UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the quarterly period ended: June 30,

2012

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from _________

to __________

Commission file number: 0-21816

INFINITE GROUP, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

52-1490422

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

60 Office Park Way

Pittsford, New York 14534

(Address of principal executive offices)

(585) 385-0610

(Registrant's telephone number)

(Former name, former address and former

fiscal year,

if changed since last report)

Indicate by check

mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days.

Yes

x

No

¨

Indicate by check

mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (

§

232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post

such files).

Yes

x

No

¨

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated filer

¨

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

Smaller reporting company

x

|

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

¨

No

x

Indicate the number of shares outstanding

of each of the issuer's classes of common stock, as of the latest practicable date.

There were 25,961,883 shares of the issuer’s

common stock, par value $.001 per share, outstanding as of August 10, 2012.

Infinite Group, Inc.

Quarterly

Report on Form

10-Q

For the Period Ended June 30, 2012

Table of Contents

|

|

|

|

PAGE

|

|

|

|

|

|

|

PART I – FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

|

Item 1.

|

Financial Statements

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets – June 30, 2012 (Unaudited) and December 31, 2011

|

3

|

|

|

|

|

|

|

|

|

Consolidated Statements of Operations (Unaudited) for the three and six months ended June 30, 2012 and 2011

|

4

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows (Unaudited) for the six months ended June 30, 2012 and 2011

|

5

|

|

|

|

|

|

|

|

|

Notes to Consolidated Financial Statements – (Unaudited)

|

6

|

|

|

|

|

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

9

|

|

|

|

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

13

|

|

|

|

|

|

|

|

Item 4.

|

Controls and Procedures

|

14

|

|

|

|

|

|

|

PART II – OTHER INFORMATION

|

|

|

|

|

|

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

14

|

|

|

|

|

|

|

|

Item 6.

|

Exhibits

|

14

|

|

|

|

|

|

|

SIGNATURES

|

14

|

FORWARD-LOOKING STATEMENTS

Certain

statements made in this Quarterly Report on Form 10-Q are “forward-looking statements” regarding the plans and objectives

of management for future operations and market trends and expectations. Such statements involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein

are based on current expectations that involve numerous risks and uncertainties. Our plans and objectives are based, in part, on

assumptions involving the continued expansion of our business. Assumptions relating to the foregoing involve judgments with respect

to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult

or impossible to predict accurately and many of which are beyond our control. Although we believe that our assumptions underlying

the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance

that the forward-looking statements included in this report will prove to be accurate. In light of the significant uncertainties

inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation

by us or any other person that our objectives and plans will be achieved. We undertake no obligation to revise or update publicly

any forward-looking statements for any reason. The terms “we”, “our”, “us”, or any derivative

thereof, as used herein refer to Infinite Group, Inc., a Delaware corporation, and its predecessors.

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

INFINITE GROUP, INC.

Consolidated Balance Sheets

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

3,542

|

|

|

$

|

36,894

|

|

|

Accounts receivable, net of allowance of $70,000

|

|

|

763,761

|

|

|

|

1,023,326

|

|

|

Prepaid expenses and other current assets

|

|

|

33,660

|

|

|

|

21,204

|

|

|

Total current assets

|

|

|

800,963

|

|

|

|

1,081,424

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

36,566

|

|

|

|

46,704

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits and other assets

|

|

|

4,318

|

|

|

|

15,924

|

|

|

Total assets

|

|

$

|

841,847

|

|

|

$

|

1,144,052

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

384,624

|

|

|

$

|

566,980

|

|

|

Accrued payroll

|

|

|

458,563

|

|

|

|

379,666

|

|

|

Accrued interest payable

|

|

|

399,205

|

|

|

|

403,387

|

|

|

Accrued retirement and pension

|

|

|

202,943

|

|

|

|

659,650

|

|

|

Accrued expenses - other

|

|

|

17,875

|

|

|

|

39,968

|

|

|

Current maturities of long-term obligations-banks and other

|

|

|

27,318

|

|

|

|

32,360

|

|

|

Notes payable

|

|

|

470,000

|

|

|

|

30,000

|

|

|

Notes payable-related parties

|

|

|

173,000

|

|

|

|

197,000

|

|

|

Total current liabilities

|

|

|

2,133,528

|

|

|

|

2,309,011

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term obligations:

|

|

|

|

|

|

|

|

|

|

Notes payable:

|

|

|

|

|

|

|

|

|

|

Banks and other

|

|

|

1,107,869

|

|

|

|

1,559,108

|

|

|

Related parties

|

|

|

501,324

|

|

|

|

501,324

|

|

|

Total liabilities

|

|

|

3,742,721

|

|

|

|

4,369,443

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficiency:

|

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value, 60,000,000 shares authorized; 25,961,883 shares issued and outstanding

|

|

|

25,961

|

|

|

|

25,961

|

|

|

Additional paid-in capital

|

|

|

30,118,045

|

|

|

|

30,078,784

|

|

|

Accumulated deficit

|

|

|

(33,044,880

|

)

|

|

|

(33,330,136

|

)

|

|

Total stockholders’ deficiency

|

|

|

(2,900,874

|

)

|

|

|

(3,225,391

|

)

|

|

Total liabilities and stockholders’ deficiency

|

|

$

|

841,847

|

|

|

$

|

1,144,052

|

|

See notes to unaudited consolidated financial statements.

INFINITE GROUP, INC.

Consolidated Statements of Operations (Unaudited)

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

2,115,812

|

|

|

$

|

2,225,237

|

|

|

$

|

4,646,668

|

|

|

$

|

4,234,719

|

|

|

Cost of services

|

|

|

1,554,321

|

|

|

|

1,604,754

|

|

|

|

3,448,859

|

|

|

|

3,140,791

|

|

|

Gross profit

|

|

|

561,491

|

|

|

|

620,483

|

|

|

|

1,197,809

|

|

|

|

1,093,928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

251,612

|

|

|

|

210,949

|

|

|

|

664,313

|

|

|

|

459,752

|

|

|

Defined benefit pension plan

|

|

|

0

|

|

|

|

134,632

|

|

|

|

(480,000

|

)

|

|

|

286,494

|

|

|

Selling

|

|

|

280,866

|

|

|

|

326,996

|

|

|

|

568,378

|

|

|

|

666,541

|

|

|

Total costs and expenses

|

|

|

532,478

|

|

|

|

672,577

|

|

|

|

752,691

|

|

|

|

1,412,787

|

|

|

Operating income (loss)

|

|

|

29,013

|

|

|

|

(52,094

|

)

|

|

|

445,118

|

|

|

|

(318,859

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Related parties

|

|

|

(13,108

|

)

|

|

|

(12,920

|

)

|

|

|

(26,710

|

)

|

|

|

(25,783

|

)

|

|

Other

|

|

|

(65,651

|

)

|

|

|

(56,855

|

)

|

|

|

(133,152

|

)

|

|

|

(109,617

|

)

|

|

Total interest expense

|

|

|

(78,759

|

)

|

|

|

(69,775

|

)

|

|

|

(159,862

|

)

|

|

|

(135,400

|

)

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(49,746

|

)

|

|

$

|

(121,869

|

)

|

|

$

|

285,256

|

|

|

$

|

(454,259

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share – basic and diluted

|

|

$

|

(.00

|

)

|

|

$

|

(.01

|

)

|

|

$

|

.01

|

|

|

$

|

(.02

|

)

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

25,961,883

|

|

|

|

26,461,883

|

|

|

|

25,961,883

|

|

|

|

26,461,883

|

|

|

Diluted

|

|

|

25,961,883

|

|

|

|

26,461,883

|

|

|

|

26,831,690

|

|

|

|

26,461,883

|

|

See notes to unaudited consolidated financial

statements.

|

INFINITE GROUP, INC.

|

|

|

|

Consolidated Statements of Cash Flows (Unaudited)

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

|

|

|

|

|

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

285,256

|

|

|

$

|

(454,259

|

)

|

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Stock based compensation

|

|

|

39,261

|

|

|

|

38,014

|

|

|

Reduction of accrued retirement and pension

|

|

|

(480,000

|

)

|

|

|

0

|

|

|

Depreciation

|

|

|

18,322

|

|

|

|

16,039

|

|

|

Decrease (increase) in assets:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

259,565

|

|

|

|

(1,239

|

)

|

|

Other assets

|

|

|

(850

|

)

|

|

|

(5,908

|

)

|

|

Increase (decrease) in liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

(182,356

|

)

|

|

|

57,664

|

|

|

Accrued expenses

|

|

|

52,622

|

|

|

|

101,848

|

|

|

Accrued pension and retirement

|

|

|

23,293

|

|

|

|

269,352

|

|

|

Net cash provided by operating activities

|

|

|

15,113

|

|

|

|

21,511

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(8,184

|

)

|

|

|

(7,990

|

)

|

|

Net cash used by investing activities

|

|

|

(8,184

|

)

|

|

|

(7,990

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Repayments of notes payable – banks and others

|

|

|

(16,281

|

)

|

|

|

(12,559

|

)

|

|

Repayments of note payable-related parties

|

|

|

(24,000

|

)

|

|

|

0

|

|

|

Net cash used by financing activities

|

|

|

(40,281

|

)

|

|

|

(12,559

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash

|

|

|

(33,352

|

)

|

|

|

962

|

|

|

Cash - beginning of period

|

|

|

36,894

|

|

|

|

33,155

|

|

|

Cash - end of period

|

|

$

|

3,542

|

|

|

$

|

34,117

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure:

|

|

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

162,774

|

|

|

$

|

86,523

|

|

|

Income taxes

|

|

$

|

0

|

|

|

$

|

0

|

|

See notes to unaudited consolidated financial

statements.

INFINITE GROUP, INC.

Notes to Consolidated Financial Statements

–

(Unaudited)

Note 1. Basis of Presentation

The accompanying unaudited consolidated

financial statements of Infinite Group, Inc. (“Infinite Group, Inc.” or the “Company”) included herein

have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (U.S.)

("GAAP") for interim financial information and with instructions to Form 10-Q. Accordingly, they do not include all of

the information and footnotes required by accounting principles generally accepted in the U.S. for complete financial statements.

In the opinion of management, all adjustments considered necessary for a fair presentation have been included. All such adjustments

are of a normal recurring nature. The December 31, 2011 balance sheet has been derived from the audited financial statements at

that date, but does not include all disclosures required by GAAP. The accompanying unaudited consolidated financial statements

should be read in conjunction with the Company’s audited consolidated financial statements and the notes thereto included

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 filed with the U.S. Securities and Exchange

Commission (SEC). Results of consolidated operations for the three and six months ended June 30, 2012 are not necessarily indicative

of the operating results that may be expected for the year ending December 31, 2012. The unaudited consolidated financial statements

herein include the accounts of the Company and its wholly owned subsidiaries. The subsidiaries are inactive. All material inter-company

accounts and transactions have been eliminated.

Note 2. Summary of Significant Accounting

Policies

There are several accounting policies that

the Company believes are significant to the presentation of its consolidated financial statements. These policies require management

to make complex or subjective judgments about matters that are inherently uncertain. Note 3 to the Company’s audited consolidated

financial statements for the year ended December 31, 2011 presents a summary of significant accounting policies as included in

the Company's Annual Report on Form 10-K as filed with the SEC.

Reclassifications

-

The Company

reclassified certain prior year amounts to conform to the current year’s presentation.

Fair Value of Financial Instruments

- Financial instruments include cash and cash equivalents, accounts receivable, accounts payable, accrued expenses and notes payable.

Fair values for all instruments were assumed to approximate carrying values for these financial instruments since they are short-term

in nature and their carrying amounts approximate fair values or they are receivable or payable on demand. The fair value of the

Company’s convertible notes payable is estimated based upon the quoted market prices for the same or similar issues or on

the current rates offered to the Company for debt of the same remaining maturities. The carrying value approximates the fair value

of these debt instruments as of June 30, 2012 and December 31, 2011.

Recent Accounting Pronouncements - Presentation

of Comprehensive Income -

In June 2011, the FASB issued Accounting Standards Update (ASU) No. 2011-05, “Comprehensive

Income (Topic 220) – Presentation of Comprehensive Income.” This ASU requires all nonowner changes in stockholders’

equity to be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements.

The amendments are effective for interim and annual periods beginning on or after December 15, 2011. However, ASU 2011-12 has deferred

the specific requirement within ASU 2011-05 to present on the face of the financial statements items that are reclassified from

accumulated other comprehensive income to net income separately with their respective components of net income and other comprehensive

income. Entities should continue to report reclassifications out of accumulated comprehensive income consistent with the presentation

requirements in effect before ASU 2011-05. The Company has adopted the presentation of a single continuous statement of comprehensive

income. There were no adjustments to other comprehensive income during the six months ended June 30, 2012.

Note 3. Warrants

On April 5, 2007, the Company engaged the

services of a consultant for a term of one year through April 4, 2008 and issued it a warrant to acquire 100,000 shares of its

common stock, exercisable at $.50 per share, which warrant expired unexercised on April 6, 2012.

Note 4. Stock Option Plans

The Company has approved stock options

plans covering up to an aggregate of 8,608,833 shares of common stock. Such options may be designated at the time of grant as either

incentive stock options or nonqualified stock options. Stock based compensation includes expense charges related to all stock-based

awards to employees, directors and consultants. Such awards include options, warrants and stock grants.

The fair value of each option grant is

estimated on the date of grant using the Black-Scholes option-pricing model. The following assumptions were used for the six months

ended June 30, 2012 and 2011.

|

|

|

|

2012

|

|

|

|

2011

|

|

|

Risk-free interest rate

|

|

|

.92% - 1.10%

|

|

|

|

2.13% - 2.46%

|

|

|

Expected dividend yield

|

|

|

0%

|

|

|

|

0%

|

|

|

Expected stock price volatility

|

|

|

75%

|

|

|

|

75%

|

|

|

Expected life of options

|

|

|

5.75 years

|

|

|

|

5.75 years

|

|

The Company recorded expense for options

issued to employees and independent service providers of $19,189 and $21,686 for the three months ended June 30, 2012 and 2011,

respectively, and $39,261 and $38,014 for the six months ended June 30, 2012 and 2011, respectively.

A summary of all stock option activity for the six months ended

June 30, 2012 follows:

|

|

|

Number of

Options

|

|

|

Weighted

Average

Exercise

Price

|

|

|

Weighted-

Average

Remaining

Contractual

Term

|

|

|

Aggregate

Intrinsic Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding at December 31, 2011

|

|

|

6,889,500

|

|

|

$

|

.20

|

|

|

|

|

|

|

|

|

|

|

Options granted

|

|

|

150,000

|

|

|

$

|

.17

|

|

|

|

|

|

|

|

|

|

|

Outstanding at June 30, 2012

|

|

|

7,039,500

|

|

|

$

|

.20

|

|

|

|

6.0 years

|

|

|

$

|

564,355

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable at June 30, 2012

|

|

|

5,338,833

|

|

|

$

|

.22

|

|

|

|

5.1 years

|

|

|

$

|

373,630

|

|

The weighted average fair value of options

granted during the six months ended June 30, 2012 was approximately $.09 ($.06 during the six months ended June 30, 2011). No options

were exercised during the six months ended June 30, 2012 and 2011.

At June 30, 2012, there was approximately

$91,000 of unrecognized compensation cost related to non-vested options. This cost is expected to be recognized over a weighted

average period of approximately two years. The total fair value of shares that vested during the six months ended June 30, 2012

was approximately $62,000.

In July 2012, we granted options to purchase

an aggregate of 100,000 shares of our common stock at an exercise price of $.225. These grants were exempt from registration pursuant

to Section 4(2) of the Securities Act of 1933, as amended.

Note 5. Earnings Per

Share

Basic

earnings per share is based on the weighted average number of common shares outstanding during the periods presented. Diluted earnings

per share is based on the weighted average number of common shares outstanding, as well as dilutive potential common shares which,

in the Company’s case, comprise shares issuable under convertible notes payable, stock options and stock warrants. The treasury

stock method is used to calculate dilutive shares, which reduces the gross number of dilutive shares by the number of shares purchasable

from the proceeds of the options and warrants assumed to be exercised. In a loss period, the calculation for basic and diluted

earnings per share is considered to be the same, as the impact of potential common shares is anti-dilutive.

The following table sets forth the computation

of basic and diluted earnings per share for the six months ended June 30, 2012:

|

|

|

|

Income

(Numerator)

|

|

|

|

Shares

(Denominator)

|

|

|

|

Per

Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income available to common stockholders

|

|

$

|

285,256

|

|

|

|

25,961,883

|

|

|

$

|

.01

|

|

|

Effect of dilutive securities - common stock options

|

|

|

0

|

|

|

|

869,807

|

|

|

|

|

|

|

Diluted earnings per share - income available to common stockholders with assumed conversions

|

|

$

|

285,256

|

|

|

|

26,831,690

|

|

|

$

|

.01

|

|

For

the six months ended June 30, 2012 and 2011, convertible debt and options to purchase 25,968,906 and 24,061,792 shares

of

common stock, respectively, that could potentially dilute basic earnings per share in the future were excluded from the calculation

of diluted net income (loss) per share because their inclusion would have been anti-dilutive.

Note 6. Employee Pension Plan

On March 30, 2012, the Company received

a decision of United States Tax Court entered on March 27, 2012 (the "Decision") wherein the Court determined that the

Company did not have any liability for taxes, excise taxes or penalties for the taxable years 2006 or 2007 related to the Osley

& Whitney, Inc. Retirement Plan (O&W Plan). As a result, during the first quarter of 2012, the Company recorded a reduction

of $480,000 in obligations previously accrued and reflected related to excise taxes, including late fees and interest on unfunded

O&W Plan contributions. At December 31, 2011, this amount was included on the Company’s balance sheet under Current Liabilities

- Accrued retirement and pension.

Since the Pension Benefit

Guaranty Corporation (PBGC) terminated the O&W Plan as of November 30, 2001 and the United States Tax Court decided on March

27, 2012 that no excise taxes are due, the Company has no further obligations to the O&W Plan, the PBGC and the Treasury other

than those stated in the Settlement Agreement with the PBGC which are reflected in the accompanying consolidated financial statements.

Defined benefit pension plan expenses include

expenses (including net periodic pension cost, professional services, and interest costs) associated with the O&W Plan of $134,632

and $286,494 for the three and six months ended June 30, 2011. Net periodic pension cost recorded in the accompanying statements

of operations includes the following components of expense (benefit) for the periods presented.

|

|

|

Three

Months

|

|

|

Six

Months

|

|

|

|

|

Ended June 30, 2011

|

|

|

Interest cost

|

|

$

|

67,878

|

|

|

$

|

138,756

|

|

|

Expected return on plan assets

|

|

|

(30,193

|

)

|

|

|

(60,386

|

)

|

|

Service cost

|

|

|

10,500

|

|

|

|

21,000

|

|

|

Actuarial loss

|

|

|

33,960

|

|

|

|

67,921

|

|

|

Net periodic pension cost

|

|

$

|

82,145

|

|

|

$

|

164,291

|

|

There were no holdings of Level 3 investments

and there were no purchases, sales, issuances, and settlements of Level 3 investments during the six months ended June 30, 2011.

Additionally, there were no transfers between Level 1 and Level 2 assets during the six months ended June 30, 2011.

Note 7. Notes Payable

During the six months ended June 30, 2012,

the Company repaid a $5,000 note payable to a related party. The Company also reduced a $23,000 note payable to another related

party by paying $19,000 during the six months ended June 30, 2012 and repaid the balance of $4,000 during July 2012.

Notes payable of $175,000 and $265,000

were reclassified from long-term obligations to current liabilities during 2012 since their scheduled maturity date is January

1, 2013.

Note 8. Management

Plans – Capital Resources

The Company reported operating income and

net income for the six months ended June 30, 2012 compared to an operating loss and net loss for the six months ended June 30,

2011. A portion of this improvement in 2012 came from recording a reduction of $480,000 in obligations previously accrued and reflected

related to excise taxes, including late fees and interest, on unfunded O&W Plan contributions.

The Company's primary source of liquidity

is cash provided by collections of accounts receivable and its factoring line of credit. At June 30, 2012, the Company had approximately

$300,000 of availability under this line. During the six months ended June 30, 2012, the Company financed its business activities

through sales with recourse of its accounts receivable. T

he Company has

notes payable of $265,000 and $175,000 which mature on January 1, 2013. The Company plans to renegotiate the terms of these notes

payable, included in current liabilities at June 30, 2012, or seek funds to repay these notes payable.

The Company believes the capital resources

available under its factoring line of credit, cash from additional related party loans and cash generated by improving the results

of its operations provide sources to fund its ongoing operations and to support the internal growth the Company expects to achieve

for at least the next 12 months. However, if the Company does not continue to maintain or improve the results of its operations

in future periods, the Company expects that additional working capital will be required to fund its business. Although the Company

has no assurances, the Company believes that related parties, who have previously provided working capital, will continue to provide

working capital loans on similar terms, as in the past, as may be necessary to fund its on-going operations for at least the next

12 months.

************

Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operations

IT Consulting

We are a leading IT service and support

solutions provider. Our extensive technical capabilities, experience, and solutions enable commercial, government, and software

companies/professional service organizations to improve IT efficiency and reduce costs. Headquartered in Pittsford, New York, our

offerings include managed services, cloud computing, mobility, unified communications, information security, program and project

management, systems engineering, and consulting. We work with other industry innovators such as

VMware,

Hewlett Packard, Microsoft, EMC, Dell, IBM, CACI, and NetApp

to deliver best in class custom solutions to their customers.

We have several contract vehicles that

enable us to deliver a broad range of our services and solutions to the U.S. Government and state governments. The quality and

consistency of services and IT expertise allow us to maintain long-term relationships with the U.S. Government and other major

clients. We have entered into various subcontract agreements with prime contractors to the U.S. Government, state and local governments

and commercial customers.

Results of Operations

Comparison

of Three and Six Month Periods ended June 30, 2012 and 2011

The following tables compare our statements

of operations data for the three and six months ended June 30, 2012 and 2011. The trends suggested by this table are not indicative

of future operating results.

|

|

|

Three Months Ended June 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 vs. 2011

|

|

|

|

|

|

|

|

As a % of

|

|

|

|

|

|

As a % of

|

|

|

Amount of

|

|

|

% Increase

|

|

|

|

|

2012

|

|

|

Sales

|

|

|

2011

|

|

|

Sales

|

|

|

Change

|

|

|

(Decrease)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

2,115,812

|

|

|

|

100.0

|

%

|

|

$

|

2,225,237

|

|

|

|

100.0

|

%

|

|

$

|

(109,425

|

)

|

|

|

(4.9

|

)%

|

|

Cost of services

|

|

|

1,554,321

|

|

|

|

73.5

|

|

|

|

1,604,754

|

|

|

|

72.1

|

|

|

|

(50,433

|

)

|

|

|

(3.1

|

)

|

|

Gross profit

|

|

|

561,491

|

|

|

|

26.5

|

|

|

|

620,483

|

|

|

|

27.9

|

|

|

|

(58,992

|

)

|

|

|

(9.5

|

)

|

|

General and administrative

|

|

|

251,612

|

|

|

|

11.9

|

|

|

|

210,949

|

|

|

|

9.5

|

|

|

|

40,663

|

|

|

|

19.3

|

|

|

Defined benefit pension plan

|

|

|

0

|

|

|

|

0.0

|

|

|

|

134,632

|

|

|

|

6.1

|

|

|

|

(134,632

|

)

|

|

|

(100.0

|

)

|

|

Selling

|

|

|

280,866

|

|

|

|

13.3

|

|

|

|

326,996

|

|

|

|

14.7

|

|

|

|

(46,130

|

)

|

|

|

(14.1

|

)

|

|

Total costs and expenses

|

|

|

532,478

|

|

|

|

25.2

|

|

|

|

672,577

|

|

|

|

30.2

|

|

|

|

(140,099

|

)

|

|

|

(20.8

|

)

|

|

Operating income (loss)

|

|

|

29,013

|

|

|

|

1.4

|

|

|

|

(52,094

|

)

|

|

|

(2.3

|

)

|

|

|

81,107

|

|

|

|

155.7

|

|

|

Interest expense

|

|

|

(78,759

|

)

|

|

|

(3.7

|

)

|

|

|

(69,775

|

)

|

|

|

(3.1

|

)

|

|

|

8,984

|

|

|

|

12.9

|

|

|

Net loss

|

|

$

|

(49,746

|

)

|

|

|

(2.4

|

)%

|

|

$

|

(121,869

|

)

|

|

|

(5.5

|

)%

|

|

$

|

72,123

|

|

|

|

59.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted

|

|

$

|

(.00

|

)

|

|

|

|

|

|

$

|

(.01

|

)

|

|

|

|

|

|

$

|

.01

|

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 vs. 2011

|

|

|

|

|

|

|

|

As a % of

|

|

|

|

|

|

As a % of

|

|

|

Amount of

|

|

|

% Increase

|

|

|

|

|

2012

|

|

|

Sales

|

|

|

2011

|

|

|

Sales

|

|

|

Change

|

|

|

(Decrease)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

4,646,668

|

|

|

|

100.0

|

%

|

|

$

|

4,234,719

|

|

|

|

100.0

|

%

|

|

$

|

411,949

|

|

|

|

9.7

|

%

|

|

Cost of services

|

|

|

3,448,859

|

|

|

|

74.2

|

|

|

|

3,140,791

|

|

|

|

74.2

|

|

|

|

308,068

|

|

|

|

9.8

|

|

|

Gross profit

|

|

|

1,197,809

|

|

|

|

25.8

|

|

|

|

1,093,928

|

|

|

|

25.8

|

|

|

|

103,881

|

|

|

|

9.5

|

|

|

General and administrative

|

|

|

664,313

|

|

|

|

14.3

|

|

|

|

459,752

|

|

|

|

10.9

|

|

|

|

204,561

|

|

|

|

44.5

|

|

|

Defined benefit pension plan

|

|

|

(480,000

|

)

|

|

|

(10.3

|

)

|

|

|

286,494

|

|

|

|

6.8

|

|

|

|

(766,494

|

)

|

|

|

(267.5

|

)

|

|

Selling

|

|

|

568,378

|

|

|

|

12.2

|

|

|

|

666,541

|

|

|

|

15.7

|

|

|

|

(98,163

|

)

|

|

|

(14.7

|

)

|

|

Total costs and expenses

|

|

|

752,691

|

|

|

|

16.2

|

|

|

|

1,412,787

|

|

|

|

33.4

|

|

|

|

(660,096

|

)

|

|

|

(46.7

|

)

|

|

Operating income (loss)

|

|

|

445,118

|

|

|

|

9.6

|

|

|

|

(318,859

|

)

|

|

|

(7.5

|

)

|

|

|

763,977

|

|

|

|

239.6

|

|

|

Interest expense

|

|

|

(159,862

|

)

|

|

|

(3.4

|

)

|

|

|

(135,400

|

)

|

|

|

(3.2

|

)

|

|

|

24,462

|

|

|

|

18.1

|

|

|

Net income (loss)

|

|

$

|

285,256

|

|

|

|

6.1

|

%

|

|

$

|

(454,259

|

)

|

|

|

(10.7

|

)%

|

|

$

|

739,515

|

|

|

|

162.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share - basic and diluted

|

|

$

|

.01

|

|

|

|

|

|

|

$

|

(.02

|

)

|

|

|

|

|

|

$

|

.03

|

|

|

|

|

|

Sales

Sales

for the six months ended June 30, 2012 were $4,646,668 an increase of $411,949 or 9.7% as compared to sales for the six months

ended June 30, 2011 of $4,234,719.

The increase in sales for the six months ended June 30, 2012 was principally a result

of increased sales under subcontracts to U.S. Government agencies.

Sales

for the three months ended June 30, 2012 were $2,115,812, a decrease of $109,425 or 4.9% as compared to sales for the three months

ended June 30, 2011 of $2,225,237.

Several long-term subcontracts expired during the three months ended June 30, 2012. These

sales reductions were not fully offset by sales increases that we realized with other clients.

We have several contract vehicles that

enable us to deliver a broad range of our services and solutions to the U.S. Government. These contract vehicles allow us additional

opportunities to bid on new projects. Although we believe we have opportunities for sales growth with government and commercial

clients, the lengthy procurement processes may result in operating losses or reduced operating income until sales increase to support

our infrastructure. We understand that the U.S. Government has expressed its intention to reduce its budgets related to technical

services contracts in the coming years, which may impact our ability to increase our sales to certain U.S. Government agencies.

Cost of Services and Gross Profit

Cost

of services represents the cost of employee services related to our sales.

Cost of services for the six months ended June 30, 2012 was $3,448,859 or 74.2% of sales as compared to $3,140,791 or 74.2% of

sales for the six months ended June 30, 2011. Gross profit was $1,197,809 or 25.8% of sales for the six months ended June 30, 2012

compared to $1,093,928 or 25.8% of sales for the six months ended June 30, 2011. The increase in the cost of services and gross

profit were primarily attributable to the increase in sales

for

the six months ended June 30, 2012.

Cost

of services for the three months ended June 30, 2012 was $1,554,321 or 73.5% of sales as compared to $1,604,754 or 72.1% of sales

for the three months ended June 30, 2011. Gross profit was $561,491 or 26.5% of sales for the three months ended June 30, 2012

compared to $620,483 or 27.9% of sales for the three months ended June 30, 2011. The decrease in the cost of services and gross

profit were primarily attributable to the expiration of several long-term subcontracts which resulted in a decrease in sales for

the three months ended June 30, 2012.

General and Administrative Expenses

General and administrative expenses include

corporate overhead such as compensation and benefits for administrative and finance personnel, rent, insurance, professional fees,

travel, and office expenses. General and administrative expenses for the six months ended June 30, 2012 increased by $204,561 or

44.5% from $459,752 for the six months ended June 30, 2011 to $664,313 for the six months ended June 30, 2012. As a percentage

of sales, general and administrative expenses were 14.3% for the six months ended June 30, 2012 and 10.9% for the six months ended

June 30, 2011.

General and administrative expenses for

the three months ended June 30, 2012 were $251,612 which was an increase of $40,663 or 19.3% as compared to $210,949 for the three

months ended June 30, 2011. As a percentage of sales, general and administrative expense was 11.9% for the three months ended June

30, 2012 and 9.5% for the three months ended June 30, 2011.

The

increase in general and administrative expenses in 2012 was a result of variable compensation expenses relating to

certain performance measures that were met, increases in professional fees in connection with annual filing requirements,

and consulting expenses that we incurred during the first quarter of this year and ongoing brand

development and marketing expenses during 2012. During 2012, we updated our web site, updated our business strategies and our

branding and marketing plans.

Defined Benefit Pension Plan Expenses

On March 30, 2012, we

received a decision of United States Tax Court entered on March 27, 2012 (the "Decision") wherein the Court determined

that we did not have any liability for taxes, excise taxes or penalties for the taxable years 2006 or 2007 related to the Osley

& Whitney, Inc. Retirement Plan (O&W Plan). As a result, in 2012, we recorded a reduction of $480,000 in obligations previously

accrued and reflected related to excise taxes, including late fees and interest, on unfunded O&W Plan contributions. Since

the Pension Benefit Guaranty Corporation (PBGC) terminated the O&W Plan as of November 30, 2001 and as a result of the Decision,

we have no further obligations to the O&W Plan, the PBGC and the Treasury other than those stated in the Settlement Agreement

with the PBGC which are reflected in the accompanying consolidated financial statements.

Defined benefit pension plan expenses include

expenses (including pension expense, professional services, and interest costs) associated with the O&W Plan of $286,494 for

the six months ended June 30, 2011. During the six months ended June 30, 2011, we incurred legal and professional fees of approximately

$44,500 in connection with compliance requirements and advocating our legal position in response to recent communication with the

appropriate regulatory authorities. Net periodic pension cost was $164,291 for the six months ended June 30, 2011. We accrued interest

and fees on unpaid excise taxes for plan years 2003, 2004 and 2005, as well as interest on unfunded contributions, which amounted

to additional expense of approximately $77,700 for the six months ended June 30, 2011.

Selling Expenses

For the six months ended June 30, 2012

we incurred selling expenses of $568,378 compared to $666,541 for the six months ended June 30, 2011, a decrease of $98,163 or

14.7%. For the three months ended June 30, 2012, we incurred selling expenses of $280,866 as compared to $326,996 for the three

months ended June 30, 2011, a decrease of $46,130 or 14.1%.

This decrease is primarily attributable

to the reduction of business development compensation expense and a reduction in occupancy expenses by changing to virtual offices

for certain of our employees.

Operating Income (Loss)

For

the six months ended June 30, 2012 our operating income was $445,118 compared to an operating loss of $318,859 for the six months

ended June 30, 2011, an improvement of $763,977. This is principally attributable to an improvement in gross profit of $103,881

and a reduction in operating expenses of $660,096.

The decrease in operating expenses in 2012 includes a reduction of $480,000

in O&W Plan obligations previously accrued, as discussed above.

For the three months ended June 30, 2012

our operating income was $29,013 compared to an operating loss of $52,094 for the three months ended June 30, 2011, an improvement

of $81,107. This is principally attributable a reduction in operating expenses of $140,099 which was offset by a decrease in gross

profit of $58,922 due to lower sales volume.

Included in the above results are non-cash

expenses and a reduction in O&W Plan related liabilities for the three and six months ended June 30, 2012 and 2011 summarized

as follows.

|

|

|

Three Months Ended

June

30,

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Stock-based compensation

|

|

$

|

19,189

|

|

|

$

|

16,328

|

|

|

$

|

39,261

|

|

|

$

|

38,014

|

|

|

Depreciation

|

|

|

6,201

|

|

|

|

8,085

|

|

|

|

18,322

|

|

|

|

16,039

|

|

|

Reduction in O&W Plan related liabilities

|

|

|

0

|

|

|

|

0

|

|

|

|

(480,000

|

)

|

|

|

0

|

|

|

Periodic pension costs, interest and fees

|

|

|

0

|

|

|

|

121,500

|

|

|

|

0

|

|

|

|

242,000

|

|

|

|

|

$

|

25,390

|

|

|

$

|

145,913

|

|

|

$

|

(422,417

|

)

|

|

$

|

296,053

|

|

Interest Expense

Interest

expense includes interest on indebtedness and fees for financing accounts receivable invoices. Interest expense was $159,862 for

the six months ended June 30, 2012, an increase of $24,462 from interest expense of $135,400 for the six months ended June 30,

2011. Interest expense was $78,759 for the three months ended June 30, 2012, an increase of $8,984 from interest expense of $69,775

for the three months ended June 30, 2011.

The increase results from an increase in notes payable to third parties of $400,000

originated in the fourth quarter of 2011 in connection with the termination of the O&W Plan. In addition, average balances

of accounts receivable financed increased in 2012 due to an increase in sales.

Net Income (Loss)

For the six months ended June 30, 2012,

we recorded net income of $285,256 or $.01 per share compared to a net loss of $454,259 or $.02 per share for the six months

ended June 30, 2011

.

For the three months ended June 30, 2012,

we recorded a net loss of $49,746 or $.00 per share

compared to a net loss of $121,869 or $.01 per share for the three months ended June 30, 2011

.

Liquidity and Capital Resources

At

June 30, 2012, we had cash of approximately $3,500 available for our working capital needs and planned capital asset expenditures.

Our primary liquidity needs are the financing of working capital and capital expenditures.

Our primary source of liquidity

is cash provided by collections of accounts receivable and our factoring line of credit.

At

June 30, 2012, we had financing availability, based on eligible accounts receivable, of approximately $300,000 under this line.

At June 30, 2012, we had a working capital

deficit of approximately $1.3 million and a current ratio of .38. Our objective is to improve our working capital position through

profitable operations.

During 2012, we financed our business activities

through sales with recourse of our accounts receivable. During 2011, we financed our business activities through the issuance of

notes payable to related parties and third parties and sales with recourse of our accounts receivable.

We have notes payable of $265,000 and $175,000

which mature on January 1, 2013. We plan to renegotiate the terms of these notes payable, included in current liabilities at June

30, 2012, or seek funds to repay these notes payable.

Our goal is to increase sales and generate

cash flow from operations. We implemented expense reductions during 2011. The PBGC terminated the O&W Plan in November 2011

and as a result, beginning in the fourth quarter of 2011, we no longer record defined benefit pension plan expense.

We believe the capital resources available

under our factoring line of credit, cash from additional related party loans and cash generated by improving the results of our

operations provide sources to fund our ongoing operations and to support the internal growth we expect to achieve for at least

the next 12 months. If we do not continue to maintain or improve the results of our operations in future periods, we expect that

additional working capital will be required to fund our business. Although we have no assurances, we believe that related parties,

who have previously provided working capital to us will continue to provide working capital loans to us on similar terms, as in

the past, as may be necessary to fund our on-going operations for at least the next 12 months. If we experience significant growth

in our sales, we believe that this may require us to increase our financing line, finance additional accounts receivable, or obtain

additional working capital from other sources to support our sales growth. There is no assurance that in the event we need additional

funds that adequate additional working capital will be available or, if available, will be offered on acceptable terms.

We anticipate financing our external growth

if we were to make business acquisitions and our longer-term internal growth through one or more of the following sources: cash

from collections of accounts receivable; additional borrowing; issuance of equity; use of our existing revolving credit facility;

or a refinancing of our accounts receivable credit facility.

The following table sets forth our sources and uses of cash

for the periods presented:

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

Net cash provided by operating activities

|

|

$

|

15,113

|

|

|

$

|

21,511

|

|

|

Net cash used by investing activities

|

|

|

(8,184

|

)

|

|

|

(7,990

|

)

|

|

Net cash used by financing activities

|

|

|

(40,281

|

)

|

|

|

(12,559

|

)

|

|

Net increase (decrease) in cash

|

|

$

|

(33,252

|

)

|

|

$

|

962

|

|

Cash Flows from

Operating Activities

During

the six months ended June 30, 2012, cash provided by operations was $15,113 compared with cash provided by operations of $21,511

for the six months ended June 30, 2011. Our operating cash flow is primarily affected by the overall profitability of our contracts,

our ability to invoice and collect from our clients in a timely manner, and our ability to manage our vendor payments by using

cash generated by operations and financing our accounts receivable. We bill our clients weekly or monthly after services are performed,

depending on the contract terms.

Our net income of $285,256 for the six months ended June 30, 2012 and a decrease in accounts

receivable of $259,565 were offset principally by a decrease in accounts payable and accrued expense of $129,734 and a reduction

in accrued retirement and pension obligation of $456,707.

Cash Flows from

Investing Activities

Cash used by investing activities for the

six months ended June 30, 2012 was $8,184 compared with $7,990 for the six months ended June 30, 2011. Cash used in investing activities

was primarily for capital expenditures for computer hardware and software. We expect to incur capital costs of approximately $10,000

during the balance of 2012 as we update our servers and related technology to demonstrate current technologies and product offerings

to potential clients and plan to finance a substantial portion of these costs with a capital lease.

Cash Flows from

Financing Activities

For

the six months ended June 30, 2012, cash used by financing activities was $16,281 for principal payments on notes

payable-banks and other and $24,000 on notes payable to related parties. During the six months ended June 30, 2011, cash used

by financing activities was $12,559 for principal payments on notes payable-banks and other.

We anticipate that we will

use approximately $27,300 through the next twelve months for funding existing contractual requirements of current maturities

of long-term debt obligations due to banks and the PBGC. We continue to evaluate repayment of other notes payable based on

our cash flow.

We have notes payable of $265,000 and $175,000

which mature on January 1, 2013. We plan to renegotiate the terms of these notes payable, included in current liabilities at

June 30, 2012, or seek funds to repay these notes payable.

Credit Agreement

We

have secured an accounts receivable financing line of credit from an

independent finance institution

that

allows us to sell selected accounts receivable invoices to the financial institution with full recourse against us in the amount

of $2 million, including a sublimit for one major client of $1.5 million. This provides us with the cash needed to finance certain

costs and expenses. At June 30, 2012, we had financing availability, based on eligible accounts receivable, of approximately $300,000

under this line. We pay fees based on the length of time that the invoice remains unpaid.

Other Trends

The recessionary economy that we have continued

to experience since 2009 has impacted certain portions of our business and our growth opportunities as certain projects are deferred

pending funding or improved economic conditions. In addition, the U.S. Government trend toward in sourcing has impacted certain

areas of our business. Since 2012 is an election year there continues to be uncertainty in the U.S. Government market. Any disruption

may have an impact on our strategy.

Since 2009, the United States and worldwide

capital and credit markets experienced significant price volatility, dislocations and liquidity disruptions, which have caused

market prices of many stocks to fluctuate substantially and the spreads on prospective debt financings to widen considerably. These

circumstances have materially impacted liquidity in the financial markets, making terms for certain financings less attractive,

and in some cases have resulted in the unavailability of financing. Continued uncertainty in the capital and credit markets may

negatively impact our business, including our ability to access additional financing at reasonable terms or to refinance our credit

at improved terms, which may negatively affect our ability to make future acquisitions or expansions of our business. A prolonged

downturn in the financial markets may cause us to seek alternative sources of potentially less attractive financing, and may require

us to adjust our business plan accordingly. These events also may make it more difficult or costly for us to raise capital through

the issuance of our equity securities. The disruptions in the financial markets may have a material adverse effect on the market

value of our common stock and other adverse effects on our business.

Item 3.

Quantitative

a

nd Qualitative Disclosures

About Market Risk.

As a smaller reporting company we are not

required to provide the information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and

Procedures.

Our management, with the participation of our chief executive officer and chief financial officer, carried out

an evaluation of the effectiveness of our “disclosure controls and procedures” (as defined in the Securities Exchange

Act of 1934 (the “Exchange Act”) Rules 13a-15(e) and 15-d-15(e)) as of the end of the period covered by this report

(the “Evaluation Date”). Based upon that evaluation, the chief executive officer and chief financial officer concluded

that as of the Evaluation Date, our disclosure controls and procedures are effective to ensure that information required to be

disclosed by us in the reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported,

within the time periods specified in the SEC’s rules and forms and (ii) is accumulated and communicated to our management,

including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required

disclosure.

Changes in Internal Control over Financial

Reporting.

There were no changes in our internal control over financial reporting that occurred during the quarter covered

by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial

reporting.

PART II - OTHER INFORMATION

Item 2.

Unregistered Sales

of Equity Securities and Use of Proceeds.

In July 2012, we granted options to purchase

an aggregate of 100,000 shares of our common stock at an exercise price of $.225. These grants were exempt from registration pursuant

to Section 4(2) of the Securities Act of 1933, as amended.

Item 6.

Exhibits.

|

Exhibit No.

|

|

Description

|

|

31.1

|

|

Chief Executive Officer Certification pursuant to section 302 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

31.2

|

|

Chief Financial Officer Certification pursuant to section 302 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

32.1

|

|

Chief Executive Officer Certification pursuant to section 906 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

32.2

|

|

Chief Financial Officer Certification pursuant to section 906 of the Sarbanes-Oxley Act of 2002.*

|

|

101.INS **

|

|

XBRL Instance Document

|

|

|

|

|

|

101.SCH**

|

|

XBRL Taxonomy Extension Schema Document

|

|

|

|

|

|

101.CAL**

|

|

XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

|

|

|

101.LAB**

|

|

XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

|

|

|

101.PRE**

|

|

XBRL Taxonomy Extension Presentation Linkbase Document.

|

|

|

|

|

|

101.DEF**

|

|

XBRL Taxonomy Extension Definition Linkbase Document.

|

|

|

*

|

Filed as an exhibit hereto.

|

|

|

**

|

Furnished with this report. In accordance with Rule 406T of Regulation S-T, the information in these exhibits shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to liability under that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

|

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

Infinite Group, Inc.

|

|

|

(Registrant)

|

|

|

|

|

Date August 10, 2012

|

/s/ James Villa

|

|

|

James Villa

|

|

|

Acting Chief Executive Officer

|

|

|

(Principal Executive Officer)

|

|

|

|

|

Date August 10, 2012

|

/s/ James Witzel

|

|

|

James Witzel

|

|

|

Chief Financial Officer

|

|

|

(Principal Financial Officer)

|

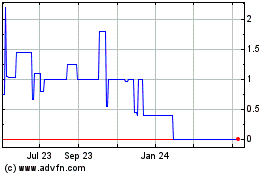

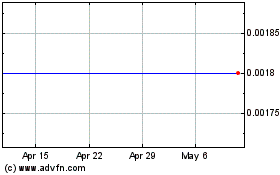

Infinite (CE) (USOTC:IMCI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Infinite (CE) (USOTC:IMCI)

Historical Stock Chart

From Jul 2023 to Jul 2024