iQSTEL, Inc. - The Calm Before The Surge (OTCQX: IQST)

October 29 2021 - 2:31PM

InvestorsHub NewsWire

October 29, 2021 -- InvestorsHub NewsWire -- via Prime Time

Profiles --

By Primetime

Editorial / Financial

IQSTEL (OTCQX:

IQST) is a diversified technology holding company that has

grown from a core telecom business into a family of tech

subsidiaries ranging from Fintech to EV.

The management team is steadily

reorganizing the subsidiary operations to seize overlapping market

opportunities where the services of one subsidiary can be sold into

the existing customer base of another subsidiary, and vice

versa.

Management’s cross selling efforts

have resulted in impressive revenue growth with the company on pace

to realize a $60 million revenue target for 2021.

Now management is working on

optimizing subsidiary redundancies to achieve operational

efficiencies that can improve profit margins.

Over a year ago when management

launched its efforts in full force to diversify from telecom into a

broader array of technologies the share price saw a meteoric climb

from $0.05 to $2.00. The PPS has since retraced and settled

in the $0.50 range plus or minus $0.10. The volatility has

settled down with the 200-day moving average climbing above the

50-day moving average late this summer.

In addition to the operational growth, management has also advanced

the company’s public reporting standards implementing an

independent board of directors, moving from the OTC Pink reporting

standard to the OTCBB and recently to the OTCQX.

Get In Now On The Nasdaq

Uplisting ROI Opportunity

The reporting standards advances

are part of the company’s stated objective to uplist to

Nasdaq. Given the steady progress the company has made thus

far in advancing its reporting standards, it’s reasonable to

presume notable progress has been made toward a Nasdaq

uplisting.

Well on track to realize $60

million in annual revenue for 2021, IQST’s market cap is still only

one times revenue at $60 million.

It would not be surprising to see

a definitive Nasdaq uplisting announcement Q1 2022 after the

company publishes its 2021 audited annual report. Along those

same lines, seeing an announcement anytime from now until the

annual report indicating the company has entered into a

relationship with a sponsoring investment bank for the Nasdaq

uplisting, would also not be surprising.

With only less than 150 million

shares outstanding, no convertible debt on the books, and $60

million in audited annual revenue anticipated to be reported for

2021, it would not be unreasonable to see IQST’s share price reach

the minimum listing requirement for a Nasdaq uplist without a

recapitalization. It could be a good time to accumulate IQST

now in the calm before a Nasdaq uplisitng surge.

Source - https://primetimeprofiles.com/iqstel-inc-the-calm-before-the-surge-otcqx-iqst/

Other stocks on the move include

NWBO,

CYDY and

ILUS.

SOURCE: Prime Time Profiles

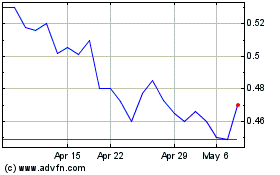

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jan 2024 to Jan 2025