- Report of Foreign Issuer (6-K)

November 09 2011 - 7:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the

Securities Exchange Act of 1934

For the month of November, 2011

Commission File Number 1-8910

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

(Translation of registrant’s name into English)

3-1, OTEMACHI

2-CHOME

CHIYODA-KU, TOKYO 100-8116 JAPAN

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

.

NOTICE CONCERNING THE CANCELLATION OF TREASURY STOCK AND REPURCHASE OF SHARES

On November 9, 2011, the registrant filed with the Tokyo Stock Exchange and other stock exchanges in Japan a notice concerning its

cancellation of treasury stock and repurchase of shares.

The information included herein contains forward-looking statements.

The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the

registrant’s actual results to differ materially from any expectation of future results that may be derived from the forward-looking statements.

The registrant’s forward-looking statements are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of the registrant in light of information currently

available to it regarding the registrant and its subsidiaries and affiliates, the economy and the telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations

of the registrant and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and

new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from any future results that may be derived from

the forward-looking statements, as well as other risks included in the registrant’s most recent Annual Report on Form 20-F and other filings and submissions with the United States Securities and Exchange Commission.

No assurance can be given that the registrant’s actual results will not vary significantly from any expectation of future results

that may be derived from the forward-looking statements included herein.

The attached material is a translation of the

Japanese original. The Japanese original is authoritative.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

|

|

|

|

|

|

By

|

|

|

|

/s/ Koji Ito

|

|

|

|

Name:

|

|

Koji Ito

|

|

|

|

Title:

|

|

General Manager

|

|

|

|

|

|

Finance and Accounting Department

|

Date: November 9, 2011

November 9, 2011

Company Name: Nippon Telegraph and Telephone Corporation

Representative: Satoshi

Miura, President and Chief Executive Officer

(Code No.: 9432, First section of Tokyo, Osaka and Nagoya Stock Exchanges and

Fukuoka and Sapporo Stock Exchanges)

NOTICE CONCERNING THE CANCELLATION OF TREASURY STOCK AND

REPURCHASE OF

SHARES

Nippon Telegraph and Telephone Corporation (“NTT”) hereby announces that at the Board of Directors’ meeting held on

November 9, 2011, the following resolutions were passed.

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Regarding the Decision to Cancel Treasury Stock

|

|

|

|

|

|

(A cancellation pursuant to the provisions of Article 178 of the Corporation Law)

|

|

|

|

|

|

|

|

|

(1)

|

|

Class of shares to be cancelled:

|

|

Common stock

|

|

|

|

|

|

|

|

|

(2)

|

|

Number of shares to be cancelled:

|

|

125,461,832 shares

|

|

|

|

|

|

|

|

|

|

|

|

|

(8.66% of the total issued shares before cancellation 【a】)

|

|

|

|

|

|

|

|

|

(3)

|

|

Date of cancellation:

|

|

November 15, 2011

|

|

|

|

|

|

|

|

2.

|

|

Regarding the Decision to Repurchase Shares

|

|

|

|

|

|

(An acquisition according to the provision in NTT’s Article of Incorporation, under Article 165, Section 2 of the Corporation Law)

|

|

|

|

|

|

|

|

(1)

|

|

Reason for the Repurchase

|

|

|

|

|

|

|

|

|

|

To increase the efficiency of its capital and to realize NTT’s capital policies for current supply and demand conditions.

|

|

|

|

|

|

|

|

(2)

|

|

Details of the Repurchase

|

|

|

|

|

|

|

|

Common Stock: 44 million shares (maximum)

|

|

|

|

|

|

Number of Shares:

|

|

* Percent of total number of issued shares before cancellation (excluding treasury stock)【b】:

3.48%

|

|

|

|

|

|

|

|

|

|

|

‚

Total Repurchase Price:

|

|

220.0 billion yen (maximum)

|

|

|

|

|

|

|

|

|

|

|

ƒ

Repurchase Period:

|

|

From November 16, 2011 to March 30, 2012

|

|

|

|

|

|

|

|

|

|

|

„

Method of Repurchase:

|

|

NTT plans to use the Tokyo Stock Exchange Trading Network Off-Auction Own Share Repurchase Trading System

(ToSTNeT-3)

|

|

|

|

|

|

|

|

|

|

|

|

Note:

|

|

|

|

|

|

• 【a】 Total number of issued shares

|

|

:

|

|

1,448,659,067 shares

|

|

• 【b】 Total number of issued shares (excluding treasury

stock)

|

|

:

|

|

1,265,604,644 shares <【a】-【c】>

|

|

• 【c】 Number of treasury stock held as of September 30,

2011

|

|

:

|

|

183,054,423 shares

|

|

• 【d】 Total number of issued shares after cancellation

|

|

:

|

|

1,323,197,235 shares

|

(Reference) Details disclosed on May 14, 2010

(Notice Concerning the Policy on Treasury Stock Cancellation)

NTT announced that at the Board of Directors’ meeting held on May 14, 2010, the basic policy on cancellation of treasury stock owned by NTT was adopted as stated below.

|

|

1.

|

All treasury stock owned by NTT as of March 31, 2010 (250,923,665 shares) shall be cancelled over two fiscal years.

|

|

|

2.

|

One-half of the treasury stock shall be cancelled during the calendar year ended December 31, 2010 and the remainder of the treasury stock shall be cancelled

during the following fiscal year ending March 31, 2012.

|

Details regarding the actual cancellation shall be

resolved separately at a Board of Directors’ meeting pursuant to the provisions of Article 178 of the Corporation Law.

|

|

|

|

|

|

|

For further information, please contact:

|

|

|

|

Mr. Hanaki or Mr. Iijima

|

|

|

|

Investor Relations Office

|

|

|

|

Finance and Accounting Department

Nippon Telegraph and Telephone Corporation

|

|

|

|

TEL: +81-3-5205-5581

|

|

|

|

FAX: +81-3-5205-5589

|

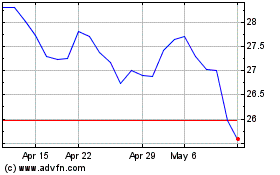

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Sep 2024 to Oct 2024

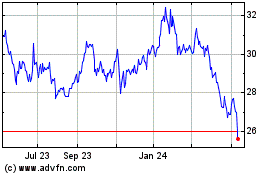

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Oct 2023 to Oct 2024