UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| MAPTELLIGENT, INC. |

| (Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

MAPTELLIGENT, INC.

2831 St Rose Pkwy, Suite 297

Henderson, NV 89052

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on July 6, 2023

1:00PM Eastern Standard Time

TO THE SHAREHOLDER OF MAPTELLIGENT, INC.:

The Annual Meeting of the shareholders of Maptelligent, Inc., a Nevada corporation (the “Company”), will be held virtually on July 6, 2023, at 1:00PM Eastern Standard Time, and will be accessible virtually at www.virtualshareholdermeeting.com/MAPT2023, for the following purposes:

1. To elect the following three (3) persons to serve as directors of the Company until the 2024 Annual Meeting of Shareholders and thereafter: Richard Ziccardi, Glenn Corso, and Joseph Cosio-Barron;

2. To the ratify appointment of Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC), as Company’s independent accountants, for the fiscal year ending December 31, 2023;

3. To approve an amendment to our Articles of Incorporation, as amended (the “Articles of Incorporation” or “Charter”), to effect, at the discretion of our Board of Directors, a reverse stock split of our common stock at a stock split ratio between 1-for-[400] and 1-for-[600], with the ultimate ratio to be determined by the Board of Directors in its sole discretion (the “Reverse Stock Split”), the implementation and timing of which shall be subject to the discretion of the Board of Directors; and

4. To transact any other business as may properly be presented at the Annual Meeting or any adjournment thereof.

A proxy statement providing information and a form of proxy to vote with respect to the foregoing matters accompany this notice.

| By Order of the Board of Directors, | |

| /s/ Joseph Cosio-Barron | |

| Joseph Cosio-Barron | |

| Chief Executive Officer | |

Dated: May 11, 2023

IMPORTANT

Whether or not you expect to attend the Annual Meeting, please complete, date and sign the accompanying proxy card and return it promptly in the enclosed return envelope or follow the instructions contained in the Proxy Materials to vote on the Internet or by telephone. If you grant a proxy, you may revoke it at any time prior to the Annual Meeting and will still have the opportunity to vote in person at the Annual Meeting.

PLEASE NOTE: If your shares are held in street name, your broker, bank, custodian or other nominee holder cannot vote your shares in the election of directors unless you direct the nominee holder how to vote by marking your proxy card.

Maptelligent, Inc.

2831 St Rose Pkwy, Suite 297

Henderson, NV 89052

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS

to be held on July 6, 2023

PROXY SOLICITATION

The Company is soliciting proxies on behalf of the Board of Directors in connection with the Company’s annual meeting of shareholders on July 6, 2023, and at any adjournment thereof. The Company will bear the entire cost of preparing, assembling, printing and mailing this Proxy Statement, the accompanying proxy card, and any additional materials that may be furnished to shareholders. In addition, the Company will reimburse nominee holders their forwarding costs. Broadridge Financial Solutions, Inc. has been engaged to solicit proxies and distribute materials to brokers, banks, custodians, and other nominee holders for forwarding to beneficial owners of the Company’s stock, and the Company will pay for these services and reimburse certain of its expenses. Proxies also may be solicited through the mail or direct communication with certain shareholders or their representatives by Company officers, directors or employees, who will receive no additional compensation for their efforts.

On or about May 18, 2023, the Company will mail to all shareholders of record, as of May 11, 2023 (the “Record Date”), a copy of this Proxy Statement, the proxy card and the Company’s Annual Report.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares on the Record Date. As of the close of business on the Record Date, a total of 753,377,477shares of common stock are entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on all matters presented at the Annual Meeting.

As of the Record Date, the Company also had 98,796 shares of Series A Preferred Stock and 20 shares of Series C Preferred Stock outstanding. Holders of shares of Series C Preferred Stock are entitled to vote on all matters at the Annual Meeting, other than the reverse stock split.

If I am a shareholder of record, how do I cast my vote?

We encourage you to vote your proxy over the Internet or telephone. You may vote by proxy over the Internet by going to www.virtualshareholdermeeting.com/MAPT2023, to complete an electronic proxy card or you may submit your vote by calling 1-800-690-6903. In order to ensure that your vote counts, we must receive your vote must by no later than 11:59 p.m. U.S. Eastern Time on July 5, 2023.

We provide Internet proxy voting to allow you to vote your shares on-line, using procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from your Internet service provider and telephone company.

You may also vote by proxy using the enclosed proxy card. If you choose to vote using the proxy card, please complete, sign and date your proxy card and return it promptly in the envelope provided.

If you are a shareholder of record, you may also vote in person at the Annual Meeting. We will give you a ballot when you arrive.

What if other matters come up at the Annual Meeting?

The matters described in this proxy statement are the only matters we know of that will be voted on at the Annual Meeting. If other matters are properly presented at the meeting, the proxy holders will vote your shares as they see fit.

Can I change my vote after I return my proxy card?

Yes. You can revoke your proxy at any time before it is exercised at the Annual Meeting in any of three ways:

| · | by submitting written notice revoking your proxy card to the Secretary of the Company; |

| | |

| · | by submitting another proxy via the Internet or by mail that is dated after your original proxy vote and, if by mail, it is properly signed; or |

| | |

| · | by voting in person at the Annual Meeting. |

Can I vote in person at the Annual Meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card or vote by proxy on the Internet to ensure that your vote is counted, you can attend the Annual Meeting and vote your shares in person.

Why are we seeking shareholder approval for these proposals?

Proposal No. 1: To elect the following three (3) persons to serve as directors of the Company until the 2024 Annual Meeting of Shareholders and thereafter: Richard Ziccardi, Glenn Corso, and Joseph Cosio-Barron.

Proposal No. 2: The Company appointed Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC) to serve as the Company’s independent auditors for the fiscal year ending December 31, 2023. The Company elects to have its shareholders ratify such appointment.

Proposal No. 3: The Company is seeking approval for an amendment to our Certificate of Amendment to Articles of Incorporation (the “Articles of Incorporation” or “Charter”), to effect, at the discretion of our Board of Directors, a reverse stock split of our common stock at a stock split ratio between 1-for-[400] and 1-for-[600], with the ultimate ratio to be determined by the Board of Directors in its sole discretion (the “Reverse Stock Split”) as may be deemed necessary to solicit interest from new investors, the implementation and timing of which shall be subject to the discretion of the Board of Directors.

Votes Required to Approve each Proposal

The holders of a majority in interest of all stock issued, outstanding and entitled to vote at a meeting, present in person or represented by proxy will constitute a quorum for the transaction of business at the Annual Meeting. Shares of common stock represented in person or by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

The following votes are required for approval of the proposals being presented at the Annual Meeting:

Proposal No. 1: Election of Directors. Votes may be cast: “FOR ALL” nominees, “WITHHOLD ALL” nominees or “FOR ALL EXCEPT” those nominees noted by you on the appropriate portion of your proxy or voting instruction card. At the Meeting, three (3) directors are to be elected, which number shall constitute our entire Board, to hold office until the next annual meeting of shareholders and until their successors shall have been duly elected and qualified., Directors are to be elected by a [plurality] of the votes of the shares present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. This means that the three candidates receiving the highest number of affirmative votes at the Meeting will be elected as directors. Proxies cannot be voted for a greater number of persons than the number of nominees named or for persons other than the named nominees. Withholding a vote from a director nominee will not be voted with respect to the director nominee indicated and will have no impact on the election of directors although it will be counted for the purposes of determining whether there is a quorum. Broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 2: To Ratify the Selection of Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” The affirmative vote of the holders of shares of common stock representing a majority of the shares of common stock cast at the meeting in person or by proxy is required for the ratification of the selection of Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC) as our independent registered public accounting firm for the current fiscal year. Abstentions will have no effect on the outcome of this proposal. There will be no broker non-votes with respect to this proposal.

Proposal No. 3: To Approve an Amendment to the Company’s Articles of Incorporation. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN. The affirmative vote of holders of shares of common stock representing a majority of the outstanding voting shares of common stock is required for the approval of this proposal to amend the Company’s Articles of Incorporation. Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present at the Annual Meeting for purposes of this proposal.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For,” “Abstain” and “Against” votes, and broker non-votes. Abstentions will not be counted as votes for any matter.

Who pays for this proxy solicitation?

We do. In addition to sending, you these materials and posting them on the Internet, some of our employees may contact you by telephone, by mail, by fax, by email or in person. None of these employees will receive any extra compensation for doing this. We may reimburse brokerage firms and other custodians for their reasonable out-of- pocket costs in forwarding these proxy materials to shareholders.

Is my vote kept confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| · | as necessary to meet applicable legal requirements; |

| | |

| · | to allow for the tabulation and certification of votes; and |

| | |

| · | to facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be disclosed in a Current Report on Form 8-K, which will be timely filed after the Annual Meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees to the Board of Directors

All of our directors hold office for one-year terms until the election and qualification of their successors. Officers are appointed by our Board and serve at the discretion of the Board, subject to applicable employment agreements. The following table sets forth information relating to our executive officers and members of our Board.

| Name | | Age | | Position |

| Joseph A. Cosio-Barron | | 73 | | CEO, President, CCO and Director |

| Richard Ziccardi | | 56 | | CFO and Director |

| Glenn Corso | | 60 | | Chairman |

Joseph A. Cosio-Barron. Mr. Cosio-Barron is an accomplished professional with many years’ experience working within the intricacies of people management and regulatory legal compliance to ensure the viability of publicly held corporations listed on the stock exchanges. From 2016 to 2019, Mr. Cosio-Barron served as President of Las Vegas Xpress, Inc., which provided passenger rail excursions in the U.S. From 2007 to 2016, Mr. Cosio-Barron served as Executive Vice President of Las Vegas Railway Express, Inc., which also provided passenger rail excursions in the U.S. From 2004 to 2007, Mr. Cosio-Barron served as President of Shearson Home Loans, a national mortgage bank. From 2002 to 2004, Mr. Cosio-Barron co-founded Liberty Capital, a $100 million asset management company based in Las Vegas, Nevada. From 1996 to 2002, Mr. Cosio-Barron served as the Managing Partner and President of CBS Consultants, Inc., a California Corporation which was a financial firm offering highly specialized services in development and lending for hotels, resorts, and casinos to include regulatory legal compliance. From 1991 to 1996, Mr. Cosio-Barron served as the Executive Vice President of Finet Holdings Corporation, a Delaware Corporation. As Executive Vice President, he was entirely responsible for the coordination of all regulatory legal compliance and the management of the sales of the staff for all the branch offices. From 1980 to 1990, Mr. Cosio-Barron served as President of Terra West Construction, a company, which he founded which in addition to building single-family subdivisions, strip, centers, duplex and four-plex units also developed syndications and formed limited partnerships for large-scale developments throughout California. From 1973 to 1980, Mr. Cosio-Barron served as Senior Vice- President of Multi-Financial Corporation, a California Corporation which was a real estate investment firm that both owned and managed commercial, retail, and residential income properties in Northern California.

Richard Ziccardi. Mr. Ziccardi is a financial professional with over 30 years of experience in Banking, Insurance and Investments with a business focus on financial products. During his working career Mr. Ziccardi has held various roles including, but not limited to: Product Manager, LOB Controller, Chief of Staff, CAO, and Global Head of Revenue and RFP Pricing while supporting the servicing of Exchange Traded Funds, Mutual Funds, Hedge Funds, Private Equity, REITs and Variable Annuities. In these capacities, Mr. Ziccardi has worked on Mergers and Acquisition integrations, Client Profitability Modelling, Revenue Maximization, Sales and Client Engagement, New Product Development, Vendor Contract Negotiations, Efficiency and Expense Reduction Initiatives, Recruiting, Hiring, Training, Employee Engagement and Retention. From 2001 - 2020, Mr. Ziccardi was employed at the Bank of New York Mellon in various roles and titles including CAO and Managing Director, and up to February 2020, Mr. Ziccardi was Global Head of Revenue Control - Asset Servicing. Mr. Ziccardi holds a Bachelor of Business Administration - Accounting - Hofstra University.

Glenn Corso. Mr. Corso has over 40 years of experience in manufacturing and business operations in Diagnostic Medical and Industrial Real Time X-Ray equipment manufacturing companies. Mr. Corso became President and CEO of Precise Optics/Photo Medic Equipment, Inc. in 1995 and President and CEO of Tecnomed USA (Bay Shore Medical Equipment Corp.) in 1990. Since 2000, Mr. Corso has owned and operated Consol Air, Inc., a company that owns and operates a Beechcraft Baron 58P which he charters for flights around the east coast. Mr. Corso worked in all aspects of the businesses from machine shop, inspection, assembly, design and production, regulatory oversight, technical writing, and ultimately management.

Family Relationships

There are no family relationships among and between our directors, officers, persons nominated or chosen by the Company to become directors or officers, or beneficial owners of more than five percent (5%) of the any class of the Company’s equity securities.

Involvement in Certain Legal Proceedings

To our knowledge, during the past ten years, none of our directors, executive officers, promoters, control persons, or nominees has:

| · | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| · | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| · | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| | been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| · | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| · | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Board Operations

All directors hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified. Directors elected at the annual meetings serve for one-year terms. Officers are elected by, and serve at the discretion of, the Board. Our Board shall hold meetings on at least a quarterly basis.

The Board has not designated a lead director. The independent directors can call and plan their executive sessions collaboratively and, between meetings of the Board, communicate with management and one another directly. Under these circumstances, the directors believe designating a lead director to take on responsibility for functions in which they all currently participate might detract from rather than enhance performance of their responsibilities as directors.

The Board receives regular reports from the Chief Executive Officer and members of senior management on operational, financial, legal and regulatory issues and risks. The Board additionally is charged with oversight of financial risk, including the Company’s internal controls, and it receives regular reports from management, the Company’s internal auditors and the Company’s independent auditors.]

The Company’s Board held 3 meetings and acted by written consent on 3 occasions during the year ended December 31, 2022. During that time, no director attended fewer than 75% of the meetings of the Board.

Board Committees

The Company does not have an audit committee, compensation committee, nor nominating and governance committee because of the small size and early stage of the Company.

Code of Business Conduct and Ethics

At this time, the Company does not have a code of business conduct and ethics that applies to all our employees, officers and directors, including those officers responsible for financial reporting. In the event that we adopt this in the future, we will make the code of business conduct and ethics available on our website at www.maptelligent.com. We intend to post any amendments to the code, or any waivers of its requirements, on our website.

Insider Trading Policy

The Company has adopted an insider trading policy to help the Company’s employees comply with federal and state securities laws, prevent insider trading and govern the terms and conditions at which the employees can trade in the Company’s securities.

Indemnification of Directors and Officers

The Nevada Revised Statutes permits a corporation to indemnify its directors and officers against expenses, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with a pending or completed action, suit or proceeding if the officer or director acted in good faith and in a manner the officer or director reasonably believed to be in the best interests of the corporation.

Our certificate of incorporation provides that, except in certain specified instances, our directors shall not be personally liable to us or our stockholders for monetary damages for breach of their fiduciary duty as directors, except for the following:

| | · | any breach of their duty of loyalty to our company or our stockholders; |

| | | |

| | · | acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; |

| | | |

| | · | unlawful payments of dividends or unlawful stock repurchases or redemptions as provided under the provisions of the Nevada Revised Statutes; and |

| | | |

| | · | any transaction from which the director derived an improper personal benefit. |

In addition, our certificate of incorporation and bylaws obligate us to indemnify our directors and officers against expenses and other amounts reasonably incurred in connection with any proceeding arising from the fact that such person is or was an agent of ours. Our bylaws also authorize us to purchase and maintain insurance on behalf of any of our directors or officers against any liability asserted against that person in that capacity, whether or not we would have the power to indemnify that person under the provisions of the Nevada Revised Statutes. We expect to continue to enter into agreements to indemnify our directors and officers as determined by our Board of Directors. These agreements provide for indemnification of related expenses including attorneys’ fees, judgments, fines, and settlement amounts incurred by any of these individuals in any action or proceeding. We believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons as directors and officers.

The limitation of liability and indemnification provisions in our certificate of incorporation and bylaws may discourage stockholders from bringing a lawsuit against our directors for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and other stockholders. Furthermore, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against directors and officers as required by these indemnification provisions. At present, there is no pending litigation or proceeding involving any of our directors, officers or employees regarding, which indemnification is sought, and we are not aware of any threatened litigation that may result in claims for indemnification.

Insofar as the provisions of our certificate of incorporation or bylaws provide for indemnification of directors or officers for liabilities arising under the Securities Act of 1933, as amended, or the Securities Act, we have been informed that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Indemnification Agreements

To date, we have no specific indemnification agreements with our directors or executive officers. However, our officers and directors are entitled to indemnification through our bylaws and to the extent allowed pursuant to the Nevada Revised Statutes, federal securities law and our directors and officers liability insurance.]

Director Compensation

We reimburse all members of our board of directors for their direct out-of-pocket expenses incurred in attending meetings of our board. This table summarizes the compensation paid to each of our independent directors who served in such capacity during the fiscal year ended December 31, 2022.

| Name | | Fees Earned or Paid in Cash ($USD) | | | Stock Based Awards ($USD) | | | Others ($USD) | | | Total ($USD) | |

| Glenn Corso 2022 | | $0 | | | $0 | | | $0 | | | $0 | |

| 2021 | | $ | | | | $ | 175,000 | | | | | | $ | 175,000 | |

[Directors will be reimbursed for reasonable expenses incurred in connection with the performance of their duties. No additional director compensation has been awarded to any directors who were serving as executive officers for the fiscal years ended December 31, 2022 and 2021.]

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Our common stock is not registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, our executive officers and directors and persons who own more than 10% of a registered class of our equity securities are not subject to the beneficial ownership reporting requirements of Section 16(a) of the Exchange Act.

EXECUTIVE OFFICE COMPENSATION

Summary Compensation Table

The following table presents information regarding the total compensation earned by our executive officers who were serving as executive officers as of December 31, 2022 for services rendered in all capacities to us for the fiscal years ended December 31, 2022 and 2021.

| | | Fiscal | | Salary | | | Bonus | | | Stock Awards | | | Option Awards | | | Non-Equity Incentive Plan Compensation | | | All Other Compensation | | | Total | |

| Name and Position | | Year | | ($) | | | ($) | | | ($)(1) | | | ($) | | | ($) | | | ($) | | | ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Joseph A. Cosio- Barron(2) | | 2022 | | | 150,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 150,000 | |

| CEO and President | | 2021 | | | 150,000 | | | | - | | | | 55,000 | | | | - | | | | - | | | | - | | | | 205,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Richard Ziccardi(3) | | 2022 | | | 150,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 150,000 | |

| CFO and Treasurer | | 2021 | | | 150,000 | | | | - | | | | 46,667 | | | | - | | | | - | | | | - | | | | 196,667 | |

| (1) | For valuation purposes, the dollar amount shown is calculated based on the grant date fair value computed in accordance with FASB ASC Topic 718. The number of shares granted, the grant date, and the market price of such shares are set forth below. |

| (2) | Joseph A. Cosio-Barron has served as our Chief Executive Officer from February 28, 2021 through the present. Mr. Cosio-Barron was appointed a Director of the Board on July 27, 2020. |

| (3) | Richard Ziccardi has served as our Chief Financial Officer from October 9, 2020, through the present. |

Employment Agreement with Joseph A. Cosio-Barron

On January 1, 2021, the start date of Joseph Cosio-Barron’s employment agreement with us, we entered into an Executive Agreement with Mr. Cosio-Barron (the “Agreement”), setting out his annual salary of $150,000 per year, plus the issuance of a bonus issuance of 2,000,000 shares of our Common Stock on the Agreement. On June 8, 2021, Mr. Cosio-Barron was issued 5,500,000 shares of our Common Stock as compensation. During the Term of this Agreement, Executive will be entitled to participate in an annual incentive compensation plan of the Company, as established and revised by the Board from time to time. The Agreement target annual bonus will be twenty five percent (25%) of the Base Salary in effect for such year (the “Target Bonus”), and the actual annual bonus may be more or less as determined by the Board of Directors, and will be determined based primarily upon (i) the achievement of certain corporate performance goals, as may be established and approved by from time to time by the Board of Directors, (ii) the achievement of personal performance goals as may be established by the CEO, and (iii) the overall goals and objectives of the Company. The annual bonus will only be paid at such time and in such manner as set forth in the annual incentive compensation plan document.

Employment Agreement with Richard Ziccardi

On January 1, 2021, the start date of Richard Ziccardi’s employment agreement with us, we entered into an Executive Agreement with Mr. Ziccardi (the “Agreement”), setting out his annual salary of $150,000 per year, plus the issuance of a bonus issuance of 2,000,000 shares of our Common Stock on the Agreement. On June 8, 2021 Mr. Ziccardi was issued 4,666,667 shares of our Common Stock as compensation. During the Term of this Agreement, Executive will be entitled to participate in an annual incentive compensation plan of the Company, as established and revised by the Board from time to time. The Agreement target annual bonus will be twenty five percent (25%) of the Base Salary in effect for such year (the “Target Bonus”), and the actual annual bonus may be more or less as determined by the CEO, and will be determined based primarily upon (i) the achievement of certain corporate performance goals, as may be established and approved by from time to time by the CEO, (ii) the achievement of personal performance goals as may be established by the CEO, and (iii) the overall goals and objectives of the Company. The annual bonus will only be paid at such time and in such manner as set forth in the annual incentive compensation plan document.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of common stock beneficially owned as of May 11, 2023 by:

| · | each of our shareholders who is known by us to beneficially own 5% or more of our common stock; |

| · | each of our executive officers; |

| · | each of our directors; and |

| · | all of our directors and current executives as a group. |

Beneficial ownership is determined based on the rules and regulations of the SEC. A person has beneficial ownership of shares if such individual has the power to vote and/or dispose of shares. This power may be sole or shared and direct or indirect. Applicable percentage ownership in the following table is based on 753,377,447 shares of common stock, 98,796 shares of Series A Preferred Stock, and 20 shares of Series C Preferred Stock outstanding as of May 4, 2023. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock that are subject to options or warrants held by that person and exercisable as of, or within sixty (60) days of, the date of this Annual Report. These shares, however, are not counted as outstanding for the purposes of computing the percentage ownership of any other person(s). Except as may be indicated in the footnotes to this table and pursuant to applicable community property laws, each person named in the table has sole voting and dispositive power with respect to the shares of common stock set forth opposite that person’s name. Unless indicated below, the address of each individual listed below is c/o Maptelligent, Inc., 2831 St Rose Pkwy, Suite 297, Henderson, NV 89052.

| Name of Beneficial Owner | | Total Common Stock Shares Beneficially Owned | | | % of Common Stock Class(1) | | | Total Series A Preferred Shares Owned(2) | | | % of Series A Class(1) | | | Total Series C Preferred Shares Owned(3) | | | % of Series C Class(1) | | | Total % of Beneficial Ownership(4) | |

| Directors and Officers: | | | | | | | | | | | | | | | | | | | | | |

| Joseph Cosio- Baron, CEO, President, CCO, Director | | | 9,308,226 | | | | 1.24 | | | | - | | | | - | | | | - | | | | - | | | 1.24 | % |

| Richard Ziccardi, CFO, Director | | | 8,316,667 | | | | 1.10 | | | | - | | | | - | | | | 4 | | | | 20 | % | | 1.10 | % |

| Glenn Corso, Director | | | 2,125,000 | | | | 0.28 | | | | - | | | | - | | | | 4 | | | | 20 | % | | 0.28 | % |

| All executive officers and directors as a group (3 persons) | | | 19,749,893 | | | | 2.62 | | | | - | | | | - | | | | - | | | | 40 | % | | | | |

| Five (5%) Percent Shareholders: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Not Applicable | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Based upon (i) 753,377,447 shares of common stock, (ii) 98,796 shares of Series A Preferred Stock, and (iii) 20 shares of Series C Preferred Stock outstanding as of May 4, 2023.

(2) Each share of Series A Preferred Stock is entitled to no voting rights and is convertible into one share of Common Stock.

(3) Each share of Series C Preferred Stock is not convertible and has voting rights equal to four times the sum of total common stock shares issued and outstanding plus the total number of preferred series A, A-2, and B that are issued and outstanding.

(4) Based on 753,476,263 shares calculated on fully diluted basis.

Certain Relationships and Related Transactions and Director Independence

No director, executive officer, shareholder holding at least 5% of shares of our common stock, or any family member thereof, had any material interest, direct or indirect, in any transaction, or proposed transaction during the year ended December 31, 2022 or 2021, in which the amount involved in the transaction exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at the year-end for the last three completed fiscal years:

There are 3 directors of which 1 is an independent director and 2 are officers.

PROPOSAL NO. 1

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF

THE NOMINEES TO THE BOARD OF DIRECTORS.

PLEASE NOTE: If your shares are held in street name, your broker, bank, custodian, or other nominee holder cannot vote your shares in the election of directors, unless you direct the holder how to vote, by marking your proxy card.

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT ACCOUNTANTS

The Board of Directors has appointed Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC) as the Company’s independent accountants for the fiscal year ended December 31, 2023, subject to ratification by the Company’s shareholders. Representatives of Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC) may be present virtually or by tele-conference at the Annual Meeting to respond to appropriate questions and will have an opportunity to make a statement, if they so desire.

In the event the shareholders fail to ratify the selection of Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC), the Board of Directors will reconsider whether or not to retain the firm. Even if the selection is ratified, the Board of Directors in its discretion may direct the appointment of a different independent accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its shareholders.

Services and Fees of Independent Accountants

The following table represents fees for professional audit services for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2022 and 2021, rendered by Pinnacle Accountancy Group of Utah (a dba of Heaton & Company, PLLC).

| | | Fiscal year ended December 31, | |

| | | 2022 | | | 2021 | |

| Audit fees (1) | | $ | 26,500 | | | $ | 29,600 | |

| Audit-related fees (2) | | | 0. | | | | 0. | |

| Total fees | | $ | 26,500 | | | $ | 29,600 | |

| (1) | Audit fees consist of fees for professional services rendered by the principal accountant for the audit of the Company’s annual financial statements and review of the financial statements included in the Company’s Form 10- K and Form 10-Q and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

| (2) | Audit-related fees consist primarily of fees for assurance and related services by the accountant that are reasonably related to the performance of the audit or review of the Company’s financial statements. |

Board of Directors Pre-Approval Policies and Procedures

The Board of Directors shall pre-approve any non-audit services proposed to be provided to the Company by the independent auditors. In accordance with the SEC’s auditor independence rules, the Board of Directors has established the following policies and procedures by which it approves in advance any audit or permissible non-audit services to be provided to the Company by its independent auditor.

Prior to the engagement of the independent auditor for any fiscal year’s audit, management submits to the Board of Directors for approval lists of recurring audit, audit-related, tax and other services expected to be provided by the auditor during that fiscal year. The Board of Directors adopts pre-approval schedules describing the recurring services that it has pre-approved, and is informed on a timely basis, and in any event by the next scheduled meeting, of any such services rendered by the independent auditor and the related fees.

The fees for any services listed in a pre-approval schedule are budgeted, and the Board of Directors requires the independent auditor and management to report actual fees versus the budget periodically throughout the year. The Board of Directors will require additional pre-approval if circumstances arise where it becomes necessary to engage the independent auditor for additional services above the amount of fees originally pre-approved. Any audit or non- audit service not listed in a pre-approval schedule must be separately pre-approved by the Board of Directors on a case-by-case basis. Every request to adopt or amend a pre-approval schedule or to provide services that are not listed in a pre-approval schedule must include a statement by the independent auditors as to whether, in their view, the request is consistent with the SEC’s rules on auditor independence.

The Board of Directors will not grant approval for:

| · | any services prohibited by applicable law or by any rule or regulation of the SEC or other regulatory body applicable to the Company; |

| · | provision by the independent auditor to the Company of strategic consulting services of the type typically provided by management consulting firms; or |

| · | the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the tax treatment of which may not be clear under the Internal Revenue Code and related regulations and which it is reasonable to conclude will be subject to audit procedures during an audit of the Company’s financial statements. |

Subject to certain exceptions, tax services proposed to be provided by the auditor to any director, officer or employee of the Company who is in an accounting role or financial reporting oversight role must be approved by the Board of Directors on a case-by-case basis where such services are to be paid for by the Company, and the Board of Directors will be informed of any services to be provided to such individuals that are not to be paid for by the Company.

In determining whether to grant pre-approval of any non-audit services in the “all other” category, the Board of Directors will consider all relevant facts and circumstances, including the following four basic guidelines:

| · | whether the service creates a mutual or conflicting interest between the auditor and the Company; |

| · | whether the service places the auditor in the position of auditing his or her own work; |

| · | whether the service results in the auditor acting as management or an employee of the Company; and |

| · | whether the service places the auditor in a position of being an advocate for the Company. |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF THE COMPANY’S INDEPENDENT ACCOUNTANTS.

PROPOSAL NO. 3

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO EFFECT THE REVERSE STOCK SPLIT

THE REVERSE STOCK SPLIT

Background and Proposed Amendment

Our Charter currently authorizes the Company to issue a total of 10,000,000,000 shares of the common stock, and up to 2,011,000 shares of preferred stock, par value $0.00001 per share, of the Company (the “Preferred Stock”), in one or more series, and expressly authorizes the Board, subject to limitations prescribed by law, to establish and fix for each such series such voting powers, full or limited, and such designations, preferences and relative, participating, optional or other special rights and such qualifications, limitations and restrictions of the shares of such series.

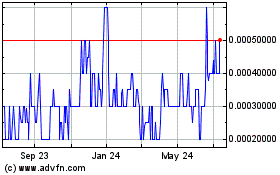

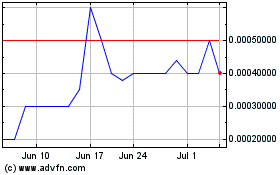

On [ ], 2023, subject to stockholder approval, the Board approved an amendment to our Charter to, at the discretion of the Board, effect the Reverse Stock Split of the common stock at a ratio of between 1-for-[400] and 1- for-[600], with the exact ratio to be determined by the Board of the Company at its discretion. The primary goal of the Reverse Stock Split is to increase the per share market price of our common stock to solicit interest from new investors. We believe that proposing multiple ratios for the Reverse Stock Split provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 promulgated under the Exchange Act. The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material respect.

If the Reverse Stock Split Proposal is approved by our stockholders and the Reverse Stock Split is effected, up to every 600 shares of our outstanding common stock would be combined and reclassified into one share of common stock. The actual timing for implementation of the Reverse Stock Split and the specific split ratio would be determined by the Board based upon its evaluation as to when such action would be most advantageous to the Company and its stockholders, but in no event later than the [one-year] anniversary of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Annual Meeting. Notwithstanding approval of the Reverse Stock Split Proposal by our stockholders, the Board will have the sole authority to elect whether or not and when to amend our Charter to effect the Reverse Stock Split. If the Reverse Stock Split Proposal is approved by our stockholders, the Board will make a determination as to whether effecting the Reverse Stock Split is in the best interests of the Company and our stockholders in light of, among other things, the Company’s ability to increase the trading price of our common stock to solicit interest from new investors without effecting the Reverse Stock Split, the per share price of the common stock immediately prior to the Reverse Stock Split and the expected stability of the per share price of the common stock following the Reverse Stock Split. If the Board determines that it is in the best interests of the Company and its stockholders to effect the Reverse Stock Split, it will hold a Board meeting to determine the ratio of the Reverse Stock Split and will publicly announce the chosen ratio at least [five] business days prior to the effectiveness of the reverse stock split. For additional information concerning the factors the Board will consider in deciding whether to effect the Reverse Stock Split, see “— Determination of the Reverse Stock Split Ratio” and “— Board Discretion to Effect the Reverse Stock Split.”

The text of the proposed amendment to the Company’s Charter to effect the Reverse Stock Split is included as Annex A to this proxy statement (the “Reverse Stock Split Charter Amendment”). If the Reverse Stock Split Proposal is approved by the Company’s stockholders, the Company will have the authority to file the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Nevada, which will become effective upon its filing. The Board has determined that the amendment is advisable and in the best interests of the Company and its stockholders and has submitted the amendment for consideration by our stockholders at the Annual Meeting.

Reasons for the Reverse Stock Split

The purpose of the Reverse Split is to increase the market price of our common stock and maintain investor interest. The Board intends to implement the Reverse Split only if it believes that a decrease in the number of shares outstanding is likely to improve the trading price for our common stock on a split adjusted basis.

The Board believes that effecting the Reverse Stock Split may be desirable for a number of reasons, including:

| Broaden our Investor Base. We believe the Reverse Split may increase the price of our common stock and thus may allow a broader range of institutional investors with the ability to invest in our common stock. For example, many funds and institutions have investment guidelines and policies that prohibit them from investing in stocks trading below a certain threshold. We believe that increased institutional investor interest in the Company and our common stock will potentially increase the overall market for our common stock. |

| Increase Analyst and Broker Interest. We believe the Reverse Split would help increase analyst and broker-dealer interest in our common stock as many brokerage and investment advisory firms’ policies can discourage analysts, advisors, and broker-dealers from following or recommending companies with low stock prices. Because of the trading volatility and lack of liquidity often associated with lower-priced stocks, many broker-dealers have adopted investment guidelines, policies and practices that either prohibit or discourage them from investing in or trading such stocks or recommending them to their customers. Some of those guidelines, policies and practices may also function to make the processing of trades in lower-priced stocks economically unattractive to broker-dealers. While we recognize that we will remain a “penny stock” under the SEC rules, we expect the increase in the stock price resulting from the Reverse Split will position us better if our business continues to grow as we anticipate. Additionally, because brokers’ commissions and dealer mark-ups/mark-downs on transactions in lower-priced stocks generally represent a higher percentage of the stock price than commissions and mark-ups/mark-downs on higher-priced stocks, the current average price per share of our common stock can result in shareholders or potential shareholders paying transaction costs representing a higher percentage of the total share value than would otherwise be the case if the share price were substantially higher. |

We are submitting this proposal to our stockholders for approval in order to increase the trading price of our common stock to solicit interest from new investors. Accordingly, we believe that the Reverse Stock Split is in our stockholders’ best interests.

Potential Increased Interest from New Investors

We believe increasing the trading price of our common stock may assist in our capital-raising efforts by making our common stock more attractive to a broader range of investors and promote greater liquidity for our stockholders. A greater price per share of our common stock could allow a broader range of institutions to invest in our common stock (namely, funds that are prohibited or discouraged from buying stocks with a price below a certain threshold), potentially increasing marketability, trading volume and liquidity of our common stock. Many institutional investors view stocks trading at low prices as unduly speculative in nature and, as a result, avoid investing in such stocks. We believe that the Reverse Stock Split will provide the Board flexibility to make our common stock a more attractive investment for these institutional investors, which we believe will enhance the liquidity for the holders of our common stock and may facilitate future sales of our common stock.

The Reverse Stock Split could also increase interest in our common stock for analysts and brokers who may otherwise have policies that discourage or prohibit them in following or recommending companies with low stock prices. Additionally, because brokers’ commissions on transactions in low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher.

The Board intends to effect the Reverse Stock Split only if it believes that a decrease in the number of shares outstanding is in the best interests of the Company and our stockholders and is likely to improve the trading price of our common stock and solicit interest from new investors. Accordingly, our Board approved the Reverse Stock Split as being advisable and in the best interests of the Company.

Risks Associated with the Reverse Stock Split

The Reverse Stock Split May Not Increase the Price of our Common Stock Over the Long-Term.

As noted above, the principal purpose of the Reverse Stock Split is to increase the trading price of our common stock to solicit interest from new investors. However, the effect of the Reverse Stock Split on the market price of our common stock cannot be predicted with any certainty, and we cannot assure you that the Reverse Stock Split will accomplish this objective for any meaningful period of time, or at all. While we expect that the reduction in the number of outstanding shares of common stock will proportionally increase the market price of our Common Stock, we cannot assure you that the Reverse Stock Split will increase the market price of our common stock by a multiple of the Reverse Stock Split ratio, or result in any permanent or sustained increase in the market price of our common stock. The market price of our common stock may be affected by other factors which may be unrelated to the number of shares outstanding, including the Company’s business and financial performance, general market conditions, and prospects for future success.

The Reverse Stock Split May Decrease the Liquidity of our Common Stock.

The Board believes that the Reverse Stock Split may result in an increase in the market price of our common stock, which could lead to increased interest in our common stock and possibly promote greater liquidity for our stockholders. However, the Reverse Stock Split will also reduce the total number of outstanding shares of common stock, which may lead to reduced trading and a smaller number of market makers for our common stock, particularly if the price per share of our common stock does not increase as a result of the Reverse Stock Split.

The Reverse Stock Split May Result in Some Stockholders Owning “Odd Lots” That May Be More Difficult to Sell or Require Greater Transaction Costs per Share to Sell.

If the Reverse Stock Split is implemented, it will increase the number of stockholders who own “odd lots” of less than 100 shares of common stock. A purchase or sale of less than 100 shares of common stock (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares of common stock following the Reverse Stock Split may be required to pay higher transaction costs if they sell their common stock.

The Reverse Stock Split May Lead to a Decrease in our Overall Market Capitalization.

The Reverse Stock Split may be viewed negatively by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of our common stock does not increase in proportion to the Reverse Stock Split ratio, then the value of our Company, as measured by our market capitalization, will be reduced. Additionally, any reduction in our market capitalization may be magnified as a result of the smaller number of total shares of common stock outstanding following the Reverse Stock Split.

Potential Consequences if the Reverse Stock Split Proposal is Not Approved

If the Reverse Stock Split Proposal is not approved by our stockholders, our Board will not have the authority to effect the Reverse Stock Split Charter Amendment to, among other things, solicit interest from new investors by increasing the per share trading price of our common stock. Any inability of our Board to effect the Reverse Stock Split could expose us to [•].

Determination of the Reverse Stock Split Ratio

The Board believes that stockholder approval of an amendment that gives the board the discretion to implement a reverse stock split at a ratio of between 1-for-[400] and 1-for-[600] for the potential Reverse Stock Split is advisable and in the best interests of our Company and stockholders because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented. We believe that of the proposed Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split ratio to be selected by our Board will not be more than 1-for-[600]. The Company will publicly announce the chosen ratio at least [five] business days prior to the effectiveness of the Reverse Stock Split and the Reverse Stock Split will be implemented by the [one-year] anniversary of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Annual Meeting, if at all.

The selection of the specific Reverse Stock Split ratio will be based on several factors, including, among other things:

| · | our ability to solicit interest from new investors; |

| | |

| · | the per share price of our common stock immediately prior to the Reverse Stock Split; |

| | |

| · | the expected stability of the per share price of our common stock following the Reverse Stock Split; |

| | |

| · | the likelihood that the Reverse Stock Split will result in increased marketability and liquidity of our common stock; |

| · | prevailing market conditions; |

| | |

| · | general economic conditions in our industry; and |

| | |

| · | our market capitalization before and after the Reverse Stock Split. |

We believe that granting our Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take these factors into consideration and to react to changing market conditions. If the Board chooses to implement the Reverse Stock Split, the Company will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Board Discretion to Effect the Reverse Stock Split

If the Reverse Stock Split Proposal is approved by our stockholders, the Board will have the discretion to implement the Reverse Stock Split or to not effect the Reverse Stock Split at all on or prior to the [one-year] anniversary of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Annual Meeting. The Board has not yet determined when or if it will be required to effect the stock split, as market conditions may improve prior to the Company needing to take action. As such, if the trading price of our Common Stock increases without effecting the Reverse Stock Split, the Reverse Stock Split may not be necessary. Following the Reverse Stock Split, if implemented, there can be no assurance that the market price of our Common Stock will rise in proportion to the reduction in the number of outstanding shares resulting from the Reverse Stock Split.

If our stockholders approve the Reverse Stock Split Proposal at the Annual Meeting, the Reverse Stock Split will be effected, if at all, only upon a determination by the Board that the Reverse Stock Split is advisable and in the best interests of the Company and its stockholders at that time. No further action on the part of the stockholders will be required to either effect or abandon the Reverse Stock Split. If our Board does not implement the Reverse Stock Split prior to the [one-year] anniversary of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the of the Annual Meeting, the authority granted in this proposal to implement the Reverse Stock Split will terminate and the Reverse Stock Split Charter Amendment will be abandoned.

The market price of our Common Stock is dependent upon our performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Furthermore, the reduced number of shares that will be outstanding after the Reverse Stock Split could significantly reduce the trading volume and otherwise adversely affect the liquidity of our common stock.

We have not proposed the Reverse Stock Split in response to any effort of which we are aware to accumulate our shares of common stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to our Board or our stockholders. Notwithstanding the decrease in the number of outstanding shares of common stock following the Reverse Stock Split, our Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Effects of the Reverse Stock Split

Effects of the Reverse Stock Split on Issued and Outstanding Shares.

If the Reverse Stock Split is effected, it will reduce the total number of issued and outstanding shares of common stock by a Reverse Stock Split ratio of between 1-for-[400] and 1-for-[600]. Accordingly, each of our stockholders will own fewer shares of common stock as a result of the Reverse Stock Split. However, the Reverse Stock Split will affect all stockholders uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except to the extent that the Reverse Stock Split would result in an adjustment to a stockholder’s ownership of common stock due to the treatment of fractional shares in the Reverse Stock Split. Therefore, voting rights and other rights, powers and preferences of the holders of common stock will not be affected by the Reverse Stock Split (other than as a result of the treatment of fractional shares). Common stock issued pursuant to the Reverse Stock Split will remain fully paid and nonassessable, and the par value per share of common stock will remain

$0.00001.

As of the record date, the Company had 753,377,447 shares of common stock outstanding. For purposes of illustration, if the Reverse Stock Split is effected at a ratio of 1-for-[400] or 1-for-[600], the number of issued and outstanding shares of common stock after the Reverse Stock Split would be approximately [•] shares and [•] shares, respectively.

We are currently authorized to issue a maximum of 10,000,000,000 shares of our common stock. As of the record date, there were 753,377,447 shares of our Common Stock issued and outstanding. Although the number of authorized shares of our common stock will not change as a result of the Reverse Stock Split, the number of shares of our common stock issued and outstanding will be reduced in proportion to the ratio selected by the Board. Thus, the Reverse Stock Split will effectively increase the number of authorized and unissued shares of our common stock available for future issuance by the amount of the reduction effected by the Reverse Stock Split.

Following the Reverse Stock Split, the Board will have the authority, subject to applicable securities laws, to issue all authorized and unissued shares without further stockholder approval, upon such terms and conditions as the Board deems appropriate. We do not currently have any plans, proposals or understandings to issue the additional shares that would be available if the Reverse Stock Split is approved and effected, but [some of the additional shares underlie warrants, which could be exercised after the Reverse Stock Split Charter Amendment is effected.

Effects of the Reverse Stock Split on Voting Rights.

Proportionate voting rights and other rights of the holders of common stock would not be affected by the Reverse Stock Split (other than as a result of the treatment of fractional shares). For example, a holder of 1% of the voting power of the outstanding common stock immediately prior to the effective time of the Reverse Stock Split would continue to hold 1% of the voting power of the outstanding common stock after the Reverse Stock Split.

Effects of the Reverse Stock Split on Regulatory Matters.

The Company is subject to the periodic reporting and other requirements of the SEC. The Reverse Stock Split will not affect the Company’s obligation to publicly file financial and other information with the SEC.

Effects of the Reverse Stock Split on Authorized Share Capital.

The total number of shares of capital stock that we are authorized to issue will not be affected by the Reverse Stock Split.

Treatment of Fractional Shares in the Reverse Stock Split

The Company does not intend to issue fractional shares in the event that a stockholder owns a number of shares of common stock that is not evenly divisible by the Reverse Stock Split ratio. If the Reverse Stock Split is effected, each fractional share of common stock will be:

| · | rounded up to the nearest whole share of common stock after all of the fractional interests of a holder have been aggregated, if such shares of common stock are held directly |

Effective Time of the Reverse Stock Split

If the Reverse Stock Split Proposal is approved by our stockholders, the Reverse Stock Split would become effective, if at all, when the Reverse Stock Split Charter Amendment is accepted and recorded by the office of the Secretary of State of the State of Nevada. However, notwithstanding approval of the Reverse Stock Split Proposal by our stockholders, the Board will have the sole authority to elect whether or not and when (prior to the [one-year] anniversary of the date on which the Reverse Stock Split is approved by the Company’s stockholders at the Annual Meeting, at which the authority granted in this proposal to implement the Reverse Stock Split will terminate and the Reverse Stock Split Charter Amendment will be abandoned) to amend our Charter to effect the Reverse Stock Split.

Exchange of Share Certificates

If the Reverse Stock Split is effected, each certificate representing pre-Reverse Stock Split shares of common stock will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split common stock at the effective time of the Reverse Stock Split. As soon as practicable after the effective time of the Reverse Stock Split, the Transfer Agent will mail a letter of transmittal to the Company’s stockholders containing instructions on how a stockholder should surrender its, his or her certificate(s) representing pre-Reverse Stock Split shares of common stock to the Transfer Agent in exchange for certificate(s) representing post-Reverse Stock Split shares of common stock. No certificate(s) representing post-Reverse Stock Split shares of common stock will be issued to a stockholder until such stockholder has surrendered all certificate(s) representing pre-Reverse Stock Split shares of common stock, together with a properly completed and executed letter of transmittal, to the Transfer Agent. No stockholder will be required to pay a transfer or other fee to exchange its, his or her certificate(s) representing pre-Reverse Stock Split shares of common stock for certificate(s) representing post-Reverse Stock Split shares of common stock registered in the same name.

Stockholders who hold uncertificated shares of common stock electronically in “book-entry” form will have their holdings electronically adjusted by the Transfer Agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Stock Split. If any certificate(s) or book-entry statement(s) representing pre-Reverse Stock Split shares of common stock to be exchanged contain a restrictive legend or notation, as applicable, the certificate(s) or book-entry statement(s) representing post-Reverse Stock Split shares of common stock will contain the same restrictive legend or notation.

Any stockholder whose share certificate(s) representing pre-Reverse Stock Split shares of common stock has been lost, stolen or destroyed will only be issued post-Reverse Stock Split Common Stock after complying with the requirements that the Company and the Transfer Agent customarily apply in connection with lost, stolen or destroyed certificates.

STOCKHOLDERS SHOULD NOT DESTROY STOCK CERTIFICATES REPRESENTING PRE- REVERSE STOCK SPLIT SHARES OF COMMON STOCK AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATES REPRESENTING PRE-REVERSE STOCK SPLIT SHARES OF COMMON STOCK UNTIL THEY ARE REQUESTED TO DO SO.

Appraisal Rights

Under the Nevada Revised Statutes, which govern Nevada’s corporate law, our stockholders are not entitled to appraisal or dissenter’s rights with respect to the Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Regulatory Approvals

The Reverse Stock Split will not be consummated, if at all, until after approval of the Company’s stockholders is obtained. The Company is not obligated to obtain any governmental approvals or comply with any state or federal regulations prior to consummating the Reverse Stock Split other than the filing of the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Nevada.

Accounting Treatment of the Reverse Stock Split

If the Reverse Stock Split is effected, the par value per share of our common stock will remain unchanged at $0.00001. Accordingly, on the effective date of the Reverse Stock Split, the stated capital on the Company’s consolidated balance sheets attributable to our common stock will be reduced in proportion to the size of the Reverse Stock Split ratio, and the additional paid-in-capital account will be increased by the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, will remain unchanged. Per share net income or loss will be increased because there will be fewer shares of common stock outstanding. The common stock held in treasury will be reduced in proportion to the Reverse Stock Split ratio. The Company does not anticipate that any other accounting consequences, including changes to the amount of stock-based compensation expense to be recognized in any period, will arise as a result of the Reverse Stock Split.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a discussion of certain material U.S. federal income tax consequences of the Reverse Stock Split. This discussion is included for general information purposes only and does not purport to address all aspects of U.S. federal income tax law that may be relevant to stockholders in light of their particular circumstances. This discussion is based on the Code and current Treasury Regulations, administrative rulings and court decisions, all of which are subject to change, possibly on a retroactive basis, and any such change could affect the continuing validity of this discussion.

All stockholders are urged to consult with their own tax advisors with respect to the tax consequences of the Reverse Stock Split. This discussion does not address the tax consequences to stockholders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, partnerships, nonresident alien individuals, broker-dealers and tax-exempt entities, persons holding shares as part of a straddle, hedge, conversion transaction or other integrated investment, U.S. holders (as defined below) subject to the alternative minimum tax or the unearned income Medicare tax and U.S. holders whose functional currency is not the U.S. dollar. This summary also assumes that the pre-Reverse Stock Split shares of common stock were, and the post-Reverse Stock Split shares of common stock will be, held as a “capital asset,” as defined in Section 1221 of the Code.

As used herein, the term “U.S. holder” means a holder that is, for U.S. federal income tax purposes:

| · | a citizen or resident of the United States; |

| | |

| · | a corporation or other entity taxed as a corporation created or organized in or under the laws of the United States, any state thereof or the District of Columbia; |

| | |

| · | an estate the income of which is subject to U.S. federal income tax regardless of its source; or |

| | |

| · | a trust (A) if a U.S. court is able to exercise primary supervision over the administration of the trust and one or more “U.S. persons” (as defined in the Code) have the authority to control all substantial decisions of the trust or (B) that has a valid election in effect to be treated as a U.S. person. |

In general, no gain or loss should be recognized by a stockholder upon the exchange of pre-Reverse Stock Split common stock for post-Reverse Stock Split common stock. The aggregate tax basis of the post-Reverse Stock Split common stock should be the same as the aggregate tax basis of the pre-Reverse Stock Split common stock exchanged in the Reverse Stock Split. A stockholder’s holding period in the post-Reverse Stock Split common stock should include the period during which the stockholder held the pre-Reverse Stock Split common stock exchanged in the Reverse Stock Split.

As noted above, we will not issue fractional shares of common stock in connection with the Reverse Stock Split. In certain circumstances, stockholders who would be entitled to receive fractional shares of common stock because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an additional fraction of a share of common stock to round up to the next whole post-Reverse Stock Split share of common stock. The U.S. federal income tax consequences of the receipt of such an additional fraction of a share of common stock is not clear.

The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the Reverse Stock Split.

Vote Required

The approval of the Reverse Stock Split Proposal requires the affirmative “FOR” vote of the majority of the voting power of the outstanding shares of common stock entitled to vote on the proposal, voting together as a single class. The failure to vote on the Reverse Stock Split Proposal will have the same effect as a vote against the proposal. An abstention will have the same effect as a vote against the Reverse Stock Split Proposal. A vote on this proposal will be considered a “routine” matter. Therefore, we do not expect any broker non-votes on this proposal and a failure to instruct your broker, bank or other nominee on how to vote your shares will not necessarily count as a vote against this proposal.

Board Recommendation

The Board unanimously recommends a vote “FOR” the Reverse Stock Split Proposal.

OTHER INFORMATION

Shareholders’ Proposals for the Next Annual Meeting

A shareholder of record may present a proposal for action at the next Annual Meeting provided that we receive the proposal at our executive office no later than 60 (sixty) days of the meeting date. The proponent may submit a maximum of one (1) proposal of not more than five hundred (500) words for inclusion in our proxy materials for a meeting of security holders. At the next Annual Meeting, management proxies will have discretionary authority, under Rule 14a-4 of the Securities Exchange Act of 1934, to vote on shareholder proposals that are not submitted for inclusion in our proxy statement unless received by us before the above-mentioned date.

Other Business

The Board of Directors knows of no business other than that set forth above to be transacted at the meeting, but if other matters requiring a vote of the shareholders arise, the persons designated as proxies will vote the shares of Common Stock represented by the proxies in accordance with their judgment on such matters. If a shareholder specifies a different choice on the proxy, his or her shares of Common Stock will be voted in accordance with the specification so made.

Where You Can Find More Information

We file annual and quarterly reports, proxy statements and other information with the SEC. Shareholders may read and copy any reports, statements or other information that we file at the SEC’s public reference rooms in Washington, D.C., New York, New York, and Chicago, Illinois. Please call the SEC at 1-800-SEC-0330 for further information about the public reference rooms. Our public filings are also available from commercial document retrieval services and at the Internet Web site maintained by the SEC at www.sec.gov. The Company’s Annual Report on Form 10-K and other reports that we file with the SEC are available on our website at ir.meetipower.com.

SHAREHOLDERS SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROXY STATEMENT TO VOTE THEIR SHARES AT THE ANNUAL MEETING. NO ONE HAS BEEN AUTHORIZED TO PROVIDE ANY INFORMATION THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS PROXY STATEMENT. THIS PROXY STATEMENT IS DATED MAY 11, 2023. SHAREHOLDERS SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROXY STATEMENT IS ACCURATE AS OF ANY DATE OTHER THAN THAT DATE, UNLESS OTHERWISE DISCLOSED.