As

filed with the Securities and Exchange Commission on January 14, 2025

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

PERMEX

PETROLEUM CORPORATION

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

98-1384682 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

1700

Post Oak Boulevard, 2 Blvd Place Suite 600

Houston,

Texas 77056

(Address

of Principal Executive Offices) (Zip Code)

Permex

Petroleum Corporation

Long-Term

Incentive Plan

(Full

title of the plan)

Bradley

Taillon

Chief

Executive Officer

Permex

Petroleum Corporation

1700

Post Oak Boulevard, 2 Blvd Place Suite 600

Houston,

Texas 77056

(Name

and address of agent for service)

(346)

245-8981

(Telephone

number, including area code, of agent for service)

With

a copy to:

Andrew

J. Bond, Esq.

Nazia

J. Khan, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

1901

Avenue of the Stars, Suite 1600

Los

Angeles, CA 90067

Telephone:

(310) 228-3700

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

ITEM

1. PLAN INFORMATION.

Permex

Petroleum Corporation (the “Company”) will provide each recipient (the “Recipients”) of a grant under the

Permex

Petroleum Corporation Long-Term Incentive Plan (the “Plan”) with documents that contain information related to the Plan,

and other information including, but not limited to, the disclosure required by Item 1 of Form S-8, which information is not required

to be and is not being filed as a part of this Registration Statement on Form S-8 (the “Registration Statement”) or as prospectuses

or prospectus supplements pursuant to Rule 424 under the Securities Act of 1933, as amended (the “Securities Act”). The foregoing

information and the documents incorporated by reference in response to Item 3 of Part II of this Registration Statement, taken together,

constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a) prospectus will be given

to each Recipient who receives common shares covered by this Registration Statement, in accordance with Rule 428(b)(1) under the Securities

Act.

ITEM

2. REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION.

We

will provide to each Recipient a written statement advising of the availability of documents incorporated by reference in Item 3 of Part

II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) prospectus) and of documents required

to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written or oral request by contacting:

Bradley

Taillon

Chief

Executive Officer

Permex

Petroleum Corporation

1700

Post Oak Boulevard, 2 Blvd Place Suite 600

Houston,

Texas 77056

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

ITEM

3. INCORPORATION OF DOCUMENTS BY REFERENCE.

The

following documents filed by the Company with the Securities and Exchange Commission (“SEC”) pursuant to the Securities Act

and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

| ● |

The

Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2024,

filed with the SEC on January 14, 2025; |

| |

|

| ● |

The

Company’s Current Reports on Form 8-K (excluding

any reports or portions thereof that are deemed to be furnished and not filed) filed with the SEC on October 28, 2024, November 7, 2024 and December 30, 2024; |

| ● |

The

description of the Company’s common shares contained in Exhibit 4.2 to the Registrant’s Annual Report on Form 10-K for

the year ended September 30, 2024 filed with the SEC on January 14, 2025, including any amendments or reports filed for the purpose

of updating such description; and |

| ● |

All

other reports and documents filed by the Company pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of

1934, as amended (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form

that relate to such items) subsequent to the date of this Registration Statement and prior to the filing of a post-effective amendment

to this Registration Statement that indicates that all securities offered hereby have been sold or that deregisters all securities

then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from

the date of filing such reports and documents. Any statement contained in a document incorporated or deemed to be incorporated by

reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement

herein or in any subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not constitute a part of this Registration Statement, except as

so modified or superseded. |

ITEM

4. DESCRIPTION OF SECURITIES.

Not

applicable.

ITEM

5. INTERESTS OF NAMED EXPERTS AND COUNSEL.

Not

applicable.

ITEM

6. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Business

Corporations Act (British Columbia)

The

Company is subject to the provisions of the Business Corporation Act (British Columbia) (the “BCBCA”).

Under

Section 160 of the BCBCA, the Company may, subject to Section 163 of the BCBCA:

(a)

indemnify an individual who:

(i)

is or was a director or officer of the Company,

(ii)

is or was a director or officer of another corporation (A) at a time when the corporation is or was an affiliate of the Company; or (B)

at our request, or

(iii)

at our request, is or was, or holds or held a position equivalent to that of, a director or officer

of a partnership, trust, joint venture or other unincorporated entity,

including,

subject to certain limited exceptions, the heirs and personal or other legal representatives of that individual (collectively, an “eligible

party”), against all eligible penalties, defined below, to which the eligible party is or may be liable; and

(b)

after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by an eligible party in respect

of that proceeding, where:

(i)

“eligible penalty” means a judgment, penalty or fine awarded or imposed in, or an amount paid in settlement of, an eligible

proceeding,

(ii)

“eligible proceeding” means a proceeding in which an eligible party or any of the heirs

and personal or other legal representatives of the eligible party, by reason of the eligible party being or having been a director or

officer of, or holding or having held a position equivalent to that of a director or officer of, the Company or an associated corporation

(A) is or may be joined as a party, or (B) is or may be liable for or in respect of a judgment, penalty or fine in, or expenses related

to, the proceeding,

(iii)

“expenses” includes costs, charges and expenses, including legal and other fees, but

does not include judgments, penalties, fines or amounts paid in settlement of a proceeding, and

(iv)

“proceeding” includes any legal proceeding or investigative action, whether current,

threatened, pending or completed.

Under

Section 161 of the BCBCA, and subject to Section 163 of the BCBCA, the Company must, after the final disposition of an eligible proceeding,

pay the expenses actually and reasonably incurred by an eligible party in respect of that proceeding if the eligible party (a) has not

been reimbursed for those expenses and (b) is wholly successful, on the merits or otherwise, in the outcome of the proceeding or is substantially

successful on the merits in the outcome of the proceeding.

Under

Section 162 of the BCBCA, and subject to Section 163 of the BCBCA, the Company may pay, as they are incurred in advance of the final

disposition of an eligible proceeding, the expenses actually and reasonably incurred by an eligible party in respect of the proceeding,

provided that the Company must not make such payments unless the Company first receives from the eligible party a written undertaking

that, if it is ultimately determined that the payment of expenses is prohibited under Section 163 of the BCBCA, the eligible party will

repay the amounts advanced.

Under

Section 163 of the BCBCA, the Company must not indemnify an eligible party against eligible penalties to which the eligible party is

or may be liable or pay the expenses of an eligible party in respect of that proceeding under Sections 160(b), 161 or 162 of the BCBCA,

as the case may be, if any of the following circumstances apply:

(a)

if the indemnity or payment is made under an earlier agreement to indemnify or pay expenses and, at the time that the agreement to indemnify

or pay expenses was made, the Company was prohibited from giving the indemnity or paying the expenses by its memorandum or Articles;

(b)

if the indemnity or payment is made otherwise than under an earlier agreement to indemnify or pay expenses and, at the time that the

indemnity or payment is made, the Company is prohibited from giving the indemnity or paying the expenses by its memorandum or Articles;

(c)

if, in relation to the subject matter of the eligible proceeding, the eligible party did not act honestly and in good faith with a view

to the best interests of the Company or the associated corporation, as the case may be; or

(d)

in the case of an eligible proceeding other than a civil proceeding, if the eligible party did not have reasonable grounds for believing

that the eligible party’s conduct in respect of which the proceeding was brought was lawful.

If

an eligible proceeding is brought against an eligible party by or on behalf of the Company or by or on behalf of an associated corporation,

we must not either indemnify the eligible party under Section 160(a) of the BCBCA against eligible penalties to which the eligible party

is or may be liable, or pay the expenses of the eligible party under Sections 160(b), 161 or 162 of the BCBCA, as the case may be, in

respect of the proceeding.

Under

Section 164 of the BCBCA, and despite any other provision of the BCBCA and whether or not payment of expenses or indemnification has

been sought, authorized or declined under the BCBCA, on application of the Company or an eligible party, the court may do one or more

of the following:

(a)

order the Company to indemnify an eligible party against any liability incurred by the eligible

party in respect of an eligible proceeding;

(b)

order the Company to pay some or all of the expenses incurred by an eligible party in respect of

an eligible proceeding;

(c)

order the enforcement of, or any payment under, an agreement of indemnification entered into by the Company;

(d)

order the Company to pay some or all of the expenses actually and reasonably incurred by any person in obtaining an order under Section

164 of the BCBCA; or

(e)

make any other order the court considers appropriate.

Section

165 of the BCBCA provides that the Company may purchase and maintain insurance for the benefit of an eligible party or the heirs and

personal or other legal representatives of the eligible party against any liability that may be incurred by reason of the eligible party

being or having been a director or officer of, or holding or having held a position equivalent to that of a director or officer of, the

Company or an associated corporation.

Company’s

Articles

Under

Part 21.2 of the Company’s Articles, and subject to the BCBCA, the Company must indemnify a director, former director or alternative

director of the Company and his or her heirs and legal personal representatives against all eligible penalties to which such person is

or may be liable, and the Company must, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably

incurred by such person in respect of that proceeding. Each director and alternate director is deemed to have contracted with the Company

on the terms of the indemnity contained in the Company’s Articles.

Under

Part 21.3 of the Company’s Articles, and subject to any restrictions in the BCBCA, the Company may agree to indemnify and may indemnify

any person.

Under

Part 21.4 of the Company’s Articles, the failure of a director, alternate director or officer of the Company to comply with the

BCBCA or the Company’s Articles or, if applicable, any former Companies Act or former articles, does not invalidate any indemnity

to which he or she is entitled under the Company’s Articles.

Under

Part 21.5 of the Company’s Articles, the Company may purchase and maintain insurance for the benefit of any person (or his or her

heirs or legal personal representatives) who:

| |

● |

is

or was a director, alternate director, officer, employee or agent of the Company; |

| |

|

|

| |

● |

is

or was a director, alternate director, officer, employee or agent of a corporation at a time when the corporation is or was an affiliate

of the Company; |

| |

|

|

| |

● |

at

the request of the Company, is or was a director, alternate director, officer, employee or agent of a corporation or of a partnership,

trust, joint venture or other unincorporated entity; |

| |

|

|

| |

● |

at

the request of the Company, holds or held a position equivalent to that of a director, alternate director or officer of a partnership,

trust, joint venture or other unincorporated entity; |

against

any liability incurred by him or her as such director, alternate director, officer, employee or agent or person who holds or held such

equivalent position.

We

carry directors and officers liability coverages designed to insure our officers and directors and those of our subsidiaries against

certain liabilities incurred by them in the performance of their duties, and also providing for reimbursement in certain cases to our

company and its subsidiaries for sums paid to directors and officers as indemnification for similar liability.

ITEM

7. EXEMPTION FROM REGISTRATION CLAIMED.

Not

applicable.

ITEM

8. EXHIBITS.

See

the attached Exhibit Index on the page immediately following the signature pages hereto, which is incorporated herein by reference.

ITEM

9. UNDERTAKINGS.

A.

The undersigned Registrant hereby undertakes:

1.

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective Registration Statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or

any material change to such information in the Registration Statement;

Provided,

however, that paragraphs (A)(1)(i) and (A)(1)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to section 13 or section

15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

2.

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

3.

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

B.

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in

the Registration Statement shall be deemed to be a new registration statement relating to the securities offered herein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Houston, State of Texas, on the 14th day of January 2025.

| |

Permex

Petroleum Corporation |

| |

|

| |

By: |

/s/

Bradley Taillon |

| |

|

Bradley

Taillon |

| |

|

Chief

Executive Officer, President and Director |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below does hereby constitute and appoint Bradley Taillon, with

full power of substitution, his or her true and lawful attorney-in-fact to act for him or her in any and all capacities, to sign any

and all amendments (including post-effective amendments) to this registration statement, and to file each of the same, with all exhibits

thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact

full power and authority to do and perform each and every act and thing requisite and necessary to be done in order to effectuate the

same as fully, to all intents and purposes, as he or she could do in person, hereby ratifying and confirming all that said attorney-in-fact

or substitutes, or any of them, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

| Signature |

|

|

|

Date |

| |

|

|

|

|

| /s/

Bradley Taillon |

|

Chief

Executive Officer, President and Director (Principal Executive Officer) |

|

January

14, 2025 |

| Bradley

Taillon |

|

|

|

|

| |

|

|

|

|

| /s/

Gregory Montgomery |

|

Chief

Financial Officer (Principal Financial and Accounting Officer) |

|

January

14, 2025 |

| Gregory

Montgomery |

|

|

|

|

| |

|

|

|

|

| /s/Richard

Little |

|

Director |

|

January

14, 2025 |

| Richard

Little |

|

|

|

|

| |

|

|

|

|

| /s/

Kevin Nanke |

|

Director |

|

January

14, 2025 |

| Kevin Nanke |

|

|

|

|

| |

|

|

|

|

|

/s/

BaShara Boyd |

|

Director |

|

January

14, 2025 |

| BaShara

Boyd |

|

|

|

|

EXHIBIT

INDEX

*

Filed herewith.

Exhibit 5.1

|

|

|

DuMoulin

Black LLP

15th

Floor, 1111 West Hastings

Vancouver,

BC, V6E 2J3

Canada

www.dumoulinblack.com

Telephone No. (604) 687-1224 |

File

No. 50824-023

January

14, 2025

Permex

Petroleum Corporation

1700

Post Oak Boulevard,

2

Blvd Place Suite 600

Houston,

Texas 77056

Dear

Sirs/Mesdames:

| Re: |

Permex

Petroleum Corporation (the “Company”) Form S-8 Registration Statement |

We

have acted as local counsel in the Province of British Columbia to the Company. We understand that the Company has prepared a Registration

Statement on Form S-8 (the “Registration Statement”) under the United States Securities Act of 1933, as amended (the

“Act”) covering up to 110,300 common shares of the Company (the “Shares”) comprised of:

(i) 41,133 Shares which may be reserved (the “Reserved Shares”) for issuance upon the exercise

or settlement of restricted share units, performance share units, deferred share units or stock options (collectively “Awards”)

granted under the Company’s Long Term Incentive Plan dated October 23, 2024 (the “Plan”); and (ii) 69,167 Shares

(the “Option Shares”) issuable upon the exercise of outstanding stock options of the Company (“Options”)

granted pursuant to the Plan, as more fully described in the Registration Statement. All capitalized terms not defined herein shall have

the meanings ascribed thereto in the Registration Statement.

For

the purposes of our opinion, we have examined originals, or copies certified or otherwise identified to our satisfaction, of:

| |

1. |

a

certificate of an officer of the Company dated January 14, 2025 (the “Officer’s Certificate”); |

| |

|

|

| |

2. |

the

Registration Statement (excluding the documents incorporated by reference under Part II, Item 3 of the Registration Statement); |

| |

|

|

| |

3. |

the

Notice of Articles and Articles of the Company (collectively, the “Constating Documents”); and |

| |

|

|

| |

4. |

the

Plan. |

Whenever

our opinion refers to shares of the Company, whether issued or to be issued, as being “fully paid and non-assessable”,

such opinion indicates that the holder of such shares will not be liable to contribute any further amounts to the Company by virtue of

its status as a holder of such shares, either in order to complete payment for the shares or to generally satisfy claims of creditors

of the Company. No opinion is expressed as to actual receipt by the Company of the consideration for the issuance of such shares or as

to the adequacy of any consideration received.

For

the purposes of our opinion below, we have relied solely on the Officer’s Certificate in respect of certain factual matters.

The

opinions expressed herein are subject to the following exceptions, qualifications and assumptions:

| |

(a) |

we

have assumed the genuineness of all signatures, the legal capacity at all relevant times of any individual signing such documents,

the authenticity and completeness of all documents submitted to us as originals, the conformity to authentic original documents of

all documents submitted to us as certified or photostatic copies or facsimiles (including scanned copies provided by email), and

the authenticity of the originals of such certified or photostatic copies or facsimiles and the truth and accuracy of all corporate

records of the Company and certificates of officers provided to us by the Company; and |

| |

|

|

| |

(b) |

we

have assumed that, at all relevant times, the Constating Documents, the resolutions of the directors of the Company upon which we

have relied and the Plan have not been or will not be varied, amended or revoked in any respect. |

We

are not qualified to practice law in the United States of America. We are solicitors qualified to practice law in the Province of British

Columbia only and we express no opinion as to the laws of any jurisdiction, or as to any matters governed by the laws of any jurisdiction,

other than the laws of the Province of British Columbia and the laws of Canada applicable therein. Our opinion herein is based on the

laws of the Province of British Columbia and the laws of Canada applicable therein (and the interpretation thereof) as such laws are

in effect and are construed as of the date hereof (the “Effective Date”). Our opinion herein does not take into account

any proposed rules or legislative changes that may come into force following the Effective Date and we disclaim any obligation or undertaking

to update our opinion or advise any person of any change in law or fact that may come to our attention after the Effective Date.

Based

and relying upon the foregoing, we are of the opinion that as at the date hereof: (i) any Reserved Shares that may become issuable pursuant

to future Awards granted under the Plan; and (ii) the Option Shares issuable upon the exercise of the Options outstanding under

the Plan, in each case, when issued in accordance with the terms of the Plan and any applicable award agreement, including receipt by

the Company of the requisite consideration therefor, and all other conditions as required by the Plan and any applicable award agreement

having been satisfied, and with the passing of all necessary corporate resolutions, such Reserved Shares and Option Shares will be

validly issued as fully paid and non-assessable common shares in the capital of the Company.

The

above opinion is rendered solely in connection with the transactions described above and may not be used, circulated, quoted from or

otherwise referred to for any other purpose without our prior written consent. Further, the above opinion is limited to the matters stated

herein, and no opinion or belief is implied or should be inferred beyond the matters expressly stated herein. For greater certainty,

we express no opinion as to matters of tax or as to the contents of, or the disclosure in, the Registration Statement, or whether the

Registration Statement provides full, true and plain disclosure of all material facts relating to the Company within the meaning of applicable

securities laws.

We

hereby consent to the use of this opinion as Exhibit 5.1 to the Registration Statement. In giving such consent, we do not hereby admit

that we are acting within the category of persons whose consent is required under Section 7 of the Act or the rules or regulations of

the United States Securities and Exchange Commission thereunder.

Yours

truly,

/s/

DuMoulin Black LLP

Exhibit

23.1

Independent

Registered Public Accounting Firm’s Consent

We

consent to the incorporation by reference in this Registration Statement of Permex Petroleum Corporation on Form S-8, of our report dated

January 14, 2025, which includes an explanatory paragraph as to Permex Petroleum Corporation’s ability to continue as a going concern,

with respect to our audits of the consolidated financial statements of Permex Petroleum Corporation as of September 30, 2024 and 2023

and for each of the two years ended September 30, 2024 appearing in the Annual Report on Form 10-K of Permex Petroleum Corporation

for the year ended September 30, 2024.

/s/

Marcum llp

Marcum

llp

Houston,

Texas

January

14, 2025

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-8

(Form

Type)

PERMEX

PETROLEUM CORPORATION

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule (1) | |

Amount Registered (2) | | |

Proposed Maximum Offering Price Per Share | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of Registration Fee | |

| Equity | |

Common Share, no par value | |

Other | |

| 110,300 | | |

$ | 2.9122 | (1) | |

$ | 321,216 | | |

$ | 0.0001531 | | |

$ | 49.18 | |

| Total Offering Amounts | | |

| | | |

$ | 321,216 | | |

| | | |

$ | 49.18 | |

| Total Fee Offsets | | |

| | | |

| | | |

| | | |

| – | |

| Net Fee Due | | |

| | | |

| | | |

| | | |

$ | 49.18 | |

| (1) |

Estimated

solely for purposes of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act of 1933, as amended

(the “Securities Act”), by utilizing the applicable prices of Permex Petroleum Corporation’s (the “Registrant’s”)

common stock, no par value (“Common Shares”) as reported on Canadian Securities Exchange on January 10, 2025 converted

to U.S. Dollars after giving effect to the Canadian dollar/U.S. dollar exchange rate of CAD$1.00 to $1.4422 which was daily exchange

rate of the Bank of Canada on January 10, 2025, which date is within five business days prior to the filing of this Registration

Statement. |

| (2) |

Pursuant

to Rule 416(a) of the Securities Act, this Registration Statement shall also cover any additional Common Shares of the Registrant

that become issuable under the Registrant’s Long Term Incentive Plan by reason of any stock dividend, stock split, recapitalization

or other similar transaction that increases the number of outstanding Common Shares. In addition,

pursuant to Rule 416(c) under the Securities Act, this Registration Statement shall also cover an indeterminate amount of interests

to be offered or sold pursuant to the employee benefit plans described herein.

|

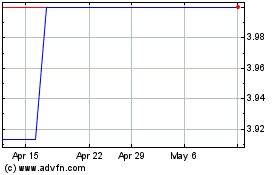

Permex Petroleum (PK) (USOTC:OILCF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Permex Petroleum (PK) (USOTC:OILCF)

Historical Stock Chart

From Feb 2024 to Feb 2025