NAB More Than Doubles Fiscal Year Profit, Final Divided -- Update

November 08 2021 - 5:38PM

Dow Jones News

By Alice Uribe

SYDNEY--National Australia Bank Ltd. more than doubled its final

dividend, after Australia's second-largest lender reported a surge

in profit amid a strong lending performance.

The bank said net profit for the 12 months through September

rose to 6.36 billion Australian dollars (US$4.72 billion), compared

with A$2.56 billion a year earlier.

Cash earnings--a profitability measure tracked closely by

analysts--rose by 77% to A$6.56 billion.

"Our results this year demonstrate we have navigated a

challenging environment while delivering better experiences for

customers and colleagues, resulting in safe growth across our

business," said Chief Executive Ross McEwan.

"Our bank has momentum, our strategy is clear and as lockdown

restrictions ease, a pick-up in activity is expected," he added.

"While some uncertainties exist in the outlook including the impact

of tapering support, our balance sheet settings are strong and we

are well positioned for the expected economic rebound in Australia

and New Zealand."

Helping to drive the result was a credit impairment write back

for fiscal 2021 of A$217 million, versus a fiscal 2020 charge of

A$2.76 billion, which the lender said was a significant improvement

and reflected a reduction in charges for forward looking provisions

and lower underlying charges.

The write back takes into account improved asset quality across

both housing and business lending combined with the impact of

higher house prices and other low charges, NAB said. Last year, the

lender was hit by the impact of the coronavirus while also making

provisions for customer remediation.

For fiscal 2021 NAB said it saw small-to-medium-sized enterprise

lending grow above system at 7%, while Australian housing lending

was up 4% over the year.

Still, NAB's net interest margin dropped by 6 basis points to

1.71%, while expenses rose by 1.8%.

The expense growth was consistent with NAB's 0-2% target,

excluding large notable items, which the lender said reflects a

"balance between cost discipline and investing for growth."

For fiscal 2022, NAB is targeting a broadly flat level of costs

and investment spending. It said it continues to target lower

absolute costs over 3-5 years relative to the fiscal 2020 base of

A$7.7 billion.

For the divisions, business and private banking division cash

earnings were up 0.3%, personal banking was up 14%, New Zealand was

up 19% while institutional banking was down 15%.

Directors of the company raised its final dividend to A$0.67 per

share, compared with A$0.30 in fiscal 2020.

The group's common equity tier 1 capital ratio was 13.00%, up

from 11.47% the previous year. NAB said it plans to manage CET1

over time toward a target range of 10.75-11.25%.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

November 08, 2021 17:23 ET (22:23 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

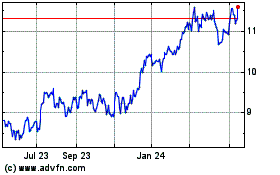

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Nov 2024 to Dec 2024

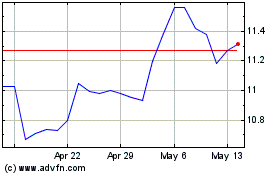

National Australia Bank (PK) (USOTC:NABZY)

Historical Stock Chart

From Dec 2023 to Dec 2024