Foxconn's Price Tag for Sharp Likely to Fall by More Than $2 Billion

March 29 2016 - 3:30AM

Dow Jones News

The boards of Sharp Corp. and Foxconn Technology Group will meet

separately on Wednesday to discuss a revised takeover package that

could slash at least 245 billion yen ($2.16 billion) off the price

tag for the troubled Japanese electronics maker, people familiar

with the matter said.

Under the new terms, which people familiar with the matter said

are still under negotiation and could change, Sharp would issue new

shares to Foxconn in exchange for an infusion of ¥ 389 billion for

about a two-thirds stake, down from Foxconn's original offer of ¥

489 billion.

To make up for the shortfall, the people said Sharp's two main

lenders, Mizuho Bank and Bank of Tokyo-Mitsubishi UFJ, would offer

a credit line of ¥ 300 billion to Sharp, which makes everything

from televisions to solar panels to screens for Apple Inc.'s

iPhones.

The two banks, which have held ¥ 200 billion worth of preferred

Sharp shares since they bailed the company out last year, would let

Foxconn delay buying those shares for about three years, the people

said.

Foxconn, known formally as Hon Hai Precision Industry Co.,

originally offered to buy half the shares for ¥ 100 billion.

The people said a side agreement for Foxconn to pay ¥ 45 billion

for the land beneath Sharp's advanced display panel factory in

Sakai, Japan, was canceled, according to the revised terms. The

people said discussions with Sharp's two main lenders over revised

terms for Sharp's ¥ 500 billion in bank debt—such as lowering

interest rates on the loans and lengthening the payback

schedule—are continuing.

Foxconn and Sharp are tentatively planning to announce an

agreement at a news conference that could come as early as

Saturday, people familiar with the matter said.

In a statement, Foxconn said it would hold a regular board

meeting on Wednesday, though discussions about Sharp would depend

on the progress of the negotiations. A Sharp spokesman said it is

working with Foxconn to reach an agreement as soon as possible.

Some Sharp board members, including Chief Executive Kozo

Takahashi, are expected to step down once the deal is approved by

Sharp shareholders in June, one of the people said.

Sharp on Monday announced that Tetsuo Onishi, an executive vice

president in charge of restructuring its display business, will

step down Thursday.

People familiar with the matter said the revised terms came due

to the extra time Foxconn had to conduct due diligence. Over the

past month, Foxconn has sent hundreds of people to take stock of

everything from Sharp's information-technology infrastructure to

its inventories, two of the people said, adding that the teams have

uncovered issues related to factory overcapacity and China sales

that helped to convince Sharp's lenders to agree to revised

terms.

Sharp declined to comment on details of the negotiations,

including what the company has discovered through the due diligence

process.

For the fiscal year ending this month, Sharp is expected to

report a net loss of ¥ 200 billion, people familiar with the matter

said, due to weaker sales of display panels and an extraordinary

one-time loss. In the previous fiscal year, Sharp posted a loss of

¥ 222 billion.

Sharp's board initially approved a package from Foxconn to buy

the floundering Japanese company for ¥ 659 billion in late

February. However, Foxconn left Sharp standing at the altar after

the Taiwanese company received a document from Sharp outlining an

additional ¥ 350 billion worth of contingent liabilities—or

potential future financial risks—that hadn't previously been

disclosed, according to people familiar with the matter.

Atsuko Fukase in Tokyo and Eva Dou in Beijing contributed to

this article.

Write to Wayne Ma at wayne.ma@wsj.com and Takashi Mochizuki at

takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

March 29, 2016 03:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

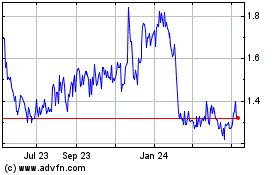

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

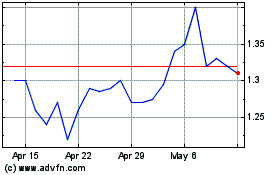

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jul 2023 to Jul 2024