UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of

1934

Date of report (Date of earliest event reported): May 10,

2019

National American University Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-34751

|

|

83-0479936

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

5301 Mt. Rushmore RoadRapid City, SD

|

|

55701

|

|

(Address of principal executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(605)

721-5220

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging

growth company [ ]

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

Securities registered pursuant to Section 12(b) of the Act:

None

Item 1.01

Entry into a Material Definitive Agreement.

On May 10, 2019, Dlorah, Inc., a South Dakota

corporation (“Dlorah”) and a wholly owned subsidiary of

National American University Holdings, Inc., a Delaware corporation

(the “Company”), entered into a Loan Agreement (the

“Loan Agreement”) with Center for Excellence in Higher

Education, Inc., an Indiana non-profit corporation (the

“Lender”). The Loan Agreement provides for a term loan

in

the principal amount of $8,500,000 (the

“Loan”), which is evidenced by that certain Promissory

Note dated May 10, 2019 (the “Note”). The Loan is

secured by certain other loan instruments given by Dlorah in favor

of the Lender, including the Real Estate Mortgage encumbering

certain land situated in Pennington County, South Dakota (the

“Mortgage”), the Account Control Agreement granting a

security interest in the Letter of Credit Collateral Account, two

Aircraft and Engine Security Agreements granting security interests

in two aircraft, the Absolute

Assignment of Leases and Rents granting a security

interests to certain lease and rent proceeds, the Partnership

Security Agreement granting a security interest in certain

ownership interests in a partnership, and such other documents and

instruments which evidence

,

secure, or

pertain to the Loan

(collectively, together with the Note and the

Mortgage, the “Loan Documents”). Any terms not defined

herein have the meanings set forth in the Loan

Agreement.

Amount

. The

Loan Agreement provides for an $8,500,000 million term

loan.

Purpose

.

The purpose of the Loan is to provide a source of cash collateral

to Dlorah to secure a

letter of credit issued by Black Hills

Community Bank N.A. (the “Senior Lender”) for the

benefit of the United States Department of Education

(“Department”) in the amount of $7,330,557 (the

“Letter of Credit”) and to discharge a judgment lien on

real estate owned by Dlorah in the amount of

$838,871.31.

Maturity

. The

Loan matures on May 31, 2020 (the “Maturity Date”)

unless accelerated pursuant to an event of default, as described

below. All amounts outstanding under the Loan will be due and

payable upon the earlier of the Maturity Date or the acceleration

of the Loan upon an Event of Default.

Interest

Rate

. The Loan bears

interest at a rate per annum of (a) 7%, until the Maturity Date,

accruing on an Actual 360 Basis (as defined below); and (b) the

Default Rate (as defined below), on and after the Maturity Date.

The term “Actual 360 Basis” means the method of

calculation of interest under the Note, whereby interest shall

accrue based on the actual number of calendar days in each month

and a 360 day year. The term “Default Rate” means

interest at the lesser of: (a) the highest rate allowed under

applicable law at the time of an Event of Default, as determined by

Lender, or (b) ten percent (10%) per annum.

Loan

Origination Fee

. Dlorah paid

a non-refundable loan origination fee equal to $250,000

to the Lender, along with the Lender’s attorney’s

fees.

Prepayment

Privilege

.

Dlorah has the right to prepay all or any

part of the outstanding indebtedness at any time, without premium

or penalty, without waiving any right to demand subsequent advances

pursuant to the terms of the Note.

Repayment

Terms

. Under the Note,

Dlorah agreed to make (a) monthly payments of accrued and unpaid

interest beginning on July 1, 2019, and (b) a final payment of all

outstanding principal, accrued and unpaid interest and all other

sums payable pursuant to the Note on the Maturity

Date.

Covenants;

Representations and Warranties; Other Provisions

. The Loan Agreement contains customary

representations, warranties and covenants. Covenants of Dlorah

include: payment of taxes, maintenance of existence, preservation

of property, maintenance of insurance, completion of financial

statements and tax returns, notification to the Lender of default

or litigation, allowing the Lender to inspect Dlorah’s books

and records, payment of all other liens against the Collateral,

obtaining no other liens, no change in control, no material change

in business, and no material cash distributions. Also, if Dlorah

obtains a loan from

Dougherty Mortgage LLC, a Delaware

limited liability company

, secured by

all or a portion of the real estate subject to the Mortgage, the

Lender will

release the Mortgage or subordinate the Mortgage

to the Lien of Dougherty’s mortgage if Dlorah complies with

certain conditions, including depositing proceeds into

Lender’s account and preparing a plan for the sale of real

estate owned by Dlorah.

Default

Provisions

. The Loan

Agreement provides for Events of Default customary for loan

agreements of this type, including late payment, breach of any term

or covenant of any Loan Document, certain judgments against Dlorah,

material injury or destruction of the Collateral, transfer or

encumbrance of the Collateral, bankruptcy, and the occurrence of a

Material Adverse Effect on Dlorah. Upon an event of default

relating to the payment of money, destruction or conveyance of the

Collateral, or bankruptcy, the amounts outstanding under the Loan

Agreement will become immediately due and payable. For all other

events of default, the Lender must give Dlorah notice and an

opportunity to cure the default. Upon the occurrence of any Event

of Default, the Lender may, after giving notice and the expiration

of the cure period, accelerate the Note and declare all

Indebtedness immediately due and payable.

Intercreditor

Agreement

. In connection with

the Loan Agreement, Dlorah and the Lender entered into an

Intercreditor and Subordination Agreement with the Senior Lender,

which provides that the Senior Lender has a first priority security

interest in the Letter of Credit Collateral

Account.

The

foregoing description of the Loan Agreement is qualified in its

entirety by reference to the full text of the Loan Agreement, a

copy of which is attached hereto as Exhibit 99.1 and incorporated

herein by reference.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance Sheet Arrangement of a Registrant.

On

March 8, 2019, the Company received a letter from the Department in

which it determined that National American University

(“NAU”) did not meet its financial responsibility

standards for institutions that participate in Title IV programs.

As a result, the letter required, among other things, NAU to post a

letter of credit to the Department in the amount of $10,995,835,

representing 15% of the Title IV program funds awarded during the

Company’s fiscal year ended May 31, 2018, to be accompanied

by the provisional form of certification to participate in Title IV

programs (the “Provisional Certification Alternative”).

The March 8, 2019 letter from the Department also placed NAU on the

Heightened Cash Monitoring 1 payment method for receipt of Title IV

funds, and required ongoing cash balance and cash flow reports to

the Department and notification to the Department of certain

specified financial events.

In

response to a request from NAU, the Department provided NAU with

two additional options under the Provisional Certification

Alternative: (1) NAU may post an irrevocable letter of credit in

the amount of 10% of its Title IV program funds for its fiscal year

ended May 31, 2018 (calculated by the Department to be $7,330,557);

or (2) NAU may be placed on the Heightened Cash Monitoring 2

(“HCM2”) payment method for receipt of Title IV program

funds and the Department will withhold a percentage of each HCM2

payment until NAU has funded an account equal to the letter of

credit requirement of $7,330,557. The Department further stated

that there will be a supplemental review of the Company’s

total Title IV receipts for its fiscal year ending May 31, 2019 to

determine at that time if the additional 5% letter of credit amount

(calculated by the Department to be $3,665,278) requested by the

Department’s letter of March 8, 2019 will still be

required.

On

April 30, 2019, NAU responded to the Department’s letter and

selected the posting of an irrevocable letter of credit in the

amount of 10% of its Title IV program funds for its fiscal year

ended May 31, 2018. On May 10, 2019, the Senior Lender issued an

irrevocable letter of credit on behalf of NAU in the amount of

$7,330,557 for the benefit of the Department. The letter of credit

expires on May 31, 2020.

The

information set forth under Item 1.01 of this Current Report on

Form 8-K is incorporated by reference into this Item

2.03.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

Loan

Agreement, dated May 10, 2019

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly

authorized.

|

|

NATIONAL AMERICAN UNIVERSITY HOLDINGS, INC.

|

|

|

|

|

|

|

Date:

May 14, 2019

|

By:

|

/s/

Ronald

L. Shape

|

|

|

|

|

Ronald

L. Shape, Ed. D.

|

|

|

|

|

Chief

Executive Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

Loan

Agreement, dated May 10, 2019

|

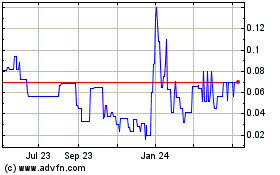

National American Univer... (QB) (USOTC:NAUH)

Historical Stock Chart

From Nov 2024 to Dec 2024

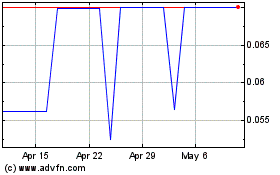

National American Univer... (QB) (USOTC:NAUH)

Historical Stock Chart

From Dec 2023 to Dec 2024