- Current report filing (8-K)

September 28 2011 - 7:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: September 27, 2011

(Date of earliest event reported: September 23, 2011)

PHOENIX INTERNATIONAL VENTURES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-140257

|

|

20-8018146

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

|

61B Industrial PKWY, Carson City, NV

|

|

89706

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

775 882 9700

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE-SHEET ARRANGEMENT OF A REGISTRANT

On September 23, 2011 we, through our wholly-owned subsidiary, Phoenix Aerospace, Inc. (“Borrower”) entered into a convertible loan agreement with Zvi Bar-Nes Nissensohn (“Lender”), to obtain a secured line of credit facility in an aggregate maximum principal amount of $1,000,000. The line of credit is evidenced by a convertible loan agreement, an unconditional guarantee agreement, a security agreement, and a pledge and security agreement (collectively “the Loan Agreement”).

The proceeds of loans made under the Loan Agreement may be used for working capital by the Borrower solely to finance its business activities. The initial term of the Loan Agreement is 12 months from the closing date, maturing on September 23, 2012, which may be extended if mutually agreed upon by the Borrower and the Lender. Our company unconditionally guaranteed the obligations of the Borrower under the Loan Agreement and our subsidiary, as Borrower granted the Lender with a lien and security interest on the cash account funded by Lender as well as a subordinated lien on Borrower’s assets subordinated to vendor and customer liens and any bank debt. We also pledged to the Lender 100% of the

shares of common stock of the Borrower. The principal amount of the line of credit shall accrue interest at 8% annually. The loan agreement contains customary representations and warranties, conditions, covenants and events of default.

The material terms of the loan agreement, unconditional guarantee agreement, security agreement, and pledge and security agreement, are qualified in their entirety by the agreements attached as Exhibits 10.1 through 10.4, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01: Financial Statements and Exhibits

(c) Exhibits

Exhibit No.

Description

|

10.1

|

Convertible Loan Agreement dated September 23, 2011

|

|

10.2

|

Unconditional Guarantee dated September 23, 2011

|

|

10.3

|

Security Agreement dated September 23, 2011

|

|

10.4

|

Security Agreement dated September 23, 2011

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 27, 2011

|

PHOENIX INTERNATIONAL VENTURES, INC.

|

|

|

|

|

|

|

/

s/ Zahir Teja ______________________

Name: Zahir Teja

|

|

|

|

Title: Chief Executive Officer

|

|

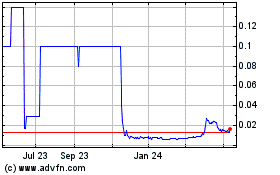

Neon Bloom (PK) (USOTC:NBCO)

Historical Stock Chart

From Jan 2025 to Feb 2025

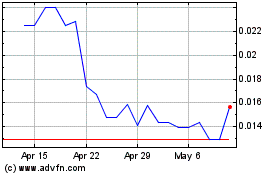

Neon Bloom (PK) (USOTC:NBCO)

Historical Stock Chart

From Feb 2024 to Feb 2025