Filed

Pursuant to Rule 253(g)(3)

File

No. 024-11593

An

offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular

shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state

in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We

may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Offering Circular was filed may be obtained.

Preliminary

Offering Circular

Subject

to Completion. Dated September 28, 2021

Livewire

Ergogenics, Inc.

(Exact

name of issuer as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation or organization)

http://www.livewireergogenics.com/

1600

N Kraemer Blvd.

Anaheim,

CA 92806

714-740-5144

(Address,

including zip code, and telephone number, including area code of issuer’s principal executive office)

|

2060

|

|

26-1212244

|

|

(Primary

Standard Industrial Classification Code Number)

|

|

(I.R.S.

Employer Identification Number)

|

Maximum

offering of 125,000,000 Shares

This

is a public offering of up to $2,000,000 in shares of Common Stock of Livewire Ergogenics, Inc. at a fixed price of $0.016

for a maximum of 125,000,000 shares.

The

offering price will be a fixed price at $0.016. The end date of the offering will be exactly 365 days from the date the Offering

Circular is approved by the Attorney General of the state of New York (unless extended by the Company, in its own discretion, for up

to another 90 days).

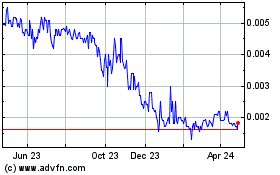

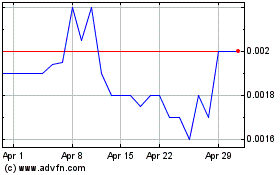

Our

Common Stock currently trades on the OTC Pink market under the symbol “LVVV” and the closing price of our Common Stock on

September 27, 2021, was $0.019 Our Common Stock currently trades on a sporadic and limited basis.

We

are offering our shares without the use of an exclusive placement agent. However, the Company reserves the right to retain one. The proceeds

will be disbursed to us, and the purchased shares will be disbursed to the investors.

We

expect to commence the sale of the shares within two calendar days of the date on which the Offering Statement of which this Offering

Circular is qualified by the Securities Exchange Commission.

See

“Risk Factors” to read about factors you should consider before buying shares of Common Stock.

Generally,

no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income

or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment

does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing,

we encourage you to refer to www.investor.gov.

The

United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the

terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These

securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent

determination that the securities offered are exempt from registration.

This

Offering Circular is following the offering circular format described in Part II (a)(1)(ii) of Form 1-A.

Offering

Circular dated September 28, 2021

TABLE

OF CONTENTS

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Offering Circular.

You must not rely on any unauthorized information or representations. This Offering Circular is an offer to sell only the shares offered

hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Offering Circular

is current only as of its date.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED BALANCE SHEET

FOR THE PERIOD ENDING MARCH 31, 2021, AND 2020

(UNAUDITED)

|

|

|

March

31, 2021

|

|

|

December

31, 2020

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

477,810

|

|

|

$

|

109,879

|

|

|

Accounts receivable from related parties

|

|

|

303,228

|

|

|

|

273,168

|

|

|

Inventory

|

|

|

2,177

|

|

|

|

2,177

|

|

|

Contract asset

|

|

|

22,000

|

|

|

|

22,000

|

|

|

Advances to Estrella Ranch

|

|

|

-

|

|

|

|

455,049

|

|

|

Loan to Estrella Ranch

|

|

|

2,042,815

|

|

|

|

667,706

|

|

|

Total current assets

|

|

|

2,848,030

|

|

|

|

1,529,979

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

|

457,582

|

|

|

|

443,432

|

|

|

Licenses, net

|

|

|

21,923

|

|

|

|

-

|

|

|

Investment in Estella Ranch

|

|

|

-

|

|

|

|

666,251

|

|

|

Investment

in Mojave Jane

|

|

|

269,002

|

|

|

|

269,002

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

other assets

|

|

|

748,507

|

|

|

|

1,378,685

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

3,596,537

|

|

|

$

|

2,908,664

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued

liabilities

|

|

|

564,040

|

|

|

|

724,077

|

|

|

Convertible notes, net

|

|

|

243,250

|

|

|

|

243,250

|

|

|

Notes payable, net

|

|

|

2,535,151

|

|

|

|

2,636,890

|

|

|

Notes payable - related

party

|

|

|

346,341

|

|

|

|

346,341

|

|

|

Derivative

liability

|

|

|

28,251

|

|

|

|

35,761

|

|

|

Total

current liabilities

|

|

|

3,717,033

|

|

|

|

3,986,319

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

3,717,033

|

|

|

|

3,986,319

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit

|

|

|

|

|

|

|

|

|

|

Preferred stock; $0.0001 par value; 9,899,925 shares authorized; 0 and

0 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively

|

|

|

-

|

|

|

|

-

|

|

|

Preferred B stock; $0.0001 par value; 100,00 shares authorized; 32,820

and 32,820 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively

|

|

|

-

|

|

|

|

-

|

|

|

Preferred C stock; $0.0001 par value; 75 shares authorized; 75 and 75

shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively

|

|

|

-

|

|

|

|

-

|

|

|

Common stock; $0.0001 par value; 1,500,000,000 shares authorized; 1,414,676,218

and 1,232,544,557 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively

|

|

|

141,468

|

|

|

|

123,256

|

|

|

Stock payable

|

|

|

334,453

|

|

|

|

88,500

|

|

|

Additional paid-in capital

|

|

|

24,579,454

|

|

|

|

23,547,666

|

|

|

Accumulated deficit

|

|

|

(25,175,871

|

)

|

|

|

(24,837,077

|

)

|

|

Total

stockholders’ deficit

|

|

|

(120,496

|

)

|

|

|

(1,077,655

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and

stockholders’ equity

|

|

$

|

3,596,537

|

|

|

$

|

2,908,664

|

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED STATEMENT OF OPERATION

FOR THE PERIOD ENDING MARCH 31, 2021, AND 2020

(UNAUDITED)

|

|

|

For

the Three Months Ended

|

|

|

|

|

March

31, 2021

|

|

|

March

31, 2020

|

|

|

|

|

|

|

|

|

|

|

Rental revenue

|

|

$

|

83,000

|

|

|

$

|

141,815

|

|

|

Cost of revenue

|

|

|

-

|

|

|

|

-

|

|

|

Gross profit

|

|

|

83,000

|

|

|

|

141,815

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Professional fees

|

|

|

143,363

|

|

|

|

45,397

|

|

|

Professional fees - related

party

|

|

|

-

|

|

|

|

150,000

|

|

|

Stock based consulting

|

|

|

10,800

|

|

|

|

26,000

|

|

|

General and administrative

|

|

|

30,324

|

|

|

|

373,136

|

|

|

Depreciation and amortization

|

|

|

31,250

|

|

|

|

30,579

|

|

|

Total operating expenses

|

|

|

215,737

|

|

|

|

625,112

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

Gain on sale of GHC and

related assets

|

|

|

-

|

|

|

|

23,213

|

|

|

Impairment of capitalized

licenses

|

|

|

-

|

|

|

|

(602,973

|

)

|

|

Gain (loss) on derivative

|

|

|

7,510

|

|

|

|

(856,892

|

)

|

|

Loss on settlement of debt

|

|

|

(88,607

|

)

|

|

|

-

|

|

|

Gain on sale of investment

shares

|

|

|

-

|

|

|

|

16,477

|

|

|

Interest income - related

party

|

|

|

560

|

|

|

|

-

|

|

|

Interest expense

|

|

|

(125,520

|

)

|

|

|

(180,118

|

)

|

|

Total other income (expense)

|

|

|

(206,057

|

)

|

|

|

(1,600,293

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing

operations

|

|

$

|

(338,794

|

)

|

|

$

|

(2,083,590

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

|

|

|

|

|

|

|

|

Income

(loss) from operations of discontinued business units

|

|

$

|

-

|

|

|

$

|

39,431

|

|

|

Income from discontinued

operations net of income taxes

|

|

|

-

|

|

|

|

39,431

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(338,794

|

)

|

|

$

|

(2,044,159

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net loss to noncontrolling

interest

|

|

$

|

-

|

|

|

$

|

19,321

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable

to Livewire

|

|

$

|

(338,794

|

)

|

|

$

|

(2,063,480

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted

|

|

|

|

|

|

|

|

|

|

Loss

from continuing operations

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Loss

from discontinued operations

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Net loss

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding - basic

|

|

|

1,328,222,022

|

|

|

|

1,190,805,164

|

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDER DEFICIT

FOR THE PERIOD ENDING MARCH 31, 2021, AND 2020

(UNAUDITED)

|

For

the Three Months Ended March 31, 2021 and 2020

|

|

|

|

Preferred

Stock

|

|

|

Preferred

Stock - B

|

|

|

Preferred

Stock - C

|

|

|

Common

Stock

|

|

|

Additional

Paid-in

|

|

|

Stock

|

|

|

Non-controlling

|

|

|

Accumulated

|

|

|

Total

Stockholders’

Equity

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Payable

|

|

|

Interest

|

|

|

Deficit

|

|

|

(Deficit)

|

|

|

Balance,

December 31, 2020

|

|

|

-

|

|

|

$

|

-

|

|

|

|

32,820

|

|

|

$

|

-

|

|

|

|

75

|

|

|

$

|

-

|

|

|

|

1,232,544,557

|

|

|

$

|

123,256

|

|

|

$

|

23,547,666

|

|

|

$

|

88,500

|

|

|

$

|

-

|

|

|

$

|

(24,837,077

|

)

|

|

|

(1,077,655

|

)

|

|

Shares issued for cash

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

182,131,661

|

|

|

|

18,212

|

|

|

|

1,031,788

|

|

|

|

12,500

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,062,500

|

|

|

Shares issued for services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

10,800

|

|

|

|

-

|

|

|

|

-

|

|

|

|

10,800

|

|

|

Shares to be issued to settle

debt

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

222,653

|

|

|

|

-

|

|

|

|

-

|

|

|

|

222,653

|

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(338,794

|

)

|

|

|

(338,794

|

)

|

|

Balance,

March 31, 2021

|

|

|

-

|

|

|

$

|

-

|

|

|

|

32,820

|

|

|

$

|

-

|

|

|

|

75

|

|

|

$

|

-

|

|

|

|

1,414,676,218

|

|

|

$

|

141,468

|

|

|

$

|

24,579,454

|

|

|

$

|

334,453

|

|

|

$

|

-

|

|

|

$

|

(25,175,871

|

)

|

|

|

(120,496

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance,

December 31, 2019

|

|

|

-

|

|

|

$

|

-

|

|

|

|

32,820

|

|

|

$

|

-

|

|

|

|

75

|

|

|

$

|

-

|

|

|

|

1,193,471,830

|

|

|

$

|

119,349

|

|

|

$

|

23,343,073

|

|

|

$

|

277,000

|

|

|

$

|

(154,553

|

)

|

|

$

|

(23,365,463

|

)

|

|

|

219,406

|

|

|

Shares issued for services

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

4,000,000

|

|

|

|

400

|

|

|

|

25,600

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

26,000

|

|

|

Divesture of GHC

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(277,000

|

)

|

|

|

135,232

|

|

|

|

129,284

|

|

|

|

(12,484

|

)

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

19,321

|

|

|

|

(2,063,480

|

)

|

|

|

(2,044,159

|

)

|

|

Balance,

March 31, 2020

|

|

|

-

|

|

|

$

|

-

|

|

|

|

32,820

|

|

|

$

|

-

|

|

|

|

75

|

|

|

$

|

-

|

|

|

|

1,197,471,830

|

|

|

$

|

119,749

|

|

|

$

|

23,368,673

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

(25,299,659

|

)

|

|

|

(1,811,237

|

)

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED STATEMENT OF CASH FLOW

FOR THE PERIOD ENDING MARCH 31, 2021 AND 2020

(UNAUDITED)

|

|

|

For

the Three Months Ended

|

|

|

|

|

March

31, 2021

|

|

|

March

31, 2020

|

|

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(338,794

|

)

|

|

$

|

(2,063,480

|

)

|

|

Adjustments to reconcile net loss to net cash

used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

31,250

|

|

|

|

30,579

|

|

|

Amortization of debt discount

|

|

|

72,136

|

|

|

|

135,978

|

|

|

Stock based compensation

|

|

|

10,800

|

|

|

|

26,000

|

|

|

Gain on derivative liabilities

|

|

|

(7,510

|

)

|

|

|

856,892

|

|

|

Gain on sale of GHC and

related assets

|

|

|

-

|

|

|

|

23,213

|

|

|

Impairment of licenses

|

|

|

-

|

|

|

|

602,973

|

|

|

Bad debt

|

|

|

-

|

|

|

|

360,000

|

|

|

Loss on settlement of debt

|

|

|

88,607

|

|

|

|

-

|

|

|

Changes in assets and liabilities

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and other

current assets

|

|

|

-

|

|

|

|

7,500

|

|

|

Sccounts receivable

|

|

|

(30,060

|

)

|

|

|

(90,000

|

)

|

|

Contract assets

|

|

|

-

|

|

|

|

50,000

|

|

|

Accounts

payable

|

|

|

(25,991

|

)

|

|

|

121,342

|

|

|

Net cash provided by (used

in) operating activities

|

|

|

(199,562

|

)

|

|

|

60,997

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities

|

|

|

|

|

|

|

|

|

|

Purchase of fixed assets

|

|

|

(45,400

|

)

|

|

|

-

|

|

|

Purchase of license

|

|

|

(21,923

|

)

|

|

|

-

|

|

|

Purchase

of investments

|

|

|

(253,809

|

)

|

|

|

(121,577

|

)

|

|

Net cash used in investing

activities

|

|

|

(321,132

|

)

|

|

|

(121,577

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance

of common stock

|

|

|

1,062,500

|

|

|

|

-

|

|

|

Payments on promissory

notes

|

|

|

(173,875

|

)

|

|

|

(27,477

|

)

|

|

Proceeds from related party

promissory notes

|

|

|

-

|

|

|

|

7,196

|

|

|

Proceeds

from related party convertible promissory notes

|

|

|

-

|

|

|

|

150,000

|

|

|

Net cash from financing

activities

|

|

|

888,625

|

|

|

|

129,719

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows provided by Discontinued Operations

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease)

in cash

|

|

|

367,931

|

|

|

|

69,139

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning cash balance

|

|

|

109,879

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending cash balance

|

|

$

|

477,810

|

|

|

$

|

69,139

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information

|

|

|

|

|

|

|

|

|

|

Cash

paid for interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash

paid for tax

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Cash investing and financing transactions

|

|

|

|

|

|

|

|

|

|

Stock

to be issued under promissory notes

|

|

$

|

-

|

|

|

$

|

1,166,900

|

|

|

Accounts payable settled

with stock, to be issued

|

|

$

|

134,046

|

|

|

$

|

-

|

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED BALANCE SHEET

FOR THE YEAR ENDING DECEMBER 31, 2020, AND 2019

(UNAUDITED)

|

|

|

December

31, 2020

|

|

|

December

31, 2019

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

109,879

|

|

|

$

|

-

|

|

|

Accounts receivable from

related parties

|

|

|

273,168

|

|

|

|

60,000

|

|

|

Inventory

|

|

|

2,177

|

|

|

|

-

|

|

|

Contract asset

|

|

|

22,000

|

|

|

|

360,000

|

|

|

Advances to Estrella Ranch

|

|

|

455,049

|

|

|

|

289,457

|

|

|

Loan to Estrella Ranch

|

|

|

667,706

|

|

|

|

-

|

|

|

Prepaid expense and other

current assets

|

|

|

-

|

|

|

|

7,500

|

|

|

Current

assets, discontinued operations

|

|

|

-

|

|

|

|

448,567

|

|

|

Total current assets

|

|

|

1,529,979

|

|

|

|

1,165,524

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

|

443,432

|

|

|

|

619,206

|

|

|

Licenses

|

|

|

-

|

|

|

|

602,973

|

|

|

Investment in Estella Ranch

|

|

|

666,251

|

|

|

|

666,251

|

|

|

Investment in Mojave Jane

|

|

|

269,002

|

|

|

|

269,002

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

other assets

|

|

|

1,378,685

|

|

|

|

2,157,432

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

2,908,664

|

|

|

$

|

3,322,956

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued

liabilities

|

|

|

724,077

|

|

|

|

565,312

|

|

|

Convertible notes, net

|

|

|

243,250

|

|

|

|

236,949

|

|

|

Notes payable, net

|

|

|

2,636,890

|

|

|

|

1,992,162

|

|

|

Notes payable - related

party

|

|

|

346,341

|

|

|

|

196,341

|

|

|

Derivative liability

|

|

|

35,761

|

|

|

|

39,636

|

|

|

Current

liabilities, discontinued operations

|

|

|

-

|

|

|

|

73,150

|

|

|

Total

current liabilities

|

|

|

3,986,319

|

|

|

|

3,103,550

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

3,986,319

|

|

|

|

3,103,550

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit

|

|

|

|

|

|

|

|

|

|

Preferred stock; $0.0001 par value; 10,000,000 shares authorized; 32,895

and 32,895 shares issued and outstanding as of December 31, 2020 and December 31, 2019, respectively

|

|

|

-

|

|

|

|

-

|

|

|

Common stock; $0.0001 par value; 1,500,000,000 shares authorized; 1,232,544,557

and 1,193,471,830 shares issued and outstanding as of December 31, 2020 and December 31, 2019, respectively

|

|

|

123,256

|

|

|

|

119,349

|

|

|

Stock payable

|

|

|

88,500

|

|

|

|

277,000

|

|

|

Additional paid-in capital

|

|

|

23,547,666

|

|

|

|

23,343,073

|

|

|

Accumulated deficit

|

|

|

(24,837,077

|

)

|

|

|

(23,365,463

|

)

|

|

Total

stockholders’ deficit

|

|

|

(1,077,655

|

)

|

|

|

373,959

|

|

|

Non-controlling interest

|

|

|

-

|

|

|

|

(154,553

|

)

|

|

Total

stockholders deficit to Livewire

|

|

|

(1,077,655

|

)

|

|

|

219,406

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and

stockholders’ equity

|

|

$

|

2,908,664

|

|

|

$

|

3,322,956

|

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED STATEMENT OF OPERATION

FOR THE YEAR ENDING DECEMBER 31, 2020, AND 2019

(UNAUDITED)

|

|

|

For

the Years Ended

|

|

|

|

|

December

31, 2020

|

|

|

December

31, 2019

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

580,315

|

|

|

$

|

344,230

|

|

|

Cost of goods sold

|

|

|

40,000

|

|

|

|

10,189

|

|

|

Gross profit

|

|

|

540,315

|

|

|

|

334,041

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Professional fees

|

|

|

240,727

|

|

|

|

313,730

|

|

|

Professional fees - related

party

|

|

|

150,000

|

|

|

|

-

|

|

|

Stock based consulting

expense

|

|

|

26,000

|

|

|

|

795,785

|

|

|

General and administrative

expenses

|

|

|

425,152

|

|

|

|

122,168

|

|

|

Depreciation

and amortization

|

|

|

163,809

|

|

|

|

137,016

|

|

|

Total operating expenses

|

|

|

1,005,688

|

|

|

|

1,368,699

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

Gain on sale of GHC and

related assets

|

|

|

23,209

|

|

|

|

-

|

|

|

Impairment of capitalized

licenses

|

|

|

(602,973

|

)

|

|

|

-

|

|

|

Gain on derivative

|

|

|

153,875

|

|

|

|

(19,636

|

)

|

|

realized gain on sale of

marketable securities

|

|

|

16,477

|

|

|

|

-

|

|

|

Loss on settlement of debt

|

|

|

(113,014

|

)

|

|

|

-

|

|

|

Gain on sale of property

|

|

|

-

|

|

|

|

1,800

|

|

|

Gain on sale of investment

shares

|

|

|

-

|

|

|

|

400,000

|

|

|

Interest income - related

party

|

|

|

33,168

|

|

|

|

-

|

|

|

Interest

expense

|

|

|

(666,378

|

)

|

|

|

(1,054,169

|

)

|

|

Total

other income (expense)

|

|

|

(1,155,636

|

)

|

|

|

(672,005

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing

operations

|

|

$

|

(1,621,009

|

)

|

|

$

|

(1,706,663

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

of discontinued business units

|

|

$

|

39,431

|

|

|

$

|

(192,875

|

)

|

|

Income

tax expense

|

|

|

-

|

|

|

|

-

|

|

|

Income from discontinued

operations net of income taxes

|

|

|

39,431

|

|

|

|

(192,875

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,581,578

|

)

|

|

$

|

(1,899,538

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net loss to noncontrolling

interest

|

|

$

|

19,321

|

|

|

$

|

(123,909

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable

to Livewire

|

|

$

|

(1,600,899

|

)

|

|

$

|

(1,775,629

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted

|

|

|

|

|

|

|

|

|

|

Loss

from continuing operations

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Loss

from discontinued operations

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Net

loss

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding - basic

|

|

|

1,204,641,528

|

|

|

|

1,111,843,228

|

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED

STATEMENT OF STOCKHOLDER DEFICIT

FOR THE YEAR ENDING DECEMBER 31, 2020, AND 2019

(UNAUDITED)

|

|

|

Preferred

Stock - B

|

|

|

Preferred

Stock - C

|

|

|

Common Stock

|

|

|

Additional

Paid-in

|

|

|

Stock

|

|

|

Non-controlling

|

|

|

Accumulated

|

|

|

Total

Stockholders’

Equity

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Payable

|

|

|

Interest

|

|

|

Deficit

|

|

|

(Deficit)

|

|

|

Balance,

December 31, 2018

|

|

|

32,820

|

|

|

|

-

|

|

|

|

75

|

|

|

|

-

|

|

|

|

1,085,270,518

|

|

|

|

108,529

|

|

|

|

21,306,608

|

|

|

|

230,400

|

|

|

|

-

|

|

|

|

(21,608,838

|

)

|

|

|

36,699

|

|

|

Shares issued for cash

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

21,709,054

|

|

|

|

2,170

|

|

|

|

258,230

|

|

|

|

(230,400

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

30,000

|

|

|

Shares issued for services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47,492,258

|

|

|

|

4,750

|

|

|

|

791,035

|

|

|

|

277,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,072,785

|

|

|

Shares issued for settlement

of debt

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

39,000,000

|

|

|

|

3,900

|

|

|

|

987,200

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

991,100

|

|

|

Investment in GHC to non-controlling

interest

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(30,644

|

)

|

|

|

19,004

|

|

|

|

(11,640

|

)

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(123,909

|

)

|

|

|

(1,775,629

|

)

|

|

|

(1,899,538

|

)

|

|

Balance,

December 31, 2019

|

|

|

32,820

|

|

|

|

-

|

|

|

|

75

|

|

|

|

-

|

|

|

|

1,193,471,830

|

|

|

|

119,349

|

|

|

|

23,343,073

|

|

|

|

277,000

|

|

|

|

(154,553

|

)

|

|

|

(23,365,463

|

)

|

|

|

219,406

|

|

|

Shares issued for cash

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

30,072,727

|

|

|

|

3,007

|

|

|

|

159,493

|

|

|

|

10,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

172,500

|

|

|

Shares issued for services

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,000,000

|

|

|

|

400

|

|

|

|

25,600

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

26,000

|

|

|

Commitment shares issued with

debt

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,000,000

|

|

|

|

500

|

|

|

|

19,500

|

|

|

|

78,500

|

|

|

|

-

|

|

|

|

-

|

|

|

|

98,500

|

|

|

Divestiture of GHC

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(277,000

|

)

|

|

|

135,232

|

|

|

|

129,285

|

|

|

|

(12,483

|

)

|

|

Net

loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

19,321

|

|

|

|

(1,600,899

|

)

|

|

|

(1,581,578

|

)

|

|

Balance,

December 31, 2020

|

|

|

32,820

|

|

|

|

-

|

|

|

|

75

|

|

|

|

-

|

|

|

|

1,232,544,557

|

|

|

|

123,256

|

|

|

|

23,547,666

|

|

|

|

88,500

|

|

|

|

-

|

|

|

|

(24,837,077

|

)

|

|

|

(1,077,655

|

)

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

LIVEWIRE

ERGOGENICS, INC.

CONSOLIDATED

STATEMENT OF CASH FLOW

FOR THE YEAR ENDING DECEMBER 31, 2020, AND 2019

(UNAUDITED)

|

|

|

For

the Years Ended

|

|

|

|

|

December

31, 2020

|

|

|

December

31, 2019

|

|

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,600,899

|

)

|

|

$

|

(1,899,538

|

)

|

|

Adjustments to reconcile net loss to net cash

used in operating activities:

|

|

|

|

|

|

|

|

|

|

Stock based compensation

|

|

|

26,000

|

|

|

|

795,785

|

|

|

Gain on derivative liabilities

|

|

|

(153,875

|

)

|

|

|

19,636

|

|

|

Gain on sale of GHC and

related assets

|

|

|

23,213

|

|

|

|

-

|

|

|

Impairment of licenses

|

|

|

602,973

|

|

|

|

-

|

|

|

Bad debt

|

|

|

360,000

|

|

|

|

-

|

|

|

Loss on settlement of debt

|

|

|

113,014

|

|

|

|

-

|

|

|

Depreciation

|

|

|

163,809

|

|

|

|

137,016

|

|

|

Amortization of debt discount

|

|

|

481,172

|

|

|

|

835,819

|

|

|

Changes in assets and liabilities

|

|

|

|

|

|

|

|

|

|

(Increase) decrease in

prepaid expenses and other current assets

|

|

|

7,500

|

|

|

|

(683,394

|

)

|

|

Increase in accounts receivable

|

|

|

(215,345

|

)

|

|

|

(60,000

|

)

|

|

(Increase) decrease in

contract assets

|

|

|

278,000

|

|

|

|

(360,000

|

)

|

|

Increase in stock payable

|

|

|

-

|

|

|

|

147,000

|

|

|

Increase

in accounts payable

|

|

|

270,594

|

|

|

|

288,816

|

|

|

Net cash used in operating

activities

|

|

|

356,156

|

|

|

|

(778,860

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities

|

|

|

|

|

|

|

|

|

|

Purchase of fixed assets

|

|

|

(40,822

|

)

|

|

|

(11,200

|

)

|

|

Purchase of investments

|

|

|

(833,298

|

)

|

|

|

(579,226

|

)

|

|

Net cash used in investing

activities

|

|

|

(874,120

|

)

|

|

|

(590,426

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance

of common stock

|

|

|

172,500

|

|

|

|

30,000

|

|

|

Payments on promissory

notes

|

|

|

(51,853

|

)

|

|

|

(157,432

|

)

|

|

Proceeds from promissory

notes

|

|

|

-

|

|

|

|

1,522,500

|

|

|

Proceeds from related party

promissory notes

|

|

|

357,196

|

|

|

|

-

|

|

|

Proceeds

from related party convertible promissory notes

|

|

|

150,000

|

|

|

|

-

|

|

|

Net cash from financing

activities

|

|

|

627,843

|

|

|

|

1,395,068

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows provided by Discontinued Operations

|

|

|

-

|

|

|

|

(53,730

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease)

in cash

|

|

|

109,879

|

|

|

|

(27,948

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Beginning cash balance

|

|

|

-

|

|

|

|

27,948

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending cash balance

|

|

$

|

109,879

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information

|

|

|

|

|

|

|

|

|

|

Cash

paid for interest

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash

paid for tax

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Cash investing and financing transactions

|

|

|

|

|

|

|

|

|

|

Stock

to be issued under promissory notes

|

|

$

|

88,500

|

|

|

$

|

1,166,900

|

|

The

accompanying notes are an integral part of these unaudited consolidated financial statements.

Notes

to Unaudited Financial Statements

LiveWire

has been operating in the health and wellness industry for several years, and in recent years has transitioned to acquiring, leasing,

and managing special purpose real estate properties conducive to discovering and developing high-end organic cannabinoid products for

the health and wellness industry. The Company is in the process of centralizing operations from its different locations throughout California

to Estrella Ranch in Paso Robles, California, according to its plan to develop the Ranch into the central hub for most of the Company’s

operations. Buildout of the operations on the ranch is in an advanced stage and the Company anticipates that this process should be concluded

during the second half of 2021. This will further streamline and centralize operations true to management’s mission statement to

run a well-organized and lean operation and keep overhead low. The Company is supervising and assisting with the license application

process by its affiliate company Estrella River Farms, LLC On July 1, 2021 Estrella River Farms (ERF) has received approval from the

County of San Luis Obispo and CalCannabis Cultivation Licensing, a division of the California Department of Food and Agriculture to operate

a commercial cannabis business at its Estrella Ranch in Paso Robles, California.

The

Company’s consultants and affiliated companies will cultivate advanced and unique, hand-crafted organic cannabis products at this

facility to take advantage of a rapidly growing and maturing cannabis industry, accelerated by the advancing legalization and increasing

public acceptance in California and throughout the country. The company is led by a team of entrepreneurs and experienced cannabis consultants.

This team applies the latest scientific knowledge and technology to cultivate the Company’s hand-crafted, and rigorously tested

organic cannabis products under strict legal and environmental compliance.

The

Company will only acquire or work with carefully selected cannabis operators that are in complete compliance with Federal and State laws.

LiveWire Ergogenics has established a unique business model for the cultivation of high-quality, handcrafted products under family-farm

like conditions and strict quality control at the Estrella Ranch location. The Company strategically aligns itself with carefully selected

businesses to become a vertically integrated company that will satisfy the fast-growing demand for high-quality and carefully tested

products in the California cannabis market. The Company considers expanding its operations into other locations as soon as Federal legislation

permits. LiveWire does not sell or distribute any products anywhere that are in violation of the United States Controlled Substance Act.

Critical

Accounting Policies

The

preparation of our consolidated financial statements in conformity with accounting principles generally accepted in the United States

requires us to make estimates and judgments that affect our reported assets, liabilities, revenues, and expenses and the disclosure of

contingent assets and liabilities. We base our estimates and judgments on historical experience and on various other assumptions we believe

to be reasonable under the circumstances. Future events, however, may differ markedly from our current expectations and assumptions.

While there are a number of significant accounting policies affecting our consolidated financial statements; we believe the following

critical accounting policies involve the most complex, difficult and subjective estimates and judgments:

Accounts

Receivable – We evaluate the collectability of our trade accounts receivable based on a number of factors. In circumstances

where we become aware of a specific customer’s inability to meet its financial obligations to us, a specific reserve for bad debts

is estimated and recorded, which reduces the recognized receivable to the estimated amount we believe will ultimately be collected. In

addition to specific customer identification of potential bad debts, bad debt charges are recorded based on our recent loss history and

an overall assessment of past due trade accounts receivable outstanding.

Inventories

– Inventories are stated at the lower of cost to purchase and/or manufacture the inventory or the current estimated market

value of the inventory. We regularly review our inventory quantities on hand and record a provision for excess and obsolete inventory

based primarily on our estimated forecast of product demand, production availability and/or our ability to sell the product(s) concerned.

Demand for our products can fluctuate significantly. Factors that could affect demand for our products include unanticipated changes

in consumer preferences, general market and economic conditions or other factors that may result in cancellations of advance orders or

reductions in the rate of reorders placed by customers and/or continued weakening of economic conditions. Additionally, management’s

estimates of future product demand may be inaccurate, which could result in an understated or overstated provision required for excess

and obsolete inventory.

Long-Lived

Assets – Management regularly reviews property and equipment and other long-lived assets, including certain definite-lived

identifiable intangible assets, for possible impairment. This review occurs annually or more frequently if events or changes in circumstances

indicate the carrying amount of the asset may not be recoverable. If there is indication of impairment of property and equipment or amortizable

intangible assets, then management prepares an estimate of future cash flows (undiscounted and without interest charges) expected to

result from the use of the asset and its eventual disposition. If these cash flows are less than the carrying amount of the asset, an

impairment loss is recognized to write down the asset to its estimated fair value. The fair value is estimated at the present value of

the future cash flows discounted at a rate commensurate with management’s estimates of the business risks.

Revenue

Recognition – We recognize revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price

is fixed or determinable and collectability is reasonably assured. Generally, ownership of and title to our products pass to customers

upon delivery of the products to customers. Net sales have been determined after deduction of promotional and other allowances in accordance

with ASC 605-50. Amounts received pursuant to new and/or amended distribution agreements entered into with certain distributors, relating

to the costs associated with terminating our prior distributors, are accounted for as revenue ratably over the anticipated life of the

respective distribution agreement, generally 20 years. Management believes that adequate provision has been made for cash discounts,

returns and spoilage based on our historical experience.

Cost

of Sales – Cost of sales consists of the costs of products distributed, in-bound freight charges, as well as certain internal

transfer co and warehouse expenses incurred prior to delivery. Variable product costs account for the largest portion of the cost of

sales.

Operating

Expenses – Operating expenses include selling expenses such as distribution expenses to transport products to customers and

warehousing expenses, as well as expenses for advertising, commissions, and other marketing expenses. Operating expenses also include

payroll costs, travel costs, professional service fees including legal fees, entertainment, insurance, postage, depreciation, and other

general and administrative costs.

Income

Taxes – We utilize the liability method of accounting for income taxes as set forth in ASC 740. Under the liability method,

deferred taxes are determined based on the temporary differences between the financial statement and tax basis of assets and liabilities

using tax rates expected to be in effect during the years in which the basis differences reverse. A valuation allowance is recorded when

it is more likely than not that some of the deferred tax assets will not be realized. In determining the need for valuation allowances,

we consider projected future taxable income and the availability of tax planning strategies. If in the future we determine that we would

not be able to realize our recorded deferred tax assets, an increase in the valuation allowance would be recorded, decreasing earnings

in the period in which such determination is made.

We

assess our income tax positions and record tax benefits for all years subject to examination based upon our evaluation of the facts,

circumstances, and information available at the reporting date. For those tax positions where there is a greater than 50% likelihood

that a tax benefit will be sustained, we have recorded the largest amount of tax benefit that may potentially be realized upon ultimate

settlement with taxing authority that has full knowledge of all relevant information. For those income tax positions where there is less

than 50% likelihood that a tax benefit will be sustained, no tax benefit has been recognized in the financial statements.

Derivative

Liabilities - The Company assessed the classification of its derivative financial instruments as of December 31,2018, which consist

of Convertible instruments and rights to shares of the Company’s common stock and determined that such Derivatives meet the criteria

for liability classification under ASC 815.

ASC

815 generally provides three criteria that, if met, require companies to bifurcate conversion options from their host instruments and

account for them as free-standing derivative financial instruments. These three criteria include circumstances in which (a) the economic

characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and

risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is

not re-measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported

in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered

a derivative instrument subject to the requirements of ASC 815. ASC 815 also provides an exception to this rule when the host instrument

is deemed to be conventional, as described.

Fair

Value of Financial Instruments - The Company has adopted FASB ASC 820 Fair Value Measurements and Disclosures, or ASC 820, for assets

and liabilities measured at fair value on a recurring basis. ASC 820 establishes a common definition for fair value to be applied to

existing generally accepted accounting principles that require the use of fair value measurements establishes a framework for measuring

fair value and expands disclosure about such fair value measurements. The adoption of ASC 820 did not have an impact on the Company’s

financial position or operating results but did expand certain disclosures.

ASC

820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

Between market participants at the measurement date. Additionally, ASC 820 requires the use of valuation techniques that maximize the

use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized below:

|

Level

1:

|

Observable

inputs such as quoted market prices in active markets for identical assets or liabilities

|

|

Level

2:

|

Observable

market-based inputs or unobservable inputs that are corroborated by market data

|

|

Level

3:

|

Unobservable

inputs for which there is little no market data, which require the use of the reporting entity’s own assumptions.

|

The

Company did not have any Level 2 or Level 3 assets or liabilities as of December 31, 2017, except for its convertible notes payable and

derivative liability. The carrying amounts of these liabilities on December 31, 2017 approximate their respective fair value based on

the Company’s incremental borrowing rate.

Cash

is considered to be highly liquid and easily tradable as of December 31, 2017, and therefore classified as Level 1 within our fair value

hierarchy.

In

addition, FASB ASC 825-10-25 Fair Value Option, or ASC 825-10-25, was effective for January 1, 2008. ASC 825-10-25 expands opportunities

to use fair value measurements in financial reporting and permits entities to choose to measure many financial instruments and certain

other items at fair value. The Company did not elect the fair value options for any of its qualifying financial instruments.

Convertible

Instruments - The Company evaluates and accounts for conversion options embedded in its convertible instruments in accordance with

professional standards for “Accounting for Derivative Instruments and Hedging Activities. Professional standards generally provide

three criteria that, if met, require companies to bifurcate conversion options from their host instruments and account for them as free-standing

derivative financial instruments. These three criteria include circumstances in which (a) the economic characteristics and risks of the

embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b)

the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under