March 31, 2014 / The Marijuana Index - the first and only equity

tracking index for marijuana stocks, cannabis stocks, and hemp

stocks featuring dynamic financial content, charts, and

centralized press for public companies – experienced several

significant (positive) events during an otherwise

turbulent month (beware the Ides of March, indeed).

While certainly not consolation to investors who experienced

corresponding losses in their portfolio – several indicators of

interest in The Marijuana Index illustrate a broader macro-economic

perspective for public markets. The index team received

requests from prestigious publications and media on a global scale

in March, and hopes to soon announce a major sponsor from a former

analyst turned publisher whose newsletter has been regarded for

decades. Needless to say, said newsletter author has their

eyes on what they expect to be an emerging bull market, and the

index is fortunate to have been targeted by such an accomplished

individual.

Previous publications which have featured or interviewed this

living legend include Barron’s, Fortune, Forbes, Newsweek,

Businessweek, and Time (to name a few). Subscribers to

The Marijuana Index Newsletter will be the first to receive

information on this new likely sponsor, which may even feature an

exclusive article or regular contributions to The Marijuana

Index content.

Index constituents succumbed to a landslide of

selling pressure while the index overall collapsed in

valuation – shedding 8.23% on Friday alone (UPDATE: the

index closed at $18.45 on Monday). As discussed in a

previous press release – The Marijuana Index recognizes

the challenges inherent with weighting the first and only

equity index for this industry, which contains highly volatile

micro- and small-cap issuers. Is it

Retracement? Index Dips to $17.95 (UPDATE: Rebounds

Slightly Monday to Close at $18.45)

The recently executed letter of intent discussed below

also make complex weighting, such as the system employed by

the Dow Jones Industrial Average, more important as The

Marijuana Index evolves and expands as the global leader for

marijuana equities. The Marijuana Index could employ a

price weighted system, with various considerations for new and

removed listings, or events such as spin-offs and stock splits.

These changes will be highlighted first to free subscribers

of The Marijuana Index Newsletter.

175,000 US Jobs Added in February

The US Department of Labor announced Friday that employers added

175,000 jobs during the month of February 2014 – while unemployment

advanced slightly to 6.7%. The data urges reflection on an

often overlooked aspect of a burgeoning marijuana economy in the

United States.

Much of the current media coverage surrounding positive

financial impacts of marijuana tends to focus on tax revenues

– with Colorado reaping $2 million in taxes during the month

of January 2014 alone. An understated financial benefit

of legal marijuana includes the jobs the industry creates

throughout the supply chain.

Consider for a moment that legal marijuana represents a

potential $50 billion industry in the United States (just

product). In a hypothetical federally legal marijuana

environment in the United States – how many new jobs might

this represent? How much money is saved on enforcement

of petty possession? What sort of impact does $50 billion in

circulation create from legitimate business owners – cash that

may have been stashed away as “mattress money” ten years ago, or

even sent to other countries? What is the economic impact of

newly circulated money which now goes to hard-working Americans

employed by the marijuana industry, instead of the private prison

systems lining their pockets from enforcement of minor 'crimes' of

possession, hoping to endlessly curtail legalization efforts for

their own benefit?

The answers to these questions aren’t known, but clearly

demonstrate a broader and more sweeping financial event than

immediately meets the eye. The public has spoken, and the

fact that even conservatives have “come around” show almost virtual

certainty that change is coming (the United States is a

democracy, right?)

Unprecedented Events for Public Marijuana Markets…

The Focal Point? The Marijuana Index

Further entrenching The Marijuana Index as the top information

destination for marijuana, cannabis, and hemp investors – a

confidential letter of intent has been executed wherein the index,

including several new websites in development and an iPhone and

Android-based app, would be acquired by a forthcoming closed-end

fund registered under the Investment Company Act of 1940.

Terms of the acquisition are confidential and are

expected to be released within the next 30-45 days, complete

with disclosures pursuant to the act.

The acquisition and deal is subject to various circumstances,

including (but not limited to) regulatory approvals and

sufficient capitalization. Contingent upon finalization and

approvals, details will be provided to subscribers of The

Marijuana Index free newsletter and via press release.

Television, radio, print, and online media who wish to receive

information or future possible interviews should subscribe to the

newsletter, and e-mail contact details to info@mmj-index.com (no

information will be provided unless and until the transaction is

finalized and announced formally).

Visit http://www.marijuanaindex.org/ to sign up for the free

newsletter – this is something subscribers and loyal index visitors

won’t want to miss. The Marijuana Index would like to express

gratitude for the overwhelmingly positive feedback from visitors,

issuers, and media during more than a year of tremendous growth and

transition. First launched during Q1 2013 – The Marijuana

Index has become a globally recognized brand in just over 14

months.

As previously detailed, The Marijuana Index will also

launch multiple tiers in Q2 – with one primary "portal"

website detailing all tiers and index charts including a new blog

and extended team of writers. The tier system will also

present three distinct websites consisting of 1) SEC reporting

issuers in the US, 2) non-reporting issuers in the US, and 3)

Canadian issuers. Hopeful companies who await potential

listing in the indices may be contacted in the coming weeks as

the three tiers expand to reflect additional market entrants.

This new index model is the foundation for a global plan

for marijuana issuers centralized on The Marijuana Index and

its various existing and forthcoming media properties, both online

and offline.

Recapping an Eventful 2014

1) The Marijuana Index expects to be involved in

a feature film intended for theatrical release featuring

the dynamic marijuana business, prominent players, and possibly

public companies involved in the industry;

2) The Marijuana Index could be the foundation of the

first publicly traded, dedicated marijuana, cannabis, and hemp

fund (subject to regulatory approvals and other factors);

3) The Marijuana Index is launching a multi-tier system to

differentiate SEC-reporting issuers from non-reporting issuers, as

well as a dedicated Canadian index, including a host of new media

properties;

4) The Marijuana Index is in early

production discussions for television and radio shows with

incredible, experienced broadcasters and media experts – the

anticipated media would be dedicated to public marijuana

company plans, executives, products, technology, and marijuana

entrepreneurs;

5) The Marijuana Index was approached by numerous

respected, global media sources wishing to profile the index – and

hopes to soon finalize sponsorship from a former analyst who has

graced the pages of the top financial publications in the

world.

Don’t miss out – sign up for FREE updates via e-mail

by subscribing to The Marijuana Index newsletter by visiting

http://www.marijuanaindex.org now.

Sample Headlines & Recent News

Plandai Biotechnology (OTCQB: PLPL), who last month

executed a licensing agreement with former Microsoft executive

Jamen Shively's controversial brand Diego Pellicer, discussed

intentions to develop Diego Pellicer Gold™. These extracts

would come in capsules and in cannabis oil for vapor use in

Pheroid™ and non-Pheroid™ to appeal to a large demographic of

medicinal consumers.

Latteno Foods (PINK: LATF) outlined various initiatives

for 2014 in Medical Marijuana -- the company recently reported that

revenues for the fourth quarter of 2013 totaled $4,097,877.

This stated total would increase 2013 revenues to

$15,100,739. The issuer detailed that full 2013 financial

statements, together with OTC Disclosure and legal opinion are

expected to be filed with OTCMarkets shortly. The company is

not yet considered a reporting issuer by OTCQB standards and is

expected to join The Marijuana Index: Pink tier shortly.

Tweed & LWI Capital Pool (TSX Venture: LWI.H)

previously announced a letter of intent in January wherein Tweed

would become among the first producers in Canada to become publicly

traded through a reverse-takeover. Tweed means "weed" in

Canadian (surely we jest). All kidding aside, Tweed has

fantastic branding and was "established to supply an

unmatched selection of premium medical marijuana to treat symptoms

such as chronic pain, seizures, muscle spasms, nausea, and loss of

appetite." If their web design and brand is any indication --

Tweed is certainly a company to watch as marijuana hopes to take

the previously mining-focused TSX Venture exchange by storm.

Should the merger complete, Tweed is likely to be among the

first issuers featured in The Marijuana Index: Canada.

Review the Full New Chain by Clicking Here

About The Marijuana Index

Network partners of marijuana media leaders Cannabis Financial

Network (http://www.cannabisfn.com/), The Marijuana Index was

founded in Q1 2013 and represents the first and only registered

equity tracking index for marijuana stocks, cannabis stocks, and

hemp stocks – providing investors and listed companies with dynamic

market data and streaming content. Currently detailing more

than thirty publicly traded issuers (with a multiple tier system

forthcoming, including a dedicated Canadian tier), The Marijuana

Index provides marijuana investors and interested observers with a

medium for research, charts, and a centralized news source.

Readers are urged to visit http://www.marijuanaindex.org/ for

up-to-date information and to sign up for updates.

Follow The Marijuana Index on Twitter

@MarijuanaIndex.

Companies or websites wishing to advertise on the index should

contact advertisers@marijuanaindex.org – advertising packages are

now available. The index site surpassed more than 380,000

unique visitors and more than 800,000 page views in March 2014

alone, and expects continued exponential growth. The index,

with new forms of online and offline media launching soon, hopes to

eventually achieve 5,000,000 or more unique visitors monthly.

DISCLAIMER

The Marijuana Index (MJX Marijuana Index, the "index") is a data

aggregation service and does not provide promotional efforts, other

than sponsorship or visual advertisements, unless otherwise noted.

The Marijuana Index does not offer investment advice.

Nothing listed on MarijuanaIndex.org or within this release

is an offer to buy or sell securities. Readers are cautioned

against using information obtained from The Marijuana Index as a

basis for any investment decision. The Marijuana Index makes

no warranties or representations as to the accuracy of posted or

streamed information. The Marijuana Index was not paid by any

companies listed within this press release, but reserves the right

to buy or sell shares in listed or mentioned companies without

notice. The word “registered” above as it relates to the

index is not meant to imply registration with the SEC – The

Marijuana Index has been registered with leading financial content

provider Quotemedia with the ticker ^MMJ since Q1 2013. The

Marijuana Index makes no expressed or implied warranties or

representations regarding the forthcoming changes to the index,

tier system, current and future features of the website, or any

company listed on the index or their performance. The

Marijuana Index makes no warranties or representations regarding

the executed letter of intent which may or may not finalize via

material definitive agreement and closing, in which the index may

be acquired by a closed-end fund, which is subject to various

factors.

For more information on the index disclaimer, visit

http://www.marijuanaindex.org/ and click on “About” and

“Disclaimer.”

INCLUSION IN THE MARIJUANA INDEX DOES NOT IMPLY THAT DUE

DILIGENCE OR EVALUATION ON ANY LEVEL HAS BEEN CONDUCTED ON LISTED

COMPANIES.

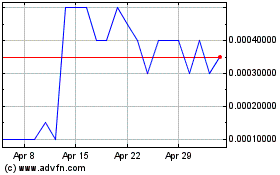

Plandai Biotechnology (PK) (USOTC:PLPL)

Historical Stock Chart

From Oct 2024 to Nov 2024

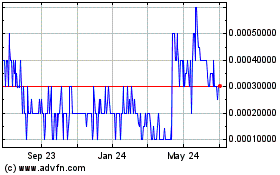

Plandai Biotechnology (PK) (USOTC:PLPL)

Historical Stock Chart

From Nov 2023 to Nov 2024