Mimosa Concludes Indigenisation Implementation Plan

December 14 2012 - 7:45AM

OTC Markets

Implats is pleased to announce that its 50% held

subsidiary Mimosa Investment Holdings (“Mimosa Investments”) has

concluded a non-binding term sheet in respect of a proposed

indigenisation implementation plan (“IIP”) with the Government of

Zimbabwe, as represented by the Ministry of Youth Development,

Indigenisation and Empowerment.

The term sheet, which was signed today, stipulates the

key terms subject to certain conditions precedent, for the sale by

Mimosa Investments of an aggregate 51% equity ownership of Mimosa

Holdings (Private) Limited (“Mimosa Holdings”) to select indigenous

entities as described below.

The sale will be effected at fair market value of

Mimosa Holdings at the date of implementation of the sale, which

has been agreed by all parties as US$1.078 billion. The purchase

price for the indigenisation shares is thus US$550

million.

Mimosa Investments will facilitate the transaction by

providing vendor funding to the indigenous entities at an interest

rate of 9%.

In terms of the IIP, the following interests in Mimosa

Holdings will be sold:

•

10% to the Zvishavane Community Share Ownership Trust

(“Community Trust”). This is the community in which the Mimosa Mine

is located.

•

10% to an employee share ownership trust to be

established for the benefit of all permanent indigenous

employees.

•

31% to the National Indigenisation & Economic Empowerment Fund (“NIEEF”).

In accordance with the terms of the Community Trust

Deed, Mimosa will provide to the Community Trust by way of donation

an aggregate amount of US$10 million. Over the course of 2011 and

2012 a total of US$3 million has been paid to the Community Trust,

with the remaining two installments of US$3.5million each being

payable by 31 December 2013 and 31 December 2014

respectively.

Should future funding be raised by equity

subscriptions, then all parties are required to contribute, failing

which dilution is provided for.

The transaction is subject to certain conditions

precedent, including, amongst others, that:

- the relevant Mimosa group and indigenous entities

conclude definitive transaction agreements;

- a certificate of compliance is issued confirming

current and future compliance by the Mimosa group entities and its

shareholders with applicable indigenisation laws and requirements

following the implementation of the IIP;

- the parties obtain all necessary regulatory approvals,

including Zimbabwe exchange control approval; and

- the Mimosa group entities obtain the requisite Board

and Shareholder approvals required to implement the

IIP.

The parties have committed to co-operating to

fulfil the conditions precedent by 31 March 2013, subject to

extension necessitated by regulatory processes.

Terence Goodlace, CEO of Implats said: “We are very

glad to have reached agreement with the government of Zimbabwe to

further realise our ambition to be a good corporate citizen and

create a sustainable platinum mining company which can attract the

kind of investment needed to deliver profits and prosperity for the

people of Zimbabwe, our employees, the local community and all

other stakeholders.”

ENDS

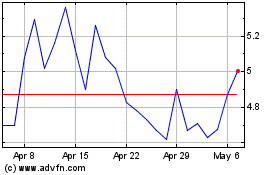

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Oct 2024 to Nov 2024

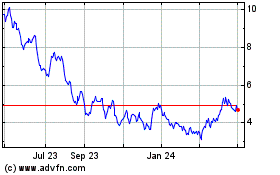

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Nov 2023 to Nov 2024