Repsol Drops Pursuit of KKR's X-Elio -Source

April 30 2019 - 5:57AM

Dow Jones News

By Alberto Delclaux

Repsol SA (REP.MC) has abandoned its pursuit of KKR & Co.'s

(KKR) solar-energy company X-Elio because the asking price of more

than 1 billion euros ($1.12 billion) is too high, a person familiar

with the matter said Tuesday.

At such a high price the deal didn't meet Repsol's profitability

criteria, the person said.

KKR purchased an 80% stake in X-Elio from Spain's Gestamp

Renovables in a deal first announced in 2015, while the remaining

20% stake is held by holding company ACEK, which also owns a

majority stake in Gestamp Automocion (GEST.MC).

According to its website, X-Elio operates 41 solar plants with a

total installed capacity of more than 650 megawatts.

Over the past year, Repsol has been looking to increase its

participation in renewables and alternative power generation as

part of a sector-wide push to cut down carbon emissions. In

November, the Madrid-based group closed a EUR733 million deal to

acquire a 2,350 megawatt portfolio of hydroelectric and

combined-cycle gas assets from Viesgo.

This story was translated in whole or in part from a

Spanish-language version initially published by EFE Dow Jones, a

partner of Dow Jones & Co.

Write to Alberto Delclaux at alberto.delclaux@dowjones.com

(END) Dow Jones Newswires

April 30, 2019 05:42 ET (09:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

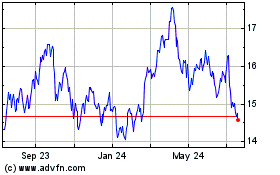

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jun 2024 to Jul 2024

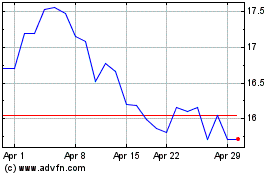

Repsol (QX) (USOTC:REPYY)

Historical Stock Chart

From Jul 2023 to Jul 2024