New iPhones Lift Foxconn Earnings

November 16 2015 - 6:30AM

Dow Jones News

BEIJING—New iPhones powered a bigger-than-expected rise in

Foxconn Technology Group's third-quarter net profit, as the world's

largest electronics contract manufacturer weathered a smartphone

slowdown.

Apple Inc. so far hasn't been hit by recent sluggishness in the

smartphone sector, but some analysts caution that iPhone sales may

slow in coming quarters. Taiwan-based Foxconn -- formally called

Hon Hai Precision Industry Co. -- is Apple's main iPhone

assembler.

Foxconn said on Monday its third-quarter net profit rose 11% to

37.9 billion New Taiwan dollars (US$1.16 billion) from NT$34.09

billion a year earlier. The results beat the NT$34.8 billion

average estimate of 10 analysts surveyed earlier by Thomson One

Analytics. Revenue rose 12% to NT$1.07 trillion from NT$950.5

billion a year earlier. The company doesn't give guidance or hold

earnings conferences.

Foxconn assembles many of the world's most popular gadgets on

behalf of customers such as Apple, largely from factories in China.

It has sought to expand to more profitable sectors in recent years

as rising labor costs in China squeeze margins for electronics

manufacturing. The company has been in discussions to buy Sharp

Corp.'s struggling liquid-panel display business and has invested

in other sectors ranging from industrial robots to mobile-phone

recycling. But its fortunes are still closely tied to Apple's, with

nearly half its revenue derived from the client, according to

analysts.

Apple launched two new large-screen iPhones in late September

that feature a "Force Touch" technology, which can distinguish

between a strong press and a light tap. The Cupertino, Calif.,

company reported a 31% earnings jump in October and forecast sales

growth for the current quarter.

Many of Apple's rivals have had it tougher. Growth in the global

smartphone market slowed to 6.8% in the third quarter, from a 25.2%

pace a year earlier, according to market research firm IDC.

LG Electronics Inc. reported a steep drop in net profit for the

third quarter, weighed by weak smartphone sales, while Taiwanese

handset maker HTC Corp. swung to a net loss. Closely held Chinese

smartphone maker Xiaomi Corp., a startup darling accustomed to

triple-digit percentage growth, reported its first drop in sales in

the third quarter, as results were hit by market saturation in

China, according to market researcher Canalys. Samsung Electronics

Co. returned its mobile division to operating-profit growth in the

quarter, although the unit grew more slowly than its other

businesses.

Write to Eva Dou at eva.dou@wsj.com

Access Investor Kit for "Apple, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0378331005

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 16, 2015 06:15 ET (11:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

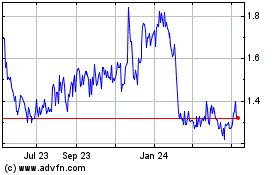

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

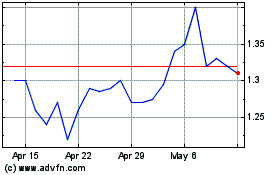

Sharp (PK) (USOTC:SHCAY)

Historical Stock Chart

From Jul 2023 to Jul 2024