U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 25, 2014

ONCOLOGIX TECH, INC.

(Name of Small Business Issuer as Specified

in Its Charter)

| |

Nevada |

|

0-15482 |

|

86-1006416 |

|

| |

(State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer |

|

| |

Organization or Incorporation) |

|

|

|

Identification Number) |

|

1604 West Pinhook Drive

Suite # 200

Lafayette, Louisiana 70508

(Address of principal executive offices)

(616) 977-9933

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Registrant’s Form 10-K, any Form

10-Q or any Form 8-K of the Registrant or any other written or oral statements made by or on behalf of the Registrant may contain

forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections

about the medical device business, and the Company itself. Statements, including without limitation, those related to: future revenue,

earnings, margins, growth, cash flows, operating measurements, tax rates and tax benefits; expected economic returns; projected

2013 operating results, future strength of the Company; future brand positioning; achievement of the Company vision; future marketing

investments; the introduction of new lines or categories of products; future growth or success in specific countries, categories

or market sectors; capital resources and market risk are forward-looking statements. In addition, words such as "anticipates,"

"believes," "estimates," "expects," "forecasts," "intends," "is likely,"

"plans," "predicts," "projects," "should," "will," variations of such words and

similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance

and involve certain risks, uncertainties and assumptions ("Risk Factors") that are difficult to predict with regard to

timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may

be expressed or forecasted in such forward-looking statements.

Readers are cautioned not to place undue reliance

on such forward-looking statements as they speak only of the Registrant’s views as of the date the statement was made. The

Registrant undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise.

ITEM 1.01 – Entry into a Material

Definitive Agreement

| A. | Senior Secured Credit Agreement Amendment. On January 3, 2014, Oncologix Tech, Inc. (the

“Company”), together with its subsidiaries Dotolo Research Corporation and Amian Angels, Inc., entered into a Senior

Secured Revolving Credit Facility Agreement with TCA Global Credit Master Fund LP (“Lender”) for a revolving credit

facility of up to Four Million Dollars ($4,000,000) for working capital financing for Borrower and for any other purposes permitted

hereunder. On September 25, 2014, the Company drew down an additional loan amount of $1,200,000 to be used for working capital

and the acquisition of Esteemcare Inc. and Affordable Medical Equipment Solutions Inc. In connection with the drawdown of the second

tranche, the Company will be required to pay additional fees of $450,000 due after six months. This second tranche, together with

the remaining principal balance of approximately $325,000 is secured by a 14.5% convertible promissory note, due in twelve months,

with an extension option of an additional twelve months. Repayments of interest and fees begin immediately. Principal repayments

begin December 25, 2014. The Company will redirect its customer receipts to a lockbox account. The Lender will hold back interest

and fees of each deposit for the first three (3) months of the agreement and then an on-going 12.5% for principal payments and

TCA Global Fund will remit all receivable balances to the Company. Monthly principal payments continue

in this manner until the note is paid in full or it reaches maturity at which a balloon payment will be due. (filed herewith as

Exhibit 10.1) |

| B. | Stock Purchase Agreement. On September 25, 2014, entered into a Stock Purchase Agreement,

dated as of September 25, 2014, (the “Agreement”) by and among Oncologix Tech Inc. (OCLG or Company), and Madhu Mathew

Mammen and Imad Siddiqui (collectively the “Owners”), for the Company to acquire 100 shares of Common Stock of Esteemcare

Inc and its wholly owned subsidiary Affordable Medical Equipment Solutions Inc. (“Esteem”), which represents all of

the issued and outstanding shares of Esteem (filed herewith as Exhibit 10.2). |

| C. | Secured Promissory Note. Upon closing of the Stock Purchase Agreement, we issued a Secured

Promissory Note to the Owners in the Amount of $100,000 (filed herewith as Exhibit 10.3). This note bears interest at a rate of

6% per annum payable in twelve (12) monthly installments beginning on October 15, 2014. The monthly payments are calculated using

a one (1) year amortization schedule and is collateralized by the stock of Esteemcare, Inc. |

ITEM 2.01 – Completion of Acquisition

or Disposition of Assets.

On September 25, 2014, a closing was held pursuant

to a Stock Purchase Agreement, dated as of September 25, 2014, (the “Agreement”) by and among Oncologix Tech Inc. (“OCLG”

or “Company”), and Madhu Mathew Mammen and Imad Siddiqui (collectively the “Owners”), for Company to acquire

100 shares of Common Stock of Esteemcare Inc. and its wholly owned subsidiary Affordable Medical Equipment Solutions Inc. (“Esteem”),

which represents all of the issued and outstanding shares of Esteem.

Pursuant to the Agreement, the Owners sold

all of the Common Stock of Esteem for $500,000 represented by a down payment of $400,000 at closing and a one year Secured Promissory

Note for $100,000. The Owners own all of the shares of Esteem, a corporation organized under the laws of the State of South Carolina,

a medical products and technologies company.

In connection with this acquisition, OCLG drew

down a second tranche from its Senior Secured Lender in the amount of $1,200,000

Under the terms of the Agreement, Harold Halman

was appointed President and Chief Operating Officer, Michael A. Kramarz was appointed Chief Financial Officer, and Roy Wayne Erwin

was appointed Chief Executive Officer of Esteem. There were no changes to the officers or directors of the Company.

RISK FACTORS

Those interested in investing in the Company

because of the Stock Purchase Agreement should carefully consider the following Risk Factors pertaining to Oncologix Tech as well

as the risks and uncertainties that are described in the Company's most recent Annual and Quarterly Reports under the Securities

Exchange Act of 1934. These Risk Factors are not all inclusive.

Going Concern Qualification.

Our Independent Accountants have expressed

doubt about our ability to continue as a going concern. The ability to continue as a going concern is an issue raised as a result

of the material operating losses incurred since inception, and its stockholders' deficit. We expect to continue to experience net

operating losses. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside

sources, including obtaining additional funding from the sale of our securities or obtaining loans from various financial institutions

where possible. The going concern increases the difficulty in meeting such goals.

Lack of Audit

While audited financial

information is not required at this time under Securities and Exchange Commission rules, such audited financial information, which

will be filed within 75 days in an amendment to this Current Report on Form 8-K, may contain adjustments which substantially modify

the foregoing disclosures. In addition, the audited financial information will contain footnotes which will assist the reader to

better understand the business of Esteem.

Need for Additional Capital

Esteem operates with positive cash flow sufficient

to service the business operations and debt payment requirements of the acquisition but will need additional funds to complete

the audit of Esteem as well as costs for other required SEC and other regulatory filings. We estimate that the Company will need

to raise at least $150,000 of additional funding by the end of 2014 to fund working capital relating to Esteencare. In addition,

we require an additional $500,000 in capital to cover costs associated with further product development of our subsidiary, Dotolo

Research Corporation. We may be unable to raise additional capital on commercially acceptable terms, if at all, and if we raise

capital through additional equity financing, existing shareholders may have their ownership interests diluted. Our failure to be

able to generate adequate funds from operations or from additional sources would harm our business.

Uncertainties Regarding Healthcare Reimbursement

and Reform

Our ability to execute our strategy in the

healthcare services and product distribution markets depends in part on the extent to which the healthcare services and Medicaid

reimbursements are paid by governmental agencies, private health insurers and other organizations, for the cost of such products

and related services. Our business could be harmed if healthcare payers and providers implement cost-containment measures and governmental

agencies implement measures that reduce payment to our Company for the utilizations of our services.

Healthcare Services and Medical Product

Industry Intensely Competitive

The healthcare service industry is very competitive.

While we maintain a strong leadership position in personal care services, there is no guarantee we can maintain that market share.

We will compete with both public and private healthcare service companies that hold licenses in other Regions within the State

of Louisiana and directly compete with companies in the State of Louisiana that may have greater financial resources and have other

competitive advantages.

Compliance with Government Regulations.

We are subject to extensive, and evolving governmental

rules, regulations and restrictions administered by the Department of Health & Hospitals, the Bureau of Health Services Financing,

by other federal and state agencies, and by governmental authorities.

Reliance on Key Personnel

Uncertainties Regarding Healthcare Reimbursement

and Reform

Our ability to execute our strategy in the

healthcare devices, services and product distribution markets depends in part on the extent to which healthcare services and Medicaid

reimbursements are paid by governmental agencies, private health insurers and other organizations for the cost of such products

and related services.

Government Regulation

The healthcare industry is subject to extensive

regulation by a number of governmental entities at the federal, state and local level. The healthcare regulatory environment is

also subject to frequent change. Laws and regulations in the healthcare industry are extremely complex. While our management believes

we are in substantial compliance with all of the existing laws and regulations applicable to us, such laws and regulations are

subject to rapid change and often are uncertain in their application In addition, the Patient Protection and Affordable Care Act,

or PPACA, and the Health Care and Education Reconciliation Act of 2010, which amended PPACA (collectively, the "Health Reform

Law"), may have a considerable impact on the financing and delivery of health care and conceivably could have a material adverse

effect on our business.

Medicare and Medicaid Reimbursement

Many of the products that we provide are reimbursed

by Medicare and state Medicaid programs and are therefore subject to extensive government regulation. Medicare is a federally funded

program that provides health insurance coverage for qualified persons age 65 or older and for some disabled persons with certain

specific conditions. Congress often enacts legislation that affects, positively or negatively, the reimbursement rates of Medicare

providers and also may impact Medicaid providers. Generally, Medicare provider payment modifications occur in the context of budget

reconciliation; however, Medicare changes also may occur in the context of broader healthcare policy legislation, including the

Health Reform Law. In the last several years, Congress has reduced Medicare reimbursement for various providers. We are also subject

to regulatory reductions and reimbursement for our products.

Regulation of Client Confidentiality

We are subject to the Health Insurance Portability

and Accountability Act, or HIPAA, which established comprehensive federal standards with respect to the use and disclosure of protected

health information, and the Health Information Technology for Economic and Clinical Health Act, or HITECH Act, which was passed

as part of the American Recovery and Reinvestment Act and which strengthens many of the requirements applicable to privacy and

security, among other things. We provide extensive training to our staff with respect to compliance with patient confidentiality

requirements and have additional systems in place to further comply with those requirements. However, the failure to meet regulatory

standards concerning patient confidentiality could subject us to criminal and civil sanctions.

Reliance on Key Personnel

The success of the Company is largely dependent

on Roy Wayne Erwin, the Company’s Chairman/CEO and Michael Kramarz, Chief Financial Officer and Vickie Hart, President, and

Harold Halman, President, who are responsible for the day-to-day management of the business. A loss of any key executives services,

either through retirement, incapacity or death, may have a material adverse effect on the Company. Our success also will depend

upon our ability to attract and retain other highly qualified health services Respiratory Technicians, sales and marketing, and

core administrative personnel to develop and maintain relationships with our referral physicians and clients in the industry.

Uncertainty as to our Ability to Grow Operations

and Manage Growth.

Our efforts to increase market penetration

will result in new and increased responsibilities for management personnel and will place a strain upon our management, financial

systems, and resources. We may be required to continue to implement and to improve our management, operating and financial systems,

procedures and controls on a timely basis and to expand, train, motivate and manage our employees. There can be no assurance that

our personnel, systems, procedures, and controls will be adequate to support our future operations.

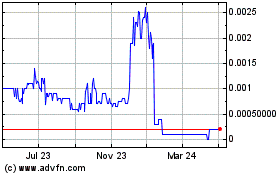

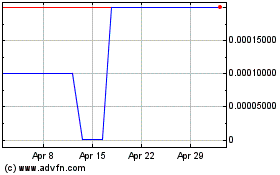

Risks Relating to Ownership of Our Common

Stock

Our common

stock is currently listed on the OTCPINK markets. Even though we expect to move to the company to become listed on the OTC:BB,

we cannot predict changes in the trading market for our common stock, including changes in liquidity. A large percentage of our

outstanding shares are held by a relatively small number of investors, including our Chief Executive Officer. Future sales of a

substantial number of our common stock in the public markets, or the perception that these sales may occur, could affect the market

price of our common stock.

Attraction and Retention of Qualified Personnel

The Company

is dependent on the efforts and abilities of its senior executive officers and Managers. While the Company is confident that its

Executive management team has significant experience and depth, appropriate senior management succession plans are in place. The

Company's future success also depends on its ability to identify, attract and retain additional qualified personnel, case management

personnel and qualified care-givers for our valued clients.

Broker-Dealer Requirements May Affect Trading

and Liquidity of Our Common Stock

Section 15(g)

of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing

in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed

and dated written receipt of the document before effecting any transaction in a penny stock for the investor's account.

Potential

investors in the Registrant's common stock are urged to obtain and read such disclosure carefully before purchasing any shares

that are deemed to be "penny stock." Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account

of any investor

for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i)

obtain from the investor information concerning his or her financial situation, investment experience and investment objectives;

(ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that

the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions;

(iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in

(ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects

the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make

it more difficult for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the

market or otherwise.

BUSINESS

The HME/DME Market

The U.S. domestic healthcare spending is expected

to increase by approximately $2.3 trillion from $2.7 trillion in 2011 to $5.0 trillion in 2022, according to the Centers for Medicare

and Medicaid Services (“CMS”). Revenues for CPAP Therapy to treat sleep disorders are projected to grow at 15%-20%

for the next 5 years. No other product line in undergoing this much consistent growth. Continuous Positive Airwave Pressure (CPAP)

is a treatment in which a mask is worn over the nose and/or mouth while you sleep. The mask is hooked up to a machine that delivers

a continuous flow of air into the nose. This air flow helps keep the airways open so that breathing is regular. CPAP is considered

by many experts to be the most effective treatment for sleep apnea.

Esteemcare targets patients with sleep obstructive

disorders or related chronic illnesses who are insured by Medicare, Medicaid, third-party insurers, or have the ability to pay

for our products from their own resources. Sleep apnea is a serious sleep disorder that occurs when a person's breathing is interrupted

during sleep. People with untreated sleep apnea stop breathing repeatedly during their sleep, sometimes hundreds of times. This

means the brain -- and the rest of the body -- may not get enough oxygen.

There are two types of sleep apnea:

• Obstructive sleep apnea (OSA): The

more common of the two forms of apnea, it is caused by a blockage of the airway, usually when the soft tissue in the back of the

throat collapses during sleep.

• Central sleep apnea: Unlike OSA,

the airway is not blocked, but the brain fails to signal the muscles to breathe, due to instability in the respiratory control

center.

Sleep apnea can affect anyone at any age, even

children. Risk factors for sleep apnea include:

• Being male

• Being overweight

• Being over age 40

• Having a large neck size (17 inches

or greater in men and 16 inches or greater in women

• Having large tonsils, a large tongue,

or a small jaw bone

• Having a family history of sleep

apnea

• Gastroesophageal reflux, or GERD

• Nasal obstruction due to a deviated

septum, allergies, or sinus problems

What Are the Effects of Sleep Apnea?

If left untreated, sleep apnea can result in

a growing number of health problems, including:

• High blood pressure

• Stroke

• Heart failure, irregular heart-beats,

and heart attacks

• Diabetes

• Depression

• Worsening of ADHD

• Headaches

As the baby boomer population ages, CMS estimates

that the number of Americans over the age of 65 will increase from an estimated 42.6 million in 2012 to 58.3 million in 2022. The

Centers for Disease Control estimates that 80% of older adults have at least one chronic condition and 50% have at least two. Esteemcare

is medical distributor providing Durable and Home Medical CPAP products and related supplies. The products that we distribute are

classified as Durable Medical Equipment (“DME”). CMS estimates that the national expenditures within the DME market

will increase by over $27 billion from $38.9 billion in 2011 to $66.7 billion in 2022. The number of DME companies billing Medicare

less than $300,000 per year has been declining, or consolidating, over the last few years according to HME News, primarily as a

result of increased Medicare accreditation, bonding requirements and Medicare Competitive Bidding. We have been able to attract

new referral physicians and patients looking for new suppliers as a result of consolidation within the DME market over the last

few years.

Small medical distribution companies can compete

against national companies because Home Medical Equipment (HME) and Durable Medical Equipment (DME) pricing is government regulated.

Medical Device-network.com in January of 2012 reports, “The market is highly regulated, however, transparent and ‘rules-based’,

small and medium enterprises (SMEs) have traditionally played a crucial role in the development of new products in the medical

services, biotech and medical device industry. Because of their quick adaptability, ability to identify market niches and considerable

innovative potential, these firms form an important component of the healthcare industry worldwide. Accounting for more than 50%

of all pipeline products, they have a significant role in the future of the healthcare industry”. According to the U.S. Census

Bureau, the generation described as the "Baby Boom" is just now reaching age 65. The United States' National Institutes

of Health, National Institute for Aging projects that in the next fifteen (15) years the population aged 65 to 84 years old will

grow by roughly 50%, peaking in 2025. The combined U.S. market for home healthcare products is expected to expand annually by nearly

7.0%. The Company anticipates an increased emphasis on medical equipment solutions that reduce the cost of care and improve patient

outcomes. Our medical distribution strategy is to serve the growing demand for HME by building a national and international distribution

network with exclusive rights to products that are positioned to address the changing industry requirements.

Key Market Segments Served

Skilled Nursing Facilities: There are in excess

of 17,000 skilled nursing facilities in US with 1.84 million beds which are projected to grow 10% per annum through 2016. By 2020,

a 65-year-old man could be expected to live to the age of 82 and a woman could be expected to live to the age of 85. For those

over the age of 65, there is a 41 percent chance that they will spend an average of 2.5 years in a skilled nursing facility. A

one-year stay in a nursing home can cost between $30,000 and $80,000.

Acute and Critical Care Facilities: Although

there has been a decline in the number of hospitals that provide acute care services in the United States, there is an estimated

5,200 medical facilities and the total numbers of acute care facilities and out-patient surgery centers have increased annually.

This shift was in part the result of payer pricing pressures, declining physician reimbursements, and this has t created an incentive

for acute care hospitals to lower-costs and to establish physician-owned, out-patient surgery centers.

Assisted Living Facilities: There are approximately

33,000 Assisted Living Facilities operating in the U.S. today. Nursing home spending is expected to grow 6.6 percent annually by

2018.

Hospitals and Medical Institutions: There are

well over 5,000 hospitals in the U.S. with approximately 1,000,000 beds. Although the short-term outlook for hospitals is mixed,

a common theme is to reduce the total cost of care, improve efficiencies and allow patients to remain in their home with home based

care as long as possible.

Federal Agencies: In fiscal year 2008, the

Department of Veterans Affairs (VA) spent about $4.1 billion on long-term care for veterans. The VA estimated a budget increase

of 165% between fiscal years 2008 and 2015 for institutional and non-institutional care.

Home Medical Care Industry: It is estimated

that in 2010 there were over 30,000 home health care facilities in the United States. Home health care spending is projected to

grow an average of 7.9 percent from 2013 to 2018.

Stroke Centers: There are an estimated 500

stroke centers throughout the United States.

Burn Centers: There are an estimated 120 burn

centers throughout the United States.

Physical/Occupational Therapy Centers: There

are well over 5,000 physical therapy facilities throughout the United States. The demand for physical therapists is expected grow

by 30% over the next decade.

Medicare Competitive Bidding Areas

Esteemcare was awarded contracts in 46 Competitive

- MSA Bid Areas.

Product Category: CPAP Devices, Respiratory

Assist Devices, and Related Supplies

Major MSA Markets Awarded By Company:

Albany-Schenectady-Troy, NY , Albuquerque,

NM ,Asheville, NC ,Atlanta-Sandy Springs-Marietta, GA Augusta-Richmond County, GA-SC ,Baton Rouge, LA , Bridgeport-Stamford-Norwalk,

CT ,Bronx-Manhattan, NY ,Cape Coral-Fort Myers, FL , Charleston-North Charleston-Summerville, SC ,New Haven-Milford, CT ,New Orleans-Metairie-Kenner,

LA ,North East NY CBA Metro ,North Port-Bradenton-Sarasota, FL ,Northern NJ Metro CBA ,Ocala, FL , Oklahoma City, OK ,Omaha-Council

Bluffs, NE-IA , Palm Bay-Melbourne-Titusville, FL ,Phoenix-Mesa-Glendale, AZ ,Poughkeepsie-Newburgh-Middletown, NY Raleigh-Cary,

NC ,Colorado Springs, CO, Columbia, SC ,Deltona-Daytona Beach-Ormond, FL ,Denver-Aurora-Broomfield, CO, Greensboro-High Point,

NC , Greenville-Mauldin-Easley, SC ,Hartford-West Hartford-East Hartford, CT, Jacksonville, FL ,Lakeland-Winter Haven, FL ,Milwaukee-Waukesha-West

Allis, WI, Minneapolis-St. Paul-Bloomington, MN-WI, Nassau-Brooklyn-Queens-Richmond County Metro Richmond, VA ,Seattle-Tacoma-Bellevue,

WA ,Southern NY Metro CBA

Medicare Competitive Bidding Area Awards

Suffolk County, Syracuse, NY ,Tampa-St. Petersburg-Clearwater,

FL ,Tucson, AZ ,Tulsa, OK Virginia Beach-Norfolk-Newport News, VA-NC , Washington-Arlington-Alexandria, DC-VA-MD-WV

Esteemcare revenues are derived from physician

referrals, sleep centers, patient referrals, in-service set-ups, and by supplying CPAP products and supplies to meet the growing

requirements to combat severe/chronic sleep disorders. Customers meet with company Respiratory Technicians and our therapists provide

the appropriate CPAP device to the customer. We market our products directly to referral physicians, insurance payers, and consumers

through our direct push marketing efforts. We target consumers with chronic sleep obstructive conditions and who require a continuous

supply of medical products that provide attractive gross margins.

We receive initial contact from prospective

customers in the form of physician prescriptions. These referrals are then qualified and become new customers. Our qualification

efforts primarily involve verifying insurance eligibility, obtaining the required medical documentation from the customer’s

physician, and explaining our billing and collection processes, if applicable. The majority of the new customers qualified from

our process typically place their initial order with us within 24 -48 hours from the time we receive initial contact from the

physician and customer. Since our inception, we have demonstrated our ability to attract and retain customers with our unique

customer service that generates recurring revenues on supply parts that can last for periods of greater than two years.

Accounts Receivable

Our accounts receivable are generally due from

Medicare, Medicaid, private insurance companies, and our private patients. Accounts receivable are reported net of allowances for

contractual adjustments and uncollectible accounts. The collection process is time consuming, complex and typically involves the

submission of claims to multiple layers of payers whose payment of claims may be contingent upon the payment of another payer.

As a result, our collection efforts may be active for up to 18 to 24 months from the initial billing date. In accordance with regulatory requirements, we

make reasonable and appropriate efforts to collect our accounts receivable, including deductible and co-payment amounts, in a manner

consistent for all classes of payers.

The Company has established an allowance

to account for contractual adjustments that result from differences between the payment amount received and the expected realizable

amount. These adjustments are recorded as a reduction of both gross revenues and accounts receivable. Based on our current billing

system, we are unable to directly compare the aggregate estimated allowance for contractual adjustments to the actual contractual

adjustments recorded. However, we do analyze the aggregate allowance for contractual adjustments as a percentage of net sales

compared to the last twelve months’ actual contractual adjustments as a percentage of net sales to determine that our estimated

allowance for contractual adjustments is a reasonable basis for recording our periodic allowance for contractual adjustments.

As a result of the Budget Control Act

of 2011, or sequestration, effective April 1, 2013, Medicare reduced payments for Part B Medicare claims by 2%, but did not change

the published allowable Medicare rates. Allowances for uncollectible accounts (or bad debts) are recorded as an operating expense

and consist of billed charges that are ultimately deemed uncollectible due to the customer’s or third-party payer’s

inability or refusal to pay. In establishing the appropriate allowance for uncollectible accounts, management makes assumptions

with respect to future collectability. We base our estimates of accounts receivable collectability on our historical collection

and write-off experience, our credit policies, and aging of our accounts receivable. Changes in judgment regarding these factors

will cause the level of accounts receivable allowances to be adjusted.

The typical collection process begins with

the electronic submission of a claim to Medicare, Medicaid, or other primary insurance carriers, for which a response (and payment)

is obtained within 15 to 30 days. Any claim denials are generally acted upon timely following the response and, where applicable,

corrected claims are submitted. A response (and co- payment) for amounts billed to secondary payers, including Medicaid, private

third-party insurance carriers, and patients, generally occurs within 30 to 60 days of submission of the claim. On a continual

basis, the outstanding accounts receivable balances are reviewed by collection personnel, including contacting the insurance company

and/or patient in an attempt to determine why payment has not been remitted and obtain payment from the respective responsible

party. When applicable, corrected claims are submitted to the insurance carrier. Patient statements are generated and sent out

monthly. Outbound calls are continually made to patients with outstanding balances in an attempt to obtain payment. Uncollectible

account balances for all payer classes are written off after remaining unpaid for a period of 24 months. Balances that are determined

to be uncollectible prior to the passage of 24 months from the last billing date are written off at the time of such determination.

We perform eligibility and insurance verification

on patients prior to the shipment of products and submission of a claim. As a result, we do not have amounts that are pending approval

from third-party payers outside of the typical review process for submitted claims.

Accounts receivable are reported net of allowances

for contractual adjustments and uncollectible accounts. Contractual adjustments are recorded against revenues. Contractual adjustments

result from differences between the payment amount received and the expected realizable amount. Bad debt is recorded as an operating

expense and consists of billed charges that are ultimately deemed uncollectible due

to the customer’s or third-party payer’s inability or refusal to pay.

The Company performs analyses to evaluate the

net realizable value of accounts receivable. Specifically, the Company considers historical realization data, accounts receivable

aging trends, other operating trends and relevant business conditions. Because of continuing changes in the health care industry

and third-party reimbursement, it is possible that the Company’s estimates could change, which could have a material impact

on the Company’s results of operations and cash flows. The Company does not accrue interest on its accounts receivable.

Revenue Recognition

We recognize revenue related to product sales

upon delivery to customers provided that we have received and verified any written documentation required to bill Medicare, other

government agencies, third-party payers, and patients. For product shipments for which we have not yet received the required written

documentation, revenue recognition is delayed until the period in which those documents are collected and verified. We record revenue

at the amounts expected to be collected from government agencies, other third-party payers, and from patients directly. We record,

if necessary, contractual adjustments equal to the difference between the reimbursement amounts defined in the fee schedule and

the revenue recorded per the billing system. These adjustments are recorded as a reduction of both gross revenues and accounts

receivable. We analyze various factors in determining revenue recognition, including a review of specific transactions, current

Medicare regulations and reimbursement rates, historical experience and the credit-worthiness of patients. Medicare reimburses

at 80% of the government-determined prices for reimbursable supplies, and we bill the remaining balance to either third-party payers

or directly to patients.

Company Payer Mix:

Medicare- 40%

Private Insurance- 26%

Blue Cross/Blue Shield of South Carolina- 17%

Private Pay 8%

Tricare/VA- 7%

Medicaid- 2%

Product Mix:

Sleep 95%- Oxygen 5%

Shipping and Handling Costs:

Shipping and handling costs are not charged

to the patients in compliance with Medicare policy.

Equipment Leases

The Company performs a review of newly acquired

equipment leases to determine whether a lease should be treated as a capital or operating lease. Capital lease assets are capitalized

and depreciated over the term of the initial lease.

A liability equal to the present value of the aggregated lease payments is recorded utilizing the stated lease interest rate. If

an interest rate is not stated, the Company will determine an estimated cost of capital and utilize that rate to calculate the

present value. For equipment leases, the Company records rent expense and amortization of leasehold improvements on a straight-line

basis over the initial term of the lease.

Operating Leases

The Company leases various software, and equipment

under non-cancelable operating leases that expire at various times that extend through April 2016.

Facilities

The Company operates from two (2) administrative

locations: Columbia South Carolina, a 1,800 square foot commercial building and Charleston, South Carolina, a 1,200 square foot

commercial building. The business leases are on month-to-month lease agreement with monthly lease payments below market average.

Employees

As of September 25, 2014, Esteemcare has ten

(10) full time employees, one (1) Office Manager, three (3) billing personnel, two (2) Respiratory Technicians, one (1) accounting

manager, one (1) delivery person, the Chief Financial Officer and the President. None of these employees are covered by any collective

bargaining agreement. The Company presently considers its employee relations to be satisfactory.

Proprietary Rights

We have entered into an Employment Agreement

with our President, Key Managers and have executed Non-Circumvent and Non-Disclosure agreements with key employees that require

them to keep all of our proprietary information and customers lists confidential. We cannot assure that such protections will prove

adequate should they be challenged in litigation.

Legal Proceedings

From time to time, we are party to certain

legal proceedings that arise in the ordinary course and are incidental to our business. There are currently no such pending proceedings

to which we are a party that our management believes will have a material adverse effect on the Company’s financial position

or results of operations. However, future events or circumstances, currently unknown to management, will determine whether the

resolution of pending or threatened litigation or claims will ultimately have a material effect on our consolidated financial position,

liquidity or results of operations in any future reporting periods.

Physicians Referrals- Customers

The Company's financial success is directly

related to maintaining the continued relationships with referring physicians and delivering a high excellence of personal care

and services to our clients and the willingness of new physicians and qualified clients to accept our organization as the “Preferred Choice” to provide

the CPAP equipment and respiratory supplies with the highest level of personal care.

ITEM 5.02 – Appointment of

Certain Officers; Compensatory Arrangements of Certain Officer

Pursuant

to the Agreement, Harold Halman was appointed President and Chief Operating Officer of Esteem, Michael A. Kramarz our current Chief

Financial Officer of Oncologix Tech, Inc., was also appointed CFO and Roy Wayne Erwin, Our current Chief Executive Officer was

appointed CEO.

Harold Halman- President/COO- Medical Product

& Technology Division- Mr. Halman brings 20+ years of new business development, medical

sales, marketing and operations experience to OCLG. Prior to joining the company, Harold was the Chief Executive Officer for Global

Medical located in Phoenix, Arizona, a national provider for home medical equipment. Mr Halman has vast knowledge and direct industry

experience in medical devices and home medical products that will accelerate expansion within the company’s Medical Products

and Technology Division both domestically and internationally. Prior to Global Medical, Mr. Halman was CEO of his management consulting

firm involved in M&A, business turnarounds and business development projects. His direct experience includes bringing forth

breakthrough medical products and technologies to the market with aggressive, multi-tiered distribution strategies.

Roy Wayne Erwin- Chairman

and CEO, has served as the Chairman/CEO of Oncologix Tech Inc. since March 2013, and played an important role in the acquisitions

of Dotolo Research Corporation and Amian Angels Inc. Since 2010, Wayne Erwin has been the Chief Executive Officer of Deep South

Capital, LLC., a company with very limited operations. From 2007 to 2010, Mr. Erwin was the co-founder and Chief Operations Officer

of Electronic Health Network, a leader in Healthcare and Medical Information Technology. From 2007 to 2004 he was the Chief Operating

Officer and Director of New Business Development at Crossroads Regional Hospital, a 68-bed, acute care, in-patient and outpatient

psychiatric and Substance Abuse Facility. From 1995 to 2004, Mr. Erwin was the Regional Director of Sales for Centerpulse Orthopedics,

Inc, a Division of Sulzer Corporation, a world-wide, $ 3.0 billion Swiss conglomerate specializing in orthopedic total joint reconstruction

of hip, knees and shoulder products. Prior to 1995, Mr. Erwin was employed by Valley Lab, Inc., Ball Aerospace and Texas Instruments

in various senior management capacities. He served in the US Army, with the rank of Captain, at the 101st Airborne Division, with

overseas assignments in Panama and Honduras and has advanced military training in Air Borne, Air Assault, and Jungle Warfare training.

Wayne graduated with a Bachelor of Science from Louisiana College- Pineville, Louisiana.

Michael A. Kramarz- has

served as Chief Financial Officer of the Company since July 15, 2004. Mr. Kramarz was first employed by the Company in September

2002, as its Controller and now has over 18 combined years working for public companies. Mr. Kramarz is responsible for all financial

statement, accounting, SEC compliance, payroll and tax functions. From 1995 to 2002, Mr. Kramarz was employed as Accounting Manager

for Assurant Group, a 6 billion dollar insurance company. Mr. Kramarz was responsible for the accounting, budgeting and payroll

functions of one of Assurant Group’s 20+ million dollar call center subsidiaries with offices in Michigan and Oklahoma. In

addition, Mr. Kramarz was responsible for quarterly consolidations into the parent company to assist with its SEC and tax filings. From 1992

to 1995, Mr. Kramarz was a staff accountant at VandenToorn & Associates CPA firm where he was responsible for compilations

and reviews of financial statements, as well as tax return preparation. Mr. Kramarz holds a Certified Management Accountant Designation

(CMA) and a Certified Public Accountant Designation (CPA). Mr. Kramarz holds a Bachelor of Science and Business Administration

in Accounting from Aquinas College and a Masters in the Science of Taxation from Grand Valley State University.

Barry Griffith- Board of Directors Barry

been a Director of the company since December of 2004. Mr. Griffith brings 20 years of early stage and upstart medical device company

experience to Oncologix. Mr. Griffith has been involved in the introduction of novel medical devices in the Orthopedic, Vascular,

Neurological and Cancer markets for companies such as Mitek, Schneider, Novoste and Medtronic. His present position is founder

and principal of The Bench which is and executive search firm within the medical device industry based out of Newport Beach Ca.

Prior to that, he was Director of Sales with Cardiovascular Systems, Inc., Director of Sales for Calypso Medical Technologies and

held the Western Area Director roles with Novoste and Isoray.

Vickie Hart- President- Amian Angels Services

Division. Ms. Hart is the President of Angels of Mercy and brings over 35 years of senior

management and healthcare services experience. Since 2011 through 2013, she was the Owner and President of Triple E Healthcare

Services, a healthcare services consulting firm located in Alexandria, Louisiana. From 1992 through 2010, Ms. Hart was an Assistant

Principal and teacher in Elementary and Secondary education for the Rapides Parish School Systems. Ms. Hart is active in civic

and charitable organizations, recently served on the D.A.R.E. Board of Directors, Central Louisiana Lions Club, and the local United

Way. Vickie Hart holds a Bachelor of Science Degree from Louisiana State University and a Master Degree in Management from Northwestern

State University, Natchitoches, Louisiana.

ITEM 9.01 – Financial Statements and

Exhibits

| (a) | Financial Statements of Business Acquired |

To be filed by amendment.

| (b) | Pro Forma Financial Information |

To be filed by amendment.

| |

|

Exhibit 10.1:

Amendment to Credit Agreement

Exhibit 10.2:

Stock Purchase Agreement

Exhibit 10.3: Secured Promissory

Note |

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

Dated: October 1, 2014

|

|

| |

ONCOLOGIX TECH, INC. |

| |

|

| |

By: /s/ Roy Wayne Erwin |

| |

Roy Wayne Erwin, Chief Executive Officer |

| |

By: /s/ Michael A. Kramarz |

| |

Michael A. Kramarz, Chief Financial Officer |

| |

|

Exhibit 10.1

AMENDMENT NO. 1

TO

SENIOR SECURED REVOLVING CREDIT FACILITY AGREEMENT

IN THE AMOUNT OF US$4,000,000

BY AND AMONG

ONCOLOGIX TECH, INC.,

as Borrower,

AMIAN

ANGELS, INC.,

DOTOLO RESEARCH CORPORATION,

ESTEEMCARE INC.,

AFFORDABLE MEDICAL EQUIPMENT SOLUTIONS, INC.,

as Joint and Several Guarantors,

AND

TCA GLOBAL CREDIT MASTER

FUND, .LP,

as Lender

September

25, 2014

AMENDMENT NO. 1 TO

SENIOR

SECURED REVOLVING CREDIT FACILITY AGREEMENT

THIS

AMENDMENT NO. 1 TO SENIOR SECURED REVOLVING CREDIT FACILITY AGREEMENT (this "Amendment”) is dated and effective

as of September 25, 2014 (the "Effective Date”),

by and among (i) ONCOLOGIX TECH, INC., a corporation incorporated under the laws of the State of Nevada (the "Borrower”),

(ii) AMIAN ANGELS, INC., a corporation incorporated under the laws of the State of Louisiana and formerly known as Angels

of Mercy, Inc. ("Amian”), DOTOLO RESEARCH CORPORATION, a corporation incorporated under the laws of the State

of Louisiana, ESTEEMCARE INC., a corporation incorporated under the laws of the State of South Carolina ("Esteemcare”),

AFFORDABLE MEDICAL EQUIPMENT SOLUTIONS, INC., a corporation incorporated under the laws of the State of Florida ("Affordable

Medical”), and any Person to hereafter become a Subsidiary of the Borrower pursuant to Section 3.4 hereof, as joint

and several guarantors (together, jointly and severally, the "Guarantors” and together with the Borrower,

the "Credit Parties”), and (iii) TCA GLOBAL CREDIT MASTER FUND, LP, a limited partnership organized

and existing under the laws of the Cayman Islands, as lender (the "Lender”).

WITNESSETII

WHEREAS,

the Credit Parties and .Lender have entered into that certain senior secured revolving credit facility agreement, dated as of November

30, 2013 and effective as of January 3, 2014 (the "Credit Agreement”), pursuant to which the Lender agreed

to make available to the Borrower a secured revolving loan in the amount of up to Four Million and No/100 United States Dollars

(US$4,000,000), subject to the terms and conditions therein contained, and of this amount, the Lender made an initial principal

advance of Five Hundred Thousand and No/100 United States Dollars (US$500,000) to the Borrower;

WHEREAS,

as of the date hereof, a total aggregate principal amount of approximately Five Hundred Thousand and No/100 United States Dollars

(US$500,000) of principal plus applicable interest and fees are outstanding;

WHEREAS,

in connection with this Amendment, the Borrower has requested and the Lender has agreed to advance an additional principal amount

of One Million Two Hundred Thousand and No/100 United States Dollars (US$1,200,000) to the Borrower for acquisition funding and

working capital financing for Borrower and for any other purposes permitted under the Credit Agreement, as amended hereby;

WHEREAS,

the parties to this Amendment desire to amend the Credit Agreement (as amended hereby, the "Amended Credit Agreement”),

as set forth herein.

NOW,

THEREFORE, in consideration of the premises set forth above, the covenants and agreements hereinafter set forth, and other good

and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

1. Defined

Terms. Unless otherwise defined herein, the capitalized terms used herein shall have the meanings assigned to such terms in

the Credit Agreement.

2. Amendment

of the Credit Agreement. Subject to the terms and conditions of this Amendment, the

Credit Agreement is hereby amended and supplemented as follows:

(a)

all references to the "Senior Secured Revolving Credit Facility Agreement” or the "Agreement” contained

in the Credit Agreement shall be deemed to refer to the Credit Agreement as further amended hereby and all references to the "Credit

Parties” in the Agreement shall mean the Credit Parties defined in the Preamble to this Amendment;

(b)

The definitions of "Revolving Loan Commitment” and "Revolving Loan Maturity Date” shall be deleted

in their entirety and shall be replaced with the following:

".Revolving

Loan Commitment” shall mean One Million Seven. Hundred Thousand and No/100 United States Dollars (US$1,700,000), and

in the event Borrower requests and Lender agrees to increase the Revolving Loan Commitment pursuant to Section 2.1(b),

such aggregate additional amount up to Four Million and No/100 United States Dollars (US$4,000,000).

".Revolving

Loan Maturity Date” means the earlier of (i) September 25 2015, (b) upon prepayment

of all of the then outstanding Revolving Notes by the Borrower in full, or (c) the acceleration of all of the then outstanding

Revolving Notes pursuant to this Agreement.

(c)

Section 2.1(d)(i) shall be deleted in its entirety and shall be replaced with

| the following: |

Mandatory Principal Repayments; Overadvances. From and after December 25, 2014, and continuing until the Revolving Loan Maturity Date, an amount equal to twelve and five tenths percent (12.5%) of all amounts deposited into the Lock Box Account (in excess of any recurring fees owed under Section 2.2, fees owed to any custodian/back-up servicer, the Receipts Collection Fee, and interest owed under Sections 2.1(c) and 2.4) shall be held by the Lender (the "Holdback”) and credited toward the outstanding principal balance of all Revolving Loans hereunder on any Payment Date (the "Mandatory Principal Repayment Amount,). All Revolving Loans hereunder shall be repaid by Borrower on or before the Revolving Loan Maturity Date, unless payable sooner pursuant to the provisions of this Agreement. In the event the aggregate outstanding principal balance of all Revolving Loans hereunder exceed the Revolving Loan Availability, Borrower shall, upon notice or demand from I,ender, immediately make such repayments of the Revolving Loans or take such other actions as shall be necessary to eliminate such excess. |

|

(d)

Section 2.1(d)(ii) shall be deleted in its entirety and shall be replaced with

| the following: |

Optional Prepayments. From time to time, the Borrower may prepay all amounts then outstanding under the Revolving Loan, in whole or in part, without penalty or premium. The Borrower acknowledges and agrees that if prepayment is made in whole, all amounts then owed to the Lender pursuant to the Advisory Fee shall be paid in full in cash at the time of such prepayment. Upon receipt of payment in full of all then outstanding amounts under the Revolving Loan, including the Advisory Fee, Lender shall release all Guaranty Agreements and release its lien on all assets of the Credit Parties. The Lender agrees to file all applicable documentation, including without limitation, all UCC-3 statements, to effectuate such release of all such liens. |

|

(e)

Section 2.1(e)(i) shall be amended by adding the following as the final sentence in such Section:

Notwithstanding

anything contained in this sub-section to the contrary the Lender shall not apply any amounts deposited in the Lock. Box Account

toward the payment of principal until after December 25, 2014, provided however,

that upon the occurrence of an Event of Default that has not been cured by the Borrower or waived by the Lender, the Lender

shall have the rights and remedies set forth in Section 12 of this Agreement.

(f) Section

9.10 shall be amended by deleting the first sentence thereof in its entirety and replacing it with the following:

|

|

The Lender shall be permitted to conduct a field examination of the assets and records of the Borrower and its Subsidiaries at any time during normal business hours and without interference with the business of the Credit Parties, the results of which must be satisfactory to Lender in Lender's sole and absolute discretion. In addition to any fees contained in this Agreement, the Credit Parties shall pay the Lender fees associated with such field examinations in an amount equal to Two Thousand Five Hundred and No/100 United States Dollars (US$2,500) per calendar quarter, commencing on October 1, 2014 and continuing on the first day of each calendar quarter thereafter. Fees provided pursuant to this Section shall be due and owing notwithstanding the actual occurrence of a field examination. |

(g)

Section 9.21 shall be deleted in its entirety and replaced with the following:

|

|

Dissolution

of Subsidiaries. The Borrower shall cause, by no later than October 25, 2014, any Subsidiary

which has not executed a counterpart to this Agreement as a Credit Party to be dissolved and shall provide evidence of same to

the Lender, which such evidence shall be satisfactory to Lender in its sole and absolute discretion. |

(h) Section

9.22 shall be added as follows:

Security

Interest. The Borrower shall cause, by no later than. February 28, 2015, On Deck Capital

and Everest Business Funding to remove any and all liens filed against Amian.

Section 11.15 shall be added as follows:

Lock

Box Account. (i) The determination in good faith by the Lender that there has been a failure to perform or default in the

performance by a Credit Party of Section 2.1(e) or (ii) the failure of the Borrower to cause sufficient funds to be on

deposit in the Lock Box Account to permit the Lender to withdraw payments at any such time payments are due to Lender by Borrower

pursuant hereto

(j) Section

10.1 shall be amended by deleting Section 10.1 in its entirety and replaced by the following;

Positive

EBITDA. Commencing at end of the first calendar quarter of 2015, Borrower shall at all times cause a positive EBITDA to be

maintained.

(k) Section

10.2 shall be amended by deleting Section 10.2 in its entirety and replacing it with the following:

Revenue

Covenant. Commencing at the end of fourth calendar quarter of 2014, for each calendar quarter while this Agreement remains

in effect, Borrower shall have sales revenues that are not less than seventy-five (75%) percent of the sales revenues shown on

the most recent of the Financial Statements.

(l) Section

13.19 shall be amended by replacing the Lender's address and contact information with the following:

|

TCA Global Credit Master Fund, LP 3960 Howard Hughes Parkway, Suite 500 Las Vegas, NV 89169 Attention: Robert Press Facsimile: (973) 807-1813 |

3. Renewal

of Revolving Loan. Pursuant to Section 2.3 of the Amended

Credit

Agreement, by its execution hereof, the Borrower hereby provides written notice to Lender of Borrower's election to renew the Revolving

Loan Commitment and extend the Revolving Loan Maturity Date for an additional twelve (12) month period commencing on the Effective

Date hereof and terminating on September 25, 2015 (subject

to the terms and conditions of the Credit Agreement, as amended hereby) and, by its execution hereof, the Lender hereby consents

and agrees to such renewal and extension.

4. Issuance

of Amended and Restated Promissory Note. Subject to the terms and conditions of this Amendment,

the Borrower shall and does hereby agree to issue to the Lender, simultaneously with the execution of this Amendment, an original

amended and restated promissory note in the principal amount of One Million Seven Hundred Thousand and No/100 United States Dollars

(US$1,700,000), dated as of the Effective Date, in the form attached hereto as Exhibit A (the "Amended and Restated

Promissory Note”).

5. Cancellation

of Existing Promissory Note. By the Credit Parties' execution and delivery to the Lender of the Amended and Restated Promissory

Note, that certain promissory note originally issued by the Borrower in favor of the Lender, dated as of November 30, 2013 and

effective as of January 3, 2014, in the original principal amount of Five Hundred Thousand and No/100 United States Dollars (US$500,000)

shall be hereby immediately and irrevocably cancelled without further action on the part of the Lender or the Borrower. It is

the intention of the parties that while the Amended and Restated Promissory Note amends, restates, replaces and supersedes the

existing promissory note, in its entirety, the issuance of the Amended and Restated Promissory Note is not in payment or satisfaction

of the existing promissory note, but rather is the substitute of one evidence of debt for another without any intent to extinguish

the existing debt.

6. Representations and Warranties of the Credit Parties. The Credit Parties represent and warrant to the Lender that

immediately after giving effect to this Amendment, the representations and warranties of the Credit Parties set forth in the Credit

Agreement, as amended hereby, are true and correct in all material respects (except to the extent such representation or warranty

expressly relates to an earlier date) and no Default or Event of Default shall have occurred and be continuing.

7. Security

Interest Confirmation. The Credit Parties each hereby represent, warrant and covenant that (i) the Lender's security interests

in all of the "Collateral” (as such term is defined in each Security Agreement executed by each of the Credit Parties

in connection with the Credit Agreement) are and remain valid, perfected, security interests in such Collateral, (ii) the additional

principal amount advanced by the Lender in connection with this Amendment and any and all additional obligations incurred by the

Credit Parties in connection therewith constitute Obligations (as defined in the Credit Agreement) and such additional principal

amount and additional obligations are each secured by Lender's security interests in all of the Collateral, and (iii) the Credit

Parties have not granted any other encumbrances or security interests of any nature or kind in favor of any other Person affecting

any of such Collateral, other than Permitted Liens.

8. Ratification.

The Credit Parties hereby acknowledge, represent, warrant and confirm to Lender that: (i) each of the Loan Documents executed

by the Credit Parties are valid and binding obligations of the Credit Parties, enforceable thereagainst in accordance with their

respective terms; (ii) all obligations of the Credit Parties under all the Loan Documents are, shall be and continue to be secured

by and under the Security Agreements, the Guaranty Agreements, the UCC Financing Statements, and all other Loan Documents; (iii)

there are no defenses, setoffs, counterclaims, cross-actions or equities in favor of the Credit Parties to or against the enforcement

of any of the Loan Documents, and to the extent the Credit Parties have any defenses, setoffs, counterclaims, cross-actions or

equities against the Lender and/or against the enforceability of any of the Loan Documents, the Credit Parties acknowledge and

agree that same are hereby fully and unconditionally waived by the Credit Parties; and (iv) no oral representations, statements, or inducements have been made by Lender or any agents or representatives of the

Lender with respect to any of the Loan Documents.

9. No Defaults. Each Credit Party hereby represents and warrants that as of the date hereof there exists no Event of

Default or any condition which, with the giving of notice or passage of time, or both, would constitute an Event of Default. The

Lender hereby acknowledges and agrees that, to its knowledge, as of the date hereof there exists no Event of Default.

10. Covenants. Each Credit Party hereby reaffirms that it has duly performed and observed the covenants and undertakings

set forth in the Credit Agreement and each. Loan Document, and covenants and undertakes to continue to duly perform and observe

such covenants and undertakings, as amended hereby, so long as the Credit Agreement, as amended hereby, shall remain in effect.

11. No Other Amendment. All other terms and conditions of the Credit Agreement shall remain in full force and

effect and the Credit Agreement shall be read and construed as if the terms of this Amendment were included therein by way of

addition or substitution, as the case may be.

12. Second Tranche Advisory Shares; Advisory Fee.

(a)

The Borrower hereby agrees to pay to the Lender, on the date hereof, a fee for corporate advisory and investment banking

services in an aggregate amount equal to Four Hundred Fifty Thousand and No/100 United States (US$450,000.00) Dollars (the "Advisory

Fee”).. At the Borrower's option, the Advisory Fee may also be converted into shares of Preferred Stock (the "Second

Tranche Advisory Shares”) on or after March , 2015 (such conversion date shall be deemed the "Conversion Date”).

The conversion price will be equal to the closing stock price of the Borrower's stock on the Conversion Date. The Advisory

Fee will be due in full in cash on the earlier of September , 2015 or the date on which prepayment in full of the Revolving Loan

is made in accordance with Section 2.1(d)(ii) above. If the Borrower converts the Advisory Fee into The Second Tranche Advisory

Shares, the Borrower shall issue certificates representing the Second Tranche Advisory Shares immediately upon the Conversion

Date. In the event such certificates representing the Second Tranche Advisory Shares issuable hereunder shall not be delivered

to the Lender within three (3) Business .Days of the Conversion Date, the Borrower shall be in immediate default under this Amendment,

the Credit Agreement and the Loan Documents. The Second Tranche Advisory Shares, when issued, shall be deemed to be validly issued,

fully paid, and non-assessable shares of the Borrower's Preferred Stock. The Second Tranche Advisory Shares shall be deemed fully

earned in connection with the Advisory Fee.

(b)

Adjustment to Second Tranche Advisory Shares. In the event that the

Advisory Fee is converted to Second Tranche Advisory Shares, it is the intention of the Borrower and Lender that the Lender shall

generate Net Proceeds from the sale of the Second Tranche Advisory Shares equal to the Advisory Fee (less any amounts paid in

connection with the Advisory Fee prior to such sale). For purposes of this Section, the term "Net Proceeds” shall

mean the (i) gross proceeds from the sale of the Second Tranche Advisory Shares in the Principal Trading Market, less (ii) customary

broker fees. The Lender shall have the right to sell the Second Tranche Commitment Shares in the Principal Trading Market or otherwise,

at any time in accordance with applicable securities laws. Within three (3) Business Days after the sale of the Second

Tranche Advisory Shares, the Lender shall deliver to the Borrower a reconciliation statement showing the Net Proceeds actually

received by the Lender from the sale of the Second Tranche Advisory Shares (the "Sale Reconciliation”).

If, as of the date of the delivery by Lender of the Sale Reconciliation, the Lender has not realized Net Proceeds from the sale

of such Second Tranche Advisory Shares equal to at least the Advisory Fee (less any amounts paid to the Lender in connection with

the Advisory Fee prior to such sale), as shown on the Sale Reconciliation, then the Borrower shall immediately take all required

action necessary or required in order to cause the issuance of additional shares of Common Stock, in the Lender's sole discretion,

to the Lender in an amount sufficient such that, when sold and the Net Proceeds thereof are added to (A) the Net Proceeds from

the sale of any of the previously issued and sold Second Tranche Advisory Shares and (B) all other amounts delivered to

the Lender in payment of the Advisory Fee, the Lender shall have received total funds equal to the Advisory Fee. If additional

shares of Common Stock are issued pursuant to the immediately preceding sentence, and after the sale of such additional issued

shares of Common Stock in accordance with the terms of this Section 2.2(i), the Lender still has not received Net Proceeds equal

to the Advisory Fee, less (A) the Net Proceeds from the sale of previously issued and sold Second Tranche Advisory Shares and (B)

all other amounts delivered to the Lender in payment of the Advisory Fee, then the Borrower shall again be required to immediately

take all required action necessary or required in order to cause the issuance of additional shares of Common Stock, in the Lender's

sole discretion, to the Lender as contemplated above, and such additional issuances shall continue until the Lender has received

Net Proceeds from the sale of such. Common Stock equal to the Advisory Fee, less (A) the Net Proceeds from the sale of previously

issued and sold Second Tranche Advisory Shares and (B) all other cash amounts delivered to the Lender in payment of the

Advisory Fee. Upon receipt of the Advisory Fee in full, if the Lender still has Second Tranche Advisory Shares remaining to be

sold, the Lender shall return all such remaining Second Tranche Advisory Shares to the Borrower within three (3) Business Days

after receipt of the Advisory Fee. In the event additional Common Stock is required to be issued as outlined above, the Borrower

shall instruct its Transfer Agent to issue certificates representing such additional shares of Common Stock to the Lender immediately

subsequent to the Lender's notification to the Borrower that additional shares of Common Stock are issuable hereunder, and the

Borrower shall in any event cause its Transfer Agent to deliver such certificates to Lender within three (3) Business Days following

the date Lender notifies the Borrower that additional shares of Common Stock are to be issued hereunder. In the event such certificates

representing such additional shares of Common Stock issuable hereunder shall not be delivered to the Lender within said three (3)

Business Day period, same shall be an immediate default under this Agreement and the Loan Documents. Notwithstanding anything contained

in this Section to the contrary, at the time at which the Second Tranche Advisory Shares become unrestricted pursuant to applicable

securities laws, the Borrower shall have the right, at any time during such period, to redeem any Second Tranche Advisory Shares

then in the Lender's possession for an amount payable by the Borrower to Lender in cash equal to the Advisory Fee, less (A) the

Net Proceeds from the sale of previously issued and sold Second Tranche Advisory Shares and (B) all other cash amounts delivered

to the Lender in payment of the Advisory Fee. Upon Lender's receipt of such cash payment in accordance with the immediately preceding

sentence, the Lender shall return any then remaining Second Tranche Advisory Shares in its possession back to the Borrower and

otherwise undertake any required actions reasonably requested by Borrower to have such then remaining Second Tranche Advisory Shares

returned to Borrower.

(c)

Mandatory Redemption. Notwithstanding anything contained herein to the contrary, in the event that

the Borrower converts the Advisory Fee into the Second Tranche Advisory Fee Shares and the Lender has not realized Net Proceeds

from the sale of Second Tranche Advisory Shares equal to the amount of the Advisory Fee (including (A) Net Proceeds received from

the sale of previously issued and sold Second Tranche Advisory Shares and (B) all other cash amounts delivered to the Lender in

payment of the Advisory Fee), by the Revolving Loan Maturity Date, then the Borrower shall redeem, on the Revolving Loan Maturity

Date, all Second Tranche Advisory Shares then in Lender's possession for cash equal to the amount of the Advisory Fee less (A)

the Net Proceeds from the sale of previously issued and sold Second Tranche Advisory Shares and (B) all other cash amounts delivered

to the Lender in payment of the Advisory Fee. The Borrower shall redeem the then remaining Second Tranche Advisory Shares in Lender's

possession for an amount equal to the Advisory Fee less (A) the Net Proceeds from the sale of previously issued and sold Second

Tranche Advisory Shares and (B) all other cash amounts delivered to the Lender in payment of the Advisory Fee. Such amount shall

be payable by wire transfer to an account designated by Lender within five (5) Business Days from the date the Lender delivers

such redemption notice to the Borrower. In the event of any conversion of the Advisory Fee to Second Tranche Advisory Shares,

such conversion shall be subject to the "Beneficial Ownership Limitations” described in the Amended and Restated Note.

Nothing in this section shall in any way limit the Borrower's affirmative obligation to pay the Advisory Fee in cash on the earlier

of September , 2015 or the date on which prepayment in full of the Revolving Loan is made in accordance with Section 2.I(d)(ii)

above.

(d)

Piggyback Registration Rights. In the event that the Borrower files a registration statement with respect

to its Common Stock with the SEC (other than a registration statement on Form S-4 or S-8 or any successor form thereto) after

the Effective Date but before the Lender sells the Second Tranche Advisory Shares, the Second Tranche Advisory Shares shall be

registered pursuant to such registration statement.

(e)

Reporting Requirement. In addition to any remedies which may be available hereunder or in the Credit Agreement,

upon each occurrence of Borrower's failure to timely comply with the reporting requirements contained in Section 9.7 of the Credit

Agreement, to the extent that any Second Tranche Advisory Shares remain in Lender's possession, Borrower agrees to immediately

pay in cash a portion of the Second Tranche Advisory Shares equal to two and one half of one percent (2.5%) of the Second Tranche

Advisory Shares remaining in Lender's possession upon each instance of Borrower's failure to comply with such reporting requirements

within five (5) days of when due under the terms of Section 9.7.

13. Fees

and. Expenses. The Borrower agrees to pay to the Lender, upon the execution hereof,

(i) a commitment fee equal to Twenty-Four Thousand and No/100 United States Dollars (US$24,000), (ii) a legal fee equal to

Ten Thousand and No/100 United States Dollars (US$10,000), (iii) a due diligence fee equal to Seven Thousand Five IIundred

and No/100 United States Dollars (US$7,500), (iv) an asset monitoring fee equal to Two Thousand and No/100 United States

Dollars ($2,000), (v) all costs and expenses of the Lender and Lender's counsel in connection with the preparation and

execution of this Amendment, including, but not limited to, documentary stamp tax fees, UCC-1 Financing Statement search fees

and filing fees, and Certificate of Good Standing fees. The Lender and the Borrower agree that all fees payable by the

Borrower to the Lender upon the execution hereof shall be listed on the closing statement executed in connection

herewith.

14. Conditions

Precedent. The effectiveness of this Amendment and the obligation that the Lender to advance the additional

principal amounts provided herein shall be expressly subject to the following conditions precedent:

(a)

Amendment. Each Credit Party shall have executed and delivered to the Lender a copy of this Amendment;

(b)

Amended and Restated Promissory Note. Each Credit Party shall have executed and delivered to the Lender the Amended

and Restated Promissory Note in the principal amount of One Million Seven I Iundred Thousand and No/100 United States Dollars

(US$1,700,000), dated as of the Effective Date;

(c)

Confession of Judgment. Each Credit Party shall have executed and delivered to the Lender a copy of a Confession

of Judgment, dated as of the Effective Date, in the form attached hereto as Exhibit B;

(d)

Use of Proceeds Confirmation. The Borrower shall have executed and delivered to the Lender a copy of a Use of Proceeds

Confirmation, including a copy of the Borrower's twelve (12) month financial projections attached as an exhibit thereto, dated

as of the Effective Date, in the form attached hereto as Exhibit C;

(e)

Security Agreement. Esteemcare and. Affordable Medical shall have each have executed and delivered to the Lender

a copy of a Security Agreement, dated as of the Effective Date, in the form attached hereto as Exhibit D;

(f)

Guaranty Agreement. Esteemcare and Affordable Medical shall have each executed and delivered to the Lender two original

copies of a Guaranty Agreement, dated as of the Effective Date, in the form attached hereto as Exhibit E;

(g)

Subordination Agreement. Madhu Mathew Mammen, Imad Siddiqui, and the Credit Parties shall have each executed and

delivered to the Lender a copy of a Subordination Agreement, dated as of the Effective Date, in the form attached hereto as Exhibit

F;

(h) Closing Statement. The Borrower shall have executed and delivered to the Lender

a closing statement in form and substance satisfactory to the Lender;

(i) Corporate Documents. The Lender shall have received such evidence as it may require as to the authority of the officers

or attorneys-in-fact executing this Amendment and such other corporate documents it may request, including, but not limited to,

approval of the board of directors of each of the Credit Parties, resolutions of the shareholders of the Subsidiaries of the Borrower,

an officer's certificate of each Credit Party, each in form and substance satisfactory to the Lender in its sole discretion;

(j) Opinion

of Counsel. The Lender shall have received a customary opinion of the Credit Parties', in form and substance satisfactory

to the Lender in its sole discretion;

(k)

Search Results. The Lender shall have received copies of UCC search reports, issued by the Secretary of State of

the state of incorporation of each Credit Party, dated such a date as is reasonably acceptable to Lender, listing all effective

financing statements which name the Credit Parties, under their present name and any previous names, as debtors, together with copies

of such financing statements;

(1)

Certificate of Good Standing. The Lender shall have received copies of certificates of good standing with respect to each

Credit Party, issued by the Secretary of State of the state of incorporation of each Credit Party, dated such a date as is reasonably