UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2015

Commission file number: 0-30394

(Translation of registrant’s name into English)

c/o Fahn Kanne, Derech Menachem Begin 23, Tel Aviv, 66183, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): £

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): £

The information contained in this Report on Form 6-K is hereby incorporated by reference into the registrant's Registration Statements on Form F-3 File Nos. 333-152119, 333-145431, 333-104147 and 333-13806 and on Form S-8, File Nos. 333-121901, 333-12064, 333-88172, 333-112755 and 333-149657.

6-K Items

|

99.1

|

Press Release, dated November 20, 2015: Metalink Announces 2015 Annual General Meeting.

|

|

99.2

|

Metalink Ltd. Notice and Proxy Statement for Annual General Meeting to be held December 29, 2015.

|

|

99.3

|

Form of Proxy Card.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

METALINK LTD.

|

|

| |

|

|

|

|

Date: November 20, 2015

|

By: |

/s/ Shay Evron

|

|

| |

|

Shay Evron

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Shay Evron

CFO

Metalink Ltd.

Tel: 972-3-7111690

Fax: 972-3-7111691

Email: Shay.Evron@il.gt.com

METALINK ANNOUNCES 2015 ANNUAL GENERAL MEETING

TEL AVIV, ISRAEL, November 20, 2015 - Metalink Ltd. (OTCQB: MTLK) today announced that its 2015 Annual General Meeting of Shareholders will be held on Tuesday, December 29, 2015, at 1:00 p.m. (Israel time), at the law offices of Goldfarb Seligman & Co., Electra Tower, 98 Yigal Alon Street, Tel Aviv, Israel. The record date for the meeting is the close of business on November 23, 2015.

The agenda of this announced annual general meeting is as follows:

|

|

1.

|

To re-elect Messrs. Tzvi Shukhman, Uzi Rozenberg and Efi Shenhar, as directors;

|

|

|

2.

|

To approve the election of Orly Etzion as an external director of the Company for a three-year period;

|

|

|

3.

|

To reappoint Brightman Almagor Zohar & Co., Certified Public Accountants (Israel), a member of Deloitte Touche Tohmatsu Limited, to serve as the Company’s auditors until immediately following the next annual general meeting of shareholders, and to authorize the Board of Directors of the Company to fix their remuneration in accordance with the volume and nature of their services, or to delegate to the Audit Committee the authority to do so; and

|

|

|

4.

|

To review and consider the audited financial statements of the Company for the year ended December 31, 2014.

|

Items 1-3 require the approval of a simple majority of the ordinary shares represented at the meeting. Item 4 does not require a vote by the shareholders.

In the absence of requisite quorum of shareholders in the meeting, the meeting shall be adjourned to the same day in the next week, at the same time and place, unless otherwise determined at the meeting in accordance with the Company's Articles of Association.

Position Statements etc.

In accordance with the Companies Law, (i) position statements must be delivered to the Company no later than 10 days prior to the meeting date, and (ii) eligible shareholders, holding at least 1% of our outstanding ordinary shares, may present proper proposals for inclusion in the meeting by submitting their proposals to the Company no later than one week following the date hereof and, if the Company determines that a shareholder proposal is appropriate to be added to the agenda in the meeting, the Company will publish a revised agenda in the manner set forth below.

Additional Information and Where to Find It

In connection with the meeting, Metalink will send to its shareholders of record a proxy statement describing the various matters to be voted upon at the meeting, along with a proxy card enabling them to indicate their vote on each matter. The Company will also furnish copies of the proxy statement and proxy card to the Securities and Exchange Commission (SEC) on Form 6-K, which may be obtained for free from the SEC's website at www.sec.gov, or by directing such request to the Company's Investor Relations above.

If applicable, valid position statements and/or a revised meeting agenda will be published by way of issuing a press release and/or submitting a Form 6-K to the SEC (which will be made available to the public on the SEC’s website above).

ABOUT METALINK

Metalink shares are quoted on OTCQB under the symbol “MTLK”. For more information, please see our public filings at the SEC's website at www.sec.gov.

Exhibit 99.2

November 20, 2015

Dear Fellow Shareholder,

You are cordially invited to attend the 2015 Annual General Meeting of Shareholders of Metalink Ltd. to be held on Tuesday, December 29, 2015, at 1:00 p.m. (Israel time), at the law offices of Goldfarb Seligman & Co., Electra Tower, 98 Yigal Alon Street, Tel Aviv, Israel.

We encourage you to read the accompanying Notice and Proxy Statement of the 2015 Annual General Meeting of Shareholders carefully, which discuss in detail the various matters to be voted upon at the meeting.

Your vote is very important to us! Whether or not you plan to attend the meeting, it is important that your shares be represented. Accordingly, you are kindly requested to complete, date and sign the enclosed form of proxy and return it promptly in the pre-addressed envelope provided, so as to be received not later than seventy-two (72) hours before the meeting. No postage is required if mailed in the United States.

We appreciate your continuing interest in Metalink Ltd.

| |

Very truly yours,

|

| |

|

| |

/s/ Uzi Rozenberg

|

| |

|

| |

Chairman of the Board of Directors

|

METALINK LTD.

___________________________

NOTICE OF THE 2015 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 29, 2015

___________________________

To the Shareholders of Metalink Ltd. (“we,” “Metalink” or the “Company”):

Notice is hereby given that the 2015 Annual General Meeting of Shareholders (the “Meeting” or the “2015 Annual General Meeting”) of Metalink will be held on Tuesday, December 29, 2015, at 1:00 p.m. (Israel time), at the law offices of Goldfarb Seligman & Co., Electra Tower, 98 Yigal Alon Street, Tel Aviv, Israel, for the following purposes:

|

1.

|

To re-elect Messrs. Tzvi Shukhman, Uzi Rozenberg and Efi Shenhar, as directors;

|

|

2.

|

To re-elect Ms. Orly Etzion as an external director of the Company;

|

|

3.

|

To reappoint Brightman Almagor Zohar & Co., Certified Public Accountants (Israel), a member of Deloitte Touche Tohmatsu Limited, to serve as the Company’s auditors until immediately following the next annual general meeting of shareholders, and to authorize the Board of Directors of the Company to fix their remuneration in accordance with the volume and nature of their services, or to delegate to the Audit Committee the authority to do so; and

|

|

4.

|

To review and consider the audited financial statements of the Company for the year ended December 31, 2014.

|

These proposals are described more fully in the enclosed proxy statement, which we urge you to read in its entirety. As more fully described in the proxy statement, eligible shareholders may present proper proposals for inclusion in the Meeting by submitting their proposals to the Company no later than November 27, 2015 and, if we determine that a shareholder proposal is appropriate to be added to the agenda in the Meeting, we will publish a revised agenda in the manner set forth in the proxy statement.

The Company’s Board of Directors recommends a vote FOR approval of each of Items 1, 2 and 3. Item 4 will not require a vote by shareholders.

Shareholders of record at the close of business on November 23, 2015 are entitled to notice of, and to vote at, the Meeting. All shareholders are cordially invited to attend the Meeting in person.

Shareholders who are unable to attend the Meeting are requested to complete, date and sign the enclosed form of proxy and to promptly mail it in the enclosed pre-addressed envelope, so as to be received not later than seventy-two (72) hours before the Meeting. No postage is required if mailed in the United States. Detailed proxy voting instructions are provided both in the Proxy Statement and on the enclosed proxy card.

| |

By Order of the Board of Directors,

|

| |

|

| |

/s/ Uzi Rozenberg

|

| |

Chairman of the Board of Directors

|

Dated: November 20, 2015

METALINK LTD.

c/o Fahn Kanne

Derech Menachem Begin 23, Tel Aviv, 66183, Israel

___________________________

PROXY STATEMENT

___________________________

2015 ANNUAL GENERAL MEETING OF SHAREHOLDERS

Introduction

This Proxy Statement is being furnished to holders of ordinary shares, NIS 1.0 nominal value (the “Ordinary Shares”), of Metalink Ltd. (“we,” “Metalink” or the “Company”) in connection with the solicitation of proxies by the Board of Directors for use at the 2015 Annual General Meeting of Shareholders (the “Meeting” or the “2015 Annual General Meeting”), or at any adjournment thereof, pursuant to the accompanying Notice of 2015 Annual General Meeting of Shareholders. The Meeting will be held on Tuesday, December 29, 2015, at 1:00 p.m. (Israel time), at the law offices of Goldfarb Seligman & Co., Electra Tower, 98 Yigal Alon Street, Tel Aviv, Israel.

It is proposed that at the Meeting the following resolutions shall be adopted:

| |

1.

|

To re-elect Messrs. Tzvi Shukhman, Uzi Rozenberg and Efi Shenhar, as directors;

|

| |

2.

|

To re-elect Ms. Orly Etzion as an external director of the Company; and

|

|

|

3.

|

To reappoint Brightman Almagor Zohar & Co., Certified Public Accountants (Israel), a member of Deloitte Touche Tohmatsu Limited, to serve as the Company’s auditors until immediately following the next annual general meeting of shareholders, and to authorize the Board of Directors of the Company to fix their remuneration in accordance with the volume and nature of their services, or to delegate to the Audit Committee the authority to do so.

|

In addition, our audited financial statements for the year ended December 31, 2014 will be reviewed and considered at the Meeting.

The Company currently is not aware of any other matters which will come before the Meeting. If any other matters properly come before the Meeting, the persons designated as proxies intend to vote in accordance with their judgment on such matters.

Recommendation of the Board of Directors

The Company’s Board of Directors recommends a vote FOR approval of all the matters to be voted upon at the Meeting.

Record Date; Outstanding Voting Securities; Quorum

Only holders of record of the Ordinary Shares, as of the close of business on the record date, November 23, 2015 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. As of November 15, 2015, the Company had 2,690,857 Ordinary Shares issued and outstanding. Each Ordinary Share outstanding on the Record Date will entitle its holder to one vote upon each of the matters to be presented at the Meeting.

A quorum must be present in order for the Meeting to be held. The presence, in person or by proxy, of at least two of the Company’s shareholders holding shares that are entitled to vote in the aggregate at least one-third (1/3) of the voting power of the Company on the Record Date will constitute a quorum for the transaction of business at the Meeting. If within an hour from the time appointed for the holding of the meeting a quorum is not present, the meeting shall stand adjourned to Tuesday, January 5, 2016 at the same time and place or any other date and place as the as the Chairman of the Board of Directors may determine with the consent of the holders of a majority of the voting power represented at the meeting in person or by proxy and voting on the question of adjournment. This notice shall serve as notice of such adjourned meeting if no quorum is present at the original date and time, and no further notice of the adjourned meeting will be given to shareholders. At such adjourned meeting, any two shareholders present in person or by proxy shall constitute a quorum.

Abstentions and broker non-votes are counted as shares present for determination of a quorum. For purposes of determining whether a matter is approved by the shareholders, abstentions and broker non-votes will not be treated as either votes “for” or “against” the matter.

Voting and Proxies

Shareholders who are unable to attend the Meeting in person, are requested to complete, date and sign the enclosed form of proxy and return it promptly in the pre-addressed envelope provided, so as to be received by the Company not later than seventy-two (72) hours before the Meeting. No postage is required if mailed in the United States.

If no direction is indicated with respect to any matter on a properly executed proxy, such proxy will be voted in accordance with the Board of Director’s recommendation. If any other matters are properly presented for action at the Meeting (which is currently not anticipated), the proxy holders will vote on such matters in accordance with their best judgment.

A shareholder returning a proxy may revoke it at any time before the exercise thereof by filing with the Company a revocation in writing or a duly executed proxy bearing a later date. In addition, any person who has executed a proxy and is present at the Meeting may vote in person instead of by proxy, thereby canceling any proxy previously given, whether or not written revocation of such proxy has been given. Any written notice revoking a proxy should be sent to Metalink Ltd., c/o Fahn Kanne, Derech Menachem Begin 23, Tel Aviv, 66183, Israel, Attention: Shay Evron, CFO.

Proxies for use at the Meeting are being solicited by the Company’s Board of Directors. Proxies are being mailed to shareholders on or about November 25, 2015 and will be solicited primarily by mail. However, certain of the Company’s officers, directors, employees and agents, none of whom will receive additional compensation therefore, may solicit proxies by telephone, telegram or other personal contact. The Company will bear the cost of the solicitation of proxies, including the cost of preparing, assembling and mailing the proxy material, and will reimburse the reasonable expense of brokerage firms and others for forwarding material to the beneficial owners of the Company’s Ordinary Shares.

Joint holders of shares should take note that, pursuant to the Articles of Association of the Company, the vote of the senior of joint holders of any share who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the vote(s) of the other holder(s) of the share, and for this purpose, seniority will be determined by the order in which the names stand in the Company’s Register of Members.

Position Statements

To the extent you would like to submit a position statement with respect to any of the proposals described in this proxy statement pursuant to the Israeli Companies Law, 5759-1999, you may do so by delivery of appropriate notice to the Company not later than 10 days prior to the meeting date, i.e., by December 19, 2015.

Shareholder Proposals

Pursuant to Section 66(b) of the Companies Law, shareholders who hold at least 1% of our outstanding ordinary shares are generally allowed to submit a proper proposal for inclusion on the agenda of a general meeting of the Company's shareholders. Such eligible shareholders may present proper proposals for inclusion in, and for consideration at, the Meeting by submitting their proposals in writing to our Chief Financial Officer at the following address: Metalink Ltd., c/o Fahn Kanne, Derech Menachem Begin 23, Tel Aviv, 66183, Israel, Attention: Shay Evron, CFO. For a shareholder proposal to be considered for inclusion in the Meeting, our Chief Financial Officer must receive the written proposal no later than November 27, 2015.

In general, a shareholder proposal must be in English and set forth (i) the name, business address, telephone number, fax number and email address of the proposing shareholder (and each member of the group constituting the proposing shareholder, if applicable) and, if not a natural person, the same information with respect to the person(s) that controls and/or manages such person, (ii) the number of ordinary shares held by the proposing shareholder, directly or indirectly, including if beneficially owned by the proposing shareholder (within the meaning of Rule 13d-3 promulgated under the U.S. Securities and Exchange Act of 1934, as amended), and, if any of such Ordinary Shares are held indirectly, an explanation of how they are held and by whom, and, if such proposing shareholder is not the holder of record of any such ordinary shares, a written statement from an authorized bank, broker, depository or other nominee, as the case may be, indicating the number of ordinary shares the proposing shareholder is entitled to vote as of a date that is no more than ten (10) days prior to the date of delivery of the shareholder proposal, (iii) any agreements, arrangements, understandings or relationships between the proposing shareholder and any other person with respect to any securities of the Company or the subject matter of the shareholder proposal, including any derivative, swap or other transaction or series of transactions engaged in, directly or indirectly, by such proposing shareholder, the purpose or effect of which is to give such proposing shareholder economic risk similar to ownership of shares of any class or series of the Company, (iv) the proposing shareholder's purpose in making the proposal, (v) the complete text of the resolution that the proposing shareholder proposes to be voted upon at the shareholders meeting, (vi) a statement of whether the proposing shareholder has a personal interest in the proposal and, if so, a description in reasonable detail of such personal interest, (vii) a declaration that all the information that is required under the Companies Law and any other applicable law to be provided to the Company in connection with such subject, if any, has been provided, (viii) if the proposal is to nominate a candidate for election to the Board of Directors, a questionnaire and declaration, in form and substance reasonably requested by the Company, signed by the nominee with respect to matters relating to his or her identity, address, background, credentials, expertise etc., and his or her consent to be named as a candidate and, if elected, to serve on the Board of Directors, and (ix) any other information reasonably requested by the Company. The Company shall be entitled to publish information provided by a proposing shareholder, and the proposing shareholder shall be responsible for the accuracy thereof. In addition, shareholder proposals must otherwise comply with applicable law. The Company may disregard shareholder proposals that are not timely and validly submitted.

If our Board of Directors will determine that a shareholder proposal is appropriate to be added to the agenda in the Meeting, we will publish a revised agenda for the Meeting no later than December 4, 2015 by way of issuing a press release and/or submitting a Current Report on Form 6-K to the SEC.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of the Company’s Ordinary Shares as of November 15, 2015, by (i) each person who is known by us to own beneficially more than 5% of the outstanding Ordinary Shares and (ii) all directors and officers as a group.

The information contained herein has been obtained from the Company’s records, from information furnished by the individual or entity to the Company or from public filings.

|

|

|

Number of Ordinary

Shares Beneficially

Owned(1)

|

|

|

Percentage of

Outstanding Ordinary

Shares(2)

|

|

|

Tzvi Shukhman (3)

|

|

|

691,030 |

|

|

|

25.68 |

% |

| |

|

|

|

|

|

|

|

|

|

Uzi Rozenberg (4)

|

|

|

477,535 |

|

|

|

17.75 |

% |

| |

|

|

|

|

|

|

|

|

|

Top Alpha Capital s.m. LTD. (5)

|

|

|

670,000 |

|

|

|

24.9 |

% |

| |

|

|

|

|

|

|

|

|

|

Directors and Officers as a group (consisting of 6 persons)

|

|

|

1,168,565 |

|

|

|

43.43 |

% |

|

|

1.

|

Except as otherwise noted and pursuant to applicable community property laws, each person named in the table has sole voting and investment power with respect to all ordinary shares listed as owned by such person. Ordinary shares beneficially owned include shares that may be acquired pursuant to options that are exercisable within 60 days of November 15, 2015.

|

|

|

2.

|

The percentage of outstanding ordinary shares is based on 2,690,857 ordinary shares outstanding as of November 15, 2015. Ordinary Shares deemed beneficially owned by virtue of the right of any person or group to acquire such shares within 60 days of November 15, 2015 are treated as outstanding only for the purposes of determining the percentage owned by such person or group.

|

|

|

3.

|

Includes 100,000 Ordinary Shares issuable upon exercise of stock options, exercisable within 60 days of November 15, 2015, at an exercise price of $1.50 per share.

|

|

|

4.

|

Includes 100,000 Ordinary Shares owned of record by U.S.R. Electronic Systems (1987) Ltd., an Israeli company, wholly owned by Mr. Rozenberg and his wife, Mrs. Shoshana Rozenberg.

|

|

|

5.

|

As of January 26, 2015, based on a Schedule 13D filed by Top Alpha Capital s.m. Ltd. with the Securities and Exchange Commission (“SEC”) on January 28, 2015.

|

PROPOSALS FOR THE 2015 ANNUAL GENERAL MEETING

ITEM 1 – ELECTION OF DIRECTORS

(Item 1 on the Proxy Card)

Background

The Company currently has a Board of five directors, including two external directors. Directors of the Company, other than the external directors, are elected at each annual meeting of shareholders.

At the Meeting, shareholders will be asked to re-elect the following three (3) directors to serve as members of the Company’s Board of Directors: (1) Tzvi Shukhman; (2) Uzi Rozenberg; and (3) Efi Shenhar.

It is intended that proxies (other than those directing the proxy holders to vote against the listed nominees or for certain of them or to abstain) will be voted for the election of the three (3) nominees named above as directors of the Company, each to hold office until the next annual general meeting or until his successor shall have duly taken officer.

In the event any one or more of such nominees should be unable to serve, the proxies will be voted for the election of such other person or persons as shall be determined by the persons named in the proxy in accordance with their best judgment. The Company is not aware of any reason why any of the nominees, if elected, should be unable to serve as a director. In addition, the Company is not aware of any understandings or agreements with respect to the future election of any nominees named herein.

Other than Mr. Rozenberg and Mr. Shenhar, who are brothers, there are no family relations between the nominees named below.

The following information is supplied with respect to each person nominated and recommended to be elected by the Board of Directors of the Company and is based upon the records of the Company and information furnished to it by the nominees. Reference is made to the above chart entitled “Ownership of Ordinary Shares” for information pertaining to share ownership by certain nominees. If re-elected, the nominees will be entitled to the compensation described under "Executive Compensation" below.

A brief biography of each director nominee is set forth below:

Tzvi Shukhman, 54, a co-founder of the Company, served as the Company’s Chief Executive Officer from the Company’s inception in 1992 until March 2015 and as Chairman of the Company’s Board of Directors from the Company’s inception in 1992 until December 2007. Prior to May 1999, Mr. Shukhman served as the Company’s President. From March 1989 until March 1993, Mr. Shukhman served as an independent consultant for RAD Data Communications Ltd. and ECI Telecom Ltd. Prior thereto, Mr. Shukhman served in the Israel Defense Forces where he founded a group involved in digital signal processing applications. Mr. Shukhman has an M.Sc. degree from the Technion, Israel Institute of Technology.

Uzi Rozenberg, 56, a co-founder of the Company, has served as a director from 1992 until 1997 and August 1999 to the present, and as Chairman of the Company’s Board of Directors from December 2007 to the present. Mr. Rozenberg is also the founder and Chairman of USR Electronics Systems (1987) Ltd. since February 1987. Mr. Rozenberg served as a director of Orbot Ltd. from 1992 to 1996 and as a director of Gibor Sport Ltd. from 1993 to 1997. Mr. Rozenberg and Mr. Shenhar are brothers.

Efi Shenhar, 59, has served as a director since July 1995. Mr. Shenhar is the Corporate Chief Executive Officer & President of USR Group. Mr. Shenhar currently serves as a member of the board of directors of USR Electronic Systems (1987) Ltd. From March 1987 until February 2003, Mr. Shenhar has served as a Vice President of USR Electronics Systems (1987) Ltd., an electronic manufacturing services company. Mr. Shenhar has a B.A. in accounting and economics from Tel Aviv University and an M.B.A. from Herriot Watt University. Mr. Shenhar is a certified public accountant. Mr. Shenhar and Mr. Rozenberg are brothers.

The Proposed Resolution

It is proposed that at the Meeting the following resolutions be adopted:

“RESOLVED, that Tzvi Shukhman be re-elected to serve as a member of the Board of Directors of the Company, effective immediately.”

“RESOLVED, that Uzi Rozenberg be re-elected to serve as a member of the Board of Directors of the Company, effective immediately.”

“RESOLVED, that Efi Shenhar be re-elected to serve as a member of the Board of Directors of the Company, effective immediately.”

Required Vote

Approval of this matter will require the affirmative vote of the holders of a majority of the Ordinary Shares represented at the Meeting, in person or by proxy, and voting on this matter.

The Board of Directors recommends that the shareholders vote FOR the election of the said nominees.

Executive Compensation

General

The aggregate remuneration we paid for the year ended December 31, 2014 to our executive officers as a group was approximately $103,000 in salaries, fees, commissions and bonuses (excluding our CFO, who is hired through an external CPA firm that provides services to Metalink). There were no amounts set aside or accrued to provide for pension, retirement or similar benefits.

Members of our board of directors (other than external directors) who are not executive officers do not receive compensation for their service on the board of directors or any committee of the board of directors, but they are reimbursed for their expenses for each board of directors meeting attended. External directors receive fixed compensation for their service on the board of directors or any committee of the board of directors of NIS 42,600 (equivalent to approximately $11,000) on an annual basis, and in addition, receive compensation for their participation in any board of directors or committee meetings of NIS 2,200 per meeting attended (equivalent to approximately $550).

Other than officers of the Company who serve as directors, no directors have arrangements to receive benefits upon termination of employment.

We have obtained directors' and officers' liability insurance with coverage of $3.0 million in aggregate. In addition, we entered into indemnification agreements with our directors and executive officers in accordance with our Articles of Association.

Compensation of Executive Officers

We only had two executive officers during 2014, both of whom were engaged through a consultancy arrangement (with them directly or with the firm they work with). The table below reflects the compensation granted to them during or with respect to the year ended December 31, 2014. We refer to these individuals for whom disclosure is provided herein as our “Covered Executives.”

All amounts reported in the table are in terms of cost to the Company, as recognized in our financial statements for the year ended December 31, 2014.

|

Name and Principal Position (1)

|

|

Consultancy Fees ($)

|

|

|

Bonus ($) (2)

|

|

|

Total ($)

|

|

|

Tzvi Shukhman, Former CEO and Director (3)

|

|

|

100,000 |

|

|

|

3,358 |

|

|

|

103,358 |

|

|

Shay Evron, CFO and Acting CEO (4)

|

|

|

53,707 |

|

|

|

N/A |

|

|

|

53,707 |

|

____________________

|

(1)

|

Neither of our Covered Executives was engaged on a full-time (100%) basis.

|

|

(2)

|

Represents annual bonuses granted to the Covered Executives based on formulas set forth in their respective arrangements.

|

|

(3)

|

For additional details, see the Consultancy Agreement by and between Mr. Shukhman and the Company, a copy of which was filed Exhibit 4.17 to the Registrant's Annual Report on Form 20-F filed with the SEC on April 30, 2012. Effective as of March 31, 2015, Mr. Shukhman resigned from his position as CEO.

|

|

(4)

|

Paid to Fahn Kanne Consulting Ltd. a subsidiary of Fahn Kanne & Co., the Israeli member firm of Grant Thornton International Ltd. (Grant Thornton International), as part of the CFO services provided to Metalink. Effective as of March 31, 2015, Mr. Evron serves as our Acting CEO.

|

ITEM 2 – ELECTION OF EXTERNAL DIRECTOR

(Item 2 on the Proxy Card)

Background

Companies incorporated under the laws of Israel whose shares have been offered to the public inside or outside of Israel are required by the Companies Law to appoint at least two external directors.

To qualify as an external director, an individual (or the individual’s relative, partner, employer or any entity under the individual's control) may not have, and may not have had at any time during the previous two years, any "affiliation" with (i) the company, the company's controlling shareholder or its relative, or another entity affiliated with the company or its controlling shareholder, or (ii) in a company without a controlling shareholder (or a shareholder that owns more than 25% of its voting power), such as Metalink, affiliation with any person who, at the time of appointment, is the chairman, the chief executive officer, the chief financial officer or a 5% shareholder of the company. Under the Companies Law, the term “affiliation” includes: an employment relationship; a business or professional relationship; control; and service as an office holder. In addition, no individual may serve as an external director if the individual’s position or other activities create or may create a conflict of interest with his or her role as an external director.

Under the Companies Law, each committee of a company’s board of directors empowered with powers of the board of directors is required to include at least one external director, except that the audit and compensation committees must be comprised of at least three directors, including all of the external directors.

The external directors generally must be elected by the shareholders. The initial term of an external director is three years and he or she may be reelected for up to two additional terms of three years each.

Pursuant to the Companies Law, (1) an external director must have either “accounting and financial expertise” or “professional qualifications” (as such terms are defined in regulations promulgated under the Companies Law) and (2) at least one of the external directors must have “accounting and financial expertise.”

Ms. Orly Etzion was elected as an external director for a term of three years at the 2009 annual shareholders meeting and was re-elected as an external director for an additional term of three years on December 31, 2012 for a three-year term that expires on December 31, 2015. Pursuant to the recommendation of our Board of Directors, shareholders will be asked at the meeting to re-elect Ms. Etzion as an external director for an additional term of three years.

The Company has received a declaration from Ms. Etzion, confirming her qualifications under the Companies Law to be elected as an external director of the Company. In addition, our Board of Directors has determined that Ms. Etzion satisfies the requisite accounting and financial expertise described above. If re-elected, the nominee will be entitled to the compensation described under "Executive Compensation" in Item 1 above.

A brief biography of the nominee is set forth below. Such information is based upon the records of the Company and information furnished to it by the nominee:

Orly Etzion, 54, has served as an external director of the Company since December 2009. She is currently the CFO of Page 3 Ltd. From February 2005 until March 2009, Ms. Etzion served as the CFO of Precede Technologies Ltd. From May 2004 until January 2005, Ms. Etzion served as the CFO of The People's Voice, Ltd. From October 2002 until April 2004, Ms. Etzion served as the Manager of finance at Millimetrix Broadband Networks Ltd. and from March 1998 until February 2002 Ms. Etzion served as the controller of Chromatis networks Ltd. Ms. Etzion holds a BA degree in Economics from the Tel Aviv University, an M.B.A. degree, specializing in Finance, from The Colman College and an LLB degree from The Academic Center of Law & Science.

The Proposed Resolution

It is proposed that at the Meeting the following resolution be adopted:

“RESOLVED, that Ms. Orly Eztion be and hereby is re-elected to the Board of Directors for a three-year term as an external director, commencing December 31, 2015.”

Required Vote

Approval of the above resolution regarding appointment of the external director will require the affirmative vote of a majority of Ordinary Shares present at the meeting, in person or by proxy, and voting on the resolution, provided that (i) the shares voting in favor of such resolution include at least a majority of the shares voted by shareholders who are neither “controlling shareholders” (as such term is defined in the Companies Law) nor having a "personal interest" in the resolution as a result of relationship with the controlling shareholder, or (ii) the total number of shares voted against the resolution by the disinterested shareholders described in clause (i) does not exceed two percent (2%) of our outstanding shares.

The Companies Law requires that each shareholder voting on the proposed resolution indicate whether or not the shareholder has a personal interest in the proposed resolution, which, in this case, means a "personal interest" in the appointment merely as a result of such shareholder's relationship with the controlling shareholder. However, as of the date hereof, the Company has no controlling shareholders within the meaning of the Companies Law.

The Board of Directors recommends that the shareholders vote FOR the re-election of Orly Etzion.

ITEM 3 - REAPPOINTMENT OF AUDITORS

(Item 3 on the Proxy Card)

At the Meeting, the shareholders will be asked to approve the reappointment of Brightman Almagor Zohar & Co., Certified Public Accountants (Israel), a member of Deloitte Touche Tohmatsu Limited, as the Company’s auditors until the next annual general meeting of shareholders. The auditors have no relationship with us or with any of the Company’s affiliates except as auditors and, to a limited extent, as tax consultants. The Audit Committee and Board of Directors believe that such limited non-audit function does not affect the independence of Brightman Almagor Zohar & Co.

At the Meeting, the shareholders will also be asked to authorize the Board of Directors of the Company to fix the compensation of the Company’s auditors in accordance with the volume and nature of their services, or to delegate such power to the Audit Committee of the Board of Directors. With respect to the year 2014, the Company paid Brightman Almagor Zohar & Co. and its affiliates approximately $21,000 for auditing and tax related services.

It is proposed that at the Meeting the following resolutions be adopted:

“RESOLVED, that Brightman Almagor Zohar & Co., certified Public Accountants (Israel) a member of Deloitte Touche Tohmatsu Limited, is hereby appointed as the auditors of the Company until immediately following the next annual general meeting of shareholders.”

“RESOLVED, that the Board of Directors of the Company be authorized to fix the compensation of the independent auditors in accordance with the volume and nature of their services, or to delegate such power to the Audit Committee of the Board of Directors.”

Approval of this matter will require the affirmative vote of a majority of the Ordinary Shares present at the Meeting, in person or by proxy, and voting on this matter.

The Board of Directors recommends that the shareholders vote FOR approval of the above resolutions.

REVIEW AND CONSIDERATION OF THE FINANCIAL STATEMENTS

In accordance with applicable Israeli law, at the Meeting, the audited financial statements of the Company for the year ended December 31, 2014 and the related auditor’s report in respect thereof will be presented and discussed.

The audited financial statements of the Company for the year ended December 31, 2014 and the related auditor’s report were filed with the SEC as part of our Annual Report on Form 20-F on April 22, 2015, which is available at the SEC’s website, www.sec.gov.

Any shareholder may receive a copy of the said Annual Report on Form 20-F, without charge, upon written request to the Company. None of the auditors’ report or the financial statements form part of the proxy solicitation material.

This item will not involve a vote of the shareholders.

OTHER MATTERS

It is not anticipated that any matters other than those on the agenda described above will be presented at the Meeting. If any other matters are properly presented to the Meeting, the persons named on the enclosed proxy will have discretionary authority to vote all proxies on such matters in accordance with their best judgment.

| |

/s/ Uzi Rozenberg

|

| |

Chairman of the Board of Directors

|

Dated: November 20, 2015

10

Exhibit 99.3

METALINK LTD.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Shay Evron and Efi Shenhar, or either of them, attorneys or attorney of the undersigned, for and in the names(s) of the undersigned, with power of substitution and revocation in each to vote any and all ordinary shares of Metalink Ltd. (the "Company"), which the undersigned would be entitled to vote as fully as the undersigned could if personally present at the Annual General Meeting of Shareholders of the Company to be held on December 29, 2015 at 1:00 p.m. at the law offices of Goldfarb Seligman & Co., Electra Tower, 98 Yigal Alon Street, Tel Aviv, Israel, and at any adjournment or adjournments thereof, hereby revoking any prior proxies to vote said shares, upon the following item of business more fully described in the notice of and proxy statement for such Annual General Meeting of Shareholders (receipt of which is hereby acknowledged):

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS SPECIFIED. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR (i) THE ELECTION OF THE NOMINEES FOR DIRECTOR IN ITEM 1, (ii) THE ELECTION OF ORLY ETZION AS AN EXTERNAL DIRECTOR AND (iii) PROPOSAL 3. THE PROXIES ARE AUTHORIZED IN THEIR DISCRETION TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING, OR ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF.

(Continued and to be signed on the reverse side)

2015 ANNUAL GENERAL MEETING OF SHAREHOLDERS

OF

METALINK LTD.

December 29, 2015

|

Ø

|

Please sign, date and mail your proxy card in the envelope provided as soon as possible.

|

|

Ø

|

Please detach along perforated line and mail in the envelope provided.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES FOR DIRECTOR IN ITEMS 1 AND 2 AND FOR PROPOSAL 3 . PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x.

|

1.

|

The election of three directors.

|

| |

[ ]

|

WITHHOLD AUTHORITY FOR ALL NOMINEES

|

| |

[ ]

|

FOR ALL EXCEPT (See instructions below)

|

NOMINEES:

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: (X)

|

2.

|

To approve the election of Orly Etzion as an external director of the Company for a three-year period.

|

|

o FOR

|

o AGAINST

|

o ABSTAIN

|

|

3.

|

To approve the reappointment of Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu Limited, as independent auditors and that the Board of Directors of the Company be authorized to fix the compensation of the independent auditors.

|

|

o FOR

|

o AGAINST

|

o ABSTAIN

|

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method.

Signature of Shareholder __________________________ Date _____________, 2015

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

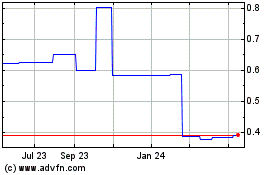

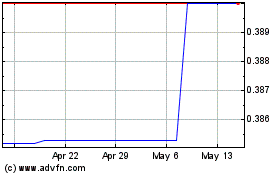

Metalink (PK) (USOTC:MTLK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Metalink (PK) (USOTC:MTLK)

Historical Stock Chart

From Jul 2023 to Jul 2024