluggish economy.

"The weight of our overseas business is growing as the domestic

nonlife insurance industry shrinks in relative size," Tokio Marine

President Shuzo Sumi said at a press conference. He noted that the

deal will boost the company's profit sources from overseas business

activities, estimating that 46% of profits will come from

activities outside Japan after the deal, compared with the current

ratio of 37%.

"We have a list of potential targets lined up that doesn't

depend on size," Sumi said, adding that the strong yen was not the

major factor in Tokio Marine's acquisition strategy, since the

company put its list together more than a year ago.

Japan's leading nonlife insurer has already made significant

overseas acquisitions over the past few years, buying U.K. insurer

Kiln for about Y95 billion and U.S. Philadelphia Consolidated

Holding Co. for $4.7 billion in 2008.

"We'll continue seeking acquisition opportunities," Sumi

said.

Delphi is a financial services company focused on specialty

insurance and insurance-related businesses with the number of about

1900 employees.

The U.S. listed company has life insurance operations, P&C

insurance operations such as workers' compensation and absence

management services through its subsidiaries.

"Delphi is an outstanding insurance group with a strong focus on

niche business lines in the employee benefits market," Sumi said.

It racked up core premium and fee income worth $1.42 billion in the

year ended December 2010.

Tokio Marine said U.S. life insurance and casualty insurance

market is the biggest in the world with a market size valued at Y89

trillion and still has potential for future growth. The deal, it

said, will help further strengthen the company's business base in

the U.S.

Tokio Marine said it will pay $43.875 per Class A common stock,

which is owned by common shareholders and pay $52.875 per Class B

common stock, which is owned by Delphi's chairman and chief

executive Robert Rosenkranz and entities he controls. The Class B

stock has voting rights equivalent to 10 Class A common shares.

The company said it will use cash on hand and bank loans to make

the acquisition of Delphi.

Macquarie Securities advised Tokio Marine on the deal, while

Lazard advised Delphi Financial.

-By Atsuko Fukase and Hiroyuki Kachi, Dow Jones Newswires;

813-6269-2789; Hiroyuki.Kachi@dowjones.com

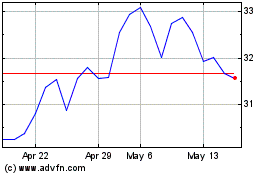

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tokio Marine (PK) (USOTC:TKOMY)

Historical Stock Chart

From Jul 2023 to Jul 2024