UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

____________________

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐

|

Preliminary Proxy Statement

|

| |

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

☒

|

Definitive Proxy Statement

|

| |

☐

|

Definitive Additional Materials

|

| |

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

|

Solitron Devices, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| |

☐

|

Fee paid previously with preliminary materials

|

| |

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

SOLITRON DEVICES, INC.

901 Sansburys Way

West Palm Beach, Florida 33411

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To be held on January 24, 2025

To our Stockholders:

The 2024 Annual Meeting of Stockholders of Solitron Devices, Inc. (the "Company") will be held on Friday, January 24, 2025 at 11:00 a.m., Eastern Time, at 901 Sansburys Way, West Palm Beach, Florida 33411 for the following purposes:

|

(1)

|

The election of two (2) directors as Class II directors to serve for a term until the 2027 Annual Meeting of Stockholders and until a successor is duly elected and qualified;

|

|

(2)

|

The ratification of the selection of Whitley Penn LLP as the Company's independent certified public accountants for the fiscal year ending February 28, 2025;

|

|

(3)

|

A non-binding advisory vote on the compensation of the named executive officers of the Company ("Say on Pay"); and

|

|

(4)

|

The transaction of such other and further business as may properly come before the meeting or any adjournments or postponements of the meeting.

|

The Board of Directors has fixed the close of business on November 26, 2024 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting.

The proxy statement, accessible by following the instructions in the enclosed notice, contains information pertaining to the matters to be voted on at the annual meeting. A copy of the Company's Annual Report on Form 10-K for the fiscal year ended February 29, 2024 is being made available with the proxy statement.

| |

By order of the Board of Directors,

Tim Eriksen

Chief Executive Officer and Director

|

West Palm Beach, Florida

December 9, 2024

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on January 24, 2025:

This notice, the accompanying proxy statement, our most recent annual report on Form 10-K

and other proxy materials are available at https://www.cstproxy.com/solitrondevices/2024

On or about December 11, 2024, we will mail a Notice of Internet Availability of Proxy Materials to our stockholders containing instructions on how to access our proxy materials, including this Proxy Statement and our 2024 Annual Report to Stockholders, and voting instructions on the internet, as well as instructions on how stockholders may obtain a paper copy of the proxy materials by mail. You may follow the instructions on the Notice of Internet Availability of Proxy Materials, then access our proxy materials and vote your shares over the internet. If you request a paper copy of the proxy materials and choose to vote by mail, please complete, sign, date and promptly return the accompanying proxy card in the enclosed addressed postage-paid envelope that will be provided to you in response to your request, even if you plan to attend the Annual Meeting. Please keep the Notice of Internet Availability of Proxy Materials for your reference through the meeting date.

SOLITRON DEVICES, INC.

901 Sansburys Way

West Palm Beach, Florida 33411

PROXY STATEMENT

2024 Annual Meeting of Stockholders

To be held on January 24, 2025

General

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Solitron Devices, Inc. of proxies to be voted at our 2024 Annual Meeting of Stockholders (the "Annual Meeting") and at any and all postponements or adjournments thereof. Our Annual Meeting will be held on Friday, January 24, 2025, at 11:00 a.m., Eastern Time, at 901 Sansburys Way, West Palm Beach, Florida 33411. If you plan to attend the Annual Meeting, you can obtain directions by contacting Lana Pazienza at (561) 848-4311 extension 208. A proxy notice containing instructions on how to access this proxy statement has first been mailed to stockholders on or about December 11, 2024. In this proxy statement, Solitron Devices, Inc. is referred to as the "Company," "we," "our" or "us."

Purposes of the Meeting

At the Annual Meeting, our stockholders will consider and vote upon the following matters:

|

(1)

|

The election of two (2) directors as Class II directors to serve for a term until the 2027 Annual Meeting of Stockholders and until a successor is duly elected and qualified;

|

|

(2)

|

The ratification of the selection of Whitley Penn LLP as the Company's independent certified public accountants for the fiscal year ending February 28, 2025;

|

|

(3)

|

A non-binding advisory vote on the compensation of the named executive officers of the Company ("Say on Pay"); and

|

|

(4)

|

The transaction of such other and further business as may properly come before the meeting or any adjournments or postponements of the meeting.

|

Outstanding Securities and Voting Rights

Only holders of record of the Company's common stock at the close of business on November 26, 2024, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. On that date, we had 2,083,436 shares of common stock outstanding that are entitled to notice of, and to vote at, the Annual Meeting. Each share of common stock is entitled to one vote at the Annual Meeting.

The holders of a majority of the issued and outstanding shares of common stock present at the Annual Meeting, either in person or by proxy, and entitled to vote at the Annual Meeting, constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be included in determining the presence of a quorum at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Under New York Stock Exchange rules, brokers who do not have instructions from their customers may not use their discretion to vote on Proposal 1 — Election of Directors and Proposal 3 — Say on Pay. As a result, any broker that is a member of the New York Stock Exchange will not have the discretion to vote on Proposals 1 and 3 if such broker has not received instructions from the beneficial owner. A broker non-vote or an abstention will have no effect on the proposals, except that an abstention will have the same effect as a vote against Proposal 2 — ratification of Whitley Penn LLP as our independent certified public accountants for the year ending February 28, 2025 and Proposal 3 — Say on Pay proposal.

Proxy Voting

Shares for which proxy cards are properly executed and returned will be voted at the Annual Meeting in accordance with the directions given or, in the absence of directions, will be voted "FOR" Proposal 1 — the election of the nominees to the Board named herein, "FOR" Proposal 2 — the ratification of Whitley Penn LLP as our independent certified public accountants for the year ending February 28, 2025 and "FOR" Proposal 3 — the approval of the Say on Pay proposal. If, however, other matters are properly presented, the person named in the proxies in the accompanying proxy card will vote in accordance with their discretion with respect to such matters.

Voting by Stockholders of Record.

If you are a stockholder of record (your shares are registered directly in your name with our transfer agent), you may vote by proxy via the Internet or by mail by following the instructions provided on the proxy card. Stockholders of record who attend the Annual Meeting may vote in person by obtaining a ballot from the inspector of elections. Please be prepared to present photo identification for admittance to the Annual Meeting.

Voting by Beneficial Owners.

If you are a beneficial owner of shares (your shares are held in the name of a brokerage firm, bank, or other nominee), you may vote by proxy by following the instructions provided in the vote instruction form, or other materials provided to you by the brokerage firm, bank, or other nominee that holds your shares. To vote in person at the Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank, or other nominee that holds your shares, and present such legal proxy from the brokerage firm, bank, or other nominee that holds your shares for admittance to the Annual Meeting. Also, be prepared to present photo identification for admittance to the Annual Meeting.

Changing Your Vote.

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet (only your latest Internet proxy submitted prior to the meeting will be counted), by signing and returning a new proxy card with a later date, or by attending the Annual Meeting and voting in person. Your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

All votes will be tabulated by an Inspector of Elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. A list of the stockholders entitled to vote at the Annual Meeting will be available at the Company's executive office, located at 901 Sansburys Way, West Palm Beach, Florida 33411, for a period of ten (10) days prior to the Annual Meeting and will be available at the Annual Meeting for examination by any stockholder.

Record Holders with Shared Address

Record holders who have the same address and last name will receive only one copy of their proxy materials, unless we are notified that one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce the Company’s printing costs and postage fees. Stockholders who do not participate in householding will continue to receive separate proxy cards. If you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of these proxy materials, or if you hold the Company’s stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact the Company’s Corporate Secretary at: Solitron Devices, Inc., 901 Sansburys Way, West Palm Beach, Florida 33411, Attention: Corporate Secretary. If you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact the Company’s Corporate Secretary as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Availability of Annual Report on Form 10-K

As required, we have filed our Annual Report on Form 10-K for the fiscal year ended February 29, 2024 with the SEC. Shareholders may obtain, free of charge, a copy of the Annual Report on Form 10-K for the fiscal year ended February 29, 2024 by writing to us at 901 Sansburys Way, West Palm Beach, Florida 33411, Attention: Corporate Secretary, or from our corporate website at www.solitrondevices.com.

ELECTION OF DIRECTORS

Our Board of Directors is currently comprised of five (5) directors divided into three separate classes, as nearly equal in number as possible, with one class being elected each year to serve a staggered three-year term. Our Class I directors are Dwight P. Aubrey and John F. Chiste; our Class II directors are Tim Eriksen and David W. Pointer; and our Class III director is Charles M. Gillman.

Upon the recommendation of the Nominating Committee, our Board has nominated Tim Eriksen and David W. Pointer to stand for election as our Class II directors to serve for a term until the 2027 Annual Meeting of Stockholders and until a successor is duly elected and qualified. Mr. Eriksen and Mr. Pointer are current directors who are standing for re-election upon the recommendation of the Nominating Committee.

Mr. Eriksen and Mr. Pointer are willing and able to serve as directors. If Mr. Eriksen and Mr. Pointer becomes unavailable for any reason, a situation which is not anticipated, a substitute nominee may be proposed by the Board, and any shares represented by proxy will be voted for the substitute nominee, unless the Board reduces the number of directors.

The Amended and Restated By-laws of the Company (the “By-laws”) require directors to be elected by a majority of votes cast with respect to such director in uncontested elections (meaning the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election).

The By-laws provide that in order for any incumbent director to become a nominee of the Board of Directors for further service on the Board of Directors, such person must submit an irrevocable resignation, contingent on (i) that person not receiving a majority of the votes cast in an uncontested election, and (ii) acceptance of that resignation by the Board of Directors in accordance with the By-Laws and any policies and procedures adopted by the Board of Directors for such purpose. If an incumbent director fails to receive a majority of the votes cast in an uncontested election, the independent directors of the Board of Directors (or, if the Board of Directors so directs, any nominating or other committee established by the Board of Directors pursuant to the By-Laws) will make a recommendation to the Board of Directors as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board of Directors will act on the resignation, taking into account the recommendation of the independent directors or any such committee, and will disclose (by a press release and by filing an appropriate disclosure with the Securities and Exchange Commission (the “SEC”)) its decision regarding the resignation (and, if such resignation is rejected, the rationale behind the decision) within 90 days following certification of the election results. If such incumbent director’s resignation is not accepted by the Board of Directors, such director will continue to serve until the annual meeting for the year in which his term expires and until his successor is duly elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office. If the Board of Directors accepts such a director’s resignation, or if any nominee for director is not elected and such nominee is not an incumbent director (and, as a result, any vacancy remains after the final adjournment of the meeting for the election of directors), then the Board of Directors may fill the resulting vacancy pursuant to the Certificate of Incorporation and the By-Laws.

The following table sets forth certain information concerning the directors and nominees for director:

|

Name

|

|

Age

|

|

Positions with the Company

|

|

Class

|

|

Year Term

Expires

|

|

Dwight P. Aubrey(1)(2)

|

|

78

|

|

Director

|

|

Class I

|

|

2026

|

|

John F. Chiste(1)(3)

|

|

68

|

|

Director

|

|

Class I

|

|

2026

|

|

Tim Eriksen

|

|

56

|

|

Chief Executive Officer and Director

|

|

Class II

|

|

2024

|

|

David W. Pointer(2)(3)

|

|

54

|

|

Chairman

|

|

Class II

|

|

2024

|

|

Charles M. Gillman(2)(3)

|

|

54

|

|

Director

|

|

Class III

|

|

2025

|

(1) Member of the Audit Committee.

(2) Member of the Compensation Committee.

(3) Member of the Nominating Committee.

CLASS II — TERM EXPIRING AT 2024 ANNUAL MEETING

Tim Eriksen

Mr. Eriksen was elected a director on August 4, 2015. Mr. Eriksen served as a member of the Audit Committee from October 14, 2015 through July 22, 2016 when he resigned from the Audit Committee and was named Chief Executive Officer and Chief Financial Officer. Mr. Eriksen was appointed Chief Executive Officer and Chief Financial Officer of the Company on July 22, 2016. Mr. Eriksen founded Eriksen Capital Management LLC ("ECM"), a Lynden, Washington based investment advisory firm, in 2005. Mr. Eriksen is the Managing Member of ECM and Cedar Creek Partners LLC ("CCP"), a hedge fund founded in 2006 that focuses primarily on micro-cap and small cap stocks. Prior to founding ECM, Mr. Eriksen worked for Walker’s Manual, Inc., a publisher of books and newsletters on micro-cap stocks, unlisted stocks and community banks. Earlier in his career, Mr. Eriksen worked for Kiewit Pacific Co, a subsidiary of Peter Kiewit Sons, as an administrative engineer on the Benicia Martinez Bridge project. Mr. Eriksen received a B.A. from The Master’s University and an M.B.A. from Texas A&M University. Mr. Eriksen served as a director and member of the Audit Committee of Novation Companies Inc. from April 2018 through August 2021. He was elected a director of TSR Inc. on October 22, 2019, and appointed to the Audit, Nominating, Compensation, and Special Committee on December 30, 2019. He served as a director of TSR until its acquisition by Vienna Parent in June 2024. On August 31, 2021, Mr. Eriksen was elected to the board of PharmChem, Inc. He chose not to stand for re-election as a director of PharmChem at its 2023 meeting. On September 1, 2023, after a transaction where CCP became the largest shareholder of PharmChem, he was appointed to the board of PharmChem as Chairman. The Company believes that Mr. Eriksen’s extensive financial expertise, including knowledge of unlisted micro-cap companies and capital allocation, and his role as an officer of one of the Company's largest institutional stockholders highly qualifies him to serve as a member of the Board of Directors.

David W. Pointer

Mr. Pointer was elected a director on August 4, 2015. Mr. Pointer was named Chairman of the Board on July 22, 2016, and also serves as a member on the Nominating Committee and Compensation Committee. Mr. Pointer is the founder and managing partner of VI Capital Management, LLC (“VICM”). VICM was founded on January 1, 2008, and was the general partner for VI Capital Fund, LP, a value-oriented investment limited partnership, until its liquidation in November 2023. VICM offers strategic and corporate governance consulting services, as well as investment research services for a private investor. Prior to founding VICM, Mr. Pointer served as Senior Vice President and Senior Portfolio Manager for ICM Investment Management (“ICM”). Prior to ICM, Mr. Pointer served as a Portfolio Manager for Invesco, Inc., where he worked with a senior partner in managing two mutual funds with assets in excess of $15 billion. Mr. Pointer was a member of the Board of Directors of CompuMed, Inc., a healthcare services company, from January 2014 through June 2023 (and served as Chairman of the Board from November 2014 through June 2023). From March 2018 through January 2022, Mr. Pointer served as Chief Executive Officer and a Board Member, including Chairman from March 2018 through August 2021, of Novation Companies Inc.

The Company believes that Mr. Pointer’s experience as a director at other companies and his ability to relate to the broader investment community highly qualifies him to serve as a member of the Board of Directors.

CLASS III — TERM EXPIRING AT 2025 ANNUAL MEETING

Charles Gillman

Mr. Gillman was appointed a director on July 22, 2016. Mr. Gillman also serves as Chairman of the Nominating Committee, and a member of the Compensation Committee. Mr. Gillman is the Owner and Executive Managing Director of the IDWR Multi-Family Office (the "IDWR"), a position he has held since 2013. The IDWR employs a team of analysts with expertise in finding publicly traded companies that require operational enhancement and an improvement in corporate capital allocation. Prior to his founding of IDWR, Mr. Gillman worked in the investment industry and as a strategic management consultant at McKinsey & Company, where he gained experience designing operational turnarounds of U.S. and international companies. Mr. Gillman previously served on the board of directors of the following publicly-traded companies: Digirad Corporation, Hill International, Points International, Hooper Holmes, Inc., Datawatch Corporation, and Novation Companies Inc.

The Company believes that Mr. Gillman’s significant experience designing operational turnarounds of companies, as a successful portfolio manager and his mergers and acquisition experience highly qualifies him to serve as a member of the Board of Directors.

CLASS I — TERM EXPIRING AT 2026 ANNUAL MEETING

Dwight P. Aubrey

Mr. Aubrey was appointed a director on January 12, 2015. Mr. Aubrey also serves as Chairman of the Compensation Committee and a member of the Audit Committee. Mr. Aubrey served as the President of ES Components LLC, a franchised distributor for wire bondable die and surface mountable components used by hybrid and semiconductor component manufacturers, from 1981 through 2017. An immediate family member of Mr. Aubrey is the majority owner of ES Components, and Mr. Aubrey is a minority owner. Mr. Aubrey also served as the President and Owner of Compatible Components, Inc., a manufacturer's representative company supplying microelectronic components, from 1979 until 2005. Mr. Aubrey restarted Compatible Components LLC as a consulting company for new business development in 2017.

The Company believes that Mr. Aubrey's extensive operational and business background in semiconductor component manufacturing highly qualifies him to serve as a member of the Board of Directors.

John F. Chiste

Mr. Chiste was appointed a director on January 12, 2015. Mr. Chiste also serves as Chairman of the Audit Committee and a member of the Nominating Committee. Mr. Chiste has served as the Chief Financial Officer of Encore Housing Opportunity Fund I, Fund II, Fund III and Rescore Property Corp., a group of private equity funds with assets under management in excess of $1.0 billion focused on acquiring opportunistic and distressed residential real estate primarily in Florida, Texas, Arizona and California, since 2010. Mr. Chiste was a director and Chairman of the Audit Committee of Forward Industries, Inc., a Nasdaq listed manufacturer and distributor of specialty and promotional products, primarily for hand held electronic devices, from February 2008 through January 2015. Mr. Chiste has also served since 2005 as Chief Financial Officer of the Falcone Group which owns a diversified real estate portfolio of companies. Mr. Chiste previously served as Chief Financial Officer of Bluegreen Corporation, a NYSE listed developer and operator of timeshare resorts, residential land and golf communities, from 1997 until 2005. He also served as Chief Financial Officer of Computer Integration Corp., a Nasdaq listed provider of information products and services, from 1992 until 1997. From 1983 until 1992, Mr. Chiste served as a Senior Manager with Ernst & Young LLP, a nationally recognized accounting firm. Mr. Chiste is a licensed Certified Public Accountant in the State of Florida.

The Company believes that Mr. Chiste's extensive financial and accounting experience highly qualifies him to serve as a member of the Board of Directors.

Legal/Disciplinary History

Below is a summary of a consent order from the State of Washington Department of Financial Institutions, Securities Division that one of our directors was subject to and an SEC administrative order that one of our directors was subject to.

V.I. Capital Management, LLC (“V.I. Capital”) and Chairman of the Board David W. Pointer are subject to a consent order (the “Consent Order”) from the State of Washington Department of Financial Institutions, Securities Division, dated March 12, 2018 (Order Number S-16-2093-17-CO01), relating to alleged breaches of their fiduciary duty as investment advisors to their clients, including (i) failure to disclose certain conflict of interest stemming from Mr. Pointer’s service on the Boards of Directors of CompuMed and Solitron Devices, Inc., (ii) pledging V.I. Capital investment fund assets as collateral for a line of credit for CompuMed, Inc. and failing to disclose such pledge to V.I. Capital’s year-end auditor, and (iii) failure to timely distribute audited financial statements and a final fund audit to investors. As conditions of the Consent Order, V.I. Capital and Mr. Pointer agreed to (i) cease and desist from violating the Securities Act of 1933, (ii) pay a fine of $10,000 and (iii) pay costs of $2,500. Mr. Pointer also agreed that he will not be a principal, officer or owner of an investment adviser or broker-dealer for 10 years following the entry of the Consent Order, but he may apply for a securities salesperson or investment adviser representative registration with an acceptable plan of supervision.

Company director Charles M. Gillman is subject to an SEC administrative order, dated February 14, 2017 (Securities Exchange Act Release No. 80038), relating to alleged violations of Section 13(d) of the Exchange Act and the rules promulgated thereunder, including failing to disclose the members of a stockholder group, and further allegations that he violated Section 16(a) of the Exchange Act and the rules promulgated thereunder, including failing to timely file initial statements of beneficial ownership on Form 3 and changes thereto on Form 4. Without admitting or denying any violations, Mr. Gillman agreed to cease and desist from committing or causing any violations of (i) Section 13(d) of the Exchange Act and Rules 13d-1 and 13d-2 promulgated thereunder and (ii) Section 16(a) of the Exchange Act and Rules 16a-2 and 16a-3 promulgated thereunder, and paid a civil penalty to the SEC in the amount of $30,000.

Other than as described above, our directors and executive officers have not been convicted or named in a pending criminal proceeding (excluding traffic and other minor offenses), or subject to any judgment, order or legal proceeding of the nature described in Item 401(f) of Regulation S-K.

Vote Required and Recommendation

Directors are elected by a majority of the votes cast with respect to such director's election at the Annual Meeting.

The Board of Directors recommends a vote "FOR" Mr. Eriksen and Mr. Pointer as Class II directors.

Director Compensation

The following table sets forth information regarding the compensation of our non-employee directors for the fiscal year ended February 29, 2024.

|

Name and Principal Position

|

|

Fees

earned or

paid in

cash

|

|

|

Stock awards

|

|

|

Total

|

|

|

David W. Pointer, Chairman

|

|

$ |

36,000 |

|

|

$ |

- |

|

|

$ |

36,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dwight P. Aubrey, Director

|

|

$ |

24,000 |

|

|

|

- |

|

|

$ |

24,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

John F. Chiste, Director

|

|

$ |

26,000 |

|

|

|

- |

|

|

$ |

26,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles Gillman, Director

|

|

$ |

20,000 |

|

|

|

- |

|

|

$ |

20,000 |

|

For the fiscal year ended February 29, 2024, each director who is not employed by the Company received $4,500 per quarter and the Chairman received $9,000 per quarter. The Chairman of the Audit Committee (Mr. Chiste) received $2,000 per quarter, the Compensation Committee Chairman (Mr. Aubrey) received $1,500 per quarter and the Nominating Committee Chairman (Mr. Gillman) received $500 per quarter. Payments for each quarter are paid in advance. All out-of-pocket expenses incurred by a director for attending Board or committee meetings are reimbursed by the Company. Mr. Eriksen does not receive any additional compensation as a director.

On February 19, 2024, the Company modified the compensation for directors, effective March 1, 2024. Chairman David Pointer’s annual cash compensation was increased to $40,000. Audit Committee Chairman John Chiste’s annual cash compensation was increased to $30,000. Compensation Committee Chairman Dwight Aubrey’s annual compensation was increased to $28,000. Nominating Committee Chairman Charles Gillman’s annual compensation was increased to $24,000.

Board Meetings; Annual Meeting Attendance; Independence

The Board oversees our business and affairs and monitors the performance of management. The Board met regularly during the fiscal year ended February 29, 2024 ("fiscal 2024") and continues to meet regularly to review matters affecting our company and to act on matters requiring Board approval. The Board also holds special meetings whenever circumstances require and may act by unanimous written consent. During fiscal 2024, the Board of Directors held six (6) meetings and took two (2) actions by unanimous written consent. During fiscal 2024, all directors attended at least 75% of all Board meetings and committee meetings on which each served. The Board of Directors encourages, but does not require, its directors to attend the Company's annual meeting. All directors attended the 2023 Annual Meeting of Stockholders either in person or telephonically.

The Board of Directors is currently composed of the following five directors: Messrs. Aubrey, Chiste, Eriksen, Gillman and Pointer. The Board has determined that Messrs. Aubrey, Chiste, Gillman and Pointer all meet the criteria for independence specified in the Nasdaq Stock Market Marketplace Rules (the "Nasdaq Rules").

Code of Ethics

The Company has adopted a Code of Ethics for senior officers, which includes the Company’s principal executive officer, principal financial officer and controller, pursuant to the Sarbanes-Oxley Act of 2002. The Code of Ethics is published on the Company’s web site at www.solitrondevices.com on the Investor Relations page.

Board Leadership Structure

The Company’s By-laws primarily provide the Board with flexibility, in its sole discretion, to separate the roles of Chairman of the Board and Chief Executive Officer. The Board decided to separate the positions of Chairman and Chief Executive Officer because the Board believes that doing so provides the appropriate leadership structure for the Company at this time. The separation of those two positions enables the Company's Chief Executive Officer to focus on the management of the business and the development and implementation of strategic initiatives while the Chairman leads the Board in the performance of its responsibilities. At this time, the Board believes that the overall corporate governance policies and practices combined with the strength of the independent directors and internal controls will complement the separate positions of Chairman and Chief Executive Officer. The By-laws do however provide the Board with the flexibility to appoint a Chairman in the future who is also an officer of the Company.

Board Oversight of Enterprise Risk

The Board of Directors is actively involved in the oversight and management of risks that could affect the Company. This oversight and management is conducted primarily through the committees of the Board of Directors identified below but the full Board of Directors has retained responsibility for general oversight of risks. The Audit Committee is primarily responsible for overseeing the risk management function, specifically with respect to management's assessment of risk exposures (including risks related to liquidity, credit, operations and regulatory compliance, among others), and the processes in place to monitor and control such exposures. The Compensation Committee and Nominating Committee consider the risks within their areas of responsibility. The Board of Directors satisfies their oversight responsibility through full reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Hedging Transactions

The Company has not adopted any practices or policies regarding the ability of employees (including officers) or directors of the Company or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company's equity securities (i) granted to the employee or director by the Company as part of the compensation of the employee or director or (ii) held, directly or indirectly, by the employee or director.

Committees

The standing committees of the Board of Directors are the Audit Committee, the Compensation Committee and the Nominating Committee.

Audit Committee

The Audit Committee consists of Messrs. Chiste (Chairman), and Aubrey. The Board of Directors has determined that the members of the Audit Committee are independent pursuant to the Nasdaq Rules. The Company’s Audit Committee generally has responsibility for appointing, overseeing and approving the compensation of our independent certified public accountants, reviewing and approving the discharge of our independent certified public accountants, reviewing the scope and approach of the independent certified public accountants’ audit, reviewing our audit and control functions, approving all non-audit services provided by our independent certified public accountants and reporting to our full Board of Directors regarding all of the foregoing. Additionally, our Audit Committee provides our Board of Directors with such additional information and materials as it may deem necessary to make our Board of Directors aware of significant financial matters that require its attention. The Company has adopted an Audit Committee Charter, a copy of which is published on the Company’s web site at www.solitrondevices.com on the Investor Relations page. The Company has determined that the "audit committee financial expert" is Mr. Chiste. The Audit Committee met five (5) times and took one (1) action by unanimous written consent during fiscal year 2024.

Compensation Committee

The members of the Compensation Committee are Messrs. Aubrey (Chairman), Gillman and Pointer. The Board of Directors has determined that the members of the Compensation Committee are independent pursuant to the Nasdaq Rules. The responsibilities and duties of the Compensation Committee consist of, but are not limited to: reviewing, evaluating and approving the agreements, plans, policies and programs of the Company to compensate the officers and directors of the Company and otherwise discharging the Board of Directors’ responsibilities relating to compensation of the Company’s officers and directors. The Compensation Committee has determined that no risks exist arising from the Company’s compensation policies and practices for its employees that are reasonably likely to have a material adverse effect on the Company. During fiscal year 2024, the Compensation Committee did not retain a compensation consultant to review our policies and procedures with respect to executive compensation. The Company has adopted a Compensation Committee Charter, a copy of which is published on the Company's website at www.solitrondevices.com on the Investor Relations page. The Compensation Committee Charter authorizes the Compensation Committee to delegate some or all of its authority to subcommittees when it deems appropriate. In particular, the Compensation Committee may delegate the approval of award grants and other transactions and other responsibilities regarding the administration of compensatory programs to a subcommittee consisting solely of members of the Compensation Committee who are (i) “Non-Employee Directors” for the purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and/or (ii) “outside directors” for the purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee met one (1) time during fiscal year 2024.

Nominating Committee

The members of the Nominating Committee are Messrs. Gillman (Chairman), Chiste and Pointer. The Board of Directors has determined that the members of the Nominating Committee are independent pursuant to the Nasdaq Rules. The responsibilities and duties of the Nominating Committee consist of, but are not limited to: developing and periodically reviewing the criteria used to evaluate the suitability of potential candidates for membership on the Board of Directors; identifying and evaluating potential director candidates and submitting to the Board of Directors the candidates for director to be recommended by the Board of Directors for election at each annual meeting and to be added by the Board of Directors at any other times due to expansions to the Board of Directors, director resignations or retirements, and candidates for membership on each committee of the Board of Directors; making recommendations to the Board of Directors regarding the size and composition of the Board of Directors and its committees; and receiving and evaluating any stockholder nominations for directors received in accordance with Article II, Section 12 of the Company's By-laws in the same manner the Nominating Committee would evaluate a nomination received from any other party. The Company has adopted a Nominating Committee Charter, a copy of which is published on the Company's website at www.solitrondevices.com on the Investor Relations page. The Nominating Committee met one (1) time and took two (2) actions by unanimous written consent during fiscal year 2024.

Communications with our Board of Directors

Any stockholder who wishes to send a communication to our Board of Directors should address the communication either to the Board of Directors or to the individual director c/o David W. Pointer, Chairman of the Board, Solitron Devices, Inc., 901 Sansburys Way, West Palm Beach, Florida 33411. Mr. Pointer will forward to the directors all communications that, in his judgment, are appropriate for consideration by the directors. Examples of communications that would not be appropriate for consideration by the directors include commercial solicitations and matters not relevant to stockholders, to the functioning of the Board of Directors, or to the affairs of the Company.

Nominees for Director

The Nominating Committee will consider all qualified director candidates identified by various sources, including members of the Board, management and stockholders. Candidates for directors recommended by stockholders will be given the same consideration as those identified from other sources. The Nominating Committee is responsible for reviewing each candidate’s biographical information and assessing each candidate’s independence, skills and expertise based on a number of factors. While we do not have a formal policy on diversity, when considering the selection of director nominees, the Nominating Committee considers individuals with diverse backgrounds, viewpoints, accomplishments, cultural backgrounds, and professional expertise, among other factors.

The Board of Directors has established board candidate selection criteria to be applied by the Nominating Committee and by the full Board of Directors in evaluating candidates for election to the Board. These criteria include general characteristics, areas of specific experience and expertise and considerations of diversity. The criteria include the following:

| |

●

|

Integrity and commitment to ethical behavior;

|

| |

●

|

Personal maturity and leadership skills, especially in related fields;

|

| |

●

|

Independence of thought;

|

| |

●

|

Diversity of background and experience;

|

| |

●

|

Broad business and/or professional experience with the understanding of business and financial affairs and the complexity of the Company's business;

|

| |

●

|

Commitment to the Company's business and its continued well-being; and

|

| |

●

|

Board members must be able to offer unbiased advice.

|

In addition to the minimum qualifications for each candidate described above, the Nominating Committee shall recommend that the Board of Directors select individuals to help ensure that:

| |

●

|

Board members have executive management experience;

|

| |

●

|

Board members have an understanding of the electronics/components industry;

|

| |

●

|

A majority of the Board consists of independent directors;

|

| |

●

|

Each of the Company's Audit Committee, Compensation Committee and Nominating Committee shall be comprised entirely of independent directors; and

|

| |

●

|

At least one member of the Audit Committee shall have such experience, education and other qualifications necessary to qualify as an "audit committee financial expert" under SEC rules.

|

Only individuals who are nominated in accordance with the procedures set forth in Article II, Section 12 of our By-laws shall be eligible for election as directors. Nominations of persons for election to the Board of Directors may be made at a meeting of stockholders at which directors are to be elected only (i) by or at the direction of the Board of Directors or (ii) by any stockholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in Article II, Section 12 of our By-laws. Such nominations, other than those made by or at the direction of the Board of Directors, shall be made by timely notice in writing to the Secretary of the Company. To be timely, a stockholder’s notice must be delivered or mailed to and received at the principal executive offices of the Company not less than 30 days prior to the date of the meeting, provided, however, that in the event that less than 40 days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, to be timely, a stockholder’s notice must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made. Such stockholder’s notice shall set forth (i) as to each person whom such stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including each such person’s written consent to serving as a director if elected); and (ii) as to the stockholder giving the notice (x) the name and address of such stockholder as they appear on the Company’s books, and (y) the class and number of shares of the Company’s capital stock that are beneficially owned by such stockholder.

SELECTION OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Audit Committee of our Board of Directors has selected Whitley Penn LLP (“Whitley Penn”) as our independent certified public accountants for the fiscal year ending February 28, 2025. Whitley Penn has served as our independent certified public accountants since August 30, 2023.

If the selection of Whitley Penn as our independent registered public accounting firm is not ratified by our stockholders, the Audit Committee will re-evaluate its selection, taking into consideration the stockholder vote on the ratification. However, the Audit Committee is solely responsible for selecting and terminating our independent registered public accounting firm, and may do so at any time at its discretion. A representative of Whitley Penn is expected to attend the Annual Meeting telephonically and be available to respond to appropriate questions. The representative also will be afforded an opportunity to make a statement, if he or she desires to do so.

Change in Independent Registered Public Accounting Firm

As disclosed in the Company’s Form 8-K filed on September 5, 2023 (“Auditor 8-K”), as amended by Form 8-K/A filed on September 5, 2023 (“Auditor 8-K/A”), on August 30, 2023, following approval by the Company’s Board of Directors and Audit Committee, the Company appointed Whitley Penn as the new independent registered public accounting firm of the Company, and dismissed MaloneBailey LLP (“MaloneBailey”) as the Company’s independent registered public accounting firm. MaloneBailey had served as the Company’s independent registered public accounting firm since October 2, 2019.

The reports of MaloneBailey on the Company’s financial statements for the fiscal years ended February 28, 2023 and 2022 did not contain any adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle. During the fiscal years ended February 28, 2023 and 2022 and the subsequent interim period through August 30, 2023, the effective date of MaloneBailey’s dismissal, there were (i) no disagreements (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and MaloneBailey on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of MaloneBailey would have caused MaloneBailey to make reference thereto in its reports on the financial statements of the Company for such years, and (ii) no “reportable events” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K, except for the material weaknesses in the Company’s internal control over financial reporting as disclosed in the Company’s Annual Reports on Form 10-K for the years ended February 28, 2023 and 2022).

The Company provided MaloneBailey with a copy of the Auditor 8-K and requested that MaloneBailey furnish a letter addressed to the SEC stating whether or not MaloneBailey agrees with the disclosures made by the Company in its Auditor 8-K. A copy of MaloneBailey’s letter is filed as Exhibit 16.1 to the Auditor 8-K/A.

During the fiscal years ended February 28, 2023 and 2022 and the subsequent interim period through August 30, 2023, neither the Company nor anyone acting on the Company’s behalf consulted Whitley Penn regarding either (i) the application of accounting principles to a specified completed or proposed transaction, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided to the Company or oral advice was provided that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions to such item) or a reportable event (as described in Item 304 (a)(1)(v) of Regulation S-K).

A representative of MaloneBailey is not expected to attend the Annual Meeting and will not be available to respond to appropriate questions or have an opportunity to make a statement. A representative of Whitley Penn will attend the Annual Meeting and will be available to respond to appropriate questions.

Auditor Fees and Services

The following table sets forth the fees billed during fiscal 2024 and fiscal 2023 by Whitley Penn and MaloneBailey, respectively. Whitley Penn was our independent certified public accountant retained for the audit of the fiscal years ended February 29, 2024. MaloneBailey was our independent certified public accountant retained for the audit of the fiscal years ended February 28, 2023.

| |

|

2024

|

|

|

|

2023

|

|

|

|

Audit Fees

|

|

$ |

170,000 |

|

|

|

$ |

157,500 |

|

|

|

Audit-Related Fees

|

|

|

151,700 |

(1) |

|

|

|

3,000 |

(2) |

|

|

Tax Fees

|

|

|

6,000 |

|

|

|

|

- |

|

|

|

All Other Fees

|

|

|

- |

|

|

|

|

- |

|

|

|

Totals

|

|

$ |

327,700 |

|

|

|

$ |

160,500 |

|

|

(1) Fees related to audit of Micro Engineering, Inc. (“Micro”) annual financial statements for acquisition of Micro completed on September 1, 2023 .

(2) Fees related to review of S-8 filing.

Pre-Approval Policies and Procedures for Audit and Permitted Non-Audit Services

The Audit Committee has a policy of considering and, if deemed appropriate, approving, on a case by case basis, any audit or permitted non-audit service proposed to be performed by the Company’s principal accountant in advance of the performance of such service. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has not implemented a policy or procedure which delegates the authority to approve, or pre-approve, audit or permitted non-audit services to be performed by the Company’s principal accountant. In connection with making any pre-approval decision, the Audit Committee must consider whether the provision of such permitted non-audit services performed by the Company’s principal accountant is consistent with maintaining the Company’s principal accountant’s status as our independent auditors at such time.

Consistent with these policies and procedures, the Audit Committee approved all of the services rendered by Whitley Penn and MaloneBailey for the fiscal years ended February 29, 2024 and February 28, 2023, respectively, as described above.

Vote Required and Recommendation

The proposal to ratify the selection of Whitely Penn as our independent accountant for the fiscal year ending February 28, 2025, requires the affirmative vote of a majority of the voting power of the issued and outstanding stock of the Company entitled to vote, present in person or represented by proxy at the Annual Meeting.

The Board of Directors recommends a vote "FOR" the proposal.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reviews the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for establishing and maintaining adequate internal control over financial reporting, for preparing the financial statements and for the report process. The Audit Committee members do not serve as professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management or the independent registered public accounting firm. We engaged Whitley Penn as our independent registered public accountants registered to report on the conformity of the Company's financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended February 29, 2024 to accounting principles generally accepted in the United States. In this context, the Audit Committee hereby reports as follows:

| |

1.

|

The Audit Committee has reviewed and discussed the audited financial statements with management of the Company.

|

| |

2.

|

The Audit Committee has discussed with Whitley Penn, our independent registered public accounting firm, the matters required to be discussed by the Public Company Accounting Oversight Board ("PCAOB") and the SEC.

|

| |

3.

|

The Audit Committee has also received the written disclosures and the letter from Whitley Penn required by applicable requirements of the PCAOB regarding the independent accountant's communications with the Audit Committee concerning independence and the Audit Committee has discussed the independence of Whitley Penn with that firm.

|

| |

4.

|

Based on the review and discussion referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors and the Board of Directors approved the inclusion of the audited financial statements in the Company's Annual Report on Form 10-K for the fiscal year ended February 29, 2024, for filing with the SEC.

|

The foregoing has been furnished by the Audit Committee:

John F. Chiste, Chairman

Dwight P. Aubrey

This "Audit Committee Report" is not "Soliciting Material," is not deemed filed with the SEC and it not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

MANAGEMENT

Executive Officers for the Fiscal year Ended February 29, 2024

Our executive officers are Tim Eriksen and Mark W. Matson. Mr. Eriksen's position with the Company, his age and his biographical information and business experience appear above under the caption "Election of Directors."

Mark W. Matson

Mr. Matson, age 64, was appointed President and Chief Operating Officer on July 22, 2016. Mr. Matson served as a consultant to the Company from May 2016 through July 2016. Prior to working as a consultant to the Company, Mr. Matson provided consulting services from March 2012 to May 2016 through Avlet, Denali Advanced Integration and Tuxedo Technologies with respect to manufacturing supply chain issues and systems and software issues related to security and processes at global manufacturing plants. Mr. Matson served as the Chief Operating Officer and Vice President of Operations at YSI, a maker of environmental monitoring instruments, sensors, software, systems and data collection platforms, from December 2010 to March 2012. Mr. Matson served as the Vice President of Global Operations and Engineering for Rockford Corporation, a company that designed, sourced and distributed high performance mobile audio products, from January 2006 to December 2010. Prior to joining Rockford Corporation, Mr. Matson was the General Manager and Chief Operations Officer for Benchmark Electronics' Division in Redmond, Washington from 2003 through 2005. Mr. Matson was a Vice President at Advanced Digital Information Corporation from 1998 to 2003 and prior to that at Interpoint Corporation. Mr. Matson has more than 20 years of operations experience.

Mr. Matson graduated with honors with a B.A. from California State University, Bakersfield.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides certain summary information concerning compensation paid by the Company, to or on behalf of the following named executive officers for the fiscal years ended February 29, 2024 and February 28, 2023.

|

Name and Principal Position

|

|

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Stock Awards

|

|

|

All Other Compensation

|

|

|

Total

|

|

|

Tim Eriksen, CEO, CFO(1)

|

|

2024

|

|

$ |

90,000 |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

- |

|

|

$ |

90,000 |

|

| |

|

2023

|

|

$ |

90,000 |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

- |

|

|

$ |

90,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark Matson, President, COO(2)

|

|

2024

|

|

$ |

240,000 |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

55,603 |

(3) |

|

$ |

295,603 |

|

| |

|

2023

|

|

$ |

240,000 |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

55,402 |

(3) |

|

$ |

295,402 |

|

|

(1)

|

Mr. Eriksen was appointed Chief Executive Officer and Chief Financial Officer effective as of July 22, 2016. On December 23, 2021, the Company awarded Mr. Eriksen a discretionary bonus of $65,000 and approved an increase in base salary from $80,000 to $90,000 effective January 1, 2022. On February 19, 2024, the Company increased Mr. Eriksen’s base salary to $100,000 effective March 1, 2024.

|

|

(2)

|

Mr. Matson was appointed President and Chief Operating Officer effective as of July 22, 2016. On December 23, 2021, the Company awarded Mr. Matson a discretionary bonus of $162,500 and approved an increase in base salary from $200,000 to $240,000 effective January 1, 2022. On February 19, 2024, the Company increased Mr. Matson’s base salary to $285,000 effective March 1, 2024.

|

|

(3)

|

Represents Life, Disability and Medical Insurance premiums, personal auto expenses, allocation of the company’s corporate housing, and cell phone.

|

Based upon the Compensation Committee's review of the Company's compensation design features, and the Company's applied compensation philosophies and objectives, the Compensation Committee determined that risks arising from the Company's compensation policies and practices for its employees are not reasonably likely to have a material adverse effect on the Company.

Pay Versus Performance

We are required by SEC rules to disclose the following information regarding compensation paid to our Principal Executive Officer (the “PEO”) and our other Named Executive Officers (“NEOs”), collectively the (“Non-PEO NEOs”). The amounts set forth below under the headings “Compensation Actually Paid to PEO” and “Average Compensation Actually Paid to Non-PEO NEOs” have been calculated in a manner prescribed by the SEC rules and do not necessarily align with how we or the Compensation Committee views the link between our performance and pay of our named executive officers. The footnotes below set forth the adjustments from the total compensation for each of our NEOs reported in the Summary Compensation Table above. As permitted under the rules applicable to smaller reporting companies, we are including two years of data and are not including a peer group total shareholder return or company-selected measure, as contemplated under Item 402(v) of Regulation S-K.

The following table sets forth additional compensation information of our PEO and Non-PEO NEOs, along with total shareholder return, and net income results for the years ended February 29, 2024 and February 28, 2023 and 2022:

|

Year

|

|

Summary

Compensation

Table Total

for PEO($)(1)

|

|

|

Compensation

Actually Paid to

PEO($)(2)

|

|

|

Average

Summary

Compensation

Table Total for

Non-PEO

NEOs($)(3)

|

|

|

Average

Compensation

Actually Paid to

Non-PEO

NEOs($)(3)

|

|

|

Value of Initial

Fixed $100

Investment

Based on Total

Shareholder

Return($)(4)

|

|

|

Net Income

(in 000’s)($)(5)

|

|

|

2024

|

|

|

90,000 |

|

|

|

90,000 |

|

|

|

295,603 |

|

|

|

295,603 |

|

|

|

277.45 |

|

|

|

5,801 |

|

|

2023

|

|

|

90,000 |

|

|

|

90,000 |

|

|

|

295,402 |

|

|

|

295,402 |

|

|

|

149.55 |

|

|

|

826 |

|

|

2022

|

|

|

146,667 |

|

|

|

146,667 |

|

|

|

402,663 |

|

|

|

402,663 |

|

|

|

148.37 |

|

|

|

3,508 |

|

|

(1)

|

Represents the total compensation of our PEO, Tim Eriksen, as reported in the Summary Compensation Table for each year indicated.

|

|

(2)

|

The following table details the applicable adjustments that were made to determine “compensation actually paid” to our PEO and Non-PEO NEO as computed in accordance with Item 402(v) of Regulation S-K, for each covered fiscal year.

|

| |

|

PEO

|

|

|

Non-PEO NEO

|

|

| |

|

2024

|

|

|

2023

|

|

|

2022

|

|

|

2024

|

|

|

2023

|

|

|

2022

|

|

|

Summary Compensation Table Total

|

|

$ |

90,000 |

|

|

$ |

90,000 |

|

|

$ |

81,667 |

|

|

$ |

295,603 |

|

|

$ |

295,402 |

|

|

$ |

402,663 |

|

|

- Grant date fair value of awards granted during the covered fiscal year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+ Fair value as of the end of the covered fiscal year of all awards granted during the covered fiscal year that are outstanding and unvested at the end of the covered year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+/- Change in fair value as of the end of the covered fiscal year (from the end of the prior fiscal year) of any awards granted in any prior fiscal year that are outstanding and unvested as of the end of the covered fiscal year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

+ Fair value as of the vesting date of any awards that are granted and vest in the same fiscal year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+/- Change in fair value as of the vesting date (from the end of the prior fiscal year) of any awards granted in any prior fiscal year for which all applicable vesting conditions were satisfied at the end of or during the covered fiscal year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Fair value of awards forfeited in current fiscal year determined at end of prior fiscal year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+ Dividends or other earnings paid on stock or option awards in the covered fiscal year prior to the vesting date that are not otherwise included in the total compensation for the covered fiscal year

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation Actually Paid

|

|

$ |

90,000 |

|

|

$ |

90,000 |

|

|

$ |

81,667 |

|

|

$ |

295,603 |

|

|

$ |

295,402 |

|

|

$ |

402,663 |

|

|

(3)

|

Represents the total compensation of our only other NEO, Mark Matson, as reported in the Summary Compensation Table for each year indicated.

|

|

(4)

|

Represents the cumulative three-year total return to shareholders of our common stock and assumes that the value of the investment was $100 on February 28, 2021. The Company did not issue any dividends during the fiscal years ended February 28, 2022, 2023 or February 29, 2024. The stock price performance included in this column is not necessarily indicative of future stock price performance.

|

|

(5)

|

Represents our reported net income for each year indicated.

|

Relationship Between Compensation Actually Paid to our NEOs and Company Performance

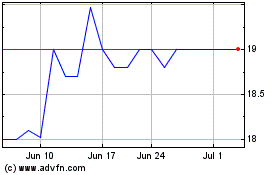

The following graphs show the relationship between the compensation actually paid to our PEO and our other NEO to our total shareholder return and net income over the three fiscal years ending February 29, 2024 as reported in the table above:

NON-BINDING ADVISORY VOTE ON

SAY ON PAY

Background of the Proposal

The Dodd-Frank Act requires all public companies to hold a separate non-binding advisory stockholder vote to approve the compensation of executive officers as described in the executive compensation tables and any related information in each such company's proxy statement (commonly known as a "Say on Pay" proposal). Accordingly, we are providing a vote on the resolution set forth below as required by the Dodd-Frank Act and Section 14A of the Securities Exchange Act of 1934, as amended. The stockholder vote at the 2021 annual meeting of stockholders supported an annual non-binding advisory vote to approve the compensation of the named executive officer of the Company. Accordingly, the Company has determined that such vote will be held annually until the next advisory vote on the frequency of the advisory vote to approve named executive officer compensation, which will be at our 2027 annual meeting of stockholders. At our 2023 annual meeting of stockholders our executive compensation program was approved on an advisory basis by approximately 98% of the votes cast.

Executive Compensation

The Board of Directors believes that our executive compensation programs are designed to secure and retain the services of high quality executives and to provide compensation to our executives that are commensurate and aligned with our performance and advances both the short and long-term interests of our company and our stockholders. We have historically sought to achieve these objectives through three principal compensation programs: base salary, annual cash incentive bonus, and long-term equity incentives, in the form of grants of equity awards. Base salaries are designed primarily to attract and retain talented executives. Annual cash incentive bonuses are designed to motivate and reward hard work and dedication to the Company. Grants of equity are designed to provide a strong incentive for achieving long-term results by aligning the interests of our executives with those of our stockholders, while at the same time encouraging our executives to remain with us. The Board of Directors believes that our compensation program for our named executive officers for the fiscal year ended February 29, 2024 was appropriately based upon our performance and the individual performance and level of responsibility of the executive officers.

This Say on Pay proposal is set forth in the following resolution:

RESOLVED, that the stockholders of Solitron Devices, Inc. approve, on an advisory basis, the compensation of its named executive officers, as disclosed in the Solitron Devices, Inc.'s Proxy Statement for the 2024 Annual Meeting of Stockholders, pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables, and any related information found in the proxy statement of Solitron Devices, Inc.

Because your vote on this proposal is advisory, it will not be binding on the Board of Directors, the Compensation Committee or the Company. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

Vote Required and Recommendation

The advisory vote on the Say on Pay proposal requires the affirmative vote of a majority of the voting power of the issued and outstanding stock of the Company entitled to vote, present in person or represented by proxy at the Annual Meeting.

The Board of Directors recommends a vote "FOR" the Say on Pay proposal.

BENEFICIAL OWNERSHIP OF SECURITIES AND SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of common stock of the Company as of November 26, 2024 by (i) all directors, (ii) the named executive officers for the year ended February 29, 2024, (iii) all executive officers and directors of the Company as a group, and (iv) each person known by the Company to beneficially own in excess of 5% of the Company’s outstanding common stock. Unless noted otherwise, the corporate address of each person listed below is 901 Sansburys Way, West Palm Beach, Florida 33411.

The Company does not know of any other beneficial owner of more than 5% of the outstanding shares of common stock other than as shown below. Unless otherwise indicated below, each stockholder has sole voting and investment power with respect to the shares beneficially owned. Except as noted below, all shares were owned directly with sole voting and investment power.

|

Name and Address

|

|

Number of

Shares

Beneficially

Owned(1)

|

|

|

|

Percentage of

Outstanding

Shares(1)

|

|

|

Tim Eriksen

|

|

|

323,223 |

(2) |

|

|

|

15.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Mark Matson

|

|

|

176,573 |

|

|

|

|

8.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Dwight P. Aubrey

|

|

|

6,000 |

|

|

|

|

0.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

John F. Chiste

|

|

|

6,000 |

|

|

|

|

0.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Charles Gillman

|

|

|

6,000 |

|

|

|

|

0.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

David W. Pointer

|

|

|

29,188 |

|

|

|

|

1.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

All Executive Officers and Directors as a Group (6 persons)

|

|

|

546,984 |

|

|

|

|

26.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Olesen Value Fund L.P.

60 W. Broad Street, Suite 304

Bethlehem, Pennsylvania 18018

|

|

|

262,593 |

(3) |

|

|

|

12.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Granite State Capital Management, LLC

6725 Brindisi Place

Round Rock, TX 78665

|

|

|

138,573 |

(4) |

|

|

|

6.7 |

% |

|

(1)

|

Based on 2,083,436 shares of our common stock outstanding as of November 26, 2024. For purposes of this table, beneficial ownership is computed pursuant to Rule 13d-3 under the Exchange Act; the inclusion of shares beneficially owned should not be construed as an admission that such shares are beneficially owned for purposes of Section 16 of such Act.

|

|

(2)

|

Represents 240,341 shares of common stock owned by Cedar Creek Partners LLC, an investment partnership, for which Eriksen Capital Management LLC ("ECM") is the Managing Member, 24,055 shares of common stock owned by managed accounts of ECM, 5,787 shares of common stock owned by Eriksen Family LLC which is managed by Mr. Eriksen, and 53,040 shares of common stock owned solely by Mr. Eriksen. The respective owners of the managed accounts are responsible to vote the shares of common stock. By virtue of ECM's investment advisory agreement with the clients of ECM, Mr. Eriksen may be deemed to beneficially own the shares owned by Cedar Creek Partners and the managed accounts.

|

|

(3)

|

This information is based solely on the Form 4 filed with the SEC on November 21, 2024. Olesen Value Fund L.P. ("OVF") is a private investment partnership existing under the laws of the State of Delaware. Olesen Value Fund GP LLC is the general partner of OVF. Olesen Capital Management LLC is the investment manager of OVF. Mr. Christian Olesen is the Managing Member of Olesen Value Fund GP LLC and Olesen Capital Management LLC. OVF has the sole power to vote and dispose of the 262,593 shares of common stock. Each of Olesen Value Fund GP LLC, Olesen Capital Management LLC and Christian Olesen has shared voting power and shared dispositive power with regard to such shares.

|

|

(4)

|

This information is based solely on the Schedule 13G/A filed with the SEC on January 26, 2024. Granite State Capital Management, LLC (“GSCM”) is an investment advisor to separately managed accounts. Mr. Eric Schleien is the Manager and CEO of GSCM. GSCM and Mr. Eric Schleien have shared voting power and shared dispositive power with regard to the 138,573 shares of common stock.

|

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information about our common stock that may be issued upon the exercise of outstanding options and our common stock that remains available for future issuance as of February 29, 2024.

|

Plan Category

|

|

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

|

|

|

Weighted-average

exercise price of

outstanding

options, warrants

and rights

|

|

|

Number of

securities

remaining

available for equity

compensation

plans (excluding

securities reflected

in column (a))

|

|

| |

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

|

Equity compensation plans approved by security holders

|

|

|

- |

|

|

|

- |

|

|

|

40,994 |

(1) |

|

Equity compensation plans not approved by security holders

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Total

|

|

|

- |

|

|

|

- |

|

|

|

40,994 |

|

|

(1)

|