UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number 000-50112

RepliCel Life Sciences Inc.

(Translation of registrant's name into English)

Suite 900 - 570 Granville Street, Vancouver, British Columbia V6C 3P1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

RepliCel Life Sciences Inc.

/s/ Andrew Schutte

Andrew Schutte

President, Chief Executive Officer and Director

Date: October 23, 2023

REPLICEL LIFE SCIENCES INC.

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(unaudited)

For the six months ended June 30, 2023 and 2022

(Expressed in Canadian Dollars)

Notice of No Auditor Review of Interim Financial Statements

Under National Instrument 51-102, Part 4, subsection 4.3(3) (a), if an auditor has not performed a review of the consolidated interim financial statements; they must be accompanied by a notice indicating that the financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim consolidated financial statements of the Company have been prepared by and are the responsibility of the Company's management.

The Company's independent auditor has not performed a review of these consolidated interim financial statements in accordance with standards established by the International Financial Reporting Standards established by the International Accounting Standards Board for a review of interim financial statements by an entity's auditor.

REPLICEL LIFE SCIENCES INC.

Consolidated Statements of Financial Position

(Stated in Canadian Dollars) |

| As at |

Notes |

|

Unaudited

June 30, 2023 |

|

|

Audited

December 31, 2022 |

|

| Assets |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

215,516 |

|

$ |

413,025 |

|

| Guaranteed investment certificate |

|

|

17,250 |

|

|

17,250 |

|

| Sales taxes recoverable |

|

|

63,348 |

|

|

46,795 |

|

| Prepaid expenses and deposits |

|

|

20,508 |

|

|

123,233 |

|

| Contract asset |

5 |

|

35,374 |

|

|

35,374 |

|

| |

|

|

351,996 |

|

|

635,677 |

|

| Non-current assets |

|

|

|

|

|

|

|

| Contract Asset |

5 |

|

142,417 |

|

|

160,103 |

|

| Equipment |

|

|

1,237 |

|

|

2,438 |

|

| |

|

|

|

|

|

|

|

| Total assets |

|

$ |

495,649 |

|

$ |

798,218 |

|

| |

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

10, 11 |

$ |

362,925 |

|

$ |

1,029,726 |

|

| Contract liability |

5 |

|

353,735 |

|

|

353,735 |

|

| Preference shares |

7 |

|

743,169 |

|

|

689,290 |

|

| |

|

|

1,459,830 |

|

|

2,072,751 |

|

| |

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

| CEBA loan payable |

8 |

|

40,956 |

|

|

40,956 |

|

| Deferred government grant income |

|

|

2,818 |

|

|

5,636 |

|

| Put liability |

5 |

|

1,530,664 |

|

|

1,370,038 |

|

| Contract liability |

5 |

|

1,424,142 |

|

|

1,601,010 |

|

| Royalty payable |

6 |

|

2,090,289 |

|

|

1,623,088 |

|

| Total liabilities |

|

|

6,548,289 |

|

|

6,713,479 |

|

| |

|

|

|

|

|

|

|

| Shareholders' deficiency |

|

|

|

|

|

|

|

| Common shares |

9 |

|

33,014,798 |

|

|

31,661,019 |

|

| Contributed surplus |

9 |

|

5,428,545 |

|

|

5,398,590 |

|

| Accumulated deficit |

|

|

(44,496,391 |

) |

|

(42,974,870 |

) |

| Total shareholders' deficiency |

|

|

(6,053,048 |

) |

|

(5,915,261 |

) |

| Total liabilities and shareholders' deficiency |

|

$ |

495,649 |

|

$ |

798,218 |

|

| |

|

|

|

|

|

|

|

| Continuance of Operations |

2(a) |

|

|

|

|

|

|

| Commitments and Contingencies |

12 |

|

|

|

|

|

|

Approved on behalf of the Board,

|

/s/ "David Hall"

|

|

/s/ "Lee Buckler"

|

|

Director

|

|

Director

|

The accompanying notes form an integral part of these condensed consolidated interim financial statements

REPLICEL LIFE SCIENCES INC.

Condensed Consolidated Interim Statements of Comprehensive Loss

For the three months ended

(Stated in Canadian Dollars)

(Unaudited) |

| |

|

For the three months ended |

|

|

For the six months ended |

|

| |

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing fees (Note 6) |

|

88,434 |

|

|

88,434 |

|

|

176,868 |

|

|

176,868 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

79,409 |

|

|

130,855 |

|

|

348,816 |

|

|

228,497 |

|

| General and administrative |

|

209,157 |

|

|

433,519 |

|

|

586,243 |

|

|

776,195 |

|

| Loss before other items |

|

(295,565 |

) |

|

(827,824 |

) |

|

(758,191 |

) |

|

(827,824 |

) |

| Other items: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion on CEBA loan |

|

- |

|

|

(88 |

) |

|

- |

|

|

(1,631 |

) |

| Accretion on preference shares |

|

(80,114 |

) |

|

(27,046 |

) |

|

(107,246 |

) |

|

(53,879 |

) |

| Accretion on put liability |

|

(63,370 |

) |

|

(66,272 |

) |

|

(160,626 |

) |

|

(129,010 |

) |

| Accretion on royalty payable |

|

(229,039 |

) |

|

(532,407 |

) |

|

(467,201 |

) |

|

(920,247 |

) |

| Foreign exchange gain (loss) |

|

11,326 |

|

|

10,693 |

|

|

(31,801 |

) |

|

31,362 |

|

| Government grant income |

|

2,818 |

|

|

1,409 |

|

|

2,818 |

|

|

2,818 |

|

| Interest income |

|

- |

|

|

- |

|

|

726 |

|

|

43 |

|

| Net and comprehensive loss |

|

(558,151 |

) |

|

(1,111,037 |

) |

|

(1,521,521 |

) |

|

(1,898,368 |

) |

| Loss per Basic and diluted share |

|

(0.01 |

) |

|

(0.03 |

) |

|

(0.03 |

) |

|

(0.05 |

) |

| Weighted average shares outstanding |

|

61,429,672 |

|

|

35,688,231 |

|

|

44,144,562 |

|

|

35,180,734 |

|

The accompanying notes form an integral part of these condensed consolidated interim financial statements.

REPLICEL LIFE SCIENCES INC.

Condensed Consolidated Interim Statements of Cash Flows

For the three months ended

(Stated in Canadian Dollars)

(Unaudited) |

| |

|

June 30,

2023 |

|

|

June 30,

2022 |

|

| |

|

|

|

|

|

|

Operating activities

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Net loss |

$ |

(1,521,522 |

) |

$ |

(1,898,368 |

) |

| Add items not involving cash: |

|

|

|

|

|

|

| Accretion and accrued dividends |

|

53,879 |

|

|

53,879 |

|

| Accretion on CEBA loan |

|

- |

|

|

3,174 |

|

| Accretion on royalty payable |

|

467,201 |

|

|

878,034 |

|

| Amortization of contract asset |

|

17,686 |

|

|

17,686 |

|

| Accretion of put liability (Note 6) |

|

160,626 |

|

|

129,010 |

|

| Government grant income |

|

(2,818 |

) |

|

(2,818 |

) |

| Loss on re-measurement of derivative liability |

|

- |

|

|

- |

|

| Revenue from contract liability (Note 6) |

|

(176,868 |

) |

|

(176,868 |

) |

| Depreciation |

|

1,201 |

|

|

419 |

|

| Stock-based compensation (Note 10 (e)) |

|

29,955 |

|

|

251,877 |

|

| |

|

|

|

|

|

|

| Changes in non-cash working capital balances: |

|

|

|

|

|

|

| Sales taxes recoverable |

|

(16,553 |

) |

|

(12,901 |

) |

| Prepaid expenses and deposits |

|

102,725 |

|

|

1,259 |

|

| Accounts payable and accrued liabilities |

|

(666,800 |

) |

|

(21,903 |

) |

| Net cash used in operating activities |

|

(1,551,288 |

) |

|

(777,521 |

) |

| |

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Gross proceeds on issuance of common shares (Note 10 b)) |

|

1,013,010 |

|

|

759,323 |

|

| Share subscriptions |

|

- |

|

|

7,760 |

|

| Shares issued for debt |

|

340,769 |

|

|

- |

|

| Net cash provided by financing activities |

|

1,353,781 |

|

|

767,083 |

|

| |

|

|

|

|

|

|

| Increase (Decrease) in cash and cash equivalents during the period |

|

(197,509 |

) |

|

(10,438 |

) |

| |

|

|

|

|

|

|

| Cash and cash equivalents, beginning of the period |

|

413,025 |

|

|

221,188 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents, end of the period |

$ |

215,516 |

|

$ |

210,750 |

|

The accompanying notes form an integral part of these condensed consolidated interim financial statements.

REPLICEL LIFE SCIENCES INC.

Consolidated Statements of Changes in Equity (Deficiency)

For the three months ended March 31, 2023 and 2022

(Stated in Canadian Dollars)

(Unaudited)

|

| |

|

Common Stock |

|

|

|

|

|

Contributed |

|

|

Accumulated |

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

Surplus |

|

|

Deficit |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance January 1, 2022 |

|

47,595,327 |

|

$ |

31,661,019 |

|

$ |

5,398,590 |

|

$ |

(42,974,870 |

) |

$ |

(5,915,261 |

) |

| Stock-based compensation (Note 10 (e)) |

|

- |

|

|

- |

|

|

29,955 |

|

|

- |

|

|

29,955 |

|

| Common shares issued private placement |

|

10,130,100 |

|

|

1,013,100 |

|

|

- |

|

|

- |

|

|

1,013,100 |

|

| Common shares issued for debt |

|

3,193,092 |

|

|

284,402 |

|

|

- |

|

|

- |

|

|

284,402 |

|

| Common shares issued for dividends |

|

508,253 |

|

|

56,367 |

|

|

- |

|

|

- |

|

|

56,367 |

|

| Net loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

(1,521,521 |

) |

|

(1,521,521 |

) |

| Balance June 30, 2023 |

|

61,426,772 |

|

$ |

33,014,798 |

|

$ |

5,428,545 |

|

$ |

(44,496,391 |

) |

$ |

6,053,048 |

|

| |

|

Common Stock |

|

|

|

|

|

Share |

|

|

Contributed |

|

|

Accumulated |

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

subscription |

|

|

Surplus |

|

|

Deficit |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, January 1, 2021 |

|

34,959,207 |

|

$ |

30,291,486 |

|

$ |

- |

|

$ |

5,097,777 |

|

$ |

(42,231,642 |

) |

$ |

(6,842,379 |

) |

| Stock-based compensation (Note 10 (e)) |

|

- |

|

|

- |

|

|

- |

|

|

121,752 |

|

|

- |

|

|

121,752 |

|

| Common shares subscriptions |

|

- |

|

|

- |

|

|

192,339 |

|

|

- |

|

|

- |

|

|

192,339 |

|

| Net loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(787,331 |

) |

|

(787,331 |

) |

| Balance June 30, 2022 |

|

34,959,207 |

|

$ |

30,291,486 |

|

$ |

192,339 |

|

$ |

5,219,529 |

|

$ |

(43,018,973 |

) |

$ |

(7,315,619 |

) |

The accompanying notes form an integral part of these condensed consolidated interim financial statements.

REPLICEL LIFE SCIENCES INC.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

For the six months ended June 30, 2023

(Stated in Canadian Dollars)(Unaudited)

|

1. Corporate Information

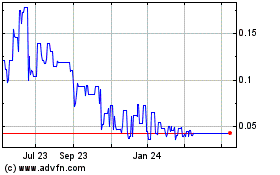

RepliCel Life Sciences Inc. (the "Company" or "RepliCel") was incorporated under the Ontario Business Corporations Act on April 24, 1967 but was continued from Ontario to British Columbia on June 22, 2011. Its common shares are listed for trading in Canada on the TSX Venture Exchange, trading under the symbol RP, and in the United States on the OTCQB, trading under the symbol REPCF.

RepliCel is a regenerative medicine company focused on developing autologous cell therapies that treat functional cellular deficits including chronic tendon injuries, androgenetic alopecia and skin aging.

The Company's corporate office and principal place of business address is Suite 900 - 570 Granville Street, Vancouver, BC, V6C 3P1.

2. Basis of Presentation

These condensed consolidated interim financial statements for the three-month period ended June 30, 2023, have been prepared in accordance with IAS 34 Interim Financial Reporting. They do not include all disclosures that would otherwise be required in a complete set of financial statements and should be read in conjunction with the Company's 2022 annual financial statements, which have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

The financial statements of subsidiaries are included in these consolidated financial statements from the date that control commences until the date that control ceases. The financial statements of the subsidiaries are prepared for the same reporting period as the parent company, using consistent accounting policies. Intra-group balances and transactions, and any unrealized income and expenses arising from intra-group transactions, are eliminated in preparing the consolidated financial statements. The accompanying consolidated financial statements include the account of RepliCel Life Sciences Inc. and its wholly owned subsidiary, Trichoscience Innovations Inc. ("Trichoscience").

The condensed consolidated interim financial statements have been prepared using accounting policies consistent with those used in the Company's 2022 annual financial statements, except as disclosed in Note 4. The condensed interim financial statements are presented in Canadian dollars, the Company's functional currency unless otherwise indicated.

Preparing financial statements compliant with IFRS requires management to make certain critical accounting estimates. It also requires management to exercise judgment in applying the Company's accounting policies. The areas involving a higher degree of judgment of complexity or areas where assumptions and estimates are significant to the financial statements are disclosed in Note 3.

The condensed consolidated interim financial statements were authorized for issue by the Board of Directors on October 23, 2023.

2. Basis of Presentation - continued

a) Continuance of Operations

These condensed consolidated interim financial statements have been prepared on a going concern basis, which assumes that the Company will continue to realize its assets and discharge its obligations and commitments in the normal course of operations. At June 30, 2023, the Company is in the research stage, has accumulated losses of $44,496,391 since its inception and expects to incur further losses in the development of its business. The Company incurred a consolidated net loss of $1,521,521 during the six month period ended June 30, 2023. The Company will require additional funding to continue its research and development activities, which may not be available on acceptable terms. This will result in material uncertainties which casts substantial doubt about the Company's ability to continue as a going concern.

The Company's ability to continue as a going concern depends on its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has a plan to address this concern and intends to obtain additional funds by equity financing to the extent there is a shortfall from operations. While the Company is continuing its best efforts to achieve the above plans, there is no assurance that any such activity will generate funds for operations.

If the going concern assumptions were not appropriate for these consolidated financial statements, then adjustments would be necessary to the carrying value of assets and liabilities, the reported net loss and the financial position classifications used.

3. Critical Accounting Estimates and Judgements

In these financial statements, RepliCel has made estimates and assumptions about the future that affect the reported amounts of assets and liabilities. Estimates and judgments are continually evaluated based on historical experience and other factors, including expectations of future events that are believed be reasonable under the circumstances. In the future, actual experience may differ from these estimates and assumptions.

The effect of a change in an accounting estimate is recognized prospectively by including it in comprehensive income in the period of the change, if the change affects that period only, or in the period of the change and future periods, if the change affects both.

Information about critical judgments in applying accounting policies that have the most significant risk of causing material adjustment to the amounts reported in these financial statements are discussed below:

Share Based Payments

The Company measures the cost of equity-settled transactions with employees by reference to the fair value of the equity instruments at the date at which they are granted. Estimating fair value for share-based payment transactions requires determining the most appropriate valuation model, which is dependent on the terms and conditions of the grant. This estimate also requires determining the most appropriate inputs to the valuation model including the expected life of the share option, volatility and dividend yield and making assumptions about them. The assumptions and models used for estimating the fair value for share-based payment transactions are disclosed in Note 9(e).

3. Critical Accounting Estimates and Judgements - continued

Revenue Recognition

The Company applies the five-step model to contracts when it is probable that the Company will collect the consideration that it is entitled to in exchange for the goods and services transferred to the customer. For collaborative arrangements that fall within the scope of IFRS 15, the Company applies the revenue recognition model to part or all of the arrangement when deemed appropriate. At contract inception, the Company assesses the goods or services promised within each contract that falls under the scope of IFRS 15 to identify distinct performance obligations. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when or as the performance obligation is satisfied. Significant judgment is involved in determining whether the transaction price allocated to the license fee should be recognized over the collaboration period or at the inception of the contract and the time period over which revenue is to be recognized.

To determine the price of the Licensing and Collaboration Agreement, the Company has to make judgments and estimates in assessing the value assigned to the put options and of the warrants as attached to the placement (See Note 5 - Licensing and Collaboration Agreement - YOFOTO (China) Health Industry Co. Ltd.).

Preference Shares

Replicel makes estimates on the issuance of preference shares which are compound instruments that consist of both an equity and a liability component. Management is required to make estimates to determine the fair value of the components of the preference share issuance at the date that it is issued. The Company also needs to make estimates on the effective interest on preference shares to calculate amounts payable on redemption and inclusive of dividends.

Put Liability

Replicel made estimates on the issuance of the put liability disclosed in Note 5. The put liability is a financial liability recorded initially at the present value of the potential exercise price of the put. Management is required to estimate to determine the effective interest rate to appropriately discount the potential exercise price over the term of the put liability to its fair value at issuance. Subsequent to its initial recording, the put liability is accreted up to the full face value at the end of the term of the agreement.

Derivative Liability

Replicel made estimates in determining the fair value of the derivative liability disclosed in Note 6. The obligation to issue common shares to Mainpointe at an agreed price at a future date is a derivative liability accounted for at FVTPL. The fair value of this derivative liability has been estimated based on the difference between the market value of the Company's shares to be issued under this arrangement at the reporting date compared to the agreed price of such shares. The derivative liability is fair valued at each measurement date until its settlement.

Royalty Payable

Replicel makes estimates of the expected timing of the payment of royalties as part of the three strategic agreements signed with Mainpointe Pharmaceuticals LLC ("Mainpointe"). Under this royalty arrangement, RepliCel has provided Mainepointe with a right to participate in RepliCel's royalty revenue stream up to a maximum payout of $16 million US and certain distribution rights of RepliCel Injector Product Line in the United States. Management is required to estimate to determine the timing of the Company's royalty revenue stream up to $16 million US.

3. Critical Accounting Estimates and Judgements - continued

Income Taxes

Significant judgment is required in determining the provision for income taxes. Many transactions and calculations are undertaken during the ordinary course of business for which the ultimate tax determination is uncertain. The Company recognizes liabilities and contingencies for anticipated tax audit issues based on the Company's current understanding of the tax law. For matters where it is probable that an adjustment will be made, the Company records its best estimate of the tax liability, including the related interest and penalties in the current tax provision. Management believes they have adequately provided for the probable outcome of these matters; however, the final outcome may result in a materially different outcome than the amount included in the tax liabilities.

In addition, the Company will recognize deferred tax assets relating to tax losses carried forward to the extent of sufficient taxable temporary differences relating to the same taxation authority and the same taxable entity against which the unused tax losses can be utilized. However, utilization of the tax losses also depends on the ability of the taxable entity to satisfy certain tests when the losses are used to offset future profits.

4. Accounting Standards, Amendments, and Interpretations

New Standards, Amendments and Interpretations Effective for the first time

There were no new standards, interpretations and amendments effective from January 1, 2022, that had a material impact on these consolidated financial statements.

5. Licensing and Collaboration Agreement - YOFOTO (China) Health Industry Co. Ltd.

On July 10, 2018, the Company signed a definitive Licensing and Collaborative Agreement with YOFOTO (China) Health Industry Co. Ltd. ("YOFOTO") to commercialize three of RepliCel's programs in Greater China subject to certain Canadian and Chinese approvals (the "Transaction").

The Transaction represents an investment in RepliCel by YOFOTO with milestone payments, minimum program funding commitments, and sales royalties in exchange for an exclusive 15-year license to three of RepliCel products for Greater China (Mainland China, Hong Kong, Macau and Taiwan) (the "Territory").

As part of the transaction, YOFOTO invested CDN $5,090,005 in a private placement of RepliCel common shares at CDN $0.95 per share that included 20% warrant coverage with each warrant exercisable at CDN $0.95 per share for a period of two years. The warrants have not yet been exercised (Note 13).

The transaction structure also included milestone payments (of up to CDN $4,750,000), sales royalties, and a commitment by YOFOTO to spend a minimum of CDN $7,000,000 on the RepliCel programs and associated cell processing manufacturing facility over the five-year period commencing on July 10, 2018, in Greater China pursuant to a License and Collaboration Agreement. The License and Collaboration Agreement contains a provision permitting YOFOTO to put up to 2/3 of the shares issued in YOFOTO's initial investment back to the Company under certain conditions until January 2027.

5. Licensing and Collaboration Agreement - YOFOTO (China) Health Industry Co. Ltd. - continued

As part of the Transaction, the Company granted YOFOTO certain financing participation rights along with a board seat nomination. Upon YOFOTO meeting certain defined conditions, relevant Chinese patents, once issued in China, will be assigned to a YOFOTO-owned Canadian subsidiary, with detailed assignment reversion rights upon failure to meet defined targets. At the date of these financial statements, no such Chinese patents have been assigned to YOFOTO.

On October 9, 2018, the $5,090,005 private placement was closed and the Company issued YOFOTO 5,357,900 RepliCel common shares, representing 19.9% of RepliCel's then-issued common shares. In association with the YOFOTO deal, the Company agreed to pay a finders/success fee of ten percent (10%) of any upfront fees received by the Company and consequently, a fee of $509,001 was paid in this respect. In addition, the Company will be paying a success fee of five percent (5%) of any milestone fees and royalty fees received by the Company as a result of this License Agreement.

Contract Asset

The finders/success fee paid in connection with the YOFOTO Licensing and Collaboration Agreement of $509,001 was incurred to secure the YOFOTO License and Collaboration Agreement as well as to close the related private placement. Consequently, the $509,001 finders/success fee was accounted for as a contract asset, a share issuance cost and a cost incurred in connection with the put obligation.

The $509,001 fee was allocated between contract costs, share issuance costs and as an offset to the fair value of the related warrants and as an offset to the fair value of the put liability. The finders/success fee was allocated based on the relative fair values of these four items. The contract asset is being amortized over the same period of time that the Company recognizes the upfront license revenue.

Contract liability

The proceeds of $5,090,005 from the placement was allocated based on the fair values of:

- the common shares that were not subject to the put - $715,280 ($794,755 less costs of $79,476);

- the 1,071,580 warrants issued - $161,684 ($179,649 less costs of $17,965); and

- the put liability - $520,426 ($578,251 less costs of $57,825).

The remaining $3,537,350 was allocated to Contract Liability to be recognized as License Fee revenue over a period of 10 years from the commencement date of the Agreement.

Put liability

Under the Agreement, YOFOTO has the right to put back all of the common shares acquired in the event that it is unable to complete human clinical trials for the licensed technologies for reasons that are outside of YOFOTO's controls on or before 8.5 years from the date of the Agreement. Although the put option can be exercised independently for each of the three licensed technologies at a rate of 1/3 per licensed technology (RCT-01, RCS-01 and RCI-02), the terms of the Agreement provide that only 2/3s of the shares can be put back to RepliCel under conditions that RepliCel does not control. As this represents an obligation to transfer cash under circumstances not within RepliCel's control, the put option in connection with 2/3s of the shares issued under the Agreement is recognized as a liability.

The Company has recorded a put liability based on management's estimate of its fair value. The fair value of this put liability was determined by calculating the present value of $3,393,337 repayable in 8.5 years discounted at 23%. $3,393,337 is 2/3s of the private placement proceeds subject to the put liability. After its initial recording at $520,426, the put liability is subsequently accreted up to the full face value at the end of the term of the agreement. Accretion expense on put liability at June 30, 2023 amounts to $160,626 (June 30, 2022 - $129,010).

6. Investment and U.S. Partnership - Mainpointe Pharmaceuticals, LLC

On January 22, 2021, RepliCel signed three strategic agreements with MainPointe: a Share Purchase Agreement, a Distribution Agreement, and a Royalty Agreement. The strategic investment of $2,700,000 under the Share Purchase Agreement from MainPointe will be spread over an 8-month period. Under the limited term distribution partnership for RepliCel's dermal injector and consumables (the "RepliCel Injector Product Line") in the United States, MainPointe has agreed to pay all costs related to securing FDA approvals to launch the RepliCel Injector Product Line in the U.S. market. The Royalty Participation Agreement provides MainPointe the right to be paid a portion of RepliCel's future royalty revenue stream earned from the sale of RCS-01, RCT-01, and RCH-01 products and any derivatives. A shareholder director of RepliCel is the Chief Technology Officer of MainPointe.

Primary Deal Terms

In consideration for an investment of $2,700,000 and the payment of all costs related to obtaining FDA approval for the Company's dermal injector and consumables, RepliCel has agreed to issue MainPointe up to an aggregate of four (4) million common shares, a right to participate in RepliCel's royalty revenue stream up to a maximum payout of 16 million US dollars, and certain distribution rights of RepliCel Injector Product Line in the United States. The investment will be made as to:

- $500,000 within five (5) days of receipt of conditional approval from the TSX Venture Exchange ($492,092 on February 8, 2021),

- $1,200,000 by February 15, 2021 (received $490,000 on March 23, 2021 and $717,871 on April 23, 2021),

- $700,000 by April 21, 2021 (received $500,528 on August 30, 2021, $199,472 received on November 29, 2021), and

- $300,000 by August 21, 2021 ($298,921 received on November 29, 2021).

The common shares will be priced at the greater of $0.675 or the Discounted Market Price as defined in the Policies of the TSX Venture Exchange.

6. Investment and U.S. Partnership - Mainpointe Pharmaceuticals, LLC - continued

During the year ended December 31, 2021, the Company received the aggregate consideration of $2,700,000 in five tranches, which were accounted for and allocated as follows on initial recognition:

Tranche receipt

date |

Tranche amount

$ |

Share capital or

share subscription

$ |

Royalty payable

$ |

Loss on

remeasurement of

derivative liability

$ |

Derivative liability

$ |

| February 8, 2021 |

492,092 |

364,512 |

346,287 |

(218,707) |

- |

| March 23, 2021 |

490,000 |

272,222 |

344,815 |

(127,037) |

445,384 |

| April 23, 2021 |

717,871 |

378,667 |

507,376 |

(168,172) |

(163,892) |

| August 30, 2021 |

500,528 |

240,995 |

352,224 |

(92,691) |

(225,991) |

| November 30, 2021 |

498,393 |

203,049 |

350,845 |

(55,501) |

(55,501) |

| Total* |

2,698,884 |

1,459,445 |

1,901,547 |

(662,108) |

- |

* The difference of $1,116 between the contractual gross proceeds and actual gross proceeds received is attributable to wire fees and foreign exchange translation differences.

The Company issued 3,986,684 common shares to fulfill its obligations pursuant to the Share Purchase Agreement:

| Issue Date |

|

Number of common shares |

|

| |

|

|

|

| February 8, 2021 |

|

729,024 |

|

| April 23, 2021 |

|

1,777,778 |

|

| December 17, 2021 |

|

1,479,882 |

|

| |

|

3,986,684 |

|

Mainpointe is entitled to a royalty up to an aggregate maximum amount of $16 million USD under the agreement equal to:

a) 5% of the amounts earned by and paid to the Company from the sale of any of its "NBDS Products" defined as its RCS-01 (NBDS Fibroblast Therapy - Treatment for Aging Skin), RCT-01 (NBDS Fibroblast Therapy - Treatment for Chronic Tendinosis) and any other product which is comprised of the non-bulbar dermal sheath cells patented by the Company, and

b) 20% of the amounts earned by and paid to the Company from the sale of any of its "DSC Products" defined as its RCH-01 (DSC Therapy for Treatment Androgenic Alopecia) and any other product which is comprised of the dermal sheath cup cells patented by the Company.

6. Investment and U.S. Partnership - Mainpointe Pharmaceuticals, LLC - continued

In consideration for paying all expenses required to obtain regulatory approval for the RepliCel Injector Product Line, the exclusive distribution rights shall commence upon receipt of regulatory approval to launch the RepliCel Injector Product Line in the U.S. market for a period expiring on the earlier of:

a) four (4) years, or

b) when MainPointe has earned USD $2,000,000 in gross income from the sale of the products in the RepliCel Injector Product Line.

The Company will have the right, in its discretion, to buy out this exclusivity right for an amount equal to the net-present value of profit to be earned on USD $2,000,000 in gross income, plus a further amount in gross income that is equal to the regulatory approval costs

The arrangement with MainPointe was accounted for as a hybrid instrument with two components: royalty payable, which is a financial liability accounted for initially at fair value and subsequently at amortized cost, and an obligation to issue common shares to MainPointe at an agreed price at a future date, which is a derivative liability accounted for at FVTPL.

The obligation to pay royalties of $16 million USD is classified as a financial liability and measured initially at its fair value and subsequently at amortized cost. Management estimated the present value of future cash flows over the expected term using an estimated effective interest rate. The timing and amount of future cash flows are significant judgments that influence measurement of this financial liability over its term until settled. The effective interest rate will be reassessed at each reporting period end date based on management's estimates of changes to the future cash flows and their timing. The Company incurred no transaction costs to enter into these agreements and has recorded accretion expense based on an effective interest rate of 57%.

Accretion expense recorded in the six months ended June 30, 2023 of $467,201 (2022: $920,247) was based management's estimate that they would pay USD $16 million royalty obligation in 2.34 years ("the Payback Period"), commencing from January 1, 2024. On December 31, 2022, the Company changed the estimated commencement date from January 1, 2024 to January 1, 2026 based on new information available. As a result of the change, the Company recognized a gain of $3,310,875 in its statement of comprehensive loss. The change in commencement date did not impact the current estimated Payback Period, which remains at 2.34 years. Any changes in this estimated Payback Period would result in variability to the Company's reported royalty obligation and annual accretion expense. Should the Payback Period extend beyond the current estimated 2.34 years, the royalty obligation at December 31, 2022, the accretion in the year ended December 31, 2022 and the effective interest rate estimate would change as presented below:

| Payback Period (years) |

|

Royalty payable estimate at

December 31, 2022

($) |

|

|

Accretion expense for

December 31, 2022

($) |

|

|

Effective interest rate |

|

| 2.34 (current estimate) |

|

1,623,088 |

|

|

2,031,758 |

|

|

57% |

|

| 5.00 |

|

3,227,547 |

|

|

784,813 |

|

|

29% |

|

| 7.50 |

|

2,969,087 |

|

|

606,255 |

|

|

24% |

|

| 10.00 |

|

2,810,512 |

|

|

498,534 |

|

|

21% |

|

6. Investment and U.S. Partnership - Mainpointe Pharmaceuticals, LLC - continued

The fair value of the derivative liability related to the Company's obligation to issue its common shares at a future date at an agreed price was estimated as the difference between the market price of the Company's common shares on the measurement date and their market price on the inception date of the Mainpointe agreement (January 22, 2021) multiplied by the number of common shares issuable per the contractual terms. The derivative liability was re-measured until the settlement date, (when agreed proceeds for the Company's common shares have been received) with a gain or loss on re-measurement recognized on the statement of profit or loss. The Company settled the obligation to issue its common shares during 2021 and recognized a loss on the re-measurement of the derivative liability of $662,108 during the settlement period.

The royalty payable is recognized when proceeds from the arrangement are received from MainPointe and is measured as a residual after subtracting the fair value of derivative liability related to the Company's obligation to issue its common shares at a future date at an agreed price from the proceeds. The royalty payable to MainPointe as at June 30, 2023 was $2,090,289 ($1,623,088 - December 31, 2022). The increased during the six month period was a result of accretion expense of $390,499 and $ 76,702 as a result of exchange loss.

7. Preference shares

On September 12, 2019, the Company announced that it had completed the first tranche of a private placement pursuant to which it issued 1,089,125 Class A Preference shares at a price of $0.40 per share for aggregate gross proceeds of $435,650.

The finalized terms of the private placement carried certain rights and restrictions, which include:

- a fixed dividend rate which shall accrue on a daily basis (based on a 360- day year consisting of 12 30-day months) at a rate of seven (7%) per annum;

- the right of the Class A Shareholder to convert the paid up amount of each Class A Share, from time-to-time, into shares of the Company (each, a "Share") at any time prior to the date that is five (5) years from the date of issuance of the Class A Shares at a conversion price of $0.33;

- voting rights only on matters pertaining to Class A Shares until they are converted to common shares at which time all voting rights attach; and

- a first priority over all Shares or shares of any other class of the Company as to dividends and upon liquidation.

Subject to the earlier conversion by Class A shareholders and compliance with applicable laws, the Company may, in its discretion at any time, prior to the date that is five (5) years from the date of issuance of the Class A Shares (the "Required Redemption Date") redeem all of the Class A Shares at a price (the "Redemption Price") of:

(i) $0.468 per Class A Share for the period from the date of issuance (the "Issue Date") to the date that is the first anniversary of the Issue Date;

(ii) $0.536 for the period from the date that is the day after the first anniversary of the Issue Date to the date that is the second anniversary of the Issue Date;

(iii) $0.604 for the period from the date that is the day after the second anniversary of the Issue Date to the date that is the third anniversary of the Issue Date;

(iv) $0.672 for the period from the date that is the day after the third anniversary of the Issue Date to the date that is the fourth anniversary of the Issue Date; and

(v) $0.740 for the period from the date that is the day after the fourth anniversary of the Issue Date and the date that is the fifth anniversary of the Issue Date.

7. Preference shares - continued

On the Required Redemption Date, the Company must redeem all remaining outstanding Class A Shares at the Redemption Price, subject to compliance with applicable laws.

The financial instrument is being measured at amortized cost. Given the Company has an obligation to redeem the preference shares in 5 years at $0.74/share, the effective interest was accreted for the redemption amount and accrued cumulative dividends that will be settled in the future.

The continuity of the preferred share liability is presented below:

| |

|

June 30, 2023 |

|

|

December 31, 2022 |

|

| Opening preference share liability |

$ |

689,290 |

|

$ |

611,386 |

|

| Dividends accrued |

|

68,616 |

|

|

30,495 |

|

| Accretion |

|

38,632 |

|

|

47,409 |

|

| Settlement of dividends through the issuance of common shares |

|

(53,367 |

) |

|

- |

|

| Balance and exercisable |

$ |

743,169 |

|

$ |

689,290 |

|

8. Government grant

Due to the global outbreak of the Novel Coronavirus ("COVID-19"), the federal government of Canada introduced the Canada Emergency Business Account ("CEBA"). CEBA provided an interest-free loan ("CEBA") of $60,000 to eligible businesses. The CEBA loan has an initial term that expires on December 31, 2023 throughout which the CEBA Loan remains interest free. Repayment of $40,000 by December 31, 2023 results in a $20,000 loan forgiveness. If the balance is not paid prior to December 31, 2023, the remaining balance will be converted to a 3-year term loan at 5% annual interest, paid monthly effective January 1, 2024. The full balance must be repaid by no later than December 31, 2026.

Pursuant to IAS 20 Accounting for Government Grants and Disclosure of Government Assistance, the benefit of a government loan at below market rate is treated as a government grant and measured in accordance with IFRS 9, Financial Instruments. The benefit of below market rate shall be measured as the difference between the initial carrying value of the loan (being the present value of a similar loan at market rates) and the proceeds received. The Company has estimated the initial carrying value of the CEBA loan at $26,663 using a discount rate of 18%, which was the estimated rate for a similar loan without the interest free component. The difference of $13,378 will be accreted to the loan liability over the term of the CEBA Loan and offset to other income on the statement of loss and comprehensive loss.

During the year ended December 31, 2022, the total accretion expense recognized for the CEBA loan amounted to $6,701 (December 31, 2021 - $5,528). In addition, the Company recognized $2,818 (2021: $2,819) in Government Grant Income.

9. Share Capital

a) Authorized:

Unlimited common shares without par value, and unlimited preferred shares without par value.

b) Issued and Outstanding:

During the period ended June 30, 2023, share activities were as below:

On January 17, 2023, the Company announced that, further to its News Release of December 23, 2022, it has received approval from the TSX Venture Exchange to the issuance of 3,193,092 common shares (each, a "Share") at a deemed price of $0.09 per Share in settlement of $287,378.32 owing to various creditors (the "Debt Settlement"). The Shares were issued on January 17, 2023. The Shares are subject to a statutory hold period of four months and one day after the closing of the Debt Settlement.

On February 1, 2023, the Company announced that, further to its News Release of January 16, 2023, it has received approval from the TSX Venture Exchange to the issuance of 508,253 common shares (the "Shares") in settlement of accrued dividends of $53,367.13 outstanding on the Class A Preferred Shares (the "Settlement"). The Shares were issued on February 1, 2023, and are subject to a statutory hold period of four months and one day after the closing of the Settlement.

On March 14, 2023, the Company has completed its previously announced non-brokered private placement (the "Offering"), as described in its News Release dated January 26, 2023, pursuant to which it has issued an aggregate of 10,131,000 units (each, a "Unit") at a price of $0.10 per Unit for gross proceeds of $1,013,100. Each Unit consists of one common share in the capital of the Company (each, a "Share") and one-half of one common share purchase warrant (each whole warrant, a "Warrant"). Each Warrant is exercisable into one additional Share at a price of $0.20 per Share for a period of four years from the closing date.

On May 4, 2022, the Company closed the first tranche of the Offering, pursuant to which it sold an aggregate of 4,218,470 Units for gross proceeds of $759,325. On June 6, 2022, the Company announced that the Exchange has granted a thirty (30) day extension to the Company for completion of its Offering. On July 7, 2022, the Company announced that it does not intend to complete the second tranche of its non-brokered private placement announced on March 21, 2022.

c) Stock Option Plans:

On May 21, 2014, the Company approved a Stock Option Plan whereby the Company may grant stock options to directors, officers, employees and consultants. The maximum number of shares reserved for issue under the plan cannot exceed 10% of the outstanding common shares of the Company as at the date of the grant. The stock options can be exercisable for 10 years from the grant date and with various vesting terms.

9. Share Capital - continued

d) Fair value of Company Options Issued from January 1, 2017 to June 30, 2023

There were no stock options granted during the three-month periods ended June 30, 2023 and 2022.

Options Issued to Employees

The fair value at grant date is determined using a Black-Scholes option pricing model that takes into account the exercise price, the term of the option, the impact of dilution, the share price at grant date and expected price volatility of the underlying share, the expected dividend yield, the expected forfeiture rate and the risk free interest rate for the term of the option.

Options Issued to Non-Employees

Options issued to non-employees, are measured based on the fair value of the goods or services received, at the date of receiving those goods or services. If the fair value of the goods or services received cannot be estimated reliably, the options are measured by determining the fair value of the options granted, using a valuation model.

e) Stock-based Compensation

The Company recognized a fair value of $30,000 (2022: $2,314), as stock based compensation expense for stock options granted under the Company Stock Option Plan and the Founders Stock Option Agreements for the six month ended June 30, 2023 and 2022.

A summary of the status of the stock options outstanding under the Company Stock Option Plan for the three-month period ended June 30, 2023 and 2020 are as follows:

| |

|

Number of

Options |

|

|

Weighted

Average

Exercise Price |

|

| Outstanding, December 31, 2022 |

|

2,675,000 |

|

$ |

0.41 |

|

| Granted |

|

2,020,000 |

|

$ |

0.12 |

|

| Expired |

|

- |

|

$ |

- |

|

| Outstanding, June 30, 2023 |

|

4,695,000 |

|

$ |

0.29 |

|

| Exercisable, June 30, 2023 |

|

3,250,000 |

|

$ |

0.29 |

|

|

|

Number of

Options |

|

|

Weighted

Average

Exercise Price |

|

| Outstanding, December 31, 2021 |

|

2,825,000 |

|

$ |

0.51 |

|

| Granted |

|

- |

|

|

- |

|

| Expired |

|

- |

|

$ |

- |

|

| Outstanding and Exercisable, June 30, 2022 |

|

2,413,750 |

|

$ |

0.51 |

|

As at June 30, 2023, the range of exercise prices for options outstanding under the Company Stock Option Plan is $0.12 - $0.43 and the weighted average remaining contractual life for stock options under the Company Stock Option Plan is 3.33 years.

9. Share Capital - continued

f) Warrants

The number of warrants outstanding at June 30, 2023, and December 31, 2022 each exercisable into one common share, is as follows:

| Issue Date |

|

Warrants

Outstanding |

|

|

Weighted

Average

Exercise Price |

|

|

Expiry Date |

|

| July 15, 2020 |

|

1,819,555 |

|

$ |

0.36 |

|

|

July 15, 2023 |

|

| May 4, 2022 |

|

2,109,234 |

|

$ |

0.40 |

|

|

May 4, 2025 |

|

| December 30, 2022 |

|

4,209,825 |

|

$ |

0.20 |

|

|

December 30, 2025 |

|

| March 14, 2023 |

|

5,065,500 |

|

|

0.20 |

|

|

March 14, 2027 |

|

| Outstanding, June 30, 2023 |

|

13,204,114 |

|

$ |

0.28 |

|

|

|

|

10. Related Party Transactions

Related party balances

The following amounts due to related parties are included in accounts payable and accrued liabilities:

| |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| Companies controlled by directors of the Company (a) |

$ |

- |

|

$ |

47,250 |

|

| Directors or officers of the Company |

|

95,000 |

|

|

43,500 |

|

| |

$ |

95,000 |

|

$ |

90,750 |

|

(a) These amounts are unsecured, non-interest bearing and have no fixed terms of repayment.

The Company incurred the following transactions with companies that are controlled by directors and/or officers of the Company. The transactions were measured at the amount agreed to by the parties.

| |

|

Three months ended |

|

| |

|

June 30,

2023 |

|

|

June 30,

2022 |

|

| Research and development |

$ |

15,000 |

|

$ |

15,000 |

|

| |

$ |

15,000 |

|

$ |

15,000 |

|

10. Related Party Transactions - continued

Key management compensation

Key management personnel are persons responsible for planning, directing and controlling the activities of an entity, and include executive directors, the CEO, the COO and the CFO.

| |

|

Six months ended |

|

| |

|

June 30,

2023 |

|

|

June 30,

2022 |

|

| General and administrative - salaries |

$ |

96,000 |

|

$ |

84,000 |

|

| Directors' fees |

|

53,000 |

|

|

21,750 |

|

| Stock-based compensation |

|

30,000 |

|

|

104,995 |

|

| |

$ |

179,000 |

|

$ |

210,745 |

|

11. Financial Instruments and Risk Management

payable and accrued liabilities, CEBA loan payable, promissory note, put liability, royalty payable and preference shares. The fair values of cash and cash equivalents, accounts payable and accrued liabilities approximate their carrying value due to their short-term maturity.

The Company is exposed through its operations to the following financial risks:

- Currency risk;

- Credit risk;

- Liquidity risk; and

- Interest rate risk.

In common with all other businesses, the Company is exposed to risks that arise from its use of financial instruments. This note describes the Company's objectives, policies and processes for managing those risks and the methods used to measure them. Further quantitative information in respect of these risks is presented throughout these financial statements.

There have been no substantive changes in the Company's exposure to financial instrument risks, its objectives, policies and processes for managing those risks or the methods used to measure them from previous periods unless otherwise stated in this note.

Currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Company has an exposure to Euros and US Dollars as certain expenditures and commitments are denominated in Euros and US Dollars, and the Company is subject to fluctuations due to exchange rate variations to the extent that transactions are made in this currency. In addition, the Company holds an amount of cash in US dollars and is therefore exposed to exchange rate fluctuations on these cash balances. The Company does not hedge its foreign exchange risk. At June 30, 2022 the Company held US dollar cash balances of $4,194 (US$3,363) (December 31, 2022: $4,194 or US$3,363). A 10% increase/decrease in the US dollars foreign exchange rate would have an impact of ±$420 (US$330) on the cash balance held on June 30, 2023.

11. Financial Instruments and Risk Management - continued

Credit risk is the risk of an unexpected loss if a customer or counterparty fails to meet its contractual obligations. The Company's credit risk is primarily attributable to its cash and cash equivalents. The Company limits exposure to credit risk by maintaining its cash and cash equivalent with large financial institutions. The Company's maximum exposure to credit risk is the carrying value of its financial assets.

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. As the Company's cash and cash equivalent is currently held in an interest-bearing bank account, management considers the interest rate risk to be limited.

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk through the management of its capital structure, more specifically, the issuance of new common shares, to ensure there is sufficient capital to meet short term business requirements, after taking into account the Company's holdings of cash and potential equity financing opportunities. The Company believes these sources will be sufficient to cover the known short and long-term requirements. There is no assurance that potential equity financing opportunities will be available to meet these obligations.

The following table sets out the contractual maturities (representing undiscounted contractual cash-flows) of financial liabilities as at June 30, 2022:

| Years of Expiry |

Financial Instruments |

Amounts |

|

| |

|

|

|

|

| Within 1 year |

Accounts payable and accrued liabilities |

$ |

574,656 |

|

| Within 1 year |

CEBA loan payable |

$ |

42,709 |

|

| Within 2 to 5 years |

Preference shares |

$ |

927,395 |

|

| Greater than 5 years |

Put liability |

$ |

3,393,337 |

|

| Greater than 5 years |

Royalty payable |

$ |

21,670,400 |

|

| Total |

|

$ |

26,608,497 |

|

Contained within accounts payable and accrued liabilities is $272,685 of accrued liabilities at June 30, 2023 (2022: $237,534).

There were no changes to the Company's fair value measurement levels during the period ended March 31, 2023 (2022: no change). The Company does not have any level 3 fair value measurements (2022: none).

12. Commitments and Contingencies

The Company has entered into a Collaboration and Technology Transfer Agreement with Shiseido Company Limited which has alleged RepliCel breached obligations in the agreement, which may allegedly be terminal to future obligations pursuant to the agreement. The Company has vigorously denied the existence of such a breach and insists on the ongoing validity of the respective obligations of both parties pursuant to the agreement. No litigation or the triggering of other dispute mechanisms has been entered into by either party, and the Company's management is actively seeking to continue discussions and/or negotiations. Management maintains that any data produced from clinical trials of the technology will, by agreement, be made available to the Company.

From time to time, the Company is subject to claims and lawsuits arising from in the ordinary course of operations. In the opinion of management, the ultimate resolution of such pending legal proceedings will not have a material adverse effect on the Company's financial position.

13. Capital Management

The Company's objective when managing capital is to safeguard the Company's ability to continue as a going concern in order to pursue business opportunities. In order to facilitate the management of its capital requirements, the Company prepares periodic budgets that are updated as necessary. The Company manages its capital structure and makes adjustments to it to effectively support the Company's objectives. In order to continue advancing its technology and to pay for general administrative costs, the Company will use its existing working capital and raise additional amounts as needed.

Management reviews its capital management approach on an ongoing basis and believes that this approach, given the company's relative size, is reasonable. The Company considers shareholders' equity, preference shares and working capital as components of its capital base. The Company can access or increase capital through the issuance of shares and by sustaining cash reserves by reducing its capital and operational expenditure program. Management primarily funds the Company's expenditures by issuing share capital rather than using capital sources that require fixed principal and/or interest repayments. The Company is not subject to externally imposed capital requirements and does not have exposure to asset-backed commercial paper or similar products, with the exception of pooling and escrowed shares, which are subject to restrictions. The Company believes it can raise additional equity capital as required but recognizes the uncertainty.

The Company's investment policy is to hold cash in interest bearing bank accounts, which pay comparable interest rates to highly liquid short-term interest bearing investments with maturities of one year or less and which can be liquidated at any time without penalties. There has been no change in the Company's approach to capital management.

14. Non-cash Transactions

Investing and financing activities that do not directly impact current cash flows are excluded from the consolidated statements of cash flow. There were no non-cash transactions during the period.

15. Segmental Reporting

The Company is organized into one business unit based on its cell replication technology and has one reportable operating segment.

REPLICEL LIFE SCIENCES INC.

MANAGEMENT DISCUSSION AND ANALYSIS

FORM 51-102F1

For the period ended June 30, 2023

Dated as of October 23, 2023

This Management's Discussion and Analysis ("MD&A") of RepliCel Life Sciences Inc (referred to as "RepliCel", the "Company", "us" or "our") provides analysis of the Company's financial results for the six-month periods ended June 30, 2023. The following information should be read in conjunction with the accompanying annual financial statements for the year ended December 31, 2022, and the notes to those financial statements, prepared in accordance with IAS 34 under International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board. Financial information contained herein is expressed in Canadian dollars unless stated otherwise. Unless otherwise indicated, all information in this MD&A is current as of October 23, 2023. This MD&A is intended to supplement and complement RepliCel's financial statements for the period ended June 30, 2023, and the notes thereto. Readers are cautioned that this MD&A contains "forward-looking statements" and that actual events may vary from management's expectations. Readers are encouraged to read the cautionary note contained herein regarding such forward-looking statements. This MD&A was approved and authorized for issue by the Company's Audit Committee on behalf of our Board of Directors on October 23, 2023.

Cautionary Statement Regarding Forward-Looking Statements

Statements included in this MD&A that do not relate to present or historical conditions are "forward-looking statements". Forward-looking statements are projections regarding future events or the Company's future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "intend", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential", or "continue", or the negative of these terms or other comparable terminology. Forward-looking information presented in such statements or disclosures may, among other things, include the Company's:

• belief that chronic tendon injuries resulting from sports-related or occupational overuse is a significant unmet medical need;

• belief that RCT-01 has advantages over current treatments such as the use of non-steroidal anti-inflammatory medication or corticosteroids, which are limited in efficacy;

• belief that the data from a phase 1/2 clinical trial to test the safety and efficacy of injections of RCT-01 on patients suffering from chronic Achilles tendinosis in Canada and other countries are sufficient to support regulatory approvals to proceed to a phase 2 trial and the design of such a dose-finding trial;

• belief that the data from the phase 1 clinical trial to test the safety and certain biological outcomes of injections of RCS-01 in patients with aging and sun-damaged skin supports regulatory approvals to proceed to a phase 2 trial and the design of such a dose-finding trial;

• belief that regulatory agencies, including those in the United States, China, Europe, and Canada will approve applications to market the DermaPrecise product line without major objection or delay;

• research pertaining to and plans to continue to prepare for a phase 2 dose-finding trail for RCH-01 and details of such a trial;

• belief that the DermaPrecise trademark filings will be generally accepted in most jurisdictions where they are submitted;

• belief that the DermaPrecise dermal injector device will have applications in certain dermatological procedures and preparation for its commercialization, including building of commercial/clinical-grade prototypes, validation testing of such prototypes, filing of the regulatory submissions seeking regulatory approval to market the device, will lead to commercial launch, revenue generation, and commercial partners; expectations regarding regulatory clearances to conduct trials and market products;

• belief that the regulatory agencies in China will approve applications to proceed with clinical studies of RCT-01 and RCS-01 in China without significant objection or delay;

• expectations that the Company will maintain patent protection over its technologies to maximize the financial value of its product prior to and through commercialization;

• belief as to the potential of the Company's products;

• expectations regarding the performance of its commercial partners, YOFOTO, and MainPointe;

• expectations regarding the payment of milestone payments by YOFOTO;

• expectations regarding the performance of critical suppliers and service providers;

• forecasts of expenditures;

• expectations regarding our ability to raise capital;

• business outlook;

• plans and objectives of management for future operations;

• anticipated financial performance.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to the Company, including information obtained from third-party industry analysts and other third-party sources. In some instances, material assumptions and factors are presented or discussed elsewhere in this MD&A in connection with the statements or disclosure containing the forward-looking information. You are cautioned that the following list of material factors and assumptions is not exhaustive. The factors and assumptions include, but are not limited to, our assumption that there be:

• no unforeseen changes in the legislative and operating framework for the business of the Company;

• a stable competitive environment; and

• no significant event occurring outside the ordinary course of business such as a natural disaster or other calamity.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks set out in the section entitled "Risks and Uncertainties" commencing on page 19, which may cause the Company's or its industry's actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to the following risks:

• negative results from the Company's clinical studies and/or trials;

• the effects of government regulation on the Company's business;

• the viability and marketability of the Company's technologies;

• the development of superior technology by the Company's competitors;

• the failure of consumers and the medical community to accept the Company's technology as safe and effective;

• risks associated with the performance of commercial partners, critical suppliers and service providers;

• risks associated with disagreements or disputes with the Company's commercial partners, critical suppliers, and service providers;

• risks associated with the Company's ability to obtain and protect rights to its intellectual property;

• risks associated with the loss or expiry of patent protections over the Company's technologies prior to the commercialization of the products related to those technologies and patents;

• risks and uncertainties associated with the Company's ability to raise additional capital;

• risks and uncertainties associated with supply chain issues caused by global and regional disruptions; and

• other factors beyond the Company's control.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity or performance. Further, any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of such factors on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

DESCRIPTION OF BUSINESS

The Company was incorporated under the Ontario Business Corporations Act on April 24, 1967. The Company is a foreign private issuer in the United States. The Company's common shares are listed for trading in Canada on the TSX Venture Exchange, trading under the symbol "RP", in the United States on the OTCPK, trading under the symbol REPCF, and in Germany on the Frankfurt Stock Exchange (FRA) under the symbol P6P2.

RepliCel is a regenerative medicine company focused on developing autologous cell therapies that treat functional cellular deficits. The diseases currently being addressed are chronic tendinosis, skin aging, and androgenetic alopecia (pattern baldness). Each disease state is consistent with a deficit of a specific cell type which the Company believes is critical to normal function. All treatments under development are based on RepliCel's innovative technology which utilizes cells isolated from a patient's own healthy hair follicles. These products are built on the Company's proprietary manufacturing platforms and are covered by issued and filed patents and trade secrets. RepliCel is also developing a programmable injector device and related consumables designed for dermal injections of cells as currently approved other products such as dermal fillers, toxins, enzymes, drugs, and biologics such as fat transfer, platelet-rich plasma, antibodies, etc.

HIGHLIGHTS OF BUSINESS

The Potential of Autologous Cell Therapy

The Company's treatments use autologous cell therapy ("ACT"), one of the most rapidly developing areas of regenerative medicine in developing novel treatments for numerous human disorders. ACT involves isolating an individual's own cells from harvested tissues and growing more of those cells, or 'expanding' those cells, in controlled conditions in a laboratory. These purified, expanded cells are then reintroduced to the donor to treat a specific condition. The benefits of autologous (derived from the same person) therapy (as compared to allogeneic derived from a different person) includes minimized risks of systemic immunological (anaphylactic) reactions, bio-incompatibility, and disease transmission. Furthermore, the effects of ACT may be more curative, regenerative, and/or longer lasting than other topical, biologic, pharmacological or surgical interventions.