Rolls-Royce Jet-Engine Woes Pressure Plane Makers --2nd Update

October 26 2018 - 10:35AM

Dow Jones News

By Robert Wall

Rolls-Royce Holdings PLC on Friday warned its aircraft-engine

production would fall short this year, adding to the pressure plane

makers face in delivering new jets to airlines on time.

Rolls-Royce, which makes engines for Boeing Co. and Airbus SE

planes, said it would ship 500 rather than 550 airliner engines.

The British manufacturer--no longer affiliated with the luxury car

maker--blamed the setback on production problems with a new engine,

the Trent 7000, used to power Airbus A330neo wide-bodies.

Boeing and Airbus have struggled this year to get planes into

customer hands because of production problems. Boeing has had 737

single-aisle planes lined up on the ramp at its Seattle production

site awaiting engines. Delays to fuselages also hit production.

For Airbus, the Rolls-Royce setback comes at a particularly

difficult time. The company is already late with deliveries of its

popular A320neo single-aisle planes. Both its engine suppliers,

United Technologies Corp.'s Pratt & Whitney unit and a joint

venture of General Electric Co. and Safran SA, fell behind this

year on producing engines. Both manufacturers this week said they

would meet 2018 targets.

Airbus has pledged to hand over around 800 airliners to

customers this year. It had delivered 503 through September.

Meeting guidance, Airbus has said, was heavily dependent on engine

makers sticking to their targets.

Though Airbus has been able to adjust production plans in

previous years to meet targets in the face of supplier headwinds,

with little more than two months left of this year, Rolls-Royce's

disclosure gives the Toulouse, France-based company little time to

adjust. Airbus, which reports third-quarter results next year,

declined to comment on the impact of Rolls-Royce's disclosure on

its plans.

Analysts at Citigroup estimate Airbus will now deliver 10 fewer

A330neos this year, with a small hit to earnings.

Airbus traded 2.75% lower and Rolls-Royce slumped 4.2% in

midafternoon trading.

Boeing this week confirmed plans to produce 810 to 815 planes

this year. Boeing Chief Executive Dennis Muilenburg on Wednesday

said 737 fuselage deliveries were back on track and that engine

delivery issues should be resolved by year-end. "We are seeing our

supply chain return to a healthy condition but we're continuing to

monitor that on a daily basis, " he told analysts.

That sense of optimism isn't universally shared. "The supply

chain remains tremendously constrained and under pressure," with no

signs of improvement in the past six months, Air Lease Corp. Chief

Executive John Plueger said this month.

Airlines are increasingly frustrated by the situation. Willie

Walsh, chief executive of British Airways parent International

Consolidated Airlines Group SA on Friday said "these issues have

gone on far too long already."

The airline's Boeing 787 Dreamliners have been beset by repair

problems on their Rolls-Royce engines. Though IAG is being paid

compensation by Rolls, Mr. Walsh called the situation

"disappointing."

Norwegian Air Shuttle ASA, which has had to rent alternative

planes because of the same engine problem, this week said

compensation payments from Rolls-Royce didn't make up for the

financial impact the struggling carrier has felt. The airline's

Chief Executive Bjorn Kjos also said that Rolls-Royce had promised

the issue would be fixed this year, but that Norwegian expected it

to last into 2019.

Mr. Walsh also bemoaned that Airbus was falling behind on plane

deliveries set for next year. IAG's Aer Lingus unit was planning to

introduce a long-range version of Airbus's A321neo plane next year,

but those are now late. Airbus said it was working with airlines to

meet targets.

Rolls-Royce said 2018 profit and cash flow targets remained

unchanged and that it regretted the impact on customers. "As we

move into 2019 we are confident that Trent 7000 production and

delivery volumes will increase significantly to meet our customer

commitments," the London-based company said.

--Maryam Cockar contributed to this article

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

October 26, 2018 10:20 ET (14:20 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

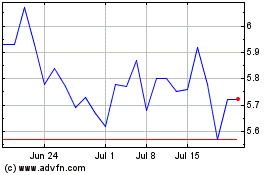

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024