Amended Statement of Beneficial Ownership (sc 13d/a)

May 16 2019 - 4:19PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A23 (Amendment No. 23)

Under

the Securities Exchange Act of 1934

RegeneRx

Biopharmaceuticals, Inc.

(Name of Issuer)

Common

Stock, Par Value $0.001 per share

(Title of Class of Securities)

75886X

10 8

(CUSIP Number)

Marino

Zigrossi

Managing Director

Essetifin S.p.A.

Via

Sudafrica, 20

Rome,

RM 00144

Italy

+39 06 5427711

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May

13, 2019

(Date of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

NOTE:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP

No. 75886X 10 8

|

|

(1)

|

NAME

OF REPORTING PERSONS

|

|

|

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

|

|

|

|

|

|

Essetifin

S.p.A.

|

|

(2)

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE

OF FUNDS

WC

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

(6)

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Italy

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person With

|

(7)

|

SOLE

VOTING POWER

0

|

|

(8)

|

SHARED

VOTING POWER

49,572,414

|

|

(9)

|

SOLE

DISPOSITIVE POWER

0

|

|

(10)

|

SHARED

DISPOSITIVE POWER

49,572,414

|

|

(11)

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

49,572,414

|

|

(12)

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

(13)

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.9%

(based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported in the Issuer’s Form 10-Q

filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable upon exercise of the

Notes (as defined below) and 6,250,000 shares issuable upon exercise of the Warrants (as defined below))

|

|

(14)

|

TYPE

OF REPORTING PERSON

CO

|

|

CUSIP

No. 75886X 10 8

|

|

(1)

|

NAME

OF REPORTING PERSONS

|

|

|

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

|

|

|

|

|

|

Paolo

Cavazza

|

|

(2)

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE

OF FUNDS

N/A

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

(6)

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Italy

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person With

|

(7)

|

SOLE

VOTING POWER

0

|

|

(8)

|

SHARED

VOTING POWER

49,572,414

|

|

(9)

|

SOLE

DISPOSITIVE POWER

0

|

|

(10)

|

SHARED

DISPOSITIVE POWER

49,572,414

|

|

(11)

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

49,572,414

|

|

(12)

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

(13)

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.9%

(based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported in the Issuer’s Form 10-Q

filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable upon exercise of the

Notes (as defined below) and 6,250,000 shares issuable upon exercise of the Warrants (as defined below))

|

|

(14)

|

TYPE

OF REPORTING PERSON

IN

|

|

CUSIP

No. 75886X 10 8

|

|

(1)

|

NAME

OF REPORTING PERSONS

|

|

|

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

|

|

|

|

|

|

Enrico

Cavazza

|

|

(2)

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE

OF FUNDS

N/A

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

(6)

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Italy

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person With

|

(7)

|

SOLE

VOTING POWER

0

|

|

(8)

|

SHARED

VOTING POWER

49,572,414

|

|

(9)

|

SOLE

DISPOSITIVE POWER

0

|

|

(10)

|

SHARED

DISPOSITIVE POWER

49,572,414

|

|

(11)

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

49,572,414

|

|

(12)

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

(13)

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.9%

(based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported in the Issuer’s Form 10-Q

filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable upon exercise of the

Notes (as defined below) and 6,250,000 shares issuable upon exercise of the Warrants (as defined below))

|

|

(14)

|

TYPE

OF REPORTING PERSON

IN

|

|

CUSIP

No. 75886X 10 8

|

|

(1)

|

NAME

OF REPORTING PERSONS

|

|

|

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

|

|

|

|

|

|

Francesca

Cavazza

|

|

(2)

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE

OF FUNDS

N/A

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

(6)

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Italy

|

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person With

|

(7)

|

SOLE

VOTING POWER

0

|

|

(8)

|

SHARED

VOTING POWER

49,572,414

|

|

(9)

|

SOLE

DISPOSITIVE POWER

0

|

|

(10)

|

SHARED

DISPOSITIVE POWER

49,572,414

|

|

(11)

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

49,572,414

|

|

(12)

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

(13)

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.9%

(based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported in the Issuer’s Form 10-Q

filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable upon exercise of the

Notes (as defined below) and 6,250,000 shares issuable upon exercise of the Warrants (as defined below))

|

|

(14)

|

TYPE

OF REPORTING PERSON

IN

|

|

CUSIP

No. 75886X 10 8

|

|

(1)

|

NAME

OF REPORTING PERSONS

|

|

|

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

|

|

|

|

|

|

Silvia

Cavazza

|

|

(2)

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE

OF FUNDS

N/A

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

(6)

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Italy

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person With

|

(7)

|

SOLE

VOTING POWER

0

|

|

(8)

|

SHARED

VOTING POWER

49,572,414

|

|

(9)

|

SOLE

DISPOSITIVE POWER

0

|

|

(10)

|

SHARED

DISPOSITIVE POWER

49,572,414

|

|

(11)

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

49,572,414

|

|

(12)

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

(13)

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.9%

(based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported in the Issuer’s Form 10-Q

filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable upon exercise of the

Notes (as defined below) and 6,250,000 shares issuable upon exercise of the Warrants (as defined below))

|

|

(14)

|

TYPE

OF REPORTING PERSON

IN

|

|

CUSIP

No. 75886X 10 8

|

|

(1)

|

NAME

OF REPORTING PERSONS

|

|

|

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (entities only)

|

|

|

|

|

|

Martina

Cavazza Preta

|

|

(2)

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐

|

|

(3)

|

SEC USE ONLY

|

|

(4)

|

SOURCE

OF FUNDS

N/A

|

|

(5)

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

(6)

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Italy

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person With

|

(7)

|

SOLE

VOTING POWER

0

|

|

(8)

|

SHARED

VOTING POWER

49,572,414

|

|

(9)

|

SOLE

DISPOSITIVE POWER

0

|

|

(10)

|

SHARED

DISPOSITIVE POWER

49,572,414

|

|

(11)

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

49,572,414

|

|

(12)

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

(13)

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.9%

(based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported in the Issuer’s Form 10-Q

filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable upon exercise of the

Notes (as defined below) and 6,250,000 shares issuable upon exercise of the Warrants (as defined below))

|

|

(14)

|

TYPE

OF REPORTING PERSON

IN

|

|

Item

1

.

|

Security

and Issuer

.

|

Item

1 of the Schedule 13D is hereby amended and restated in its entirety as follows:

This

Amendment No. 23 by Essetifin S.p.A., an Italian corporation (“

Essetifin

”), Paolo Cavazza, an Italian citizen,

Enrico Cavazza, an Italian citizen, Francesca Cavazza, an Italian citizen, Silvia Cavazza, an Italian citizen, and Martina Cavazza

Preta, an Italian citizen (together with Essetifin, Paolo Cavazza, Enrico Cavazza, Francesca Cavazza and Silvia Cavazza, the “

Reporting

Parties

”), amends the Schedule 13D filed with the Securities and Exchange Commission (the “

SEC

”)

on June 23, 2003, as last amended by Amendment No. 22, filed with the SEC on March 1, 2019 (the “

Schedule 13D

”),

with respect to the common stock, $0.001 par value (the “

Common Stock

”), of RegeneRx Biopharmaceuticals, Inc.

(the “

Issuer

”), a Delaware corporation whose principal offices are located at 15245 Shady Grove Road, Suite

470, Rockville, MD 20850.

|

Item

3

.

|

Source

and Amount of Funds or Other Consideration

.

|

Item

3 of the Schedule 13D is hereby amended by adding the following at the end thereof:

Effective

May 13, 2019, Essetifin purchased the second $500,000 tranche of Notes and Warrants (such purchase consisting of the “

May

2019 Note

” and the “

May 2019 Warrant

”). The $500,000 purchase price for the May 2019 Note and May

2019 Warrant was paid from Essetifin’s working capital.

The

outstanding principal amount of the May 2019 Note of $500,000, excluding interest, if converted into Common Stock, would result

in the issuance of 4,166,667 shares; the full outstanding principal amount of the Notes (consisting of the February 2019 Note

and the May 2019 Note) of $1,000,000, excluding interest, if converted into Common Stock, would result in the issuance of 8,333,334

shares. The May 2019 Warrant is exercisable into up to 3,125,000 shares of Common Stock; the Warrants (consisting of the February

2019 Warrant and the May 2019 Warrant) are exercisable into an aggregate of up to 6,250,000 shares of Common Stock. The May 2019

Warrant is exercisable from November 13, 2019 through March 1, 2024, at which time the May 2019 Warrant is void.

The

terms of the May 2019 Note and May 2019 Warrant are substantially similar to the terms of the February 2019 Note and February

2019 Warrant, respectively, forms of which are filed as Exhibits 4 and 5, respectively, to this Schedule 13D and are incorporated

herein by reference.

Dispositive

power over the shares of Common Stock owned by Essetifin is shared by Paolo Cavazza, Enrico Cavazza, Silvia Cavazza, Francesca

Cavazza and Martina Cavazza Preta. Each of the foregoing disclaims beneficial ownership of all shares of common stock held by

Essetifin except to the extent of any pecuniary interest therein.

|

Item

5

.

|

Interest

in Securities of the Issuer

.

|

Item

5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a)

As of May 13, 2019, the Reporting Parties are the beneficial owners of 49,572,414 shares of Common Stock, representing 33.9% of

the Issuer’s outstanding Common Stock, based on 131,506,494 shares of Common Stock outstanding as of May 7, 2019, as reported

in the Issuer’s Form 10-Q filed with the Securities and Exchange Commission on May 15, 2019, plus 8,333,334 shares issuable

upon exercise of the Notes and 6,250,000 shares issuable upon exercise of the Warrants.

(b)

The number of shares of Common Stock as to which each of the Reporting Parties has the sole power to vote or direct the vote is

zero. The number of shares of Common Stock as to which each of the Reporting Parties shares the power to vote or direct the vote

is 49,572,414. The number of shares of Common Stock as to which each of the Reporting Parties has the sole power to dispose or

direct the disposition is zero. The number of shares of Common Stock as to which each of the Reporting Parties shares the power

to dispose or direct the disposition is 49,572,414.

(c)

See

Items 3

and

4

above.

(d)

Not applicable.

(e)

Not applicable.

|

I

tem 7

.

|

Material

to Be Filed as Exhibits

.

|

Item

7 of the Schedule 13D is hereby amended and restated in its entirety as follows:

|

1

|

Incorporated

by reference to the Reporting Persons’ Amendment No. 19 to Schedule 13D filed with the SEC on October 17, 2017.

|

|

2

|

Incorporated

by reference to the Reporting Persons’ Amendment No. 22 to Schedule 13D filed with the SEC on March 1, 2019.

|

|

3

|

Incorporated

by reference to the Reporting Persons’ Amendment No. 22 to Schedule 13D filed with the SEC on March 1, 2019.

|

|

4

|

Incorporated

by reference to the Reporting Persons’ Amendment No. 22 to Schedule 13D filed with the SEC on March 1, 2019.

|

|

5

|

Incorporated

by reference to the Reporting Persons’ Amendment No. 22 to Schedule 13D filed with the SEC on March 1, 2019.

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement with

respect to Essetifin S.p.A. is true, complete and correct.

|

Date:

May 16, 2019

|

|

|

|

|

|

|

ESSETIFIN

S.P.A.

|

|

|

|

|

|

By:

|

/s/

Marino Zigrossi

|

|

|

|

Name:

Marino Zigrossi

|

|

|

|

Title:

Managing Director

|

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement with

respect to Paolo Cavazza is true, complete and correct.

|

Date:

May 16, 2019

|

|

|

|

|

|

|

PAOLO

CAVAZZA

|

|

|

|

|

|

By:

|

/s/

Fabio Poma

|

|

|

|

Name:

Fabio Poma

|

|

|

|

Title:

Attorney-in-fact

|

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement with

respect to Enrico Cavazza is true, complete and correct.

|

Date:

May 16, 2019

|

|

|

|

|

|

|

ENRICO

CAVAZZA

|

|

|

|

|

|

By:

|

/s/

Marino Zigrossi

|

|

|

|

Name:

Marino Zigrossi

|

|

|

|

Title:

Attorney-in-fact**

|

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement with

respect to Francesca Cavazza is true, complete and correct.

|

Date:

May 16, 2019

|

|

|

|

|

|

|

FRANCESCA

CAVAZZA

|

|

|

|

|

|

By:

|

/s/

Marino Zigrossi

|

|

|

|

Name:

Marino Zigrossi

|

|

|

|

Title:

Attorney-in-fact**

|

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement with

respect to Silvia Cavazza is true, complete and correct.

|

Date:

May 16, 2019

|

|

|

|

|

|

|

SILVIA

CAVAZZA

|

|

|

|

|

|

By:

|

/s/

Marino Zigrossi

|

|

|

|

Name:

Marino Zigrossi

|

|

|

|

Title:

Attorney-in-fact**

|

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement with

respect to Martina Cavazza Preta is true, complete and correct.

|

Date:

May 16, 2019

|

|

|

|

|

|

|

MARTINA

CAVAZZA PRETA

|

|

|

|

|

|

By:

|

/s/

Marino Zigrossi

|

|

|

|

Name:

Marino Zigrossi

|

|

|

|

Title:

Attorney-in-fact**

|

|

|

**

|

Power

of attorney was previously filed with Securities and Exchange Commission as an exhibit to the Form 3/A filed on October 4, 2017,

with respect to the common stock of Fennec Pharmaceuticals, Inc.

|

10

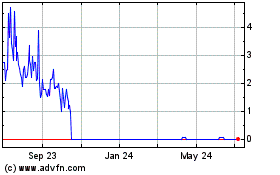

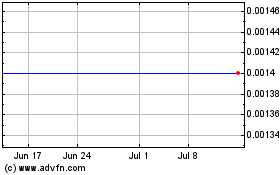

RegeneRX Biopharmaceutic... (CE) (USOTC:RGRX)

Historical Stock Chart

From Aug 2024 to Sep 2024

RegeneRX Biopharmaceutic... (CE) (USOTC:RGRX)

Historical Stock Chart

From Sep 2023 to Sep 2024