Table

of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES

EXCHANGE ACT OF 1934

Mining Global, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

74-3249571 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

500 S Australian Avenue, West Palm Beach, FL

33401

(Address of principal executive offices)

(Registrant’s telephone number, including area code) 954-837-6833

Copies of all correspondence to:

Jonathan D. Leinwand, P.A.

Jonathan Leinwand, Esq.

18305 Biscayne Blvd., Suite 200

Aventura, FL 33160

(954) 903-7856

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock par value $.001

(Title of class)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

TABLE OF CONTENTS

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

Some of the statements contained in this registration

statement on Form 10 of Mining Global, Inc. (hereinafter the “Company,” “MNGG,” “we,” “us”

or “our”) discuss future expectations, contain projections of our plan of operation or financial condition or state other

forward-looking information. In this registration statement, forward-looking statements are generally identified by the words such as

“anticipate,” “plan,” “believe,” “expect,” “estimate” and the like. Forward-looking

statements involve future risks and uncertainties, there are factors that could cause actual results or plans to differ materially from

those expressed or implied. These statements are subject to known and unknown risks, uncertainties, and other factors that could cause

the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various

factors and is derived using numerous assumptions. A reader should not place undue reliance on these forward-looking statements, which

apply only as of the date of this registration statement. Important factors that may cause actual results to differ from projections include,

for example:

| |

● |

the success or failure of management’s efforts to implement the Company’s business plan; |

| |

|

|

| |

● |

the ability of the Company to fund its operating expenses; |

| |

|

|

| |

● |

the ability of the Company to compete with other companies that have a similar business plan; |

| |

|

|

| |

● |

the effect of changing economic conditions impacting our plan of operation; |

| |

|

|

| |

● |

the ability of the Company to meet the other risks as may be described in future filings with the SEC. |

Readers are cautioned not to place undue reliance

on the forward-looking statements contained herein, which speak only as of the date hereof. We believe the information contained in this

Form 10 to be accurate as of the date hereof. Changes may occur after that date. We will not update that information except as required

by law in the normal course of our public disclosure practices.

Additionally, the following discussion regarding

our financial condition and results of operations should be read in conjunction with the financial statements and related notes included

in this Form 10.

Item 1. Business

Business Overview

Mining Global, Inc. (the “Company”, “we” or

“MNGG”) evaluates and acquires mining projects as well as companies focused on lithium, limestone, copper, silver, gold, iron,

and other critical metals. The Company’s common stock is traded on OTC Markets’ Pink tier under the symbol MNGG. We incorporated

in Nevada on November 20, 2006.

We are a natural resources company with an objective of acquiring,

exploring or developing natural resource properties or natural resource companies in the United States as well as globally. In terms of

properties the term “acquire” means the outright purchase of property or the lease, license, claim (whether patented or unpatented)

or other use agreement which provides us the real property rights, other interests in land, including mining and surface rights, easements,

and rights of way and options to conduct mining operations on real property. We may acquire companies that develop and operate mining

properties either alone or with partners.

Furthermore, we are looking to acquire and develop rare earth and technology

metals refining capabilities for establishing a secure and reliable supply chain for critical minerals. Our strategy is to target underfunded

entities with a lack of knowledge in the mining sector, and or those with a lack of versed management.

Base metals are essential for building the infrastructure of the world

economy.

| • |

Iron ore is the most mined metal, as it is a critical component for the production of steel, which companies must use in bridges, buildings,

and pipelines. |

| • |

Aluminum is the second most mined metal due to its importance for the aerospace and automotive sectors |

| • |

Copper completes the top three because of its ability to conduct electricity. |

Demand for lithium is on the verge of exceeding the current rate of

production of mining companies. By 2050, analysts predict that consumption may be up to 170% above currently known lithium reserves.

The Market

The global mining market size grew from $1.84 trillion in 2021 to $2.06

trillion in 2022 at a compound annual growth rate (CAGR) of 12.0%. With a compound annual growth rate (CAGR) of 6.1%, the worldwide mining

industry increased from $2,022.6 billion in 2022 to $2,145.15 billion in 2023. At a CAGR of 6.7%, the mining industry is anticipated to

reach $2,775.5 billion in 2027. Asia-Pacific was the largest region in the mining market in 2022. North America was the second largest

region in the market. The regions covered in the mining market are Asia-Pacific, Western Europe, Eastern Europe, North America, South

America, Middle East and Africa.1

The global surface mining market was valued at USD $38.5 billion in

2020 and is expected to reach the value of US$54.18 billion by the end of 2031. The surface mining market size has grown steadily in recent

years. It will grow from $28.39 billion in 2023 to $29.59 billion in 2024 at a compound annual growth rate (CAGR) of 4.2%.2

_________________________

1

https://www.thebusinessresearchcompany.com/report/mining-global-market-report

2

https://www.researchandmarkets.com/report/surface-mining

The global base metal mining market size was projected to grow at

a compound annual growth rate of four percent between 2021 and 2026. It was expected to increase from 338 billion U.S. dollars in 2020

to $428 billion U.S. dollars in 2026.

Competition

We operate in a highly competitive industry, competing with other mining,

refining and exploration companies, and institutional and individual investors, which are actively seeking metal and mineral based exploration

properties throughout the world together with the equipment, labor and materials required to exploit such properties. Many of our competitors

have financial resources, staff and facilities substantially greater than ours. The principal area of competition is encountered in the

financial ability to cost effectively acquire prime metal and minerals exploration prospects and then exploit such prospects. Competition

for the acquisition of metal and minerals exploration properties is intense, with many properties available in a competitive bidding process

in which we may lack technological information or expertise available to other bidders. Therefore, we may not be successful in acquiring

or developing profitable properties in the face of this competition. No assurance can be given that a sufficient number of suitable metal

and minerals exploration companies or properties will be available for acquisition and development.

Our competitors include:

Newmont Corporation

Newmont is the only gold producer listed in the S&P 500 Index.

Its shares are traded on the New York Stock Exchange under the symbol “NEM”. They are primarily engaged in the exploration

for and acquisition of gold properties, some of which may contain copper, silver, lead, zinc or other metals. They have significant operations

and/or assets in the U.S., Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, and Ghana. In 2022, Newmont

had sales of $11.9 billion with a net loss of $429 million. For the first nine months of 2023 they had sales of $7.8 billion and net income

of $649 million.

Freeport-McMoRan Inc.

Freeport-McMoRan operates large, long-lived, geographically diverse

assets with significant proven and probable mineral reserves of copper, gold, and molybdenum. They are one of the world’s largest

publicly traded copper producers. Its shares are traded on the New York Stock Exchange under the symbol “FCX”. They had revenues

of $22.7 billion in 2022 with net income of $3.4 billion.

NACCO Industries, Inc.

NACCO Industries, Inc. operates under three business segments: Coal

Mining, which provides coal for power generation; North American Mining, works with producers of aggregates, activated carbon, lithium

and other industrial minerals; and Minerals Management, which acquires and promotes the development of mineral interests. IN 2022 they

had revenues of $241,719,000 with net income of $74,158,000.

Employees

We do not have any full-time employees. Simon

Hackl is our President/Chief Executive Officer and Gunter Dornetshuber is our Chairman of the Board. These individuals are primarily responsible

for all our day-to-day operations. Other services are provided by outsourcing, consultant, and special purpose contracts.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Government Regulation

Our intended minerals exploration or asset acquisition activities are,

or will be, subject to extensive US and/or foreign laws and regulations governing prospecting, development, production, exports, taxes,

labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected

species, mine safety, toxic substances, and other matters. Minerals exploration is also subject to risks and liabilities associated with

pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with

these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes in these

regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements

and could have a material adverse effect on our business operations.

Federal and state governments have developed comprehensive mining regulatory

schemes. U.S. mining law may originate from federal, state, and local laws, including constitutions, statutes, administrative regulations

or ordinances, and judicial and administrative body common law.

Determining which level of government has jurisdiction over mining

activities largely depends on surface and mineral ownership. A substantial amount of mining in the United States occurs on federal lands

where the federal government owns both the surface and mineral estates. On these lands, federal law primarily governs mineral ownership,

operations, and environmental compliance, with state and local governments having concurrent or independent authority over certain aspects

of land mining projects (e.g., permitting, water rights and access authorizations). The U.S. Department of the Interior Bureau of Land

Management (the “BLM”) and the U.S. Department of Agriculture Forest Service Regulation manage mining on federal lands. The

BLM manages approximately 30% of the minerals located in the U.S. and one in every 10 acres of land in the U.S.

If the resource occurs on private land, estate ownership is a matter

of state contract and real property law, but operations and environmental compliance are still regulated by applicable federal and state

laws. Estate ownership on state-owned land is regulated by state law, and operations and environmental compliance are regulated by applicable

federal and state laws, and in some cases local zoning ordinances.

Item 1A. Risk Factors

An investment in our common stock involves

a high degree of risk. An investor should carefully consider the following risk factors and the other information in this registration

statement before investing in our common stock. Our business and results of operations could be seriously harmed by any of the following

risks.

We

are an exploration stage company with a limited operating history, we currently do not operate any mines, and there is no assurance that

we will ever produce minerals from any of our properties.

We are

an exploration stage company, which means that we have no material property with reserves disclosed. We do not currently operate any mines,

and we do not have any direct or indirect interest in any active mining operations. As a result, we have never produced revenue, and we

have extremely limited operating history upon which to base estimates of future operating costs, capital expenditure needs, site remediation

costs or other necessary investments. We have no experience in developing or operating a mine. We may never be able to develop and produce

minerals from a commercially viable mineral property.

Advancing

our business plan will require significant capital and time, and successful commercial production from any mines will be subject to the

additional risks associated with developing and establishing new mining operations and business enterprises including:

| · | completing feasibility studies to verify reserves and commercial viability, including the ability to find

sufficient mineralization to support a commercial mining operation; |

| | | |

| · | obtaining the financial resources to fund further exploration, permitting

and construction of infrastructure, mining, refining and other processing facilities and equipment; |

| | | |

| · | the availability of drilling and other mining and processing equipment; |

| | | |

| · | compliance with environmental and other governmental approval and permit requirements; |

| | | |

| · | potential opposition from non-governmental organizations,

local groups or local inhabitants that may delay or prevent development activities; |

| | | |

| · | potential increases in exploration, construction, and operating costs due to changes in the cost of fuel,

water, power, materials, and supplies; |

| | | |

| · | potential shortages of mineral processing, construction, and other facilities and related supplies; and |

| | | |

| · | potential shortages of properly trained and experienced exploration personnel, skilled labor and other

personnel. |

Accordingly,

we may not be able to successfully complete our planned exploration activities, establish mining operations or profitably produce minerals

at any of our current or future properties.

We intend to rely on joint ventures or other third-party contracts

to conduct key aspects of our operations.

We intend to enter into and rely on joint ventures or other types of

third-party contracts to develop certain of our mineral properties or for other key aspects of our operations. In that event, our

operations will be subject to risks, some of which will be outside of our control, including, among others, risks relating to:

| • | negotiating agreements with such third parties on acceptable terms; |

| | | |

| • | the inability to replace a third party and its operating equipment in the event that we or the third party terminate the applicable

agreement; |

| | | |

| • | reduced control over those aspects of our operations that are the responsibility of the joint venture partner or other third party; |

| | | |

| • | failure of a joint venture partner or other third party to perform under an agreement or disputes relative to performance under such

agreement; |

| | | |

| • | interruption of operations or increased costs in the event that a joint venture partner or other third party ceases its business due

to insolvency or other unforeseen events and our ability to replace the joint venture partner with a new partner on comparable and commercially

reasonable terms; |

| • | failure of a joint venture partner or other third party to comply with legal and regulatory requirements; and |

| | | |

| • | problems of a joint venture partner or other third party with managing its workforce, including as a result of labor unrest, shortages,

or other employment issues. |

In addition, we may incur liability to third parties as a result of

the actions of our joint venture partners or other third parties. The occurrence of one or more of these risks could increase our costs,

and adversely affect our business, financial condition, results of operations and prospects.

We intend to operate internationally

and will be exposed to political and social risks in the countries in which we have significant operations or interests.

We expect that a majority of our revenues

will be generated by operations outside the United States, and we will be subject to significant risks inherent in resource extraction

by foreign companies and contracts with government owned entities. Exploration, development, production and closure activities in many

countries are potentially subject to heightened political and social risks that are beyond our control. These risks include the possible

unilateral cancellation or forced re-negotiation of contracts, unfavorable changes in foreign laws and regulations, royalty and tax increases,

claims by governmental entities or indigenous communities, expropriation or nationalization of property and other risks arising out of

foreign sovereignty over areas in which our operations are conducted. The right to export silver and gold may depend on obtaining certain

licenses and quotas, which could be delayed or denied at the discretion of the relevant regulatory authorities. In addition, our rights

under local law may be less secure in countries where judicial systems are susceptible to manipulation and intimidation by government

agencies, non-governmental organizations or civic groups.

Any of these developments could require us

to curtail or terminate operations at our mines, incur significant costs to meet newly-imposed environmental or other standards, pay greater

royalties or higher prices for labor or services and recognize higher taxes, which could materially and adversely affect our financial

condition, results of operations and cash flows.

These risks may be higher in developing countries

in which we may expand our exploration for and development of mineral deposits. Potential operations in these areas increase our exposure

to risks of war, local economic conditions, political disruption, civil disturbance and governmental policies that may disrupt our operations.

Our operations outside the United States

also expose us to economic and operational risks.

Our operations outside the United States also

expose us to economic and operational risks. Local economic conditions can cause us to experience shortages of skilled workers and supplies,

increase costs and adversely affect the security of operations. In addition, higher incidences of criminal activity and violence in the

area of some of our foreign operations, including drug-cartel related violence in Mexico, could adversely affect our ability to operate

in an optimal fashion and may impose greater risks of theft and greater risks as to property security. These conditions could lead to

lower productivity and higher costs, which would adversely affect results of operations and cash flows.

Silver and gold mining involves significant

production and operational risks.

Silver and gold mining involves significant

production and operational risks, including those related to uncertain mineral exploration success, unexpected geological or mining conditions,

the difficulty of development of new deposits, unfavorable climate conditions, equipment or service failures, current unavailability of

or delays in installing and commissioning plants and equipment, import or customs delays and other general operating risks. Commencement

of mining can reveal mineralization or geologic formations, including higher than expected content of other minerals that can be difficult

to separate from silver, which can result in unexpectedly low recovery rates.

Problems also may arise due to the quality

or failure of locally obtained equipment or interruptions to services (such as power, water, fuel or transport or processing capacity)

or technical support, which could result in the failure to achieve expected target dates for exploration, or could cause production activities

to require greater capital expenditure to achieve expected recoveries.

Many of these production and operational risks

are beyond our control. Delays in commencing successful mining activities at new or expanded mines, disruptions in production and low

recovery rates could have adverse effects on our financial condition, results of operations and cash flows.

Our future growth will depend upon our

ability to develop new mines, either through exploration or by acquisition from other mining companies.

Because mines have limited lives based on

proven and probable ore reserves, an important element of our business strategy is the opportunistic acquisition of silver and gold mines,

properties and businesses or interests therein. Our ability to achieve significant additional growth in revenues and cash flows will depend

upon our success in further developing our existing properties and developing or acquiring new mining properties. Both strategies are

inherently risky, and we cannot assure that we will be able to successfully compete in either the development of our existing or new mining

properties or acquisitions of additional mining properties.

While it is our practice to engage independent

mining consultants to assist in evaluating and making acquisitions, any mining properties or interests that we may acquire may not be

developed profitably. If profitable when acquired, that profitability might not be sustained. In connection with any future acquisitions,

we may incur indebtedness or issue equity securities, resulting in increased interest expense, or dilution of the percentage ownership

of existing shareholders. We cannot predict the impact of future acquisitions on the price of our business or our common stock or that

we would be able to obtain any necessary financing on acceptable terms. Unprofitable acquisitions, or additional indebtedness or issuances

of securities in connection with such acquisitions, may negatively affect our results of operations.

The mining industry is highly competitive.

The mining industry is highly competitive. Much of our competition

will come from larger and more established mining companies that have greater resources than us, including more executive management and

administrative personnel, more qualified employees, newer and more efficient equipment, lower cost structures, greater liquidity and access

to credit and other financial resources, more effective risk management policies and procedures, and greater financial resources allowing

for a greater ability to explore and develop mining properties and withstand potential losses. As a result of such advantages, some of

our competitors may be able to (i) respond more quickly to new laws, regulations or emerging technologies, (ii) devote greater

resources to the operation, expansion or efficiency of their operations, and (iii) expend greater amounts of resources, including

capital, in acquiring new and prospective mining properties. In addition, current and potential competitors may make strategic acquisitions

or establish cooperative relationships among themselves or with third parties; and the resulting competitors or alliances may gain significant

market share to our detriment. We may not be able to compete successfully against current and future competitors, and any such failure

to compete successfully could have a material adverse effect on our business, financial condition, or results of operations.

Mineral exploration and development

inherently involves significant and irreducible financial risks. We may suffer from the failure to find and develop profitable mines.

The exploration for and development of mineral

deposits involves significant financial risks that even a combination of careful evaluation, experience and knowledge cannot eliminate.

Unprofitable efforts may result from the failure to discover mineral deposits. Even if mineral deposits are found, those deposits may

be insufficient in quantity and quality to return a profit from production, or it may take a number of years until production is possible,

during which time the economic viability of the project may change. Few properties which are explored are ultimately developed into producing

mines.

Substantial expenditures are required to establish

ore reserves, to extract metals from ores and, in the case of new properties, to construct mining and processing facilities. The economic

feasibility of any development project is based upon, among other things, volatile metals prices, estimates of the size and grade of ore

reserves, proximity to infrastructures and other resources such as water and power, metallurgical recoveries, production rates and capital

and operating costs. Development projects also are subject to the completion of favorable feasibility studies, issuance and maintenance

of necessary permits and receipt of adequate financing.

The commercial viability of a mineral deposit,

once developed, depends on a number of factors, including: the particular attributes of the deposit, such as size, grade and proximity

to infrastructure; government regulations including taxes, royalties and land tenure; land use; importing and exporting of minerals; environmental

protection; and mineral prices. Factors that affect adequacy of infrastructure include: reliability of roads, bridges, power sources and

water supply; unusual or infrequent weather phenomena; sabotage; and government or other interference in the maintenance or provision

of such infrastructure. All of these factors are highly cyclical. The exact effect of these factors cannot be accurately predicted, but

the combination may result in not receiving an adequate return on invested capital.

Significant investment risks and operational

costs are associated with our exploration, development and mining activities. These risks and costs may result in lower economic returns

and may adversely affect our business.

Our ability to sustain or increase our production

levels depends in part on successful exploration and development of new ore bodies and expansion of existing mining operations. Mineral

exploration, particularly for silver and gold, involves many risks and is frequently unproductive. The economic feasibility of any development

project is based upon, among other things, estimates of the size and grade of ore reserves, proximity to infrastructures and other resources

(such as water and power), metallurgical recoveries, production rates and capital and operating costs of such development projects, and

metals prices. Development projects are also subject to the completion of favorable feasibility studies, issuance and maintenance of necessary

permits and receipt of adequate financing.

Development projects may have no operating

history upon which to base estimates of future operating costs and capital requirements. Development project items such as estimates of

reserves, metal recoveries and cash operating costs are to a large extent based upon the interpretation of geologic data, obtained from

a limited number of drill holes and other sampling techniques, and feasibility studies. Estimates of cash operating costs are then derived

based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates

of metals from the ore, comparable facility and equipment costs, anticipated climate conditions and other factors.

As a result, actual cash operating costs and

economic returns of any and all development projects may materially differ from the costs and returns estimated, and accordingly, our

financial condition, results of operations and cash flows may be negatively affected.

There are significant hazards associated

with our mining activities, some of which may not be fully covered by insurance.

The mining business is subject to risks and

hazards, including environmental hazards, industrial accidents, the encountering of unusual or unexpected geological formations, cave-ins,

flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage

to, or destruction of, mineral properties or production facilities, personal injury or death, environmental damage, reduced production

and delays in mining, asset write-downs, monetary losses and possible legal liability. Insurance fully covering many environmental risks,

including potential liability for pollution or other hazards as a result of disposal of waste products occurring from exploration and

production, is not generally available to us or to other companies in the industry. Any liabilities that we incur for these risks and

hazards could be significant and could adversely affect results of operation, cash flows and financial condition.

We are subject to significant governmental

regulations, including under the Federal Mine Safety and Health Act, and related costs and delays may negatively affect our business.

Mining activities are subject to extensive

federal, state, local and foreign laws and regulations governing environmental protection, natural resources, prospecting, development,

production, post-closure reclamation, taxes, labor standards and occupational health and safety laws and regulations, including mine safety,

toxic substances and other matters. The costs associated with compliance with such laws and regulations are substantial. Possible future

laws and regulations, or more restrictive interpretations of current laws and regulations by governmental authorities, could cause additional

expense, capital expenditures, restrictions on or suspensions of operations and delays in the development of new properties.

U.S. surface and underground mines are continuously

inspected by the U.S. Mine Safety and Health Administration (“MSHA”), which inspections often lead to notices of violation.

Recently, the MSHA has been conducting more frequent and more comprehensive inspections.

Failure to comply with applicable laws, regulations

and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations

to cease or be curtailed, which may require corrective measures including capital expenditures, installation of additional equipment or

remedial actions. In addition, any of our U.S. mines could be subject to a temporary or extended shut down as a result of a violation

alleged by the MSHA. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to

compensate those suffering loss or damage by reason of the mining activities and may be subject to civil or criminal fines or penalties

imposed for violations of applicable laws or regulations. Any such penalties, fines, sanctions or shutdowns could have a material

adverse effect on our business and results of operations.

Compliance with environmental regulations

and litigation based on environmental regulations could require significant expenditures.

Environmental regulations mandate, among other

things, the maintenance of air and water quality standards and land reclamation, and set forth limitations on the generation, transportation,

storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner that will require stricter standards

and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and

a heightened degree of responsibility for mining companies and their officers, directors and employees. We may incur environmental costs

that could have a material adverse effect on our financial condition and results of operations. Any failure to remedy an environmental

problem could require us to suspend operations or enter into interim compliance measures pending completion of the required remedy. The

environmental standards that ultimately may be imposed at a mine site affect the cost of remediation and could exceed the financial accruals

that we have made for such remediation. The potential exposure may be significant and could have a material adverse effect on our financial

condition and results of operations.

Moreover, governmental authorities and private

parties may bring lawsuits based upon damage to property and injury to persons resulting from the environmental, health and safety impacts

of prior and current operations, including operations conducted by other mining companies many years ago at sites located on properties

that we currently or formerly owned. These lawsuits could lead to the imposition of substantial fines, remediation costs, penalties and

other civil and criminal sanctions. Substantial costs and liabilities, including for restoring the environment after the closure of mines,

are inherent in our operations. We cannot assure you that any such law, regulation, enforcement or private claim would not have a negative

effect on our financial condition, results of operations or cash flows.

Some of our mining wastes currently are exempt

to a limited extent from the extensive set of federal Environmental Protection Agency (the “EPA”) regulations governing hazardous

waste under the Resource Conservation and Recovery Act (“RCRA”). If the EPA designates these wastes as hazardous under RCRA,

we would be required to expend additional amounts on the handling of such wastes and to make significant expenditures to construct hazardous

waste disposal facilities. In addition, if any of these wastes causes contamination in or damage to the environment at a mining facility,

that facility could be designated as a “Superfund” site under the Comprehensive Environmental Response, Compensation and Liability

Act (“CERCLA”). Under CERCLA, any present owner or operator of a Superfund site or the owner or operator at the time of contamination

may be held liable and may be forced to undertake extensive remedial cleanup action or to pay for the government’s cleanup efforts.

The owner or operator also may be liable to governmental entities for the cost of damages to natural resources, which could be substantial.

Additional regulations or requirements also are imposed on our tailings and waste disposal areas in Alaska under the federal Clean Water

Act (“CWA”) and in Nevada under the Nevada Water Pollution Control Law which implements the CWA.

Airborne emissions are subject to controls

under air pollution statutes implementing the Clean Air Act in Nevada and Alaska. In addition, there are numerous legislative and regulatory

proposals related to climate change, including legislation pending in the U.S. Congress to require reductions in greenhouse gas emissions.

Adoption of these proposals could have a materially adverse effect on our results of operations and cash flows.

Risks Related to Our Financial Position and Capital Needs

Our independent registered public accounting firm has expressed

substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our recurring losses from operations raise substantial doubt about

our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph

in its report on our financial statements for the years ended December 31, 2022 and 2021 with respect to this uncertainty. While

we believe that the net proceeds from this offering, together with our existing cash and cash equivalents, will be sufficient for us to

fund our operating expenses and capital expenditures requirements for the next 12 months, we have based these estimates on assumptions

that may prove to be wrong, and we may need to raise additional funds. The reaction of investors to the inclusion of a going concern statement

by our independent registered public accounting firm, and its potential inability to continue as a going concern, in future years

could materially adversely affect the share price of our common stock and our ability to raise new capital.

We will require substantial additional capital to explore and/or

develop our mineral properties and we may be unable to raise additional capital on favorable terms or at all.

Our business is capital intensive. Specifically, the exploration and

exploitation of reserves, mining and processing costs, the maintenance of machinery and equipment and compliance with applicable laws

and regulations require substantial capital expenditures. We will be required to make substantial expenditures for the continued exploration

and, if warranted, development of our mineral properties. Mining industry development projects typically require a number of years

and significant expenditures before production can begin. Such projects could experience unexpected problems and delays during development,

construction and start-up. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing

may not be on terms that are favorable to us. Any failure to obtain sufficient equity or debt financing for our operations on favorable

terms could have a material adverse effect on our financial condition, results of operations, and prospects.

We have a limited operating history on which to evaluate our

business and performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

We were incorporated under the laws of the State of Nevada in, 2006.

We have never generated any revenue from operations, our mineral properties are in the exploration stage, and we have never produced minerals

in commercial quantities from any of our mineral properties. We face many risks common to early-stage enterprises, including under-capitalization,

cash shortages and limitations with respect to personnel and other resources. The likelihood that in the future we will generate a level

of revenue to achieve and sustain profitable operations must be considered in light of the early stage of our operations.

There is no assurance that any of our mineral properties will ultimately

produce minerals in commercially viable quantities or otherwise generate operating earnings. Advancing our mineral properties into the

development stage will require significant capital and time, and successful commercial production from any mines on such properties will

require us to complete feasibility studies to estimate the anticipated economic returns of a project, obtain adequate financing, obtain

various permits, construct processing plants and infrastructure, and complete other activities. We may not succeed in establishing mining

operations or profitably producing metals at any of our current or future properties.

Item 2. Financial Information.

The following discussion and analysis of our

financial condition and results of operations should be read in conjunction with the consolidated financial statements and the related

notes included elsewhere herein and in our consolidated financial statements.

In addition to our consolidated financial statements,

the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ

materially from those discussed in the forward-looking statements. See Forward-Looking Statements and Item 1A.

Risk Factors for a discussion of the uncertainties, risks and assumptions associated with these statements.

Results of Operations

Three Months Ended

November 30, 2023, and November 30, 2022

For the three months

ended November 30, 2023, and 2022 we did not generate any revenue. We had a net loss of $55,047 and $8,852 for the periods ended 2023

and 2022 respectively. The increase in net loss was due an increase in audit and other expenses related to maintaining the Company’s

status as a public company.

Total Liabilities for

the three months ended November 30, 2023, and 2022 increased to $172,906 from $116,247 due to an increase in Loan Payables and accrual

of interest. Cash decreased from $20,365 in 2022 to $13,142 in 2023.

Year Ended August

31, 2023 Compared with the Year Ended August 31, 2022

For the year ended August

31, 2023, and August 31, 2022, we did not generate any revenue. We had net losses of $35,409 and $60,973 for the years ended August 31,

2023, and August 31, 2022, respectively. Our losses were composed solely of general and administrative expenses related to maintaining

the Company as a reporting issuer.

Total Liabilities increased

to $116,247 for the year ended August 31, 2023, compared to $60, 973 for the prior year period. The increase was due to an increase in

Loan Payables and accrual of interest

Liquidity and Capital Resources

For the year ended August 31, 2023, we had current

assets of $20,365 existing exclusive of cash obtained through loans.

Item 3.

Properties.

The Company currently leases space for its corporate office at 500

S Australian Ave Suite #600 West Palm Beach, FL 33401. The company pays $300 per month.

Item

4. Security Ownership of Certain Beneficial Owners and Management.

The following table displays, as of November 30,

2023, the voting securities beneficially owned by any holder who beneficially owns more than 5% of any class of our capital stock:

| Title of class | |

Name and address of beneficial owner | |

Amount and nature of beneficial ownership | |

Amount and nature of beneficial ownership acquirable | | |

Percent

of class | |

| Common Stock | |

Miroslav Zecevic (1) | |

400,000,000 shares of Common Stock | |

| – | | |

| 5.5% | |

| Class A Preferred Stock | |

Fuya Holding Group (2) | |

100,000,000 shares of Series A Preferred Stock | |

| – | | |

| 100% | |

| Class B Preferred Stock | |

BlueSky Global Macro Fund Ltd (3) | |

100,000,000 shares of Series B Preferred Stock | |

| – | | |

| 100% | |

| (1) | The address for Miroslav Zecevic is Wellington, FL |

| (2) | The address for Fuya Holding Group is 6575 NEST LOOP SOUTH, SUITE 500, BELLAIRE TX 77401. Parash Patel is the beneficial owner of

Fuya Holding Group |

| (3) | The address for Blue Sky Global Macro Fund Ltd. is 500 S Australian Ave, West Palm Beach, FL, Gunter Dornetshuber is the beneficial

owner of Blue Sky Global Macro Fund Ltd. |

The following table displays, as of November 30,

2023, the voting securities beneficially owned by (1) any individual director or officer; and (2) all executive officers and directors

as a group:

| Title of class | |

Name of beneficial owner | |

Amount and nature of beneficial ownership | |

Amount and nature of beneficial ownership acquirable | | |

Percent

of class | |

| Common Stock | |

Simon Hackl (1) | |

- | |

| – | | |

| –% | |

| Common Stock | |

Gunter Dornetshuber (2) | |

- | |

| – | | |

| – | |

| Series B Preferred | |

Gunter Dornetshuber (2) | |

100,000,000 Indirect (3) | |

| – | | |

| 100% | |

| Common Stock | |

Aleksander Sentic (4) | |

- | |

| – | | |

| – | |

| Common Stock | |

Irina Veselinovic (5) | |

- | |

| – | | |

| – | |

| Common Stock | |

Zoran Cvetojevic (6) | |

- | |

| – | | |

| – | |

| | |

All Officers and Directors as a Group | |

100,000,000 Series B Preferred Stock | |

| – | | |

| 100% | |

| (1) | Simon Hackl was appointed as CEO on November 10, 2023. |

| (2) | Gunter Dornetshuber was appointed Chairman of the Board of Directors on November 10, 2023 |

| (3) | 100,000,000 shares of Series B Preferred are owned by Bluesky Global Macro Fund Ltd of which Mr. Dornetshuber is the ultimate beneficial

owner. |

| (4) | Aleksander Sentic resigned as interim CEO on November 10, 2023 |

| (5) | Irina Veselinovic resigned as interim COO on November 10, 2023 |

| (6) | Zoran Cvetojevic resigned as Chairman of the Board on November 10, 2023 |

Item 5.

Directors and Executive Officers.

| Name | |

Position | |

Age | | |

Term in Office | |

Fulltime with the Company |

| Executive Officers | |

| |

| | | |

| |

|

| Simon Hackl | |

CEO | |

| 25 | | |

Since November 2023 | |

Yes |

| | |

| |

| | | |

| |

|

| Directors | |

| |

| | | |

| |

|

| Gunter Dornetshuber | |

Chairman | |

| 31 | | |

Since November 2023 | |

|

Directors, Officers and Significant Employees

Simon Hackl, CEO

Simon Hackl attended Johannes Kepler University in Linz, Austria and

University of Salzburg. Since 2019 he has been working in fund management with Sparkasse Oberösterreich Bank AG where he is responsible

for Risk Management, UCITS Fund Pricing, Investment limits, communication with Austrian Financial Market Authorities, and preparing quarterly

and semiannual Fund reports. While being employed with the bank he gained knowledge in global Commodity and Metal trading.

Gunter Dornetshuber, Chairman

Gunter Dornetshuber has worked for Sparkasse Oberoesterreich Bank AG

since 2018 in the areas of product governance and fund management. He is currently managing several Bond Funds with the Bank and is highly

experienced in consulting investors on sustainable energy, decarbonization and renewable fuels. He received a Bachelor of Science degree

in natural sciences from Johannes Kepler University in Linz, Austria.

Item

6. Executive Compensation.

The following discussion and analysis of compensation

arrangements should be read with the compensation tables and related disclosures set forth below. This discussion contains forward-looking

statements that are based on our current plans and expectations regarding future compensation programs. The actual compensation programs

that we adopt may differ materially from the programs summarized in this discussion.

For the fiscal years ended August 31, 2023, and

2022 the Company compensated our three highest-paid executive officers as follows:

| Name and principal position | |

Year | |

Salary

($) | | |

Bonus

($) | | |

Stock awards ($)(1) | | |

Option awards ($)(2) | | |

Non-equity incentive plan compen- sation

($) | | |

Non-qualified deferred compen-

sation

earnings

($) | | |

All other compen- sation

($)(3) | | |

Total

($) | |

| Alexander Sentic | |

2023 | |

$ | 800 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

$ | 800 | |

| Interim Chief Executive Officer (1) | |

2022 | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Irina Veselinovic | |

2023 | |

$ | 800 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

$ | 800 | |

| Interim COO (2) | |

2022 | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| (1) | Resigned November 10, 2023 |

| (2) | Resigned November 10, 2023 |

Employment Agreements

Compensation of Directors

For the fiscal year ended August 31, 2023, the

Company compensated our directors for their board service as follows:

| Name |

|

Fees earned or paid in cash ($)(1) |

|

|

Stock awards ($)(2) |

|

|

Option awards ($) |

|

|

Non-equity incentive plan compensation ($) |

|

|

Nonqualified deferred compensation earnings

($) |

|

|

All other compensation ($) |

|

|

Total ($) |

|

| Zoran Cvetojevic |

|

$ |

800 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company has agreed to pay Mr. Cvetojevic $400 per month.

Long-Term Incentive Plans

There are no arrangements or plans in which we

provide pension, retirement or similar benefits.

Item

7. Certain Relationships and Related Transactions, and Director Independence.

Related Party Transactions

None

Item 8.

Legal Proceedings.

The Company is not engaged in any legal proceedings.

Item 9.

Market Price of Registrant’s Common Equity and Related Stockholder Matters.

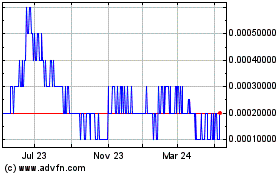

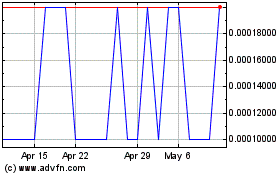

Our common stock is quoted OTC Markets and trades under the symbol

“MNGG”. The high and low prices for our common stock traded on OTC Markets is as follows:

| Quarter Ended |

High |

Low |

| November 30, 2023 |

$.0003 |

$0.0001 |

| Quarter Ended |

High |

Low |

| August 31, 2023 |

$0.0006 |

$0.0002 |

| May 30, 2023 |

$0.0004 |

$0.0001 |

| February 28, 2023 |

$0.0005 |

$0.0003 |

| November 30, 2022 |

$0.0010 |

$0.0001 |

| Quarter Ended |

High |

Low |

| August 31, 2022 |

$0.0001 |

$0.0001 |

| May 30, 2022 |

$0.0001 |

$0.0001 |

| February 28, 2022 |

-- |

-- |

| November 30, 2021 |

-- |

-- |

Prices reflect inter-dealer prices without retail mark-up, mark-down,

or commission and may not reflect actual transactions.

As of February 7, 2024, we had 7,615,161,617 shares of common stock

issued and outstanding held by approximately 3,802 shareholders of record.

Item 10.

Recent Sales of Unregistered Securities.

The Company entered into convertible note agreements with investors

as follows:

March 31, 2021, in the amount of $60,000

September 6, 2023, in the amount of $26,000

November 10, 2023, in the amount of $10,000

Each of the notes had the following terms:

| 1. | Maturity date on the third anniversary of the loan |

| 2. | 10% interest per annum, accruing monthly |

| 3. | Conversion into common stock as follows: |

| a. | “Conversion Price” means 0.000001 |

| i. | in the case of a Significant Financing (defined below), the lower of: (A) the lowest price paid per Significant Financing Security

(defined below); and (B) the Capped Price; |

| ii. | in the case of a Change of Control (defined below), the lower of: (A) the price per share of the Corporation based on the valuation

given in connection with the event triggering the Change of Control; and (B) the Capped Price; |

| iii. | in the case of a Discretionary Conversion (defined below), the lower of: (A) the price per share of the Corporation paid to the Corporation

for Securities (defined below) at the last external financing (i.e. a financing where such Securities were issued which includes investors

other than the current directors, officers and employees of the Corporation) completed after the date of this Loan Agreement; and (B)

the Capped Price, however where no external financing has occurred after the date of this Loan Agreement, the price will be the Capped

Price. |

| b. | “Capped Price” means the pre-money price per share of the Corporation, which is capped at Two Hundred and Twenty-Five

Thousand Dollars ($225,000). |

| c. | “Discount” means a discount of 0% to the Conversion Price |

Item 11.

Description of Registrant’s Securities to be Registered.

Common Stock: The Company, Mining Global, Inc., has authorized 9,800,000,000

shares of Common Stock, par value of $.001per share. The Common Stock is transferable and shall entitle the holders thereof to one vote

per share on all matters submitted to a vote of the stockholders of the Company. The Common Stock does not carry any preferences, rights,

or privileges. Each share of Common Stock has equal rights to receive dividends, if declared by the Board of Directors, and upon liquidation,

dissolution, or winding up of the Company, is entitled to share pro rata in the assets of the Company available for distribution to the

stockholders. The Common Stock is subject to the terms and conditions set forth in the Company's Bylaws and applicable provisions of the

Nevada Revised Statutes.

The Common Stock does not have any preemptive, conversion, redemption,

or sinking fund rights. The Common Stock is not subject to any limitations on voting rights, dividends, or other rights or preferences,

except as otherwise provided by law or the Company's Bylaws or the designations of the Company’s classes of preferred Stock.

Anti-Takeover Provisions of Nevada Revised Statutes

The Company's Common Stock is subject to the anti-takeover provisions

of the Nevada Revised Statutes (NRS). Pursuant to the NRS, the Company has adopted certain provisions in its Bylaws to deter and protect

against hostile takeover attempts. These provisions are designed to provide the Company's board of directors with additional authority

and control in the event of an unsolicited acquisition proposal or an attempt to gain control of the Company without the approval of the

board of directors.

One such provision is the Board's ability to adopt and amend Bylaws,

including provisions relating to the regulation of the Company's internal affairs and the conduct of its business. This grants the board

of directors broad authority to take actions that may delay, deter, or prevent a change in control of the Company.

Additionally, the NRS provides that certain business combinations,

including mergers, sales of assets, or other transactions between the Company and an interested stockholder, may require approval by a

majority of the disinterested stockholders. This provision is intended to protect the interests of the Company's stockholders by ensuring

that any potential business combination is fair and equitable to all stockholders.

Furthermore, the NRS allows the Company to issue preferred stock with

voting, conversion, or other rights that could be used to dilute the voting power of existing stockholders or to deter hostile takeover

attempts. The Board has the authority to issue such preferred stock without stockholder approval.

Please note that the foregoing description is a summary of the anti-takeover

provisions of the Nevada Revised Statutes and is not intended to be comprehensive. Stockholders are encouraged to review the Company's

Bylaws and the relevant provisions of the NRS for a complete understanding of these provisions.

Item 12.

Indemnification of Directors and Officers.

Our Articles of Incorporation and Bylaws both

provide for the indemnification of our officers and directors to the fullest extent permitted by the Nevada Revised Statutes (the “NRS”).

Our Articles of Incorporation state that a director of the Company shall not be personally liable to the Company or its stockholders for

monetary damages for breach of fiduciary duty as a director. Pursuant to the Bylaws, the Company must indemnify to the maximum extent

permitted by Nevada law its officers and directors in any civil, criminal, administrative or investigative proceeding except an action

by or in the right of the Company, including attorneys’ fees, judgments, fines and amounts paid in settlement provide he or she

acted in good faith and in a manner that he or she reasonably believed to be in, and not opposed to, the Company’s best interests.

Pursuant to NRS 78.138, no indemnification is required if it is proven that the officer or director breached his or her fiduciary duties

and that breach involved intentional misconduct, fraud or a knowing violation of law. The termination of any such proceeding by judgment,

order, settlement, conviction, or upon a plea of nolo contendere shall not by itself create a presumption that the person did not act

in good faith and in a manner which he reasonably believed to be in the Company’s best interests and that, with respect to any criminal

action or proceeding, he had reasonable cause to believe that his conduct was unlawful. The Company must indemnify officers and directors

who are party or are threatened to be made a party to any action or lawsuit by or in the right of the Company to the maximum extent permitted

by the NRS, including attorneys’ fees, unless it is proven his or her act, or failure to act, was a breach of fiduciary duty involving

intentional misconduct, fraud, or a knowing violation of law rendering him or her liable under NRS 78.138, unless he or she acted in good

faith and in a manner he or she reasonably believed to be in, and not opposed to, the Company’s best interests. Additionally, the

Bylaws gives the Board of Directors sole discretion to indemnify the Company’s employees and agents to the extent not prohibited

by the NRS or other applicable law. The Bylaws permit the Company to advance the costs of defense to persons involved in legal proceedings

at the discretion of the Board of Directors upon receipt of an undertaking by or on behalf of such person to repay such amount unless

it is determined that he or she is entitled to indemnification by the Company under the Bylaws or the NRS.

Item 13.

Financial Statements and Supplementary Data.

The consolidated financial statements of the Company

appear at the end of this report beginning on page F-1.

Item

14. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 15.

Financial Statements and Exhibits.

| (a) |

The information required by this item is contained under the section

of the registration statement entitled “Index to Financial Statements” (and the financial statements and related noted referenced

therein). That section is incorporated herein by reference. |

| |

|

| (b) |

|

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange

Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly

authorized.

MINING GLOBAL INC.

| Date: February 9, 2024 |

By: /s/ Simon

Hackl |

| |

Principal Executive Officer and |

| |

Principal Accounting Officer |

MINING GLOBAL, INC.

Index to the Financial Statements

Report of an Independent Registered Public Accounting

Firm

To the shareholders and the board of directors

of Mining Global, Inc

Opinion on the Financial Statements

We have audited the accompanying balance sheets

of Mining Global, Inc (the “Company”) as of August 31, 2023, and 2022, the related statements of

operations, changes in shareholders’ equity and cash flows, for each of the two years in the period ended August 31, 2023,

and the related notes collectively referred to as the “financial statements.

In our opinion, the financial statements present

fairly, in all material respects, the financial position of the Company as of August 31, 2023, and 2022, and the results of its operations

and its cash flows for the year ended August 31, 2023, in conformity with U.S. generally accepted accounting principles.

Going Concern

The accompanying financial statements have been

prepared assuming the company will continue as a going concern as disclosed in Note 3 to the financial statement, the Company has continuously

incurred a net loss of $35,409 for the year ended August 31, 2023, and an accumulated deficit of $96,382 at August 31, 2023. The continuation

of the Company as a going concern through August 31, 2023, is dependent upon improving the profitability and the continuing financial

support from its stockholders. Management believes the existing shareholders or external financing will provide additional cash to meet

the Company’s obligations as they become due.

These factors raise substantial doubt about the

company’s ability to continue as a going concern. These financial statements do not include any adjustments that might result from

the outcome of the uncertainty.

Basis for Opinion

These financial statements are the

responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial

statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S.

federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We

conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to

obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether

due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis,

evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting

principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial

statements. We believe that our audits provide a reasonable basis for our opinion. The company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an

understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of

the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

OLAYINKA

OYEBOLA & CO.

(Chartered Accountants)

We have served as the Company’s auditor

since September 2023.

November 6th, 2023.

Lagos, Nigeria

MINING GLOBAL, INC.

BALANCE SHEETS

| | |

August 31, 2023 | | |

August 31, 2022 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 20,365 | | |

$ | – | |

| Total Assets | |

$ | 20,365 | | |

$ | – | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDER’S EQUITY(DEFICIT) | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Convertible note payables | |

$ | 60,000 | | |

$ | 60,000 | |

| Accrued interest | |

| 6,247 | | |

| 973 | |

| Loan payables | |

| 50,000 | | |

| – | |

| Total Liabilities | |

| 116,247 | | |

| 60,973 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Common stock, $0.001 par value, 7,350,000,000 shares authorized; 7,225,161,617 and 7,225,161,617 shares issued and outstanding as of August 31, 2023, and 2022 respectively | |

| 7,225,162 | | |

| 7,225,162 | |

| Preferred stock A $0.001 par value, 10,000,000 shares authorized and issued. | |

| 10,000 | | |

| 10,000 | |

| Preferred stock B $0.001 par value, 100,000,000 shares authorized and issued. | |

| 100,000 | | |

| 100,000 | |

| Additional paid in capital | |

| (7,334,662 | ) | |

| (7,334,662 | ) |

| Accumulated deficit | |

| (96,382 | ) | |

| (60,973 | ) |

| Total stockholders’ equity | |

| (95,882 | ) | |

| (60,973 | ) |

| Total Liabilities and Stockholder’s Equity | |

$ | 20,365 | | |

$ | – | |

The accompanying notes are an integral part

of these audited financial statements.

MINING GLOBAL, INC.

STATEMENTS OF OPERATIONS

| | |

August 31, 2023 | | |

August 31, 2022 | |

| | |

| | |

| |

| Revenue | |

$ | – | | |

$ | – | |

| Cost of revenue | |

| – | | |

| – | |

| Gross profit | |

| – | | |

| – | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| General and administrative | |

| 35,409 | | |

| 60,973 | |

| Total operating expenses | |

| 35,409 | | |

| 60,973 | |

| Income (Loss) from Operations | |

| (35,409 | ) | |

| (60,973 | ) |

| Other Income/(expense) | |

| | | |

| | |

| Interest expense | |

| (35,409 | ) | |

| (60,973 | ) |

| Income (loss) before income tax provision | |

| (35,409 | ) | |

| (60,973 | ) |

| Income tax provision | |

| – | | |

| – | |

| Net Income (Loss) | |

$ | (35,409 | ) | |

$ | (60,973 | ) |

| | |

| | | |

| | |

| Net Loss Per Common Share: | |

| | | |

| | |

| Net Loss per common share - Basic and Diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Outstanding - Basic and Diluted | |

| 7,225,161,617 | | |

| 7,225,161,617 | |

The accompanying notes are an integral part

of these audited financial statements.

MINING GLOBAL, INC.

STATEMENTS OF STOCKHOLDERS’ EQUITY

| | |

Common Stock | | |

Preferred stock A | | |

Preferred stock B | | |

Additional | | |

| | |

Total | |

| | |

No. of | | |

| | |

No. of | | |

| | |

No. of | | |

| | |

paid-in | | |

Accumulated | | |

shareholders’ | |

| | |

shares | | |

Amount | | |

shares | | |

Amount | | |

shares | | |

Amount | | |

capital | | |

deficit | | |

deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of September 1, 2021 | |

| 7,225,161,617 | | |

$ | 7,225,162 | | |

| 10,000,000 | | |

$ | 10,000 | | |

| 100,000,000 | | |

$ | 100,000 | | |

$ | (7,335,162 | ) | |

$ | – | | |

$ | – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the year | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (60,973 | ) | |

| (60,973 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of August 31, 2022 | |

| 7,225,161,617 | | |

$ | 7,225,162 | | |

| 10,000,000 | | |

$ | 10,000 | | |

| 100,000,000 | | |

$ | 100,000 | | |

$ | (7,335,162 | ) | |

$ | (60,973 | ) | |

$ | (60,973 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 1, 2022 | |

| 7,225,161,617 | | |

$ | 7,225,162 | | |

| 10,000,000 | | |

$ | 10,000 | | |

| 100,000,000 | | |

$ | 100,000 | | |

$ | – | | |

$ | (60,973 | ) | |

$ | (60,973 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Additional paid in capital | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 500 | | |

| – | | |

| 500 | |

| Net loss for the year | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (35,409 | ) | |

| (35,409 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of August 31, 2023 | |

| 7,225,161,617 | | |

$ | 7,225,162 | | |

| 10,000,000 | | |

$ | 10,000 | | |

| 100,000,000 | | |

$ | 100,000 | | |

$ | (7,334,662 | ) | |

$ | (96,382 | ) | |

$ | (95,882 | ) |

The accompanying notes are an integral part

of these audited financial statements.

MINING GLOBAL, INC.

STATEMENTS OF CASH FLOWS

| | |

Year Ended

August 31, 2023 | | |

Year Ended

August 31, 2022 | |

| | |

| | |

| |

| Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (35,409 | ) | |

$ | (60,973 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Due to related party and interest payable | |

| 55,274 | | |

| 60,973 | |

| | |

| | | |

| | |

| Net Cash Provided (Used) by Operating Activities | |

| 19,865 | | |

| – | |

| | |

| | | |

| | |

| Investing Activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| – | | |

| – | |

| | |

| | | |

| | |

| Net Cash Used in Investing Activities | |

| – | | |

| – | |

| | |

| | | |

| | |

| Financing Activities: | |

| | | |

| | |

| Additional paid in capital | |

| 500 | | |

| (7,335,162 | ) |

| Preferred stock A | |

| – | | |

| 10,000 | |

| Preferred stock B | |

| – | | |

| 100,000 | |

| Common Stock | |

| – | | |

| 7,225,162 | |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 500 | | |

| – | |

| | |

| | | |

| | |

| Net Change in Cash | |

| 20,365 | | |

| – | |

| Cash - Beginning of Period | |

| – | | |

| – | |

| Cash - End of Period | |

$ | 20,365 | | |

$ | – | |

| | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | – | | |

$ | – | |

| Income tax paid | |

$ | – | | |

$ | – | |

The accompanying notes

are an integral part of these financial statements.

MINING GLOBAL, INC.

NOTES TO AUGUST 31, 2023, AND 2022

FINANCIAL STATEMENTS

Note 1 – Organization and Operations

MINING GLOBAL Inc. was incorporated as Yaterra

Ventures Corp (the “Company”) under the laws of the State of Nevada in November 20,2006. Office address is located at 500

S Australian Ave, 600 West Palm Beach FI 33401 USA. The MINING GLOBAL INC is linked to mining and as well involved in commodity investing

in general as a business VAR aggregator.

The company engages in investing in exploration

and mining. Investing in commodity stocks, researching, investing in already listed mining companies that are currently undervalued. MNGG

target underfunded entities with a lack of knowledge in the mining sector and or with a lack of versed management. MINING GLOBAL Inc was

incorporated in November 2006 in Nevada, USA. MINING GLOBAL Inc trades on the Pink Sheets under “MNGG”.

Note 2 – Summary of Significant Accounting

Policies

Basis of Presentation

The Company’s financial statements have

been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Use of Estimates and Assumptions and Critical

Accounting Estimates and Assumptions

The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date(s) of the financial

statements and the reported amounts of revenues and expenses during the reporting period(s).Critical accounting estimates are estimates

for which (a) the nature of the estimate is material due to the levels of subjectivity and judgment necessary to account for highly uncertain

matters or the susceptibility of such matters to change and (b) the impact of the estimate on financial condition or operating performance

is material. The Company’s critical accounting estimates and assumptions affecting the financial statements were:

| |

(i) |

Assumption as a going concern: Management assumes that the Company will continue as a going concern, which contemplates continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. |

These significant accounting estimates or assumptions

bear the risk of change due to the fact that there are uncertainties attached to these estimates or assumptions, and certain estimates

or assumptions are difficult to measure or value.

Management bases its estimates on historical

experience and on various assumptions that are believed to be reasonable in relation to the financial statements taken as a whole under

the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are