Current Report Filing (8-k)

December 11 2020 - 4:03PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 7, 2020

Mobivity

Holdings Corp.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-53851

|

|

26-3439095

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification Number)

|

55

N. Arizona Place, Suite 310

Chandler,

Arizona 85225

(Address

of principal executive offices) (zip code)

(866)

282-7660

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Securities

registered pursuant to Section 12(b)of the Act:

None

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant

under any of the following provisions.

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14d-2(b)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers

On

December 8, 2020, Lynn Tiscareno resigned as our Chief Financial Officer. Effective as of December 8, 2020, we have appointed

Lisa Brennan to serve as our Chief Financial Officer.

Ms.

Brennan previously served as an independent financial consultant, providing financial and strategic planning, finance management

and system implementation support to a variety of companies, from April 2019 to December 2020. From May 2017 to April 2019, Ms.

Brennan served as Chief Financial Officer of Network Group, LLC, a privately-held coworking company. From October 2013 to May

2017, Ms. Brennan served as Vice President Financial Planning and Operations and Chief Financial Officer of Merchant Customer

Exchange, a Fintech company owned by a group of 40 retailers including Walmart, Target, Best Buy and the GAP. Ms. Brennan earned

an undergraduate degree in mathematics and economics from Wellesley College, a master degree in mathematics from Brandeis University

and master of science in management from the Sloan School of the Massachusetts Institute of Technology. Ms. Brennan is the daughter

of a member of our board of directors, Phil Guarascio.

In

connection with her appointment as our Chief Financial Officer, we entered into an employment agreement dated December 7, 2020

with Ms. Brennan. Under the agreement, Ms. Brennan will be paid a base annual salary of $225,000. The base salary is subject to

an annual increase at the sole discretion our board of directors. Ms. Brennan is eligible to receive an annual bonus of up to

25% of her base salary in effect at the time based on her satisfaction of certain performance conditions established by our board

of directors. If the agreement is terminated by us without cause (as defined in the agreement), we will be required to pay Ms.

Brennan a severance payment equal to three months of her base salary payable in regular intervals following such termination.

The agreement also includes standard health and vacation benefits, as well as customary non-compete, non-solicitation, intellectual

property assignment and confidentiality provisions that are customary in our industry.

In

connection with her appointment, we also granted Ms. Brennan options to purchase up to 600,000 shares of our common stock at an

exercise price of $1.55 per share. The options vest and first become exercisable in 48 equal monthly installments of 12,500 options.

The options were granted under our 2013 Equity Incentive Plan.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

MOBIVITY

HOLDINGS CORP.

|

|

|

|

|

|

December

11, 2020

|

By:

|

/s/

Dennis Becker

|

|

|

|

Dennis

Becker,

Chief

Executive Officer

|

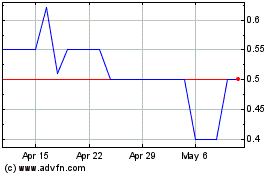

Mobivity (QB) (USOTC:MFON)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mobivity (QB) (USOTC:MFON)

Historical Stock Chart

From Jan 2024 to Jan 2025