Law Firm Hired by Swedbank Confirms Anti-Money Laundering Shortcomings

March 23 2020 - 3:21AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--The law firm hired by Swedbank AB to investigate the

bank's potential involvement in historical money-laundering said

Monday that it found the bank had inadequate systems to manage

money-laundering risk, but that it didn't conclude that Swedbank

engaged in money laundering.

The law firm found payments to customer accounts worth 17.8

billion euros ($19.03 billion) and payments from customer accounts

worth EUR18.9 billion in the bank's Baltic subsidiaries between

2014 and 2019 that represented a high risk for money

laundering.

However, it said it cannot conclude that money laundering has

actually taken place.

Swedbank came under scrutiny in February last year after a

Swedish TV show reported that billions of dollars of potentially

illicit funds may have passed through the bank's Estonian branch.

In response, it hired law firm Clifford Chance to investigate

customers, transactions and activities from 2007 through March 2019

and how the bank handled internal and external information

disclosures.

It has also assessed Swedbank's historical response to

previously identified deficiencies.

In this work, Clifford Chance considered billions of transaction

records, around 160 million customer records, more than 38

terabytes of electronic and scanned hard copy data from Swedbank's

internal files and conducted 100 interviews of 81 people.

Clifford Chance on Monday presented its findings, saying it had

found a number of shortcomings in Swedbank's anti-money laundering

work.

It said Swedbank Estonia and Swedbank Latvia actively pursued

high-risk customers and Swedbank Estonia accepted certain high-risk

customers who had been offboarded as customers in another bank in

Estonia. High-risk customers in Baltic banking were also allowed to

open accounts in the bank's other business areas in Sweden.

Following early findings from the probe, Swedbank recently

notified the U.S. Treasury Department's Office of Foreign Assets

Control of potential sanctions violations regarding $4.8 million of

transactions.

Last week the Swedish financial supervisory authority handed

Swedbank a 4 billion-Swedish kronor ($384.5 million) fine after

finding the lender's Baltic operations had serious deficiencies in

its anti-money laundering measures as well as shortcomings in its

cooperation with the investigation.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

March 23, 2020 03:06 ET (07:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

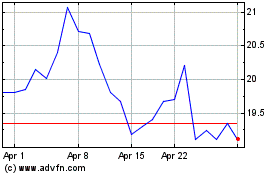

Swedbank A B (PK) (USOTC:SWDBY)

Historical Stock Chart

From Aug 2024 to Sep 2024

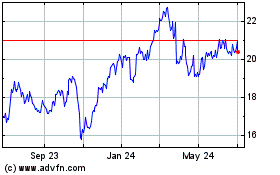

Swedbank A B (PK) (USOTC:SWDBY)

Historical Stock Chart

From Sep 2023 to Sep 2024