KaloBios Bankruptcy Loans Could Dilute Shkreli's Holdings

March 21 2016 - 7:10PM

Dow Jones News

KaloBios Pharmaceuticals Inc. has lined up $14 million in loans

to see it through and out of bankruptcy, financing that could be

paid off in the form of bargain-priced stock that would water down

the holdings of former chief executive Martin Shkreli.

Nomis Bay Ltd. has joined Black Horse Capital LP in offering

loans designed to fund a deal to get KaloBios back on its feet and

soothe a sore spot—the company's association with Mr. Shkreli, who

attained notoriety for hiking the price of a vital drug by 5,000%

last year.

KaloBios was on the point of being liquidated last November when

Mr. Shkreli took control of it, after which the stock price rose.

About a month later, he was pushed out of KaloBios after his arrest

on fraud charges unrelated to the company. He remains one of the

company's largest shareholders.

Mr. Shkreli denies the fraud charges, which date back to his

days as a hedge-fund manager. His KaloBios shares are pledged to

secure his bail.

Meanwhile, KaloBios is operating under chapter 11 bankruptcy

protection, raising money to revive a deal Mr. Shkreli was working

on at the time of his arrest. KaloBios's new leaders have told the

company's bankruptcy judge that he has no say in what is going on

at the company.

If the financing works out, Mr. Shkreli's influence will be even

more muted, KaloBios lawyer Gregory Werkheiser told Judge Laurie

Selber Silverstein at a hearing Monday in the U.S. Bankruptcy Court

in Wilmington, Del.

To "claw its way back from near-oblivion," as Mr. Werkheiser put

it, KaloBios is trying to buy benznidazole, a tropical disease

treatment that could earn the owner a ticket for a fast ride

through the regulatory process.

Benznidazole is an established treatment for Chagas Disease in

Latin America, but it isn't yet approved in the U.S., where 300,000

people are afflicted.

The proposed loans are to pull off a $3 million deal with Savant

Neglected Diseases LLC, which owns the drug. Savant says it will

sell to KaloBios, but only if the company exits bankruptcy swiftly

and has $10 million to put it on solid financial ground.

Nomis Bay and Black Horse are the only new investors, so far,

that are willing to take a chance on the troubled biotech

company.

The proposed loans are tied to assurances that Mr. Shkreli will

have voting control of no more than 20% of KaloBios's shares once

the company emerges from chapter 11, Mr. Werkheiser said. If the

loans are paid off in KaloBios stock, he said, Mr. Shkreli's

holdings will be diluted to an estimated 16% of the equity in the

company.

Judge Silverstein Monday said she'd likely allow KaloBios to

move ahead on the loans, subject to resolving some disputed terms

related to compensating the proposed lenders should a better

financing package be found.

At Monday's hearing, Mr. Werkheiser said investors are "scared

to death of the Shkreli effect."

"Investors are wary of KaloBios because Mr. Shkreli was

associated with the company, even though that involvement was only

for one month and Mr. Shkreli is no longer involved in management,"

Judge Silverstein observed.

The man who replaced Mr. Shkreli as chief executive, Cameron

Durrant, said in court papers that investors have been reluctant to

plunge more money into KaloBios due in part to the company's

"brief, but disastrous association with Martin Shkreli and the

negative press coverage, legal troubles, and ill-will surrounding

Mr. Shkreli, as well as broader concerns about the state of the

biotechnology and pharmaceutical industry that Mr. Shkreli's

comments have fueled."

Mr. Shkreli's lawyer, Ben Brafman, disputed linking investors'

reticence to Mr. Shkreli's involvement.

"To suggest that a sophisticated investor may be cautious about

the current state of play in the biotech sector may have some

merit. To suggest however, that any sophisticated investor's

hesitation is linked to Mr. Shkreli's 'brief' association with the

company is just absurd speculation that borders on recklessness,"

Mr. Brafman said in an email.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

March 21, 2016 18:55 ET (22:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

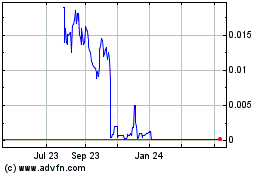

Humanigen (CE) (USOTC:HGEN)

Historical Stock Chart

From Jul 2023 to Jul 2024