As filed with the Securities and Exchange Commission on May 18, 2021

Registration No. 333-255356

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2 TO FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HEALTHIER CHOICES MANAGEMENT CORPORATION

(Exact name of registrant as specified in its charter)

3800 North 28th Way

Hollywood, FL 33020

(305) 600-5004

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey Holman

Chief Executive Officer

3800 North 28th Way

Hollywood, FL 33020

(305) 600-5004

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated

filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting

pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 18, 2021

PRELIMINARY PROSPECTUS

Subscription Rights to Purchase

Up to 70,175,438,596 Shares of Common Stock

We are distributing, at no charge, non-transferable Subscription Rights entitling holders of common stock as of the record date of 5:00 p.m. (Eastern time) on May 18, 2021, one Subscription Right to

purchase one share of common stock for every four shares of common stock owned. The per share exercise price (the “Actual Subscription Price”) of the Subscription Right will be a 25% discount to the volume-weighted average of the trading prices

(“VWAP”) of our common stock on the OTC Pink Sheets for the five consecutive trading days ending on the expiration date of the offering. For purposes of this preliminary prospectus, the estimated subscription price is $0.001425 (the “Estimated

Subscription Price”), subject to change when calculated on such expiration date of this offering.

The holders of our Series D convertible preferred stock will also receive Subscription Rights based on the number of shares of common stock that would be received upon conversion in full of such

preferred stock. The maximum aggregate amount of subscriptions that will be accepted by the Company will be $100 million (“Maximum Offering Amount”).

Pursuant to your Subscription Rights, you will have the right, which we refer to as your basic right, to purchase a number of shares based on the number of shares of common stock you held as of the

record date. If you exercise your basic right in full, you will also have the right, or over-subscription right, to purchase additional shares for which other rights holders do not subscribe. If you wish to exercise your over-subscription right, you

may request to purchase any number of shares of common stock. These requests for the exercise of the basic right or the over-subscription right, however, will be subject to a pro-rata reduction in the event that the Maximum Offering Amount is reached,

in which case you will only pay for the shares that you are able to purchase and a refund will be issued to you for the unapplied subscription payment. Once made, all exercises of your basic rights and over-subscription rights are irrevocable.

Your basic rights and over-subscription right will expire if not exercised by 5:00 p.m. (Eastern time) on June 3, 2021 (the “Expiration Date”), unless we extend or terminate this offering. We may

extend this offering for one or more additional periods in our sole discretion. We will announce any extension in a press release issued no later than 9 a.m. (Eastern time) on the business day after the most recently announced Expiration Date.

There is no minimum number of shares that we must sell in order to complete the rights offering. Stockholders who subscribe for their full basic right will not be diluted as they will continue to own

at least the same percentage of the total shares of common stock outstanding. Stockholders who do not participate in the rights offering will continue to own the same number of shares, but will own a smaller percentage of the total shares outstanding

to the extent that other stockholders participate in the rights offering. One way a rights offering differs from a reverse stock split is that a stockholder’s actual number of shares owned are not reduced in a rights offering. Subscription Rights

that are not exercised by the Expiration Date will expire and have no value. The Subscription Rights are not transferable.

The purpose of this rights offering is to raise equity capital in a cost-effective and potentially non-dilutive manner that provides all of our existing stockholders the opportunity to participate and

purchase up to approximately an additional 22.7% of the Company’s common stock. The net proceeds will be used for general working capital purposes, including the protection of our intellectual property rights through litigation and other methods,

funding future research and development for both our intellectual property suite and products, and funding for growth initiatives for both our grocery and vape segments.

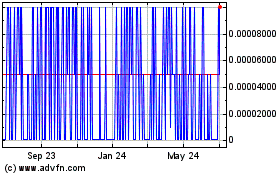

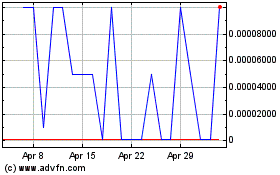

Our common stock is traded on the OTC Pink Sheets under the symbol “HCMC.” The last reported sale price of the common stock on May 17, 2021 was $0.0016 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 12 of this prospectus. We and our board of directors are not making any recommendation regarding

the exercise of your rights.

We have engaged Maxim Group LLC, or Maxim, to act as dealer-manager for this offering.

Our offering is being conducted on a best-efforts basis, and we do not need to receive any minimum amount of proceeds in order to complete the offering. We have not entered into any standby purchase

agreement, backstop commitment or similar arrangement in connection with this offering.

Broadridge Corporate Issuer Solutions, Inc. will serve as the subscription agent for this offering and will hold in escrow funds received from subscribers until we complete or terminate the offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

It is anticipated that delivery of shares purchased in this offering will be made on or about June _, 2021.

Dealer-Manager

Maxim Group LLC

The date of this prospectus is May __, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”). The exhibits to the registration statement contain the full text of

certain contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase our securities, you should review the full

text of these documents. The registration statement and the exhibits can be obtained from the SEC as indicated under the sections entitled “Where You Can Find Additional Information” and “Incorporation by Reference.”

You should rely only on the information contained in this prospectus and any free writing prospectus we may authorize to be delivered to you. We have not, and Maxim has not,

authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus and any related free writing prospectus. We and Maxim take no responsibility for, and can provide no assurances as to the

reliability of, any information that others may give you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this

prospectus is only accurate as of the date of this prospectus, regardless of the time of delivery of this prospectus and any sale of shares.

Any reference in this prospectus to information that is “contained,” “referred to” or “included” in this prospectus, or any similar expression, includes not only the information

expressly set forth in this prospectus but also the information incorporated by reference in this prospectus.

Unless the context requires otherwise, references in this prospectus to “HCMC,” “our company,” “we,” “our” “us” and similar terms refer to Healthier Choices Management Corp., a Delaware corporation,

and its subsidiaries, unless the context otherwise requires.

The following summary highlights selected information contained in this prospectus. Because the following is only a summary, it does not contain all of the information you should

consider before investing in our securities. Before making an investment decision, you should carefully read all of the information contained in this prospectus, including the risks described under “Risk Factors” and our consolidated financial

statements and the related notes incorporated by reference from our 2020 Form 10-K, before making an investment decision.

Our Business

Healthier Choices Management Corp. is a holding company focused on providing consumers with healthier daily choices with respect to nutrition and other lifestyle alternatives. The Company currently

operates eight retail vape stores in the Southeast region of the United States, through which it offers e-liquids, vaporizers and related products. The Company also operates Ada’s Natural Market, a natural and organic grocery store, through its wholly

owned subsidiary Healthy Choice Markets, Inc. and Paradise Health and Nutrition, stores that offer fresh produce, bulk foods, vitamins and supplements, packaged groceries, meat and seafood, deli, baked goods, dairy products, frozen foods, health &

beauty products and natural household items through its wholly owned subsidiary-Healthy Choice Markets 2, LLC. The Company also sells vitamins and supplements on its website TheVitaminStore.com and on Amazon.com marketplace through its wholly-owned

subsidiary Healthy U Wholesale, Inc.

Through its wholly owned subsidiary, HCMC Intellectual Property Holdings, LLC, the Company manages and intends to expand on its intellectual property portfolio. The Company also markets its Q-Cup®

technology under the vape segment. This patented technology is based on a small, quartz cup called The Q-Cup®, which a customer can purchase already filled by a third party in some regions, or can partially fill themselves with either cannabis or CBD

concentrate (approximately 50 mg), also purchased from a third party. The Q-Cup® can then be inserted into the patented Q-Unit™, which heats the cup from the outside without coming in direct contact with the solid concentrate. This Q-Cup™® and

Q-Unit™ technology provides significantly more efficiency and an “on the go” solution for consumers who prefer to vape concentrates either medicinally or recreationally. The Q-Cup® can also be used in other devices as a convenient micro-dosing system.

For a complete description of our business, financial condition, results of operations and other important information, please read our filings with the SEC that are incorporated by reference in this

prospectus, including our 2020 Form 10-K. For instructions on how to find copies of these documents, please read “Where You Can Find Additional Information.”

This Offering

Subscription Rights

We are distributing, at no charge, non-transferable Subscription Rights (“Subscription Rights”) entitling holders of common stock as of the record date of 5:00 p.m. (Eastern time) on May 18, 2021, whom

we refer to as rights holders or you, to purchase additional shares of our common stock. Your Subscription Rights will consist of:

• your basic right, which will entitle you to purchase one share of common stock for

every four shares you held as of the record date; and

• your over-subscription right, which will be exercisable only if you exercise your basic

right in full and will entitle you to purchase additional shares for which other rights holders do not subscribe, subject to a pro rata allocation of those additional shares to participating rights holders based on your percentage ownership in the

Company.

Subscription Price

All shares are being offered and sold at a subscription price equal to 75% of the volume-weighted average of the trading prices (the “VWAP”) of our common stock on the OTC Pink Sheets for the five

consecutive trading days ending on the Expiration Date (the “Actual Subscription Price”). For purposes of this preliminary prospectus, the estimated subscription price is $0.001425 (“Estimated Subscription Price”), which is equal to 75% of the VWAP

for the five consecutive trading days ending on May 12, 2021. The number of shares purchased will be adjusted for the Actual Subscription Price.

Because the Actual Subscription Price will be determined on the Expiration Date, rights holders will not know the subscription price at the time of exercise. The rights holders, therefore, will be

required initially to pay for the shares subscribed for pursuant to their basic rights and any additional shares subscribed for pursuant to the over-subscription right at the Estimated Subscription Price. Stockholders exercising their Subscription

Rights are in effect investing a fixed amount in the Company to receive the maximum number of shares of Common Stock issuable at the Actual Subscription Price.

If, on the Expiration Date, the Actual Subscription Price is lower than the Estimated Subscription Price, any excess subscription amounts paid by a subscriber (the “Excess Subscription Amount”) will be

applied towards the purchase of additional shares in the rights offering. If, on the Expiration Date, the Actual Subscription Price is higher than the Estimated Subscription Price, the subscriber will receive less shares than subscribed for and any

payments made by a subscriber toward the over-subscription rights will first be applied toward completing the purchase of all shares subscribed for pursuant to their basic rights, and then towards shares subscribed for pursuant to the over-subscription

rights, if any. For more information, see “Questions and Answers About the Rights Offering” below.

Exercise of Subscription Rights

Subscription Rights, consisting of basic rights and over-subscription rights, may be exercised at any time during the subscription period, which commences on May 19, 2021 and expires at 5:00 p.m.

(Eastern time) on June 3, 2021, or the Expiration Date, unless we extend or terminate this offering. Once made, all exercises of Subscription Rights are irrevocable.

We may extend this offering for one or more additional periods in our sole discretion. We will announce any extension in a press release issued no later than 9:00 a.m. (Eastern time) on the business

day after the most recently announced Expiration Date.

Subscription Rights may only be exercised in aggregate for at least one whole right. Any fractional Subscription Rights will be rounded up to one Subscription Right.

Transferability

The Subscription Rights are evidenced by a subscription certificate and are non-transferable. Shares of common stock included in the offering will be transferable following their issuance.

Use of Proceeds

Assuming this offering is fully subscribed, we estimate our net proceeds from the offering will total approximately $92.0 million, after deducting fees and expenses of Maxim, as dealer-manager, and our

other estimated offering expenses. We intend to use the net proceeds for general working capital purposes, including the protection of our intellectual property rights through litigation and other methods, funding future research and development of

our intellectual property and products, and funding for growth initiatives for both our grocery and vape segments. See “Use of Proceeds.”

Issuance of Our Common Stock

If you purchase shares of common stock through the rights offering, we will issue those shares to you in book-entry, or uncertificated, form as soon as practicable after the completion of the rights

offering. Stock certificates will not be issued for shares of our common stock purchased in the rights offering.

Subscription Information

In order to obtain subscription information, you should contact:

• Broadridge Corporate Issuer Solutions, Inc., which will act as the

subscription agent and the information agent in connection with this offering, by telephone at (855) 793-5068 or by email at shareholder@broadridge.com; or

• your broker-dealer, trust company or other nominee (including any

mobile investment platform) where your Subscription Rights are held.

Subscription Procedures

In order to exercise your Subscription Rights, including your over-subscription right, you should deliver a completed subscription certificate and the required payment to Broadridge Corporate Issuer

Solutions, Inc., the subscription agent for this offering, by the Expiration Date.

Important Dates

Set forth below are important dates for this offering, which generally are subject to extension:

Dealer-manager

Maxim Group LLC will act as the dealer-manager for the rights offering.

QUESTIONS AND ANSWERS RELATING TO THIS OFFERING

The following are examples of what we anticipate will be common questions about this offering. The answers are based on selected information included elsewhere in this prospectus. The following

questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about this offering. This prospectus, including the documents we incorporate by reference, contains

more detailed descriptions of the terms and conditions of this offering and provides additional information about our company and our business, including potential risks related to our business, the Rights Offering and common stock.

What is the Rights Offering?

We are issuing to each holder of common stock and the holders of our Series D convertible preferred stock (“Series D Preferred Stock”) as of the record date, whom we refer to as a rights holder or you, one

non-transferable subscription right for every four shares of common stock then owned by the holder as of the Record Date. Each basic right entitles the holder to purchase one share at the Actual Subscription Price. For purposes of submitting

subscription payments, the Estimated Subscription Price will be $0.001425. The Actual Subscription Price is equal to 75% of the VWAP of our common stock on the OTC Pink Sheets for the five consecutive trading days ending on the Expiration Date. In

effect, the participants in the rights offering will be purchasing their shares at a 25% discount to such VWAP.

What is the Subscription Price?

The Actual Subscription Price for the shares to be issued pursuant to the offer will equal 75% of the VWAP of our common stock on the OTC Pink Sheets for the five consecutive trading days ending on the Expiration Date.

Because the subscription price will be determined on the Expiration Date, rights holders will not know the subscription price at the time of exercise and will be required initially to pay for both the shares subscribed for pursuant to their basic

Subscription Rights and, if eligible, any additional shares subscribed for pursuant to the over-subscription right at the Estimated Subscription Price of $0.001425 per share. The Estimated Subscription Price reflects what the Actual Subscription Price

would be if it was calculated using May 12, 2021 as the end date for the VWAP. Stockholders exercising their Subscription Rights are in effect investing a fixed amount in the Company to receive the maximum number of shares of Common Stock issuable at

the Actual Subscription Price. Regardless of the Actual Subscription Price, Stockholders who exercise their rights will have no right to rescind their subscriptions after receipt of their completed subscription certificates together with payment for

shares by the subscription agent.

By way of example, if you wish to purchase 1,000,000 shares (assuming 500,000 shares pursuant to your basic rights and 500,000 shares pursuant to your over-subscription rights) at the Estimated Subscription Price of

$0.001425, you would be investing $1,425. The amount of shares that you receive for your $1,425 will be adjusted based on the Actual Subscription Price. Using the previous example, if the Actual Subscription Price is $0.00135, you will receive

1,055,556 shares for your same $1,425 investment. Conversely, if the Actual Subscription Price is increased to $0.0015 you will receive 950,000 shares for your $1,425 investment. However, in both cases you will be receiving a 25% discount to the VWAP

for the common stock over the five consecutive trading days ending on the Expiration Date. This example assumes the shares in excess of 500,000 were available pursuant to Over-Subscription Rights.

What are the basic rights?

For each basic right held, each rights holder has the opportunity to purchase one share at the Actual Subscription Price, provided that (1) basic rights must be exercised for a whole share (cannot exercise 0.5

Subscription Rights), and (2) the total subscription price payable upon any exercise of Subscription Rights will be rounded to the nearest whole cent. Any fractional basic rights will be rounded up to one Subscription Right. We have granted to you,

as a holder of common stock as of the record date, one basic right for each four shares of common stock you then owned. For example, if you owned 4,000 shares of common stock as of the record date, you would receive 1,000 basic rights and would have

the right to purchase, for an aggregate Subscription Price, 1,000 shares of common stock. You may exercise all, a portion or none of your basic rights. If you exercise fewer than all of your basic rights, however, you will not be entitled to purchase

any additional shares pursuant to the over-subscription right. See “—What is the over-subscription right?” below.

What is the over-subscription right?

If you exercise all of your basic rights, you will have the right, which we refer to as the over-subscription right, to purchase additional shares that remain unsubscribed as a result of any unexercised basic rights. We

refer to the basic rights and over-subscription right collectively as Subscription Rights. You should indicate on your subscription certificate, or the form provided by your nominee if your shares are held in the name of a nominee, how many additional

shares you would like to purchase pursuant to your over-subscription right. You are entitled to exercise your over-subscription right only if you exercise your basic rights in full. If over-subscription requests exceed the number of shares available,

however, we will allocate the available shares pro rata among rights holders who over-subscribe based on their percentage ownership in the Company. See “The Rights Offering—Over-Subscription Right.”

May the Subscription Rights that I exercise be reduced for any reason?

Yes. While we are distributing to holders of our common stock and Series D preferred stock one subscription right for every four shares of common stock owned or deemed owned on the Record Date, we are only seeking to

raise $100 million dollars in gross proceeds in this offering. As a result, based on (1) 307,926,082,074 shares of common stock outstanding as of the date of the preliminary prospectus and (2) 2,083,333,333 shares of common stock deemed to be owned by

the Series D holders that have a contractual right to participate in this offering and deemed to be outstanding as of the Record Date, we would grant subscription rights to acquire 77,502,353,852 shares of common stock but will only accept

subscriptions for 70,175,438,596 shares of common stock based on the Estimated Subscription Amount. Accordingly, sufficient shares may not be available to fulfill all of the subscriptions rights that have been exercised. In the event the Company is

not able fulfill the subscriptions entirely, the Company will reduce the subscriptions pro rata based on your number of basic rights exercised in relation to the total subscription amounts and return any remaining funds to the subscriber.

In addition, sufficient shares may not be available to honor your exercise of the over-subscription right. If exercises of over-subscription rights exceed the number of shares available, we will allocate the available

shares pro rata among rights holders who over-subscribe based on the number of over-subscription shares for which the rights holders have subscribed.

Why are we conducting this offering?

In accordance with our strategic plan, we are conducting this offering primarily to raise funds to facilitate the enforcement of our patent rights through litigation and other methods, research and development of our

intellectual property suite and products, to accelerate our growth efforts in the health food, vitamin and vape sectors, to improve our overall liquidity, and for other general corporate purposes. Our board of directors has approved this offering and

believes it will allow us to raise equity capital in a cost-effective manner that provides all of our existing stockholders the opportunity to participate in a non-dilutive manner. Based on information available to the board, as well as subsequent

analyses of the board, the board believes that this offering is in the best interests of our company and stockholders. Our board is not, however, making any recommendation regarding your exercise of the Subscription Rights.

Our board considered and evaluated a number of factors relating to this offering, including:

Am I required to exercise the Subscription Rights I receive in this offering?

No. You may exercise any number of your Subscription Rights, or you may choose not to exercise any of your Subscription Rights. If, however, you choose not to exercise your Subscription Rights or you exercise less than

your full amount of Subscription Rights and other stockholders fully exercise their Subscription Rights, the percentage of common stock owned by other stockholders will increase relative to your ownership percentage and your voting and other rights in

our company will likewise be diluted due to your reduced ownership in HCMC ― see “Description of Securities” for a description of the voting and liquidation rights of our common stock. However, your amount of shares you own will in no instance be

reduced.

May I sell, transfer or assign my Subscription Rights?

No. You may not transfer, sell or assign any of the Subscription Rights distributed to you, except that Subscription Rights will be transferable by operation of law (e.g., by

death). The Subscription Rights are non-transferable and will not be listed on any securities exchange or included in any automated quotation system. Therefore, there will be no market for the Subscription Rights.

How do I exercise my Subscription Rights if my shares of common stock are held in my name?

If you hold your shares of common stock in your name and you wish to participate in this offering, you must deliver a properly completed and duly executed subscription certificate and all other required subscription

documents, together with payment of the full subscription price, to the subscription agent before 5:00 p.m. (Eastern time) on the Expiration Date.

If you send an uncertified check, payment will not be deemed to have been delivered to the subscription agent until the check has cleared. In certain cases, you may be required to provide signature guarantees. If you

send an uncertified check, please send it as early as possible to have the best chance of it clearing before the Expiration Date.

Please follow the delivery instructions on the subscription certificate. Please DO NOT deliver documents to HCMC. You are solely responsible for completing delivery of your subscription certificate, all other required

subscription documents and subscription payment to the subscription agent. You should allow sufficient time for delivery of your subscription materials to the subscription agent so that the subscription agent receives them by 5:00 p.m. (Eastern time)

on the Expiration Date. See “—To whom should I send my forms and payment?” below.

If you send a payment that is insufficient to purchase the shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your Subscription

Rights to the fullest extent possible based on the amount of the payment received pursuant to your Subscription Rights. Any payment that is received but not so applied will be refunded to you without interest (subject to the rounding of the amount so

applied to the nearest whole cent).

What form of payment is required to purchase shares in the offering?

As described in the instructions accompanying the subscription certificate, payments submitted to the subscription agent must be made in U.S. dollars. Checks or bank drafts drawn on U.S. banks should be payable to the

order of “Broadridge Corporate Issuer Solutions, Inc., as Subscription Agent for Healthier Choices Management Corp.” Payments by uncertified check will be deemed to have been received upon clearance. Please note that funds paid by uncertified check

may take five or more business days to clear. Accordingly, rights holders who wish to pay the subscription price by means of uncertified check are urged to make payment sufficiently in advance of the expiration time to ensure that such payment is

received and clears by such date. If you hold your shares of common stock in the name of a broker, dealer, custodian bank or other nominee (including any mobile investment platform), separate payment instructions may apply. Please contact your

nominee, if applicable, for further payment instructions.

How do I exercise my Subscription Rights if my shares of common stock are held in the name of a broker, dealer, custodian bank or other nominee?

If you hold shares of common stock in the name of a broker, dealer, custodian bank or other nominee (including any mobile investment platform) that uses the services of Depository Trust Company (DTC), then Depository

Trust Company will credit one basic right to your nominee record holder for every four shares of common stock that you beneficially owned as of the record date. If you are not contacted by your nominee (including any mobile investment platform), you

should contact your nominee as soon as possible.

How soon must I act to exercise my Subscription Rights?

If your shares of common stock are registered in your name and you elect to exercise any of your Subscription Rights, the subscription agent must receive your properly completed and duly executed subscription

certificate, all other required subscription documents and full subscription payment, including final clearance of any uncertified check, before 5:00 p.m. (Eastern time) on the Expiration Date on June 3, 2021. If you hold shares in the name of a

broker, dealer, custodian bank or other nominee, your nominee (including any mobile investment platform) may establish an earlier deadline before the expiration of this offering by which time you must provide the nominee with your instructions and

payment to exercise your Subscription Rights.

Although we will make reasonable attempts to provide this prospectus to our stockholders to whom rights are distributed, this offering and all related Subscription Rights will expire at 5:00 p.m. (Eastern time) on the

Expiration Date, whether or not we have been able to locate and deliver this prospectus to you or any other stockholder.

After I exercise my Subscription Rights, can I change my mind?

No. Once made, all exercises of Subscription Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your Subscription Right or if the offering is extended by

the board of directors. You should not exercise your subscription right unless you are certain that you wish to purchase shares at the Estimated Subscription Price.

What happens if the Actual Subscription Price is less than the Estimated Subscription Price?

If, on the Expiration Date, the Actual Subscription Price is lower than the Estimated Subscription Price paid by the subscriber, any Excess Subscription Amounts paid by a subscriber will be applied towards the purchase

of additional shares in the rights offering. For example, assume that the Estimated Initial Subscription Price is $0.001425 per share. If you want to exercise your rights to purchase 1,000,000 shares, you will promptly send payment to the

subscription agent in the amount of $1,425. If the Actual Subscription Price decreases to $0.00135 per share, you will be deemed to have exercised the over-subscription rights and will receive 1,055,556 shares rather than 1,000,000 shares and no cash

back. Detailed instructions to exercise your rights, including regarding payment of the subscription price, are also included on your rights certificate. For assistance you may contact the subscription agent, Broadridge Corporate Issuer Solutions,

Inc., toll free at 1-888-789-8409 or by e-mail at shareholder@broadridge.com.

What happens if the Actual Subscription Price is more than the Estimated Subscription Price?

If, on the Expiration Date, the Actual Subscription Price is greater than the Estimated Subscription Price paid by the subscriber, any payments made by a subscriber with respect to the over-subscription rights will first

be applied towards the purchase of shares subscribed for pursuant to the subscriber’s basic rights, and then towards shares subscribed for pursuant to the over-subscription rights, if any. If you did not exercise the over-subscription rights, you will

receive fewer shares than you elected to purchase pursuant to the basic rights. For example, assume that the Estimated Subscription Price is $0.001425 per share. If you want to exercise your rights to purchase 1,000,000 shares, you will promptly send

payment to the subscription agent in the amount of $1,425. If the Actual Subscription Price increases to $0.0015 per share, you will receive 950,000 shares rather than 1,000,000 shares for your payment with respect to your basic rights. In addition,

if you made a payment with respect to your over-subscription right, a portion of such payment will be used to fulfill your purchase request for the additional 500,000 shares related to your basic rights. Detailed instructions to exercise your rights,

including regarding payment of the subscription price, are also included on your rights certificate. Regardless of the Actual Subscription Price, Stockholders who exercise their rights will have no right to rescind their subscriptions after receipt of

their completed subscription certificates together with payment for shares by the subscription agent. For assistance you may contact the subscription agent, Broadridge Corporate Issuer Solutions, Inc., toll free at 1-888-789-8409 or by e-mail at

shareholder@broadridge.com.

Does HCMC need to achieve a minimum participation level in order to complete the rights offering?

No. There is no minimum subscription requirement. We may consummate the offering regardless of the amount raised from the exercise of basic and over-subscription rights by the expiration date.

Can this offering be terminated or extended?

Yes. If we terminate this offering, neither we nor the subscription agent will have any obligation with respect to Subscription Rights that have been exercised except to promptly return, without interest or deduction,

any subscription payment the subscription agent received from you. If we were to terminate this offering, any money received from subscribing stockholders would be promptly returned, without interest or deduction, and we would not be obligated to

issue shares or shares of common stock to rights holders who have exercised their Subscription Rights prior to termination.

Is a rights offering similar to a reverse stock split?

No. These are completely different corporate actions. Among other differences between these actions, the numbers of shares owned by a stockholder is reduced in a reverse stock split. No reduction in shares owned by

any stockholder will occur as a result of the rights offering.

How was the subscription price determined?

The subscription price was set by our board of directors, considering, among other things, input from its dealer-manager for this offering. The factors considered by our board are discussed in “The Rights

Offering—Reasons for this Offering” and “Determination of the Subscription Price.”

Has the board of directors made a recommendation to stockholders regarding the exercise of rights under this offering?

No. Our board of directors has not made, nor will it make, any recommendation to stockholders regarding the exercise of Subscription Rights in this offering. We cannot predict the price at which shares of our

outstanding common stock will trade after this offering. You should make an independent investment decision about whether or not to exercise your Subscription Rights. Rights holders who exercise Subscription Rights risk investment loss on new money

invested. We cannot assure you that the market price for common stock will remain above the price payable per share of common stock, or that anyone purchasing shares of common stock at the exercise price will be able to sell those shares in the future

at the same price or a higher price. If you do not exercise your Subscription Rights, you will lose any value represented by your Subscription Rights, and if you do not exercise your rights in full, your percentage ownership interest and related

rights in our company will be diluted due to your reduced ownership in HCMC.

May I participate in this offering if I sell my common stock after the record date?

The record date for this offering is 5:00 p.m. (Eastern time) May 18, 2021. If you own common stock as of the record date, you will receive Subscription Rights and may participate in this offering even if you

subsequently sell your common stock.

Are there any risks associated with this offering?

Yes. The exercise of your Subscription Rights involves risks. Exercising your Subscription Rights involves the purchase of common stock and should be considered as carefully as you would consider any other equity

investment. Among other things, you should carefully consider the risks described under the heading “Risk Factors” in this prospectus and all other information contained in this prospectus.

Will the directors and executive officers participate in this offering?

No. To the extent they hold common stock as of the record date, our directors and executive officers are entitled to participate in this offering on the same terms and conditions applicable to all other stockholders.

Our directors and executive officers, however, have agreed with the Company not to participate in this offering, although they are not required to do so.

May stockholders in all jurisdictions participate in the rights offering?

Although we intend to distribute the rights to all stockholders, we reserve the right in some states to require stockholders, if they wish to participate, to state and agree upon exercise of their respective rights that

they are acquiring the shares for investment purposes only, and that they have no present intention to resell or transfer any shares acquired. Our securities are not being offered in any jurisdiction where the offer is not permitted under applicable

local laws.

When will I receive my shares of common stock?

If you purchase shares of common stock through the rights offering, we will issue those shares to you in book-entry, or uncertificated, form. Although we will endeavor to issue the appropriate book-entries as soon as

practicable after completion of this offering, there may be some delay between the Expiration Date and the time that we issue the new book-entries. Stock certificates will not be issued for shares of our common stock purchased in the rights offering.

What effects will this offering have on our outstanding common stock?

Based on shares of common stock outstanding as of May 11, 2021, if this offering is fully subscribed at the Estimated Subscription Price, we will have 378,101,520,610 shares of common stock outstanding, representing an

increase of 22.7% in our outstanding shares as of the record date. If you fully exercise your basic rights, your proportional interest in our company will not change. If you exercise only a portion, or none, of your basic rights, your interest in our

company will be diluted and your proportional interest in our company will decrease.

The number of shares of common stock outstanding listed in each case above assumes that (1) all of the other shares of common stock issued and outstanding on the record date will remain issued and outstanding and owned

by the same persons as of the closing of this offering, and (2) we will not issue any shares of common stock in the period between the record date and the closing of this offering.

Can the holders of the Series D Preferred Stock Participate in the Rights Offering?

Yes. The holders of our Series D Preferred Stock will also receive Subscription Rights based on the number of shares of common stock that would be received upon conversion in full of such preferred stock. Pursuant to

our Certificate of Incorporation, the 5,000 shares of the Series D Preferred Stock outstanding may currently convert into 2,083,333,333 shares of our common stock in the aggregate.

How much will HCMC receive from this offering, and how will its proceeds be used?

If this offering is fully subscribed, we estimate our net proceeds from the offering will total approximately $92.0 million, after deducting fees and expenses of Maxim, as dealer-manager, and our other estimated offering

expenses. We intend to use the net proceeds to facilitate the enforcement of our intellectual property rights through litigation and other methods, research and development of our intellectual property suite and products, to accelerate our growth

efforts in the health food, vitamin and vape sectors, to improve our overall liquidity, and for other general corporate purposes.

If my exercise of Subscription Rights is cutback due to the offering being oversubscribed, is not valid or if this offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription agent will hold all funds it receives in escrow until the completion or termination of this offering. If your exercise of Subscription Rights is deemed not to be valid or this offering is not

completed, all subscription payments received by the subscription agent will be promptly returned, without interest or deduction, following the expiration of the offering. If you own shares through a nominee (including any mobile investment platform),

it may take longer for you to receive your subscription price repayment because the subscription agent will return payments through your nominee.

What fees or charges apply if I purchase shares in this offering?

We are not charging any fee or sales commission to issue rights to you or, if you exercise any of your Subscription Rights, to issue shares to you. If you exercise your Subscription Rights through a broker, dealer,

custodian bank or other nominee (including any mobile investment platform), you are responsible for paying any fees your nominee may charge you.

What are the U.S. federal income tax consequences of exercising my Subscription Rights?

For U.S. federal income tax purposes, a rights holder should not recognize income or loss in connection with the receipt or exercise of rights in this offering. You should consult your tax advisor as to your particular

tax consequences resulting from the offering. For a summary of certain U.S. federal income tax consequences of this offering, see “Material U.S. Federal Income Tax Considerations.”

To whom should I send my forms and payment?

If your shares of common stock are held in the name of a broker, dealer, custodian bank or other nominee (including any mobile investment platform), then you should deliver all required subscription documents and

subscription payments pursuant to the instructions provided by your nominee. If your shares of common stock are held in your name, then you should send your subscription certificate, all other required subscription documents and your subscription

payment by mail to:

Broadridge Corporate Issuer Solutions, Inc.

Attn: BCIS re-Organization Dept.

P.O. Box 1317

Brentwood, NY 11717-0718

or by hand delivery or overnight courier to:

Broadridge Corporate Issuer Solutions, Inc.

Attn: BCIS IWS

51 Mercedes Way

Edgewood, NY 11717

You and, if applicable, your nominee are solely responsible for completing delivery to the subscription agent of your subscription certificate, as well as for completing delivery of all other required subscription

documents and your subscription payment. You should allow sufficient time for delivery of your subscription materials to the subscription agent and for clearance of payments before the expiration of this offering. If you hold your common stock

through a broker, dealer, custodian bank or other nominee (including any mobile investment platform), your nominee may establish an earlier deadline before the Expiration Date of this offering.

Who is the dealer-manager?

Maxim will act as dealer-manager for this offering. Under the terms and subject to the conditions contained in the dealer-manager agreement, Maxim will act as an advisor for purposes of this offering. We have agreed to

pay Maxim certain fees for acting as dealer-manager and to reimburse it for certain expenses incurred in connection with this offering. Maxim is not underwriting, soliciting or placing any of the Subscription Rights or the shares of common stock being

issued in this offering and is not making any recommendation with respect to such Subscription Rights (including with respect to the exercise or expiration of such Subscription Rights) or shares of common stock.

Whom should I contact if I have other questions?

If you have any questions regarding this offering, completion of the subscription certificate or any other subscription documents or submitting payment in the offering, please contact Broadridge Corporate Issuer

Solutions, Inc. by telephone at (855) 793-5068 or by email at shareholder@broadridge.com.

Investing in our securities involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information contained in this

prospectus, before making an investment decision with respect to our securities. The occurrence of any of the following risks or those incorporated by reference, or additional risks and uncertainties not presently known to us or that we currently

believe to be immaterial could materially and adversely affect our business, financial condition, results of operations or cash flows. In any such case, the trading price of common stock, could decline, and you may lose all or part of your

investment. This prospectus also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific

factors, including the risks and uncertainties described below and those incorporated by reference.

RISKS RELATED TO THE RIGHTS OFFERING

This offering may cause the price of common stock to decline, and the price may not recover for a substantial period of time, or at all.

The subscription price of shares in this offering, together with the number of shares of common stock we propose to issue and ultimately will issue in the offering, may result in an immediate decrease in the market value

of the common stock. If the market price of common stock falls, you may have irrevocably committed to buy shares of common stock in this offering at an effective price per share greater than the prevailing market price. Further, if a substantial

number of Subscription Rights are exercised and the exercising rights holders choose to sell some or all of the shares purchased directly, the resulting sales could depress the market price of common stock. We cannot assure you that the market price

of common stock will not decline prior to the expiration of this offering or that, after shares of common stock are issued upon exercise of Subscription Rights, you will be able to sell shares of common stock purchased in the offering at a price

greater than or equal to the effective price paid in the offering.

The subscription price determined for this offering may not be indicative of the fair value of common stock.

The subscription price was set by our board of directors, and you should not consider the subscription price as an indication of the fair value of common stock. The subscription price does not necessarily bear any

relationship to the book value of our assets, net worth, past operations, cash flows, earnings/losses, financial condition or any other established criteria for fair value. The market price of common stock could decline during or after this offering,

and you may not be able to sell shares of common stock purchased in the offering, at a price equal to or greater than the effective price paid in the offering, or at all.

Your interest in our company may be diluted as a result of this offering.

If you do not fully exercise your basic rights, you will, at the completion of this offering, own a smaller proportional interest in our company on a fully diluted basis than would have been the case if you had fully

exercised your basic rights. Based on shares outstanding as of May 11, 2021, after giving effect to this offering (assuming the offering is fully subscribed at the Estimated Subscription Price of $0.001425), we would have 378,101,520,610 shares of

common stock outstanding, representing an increase in outstanding shares of 22.7%.

The Subscription Rights are non-transferable.

You cannot transfer or sell your Subscription Rights to anyone else. We therefore do not intend to list the Subscription Rights on any securities exchange or include them in any automated quotation system and there will

be no market for the Subscription Rights.

We may have broad discretion in the use of a significant portion of the net proceeds from this offering and may not use those net proceeds effectively.

We intend to use the net proceeds to facilitate enforcement of our intellectual property rights through litigation and other methods, research and development of our intellectual property rights and products to

accelerate our growth rate in the health food, vitamin and vape segments to improve our overall liquidity and reduce our indebtedness, and for other general corporate purposes. We cannot specify with any certainty the particular uses of the net

proceeds, if any, that we receive from this offering. Our management will have broad discretion in the application of those additional net proceeds, and we may spend or invest those net proceeds in a way with which stockholders disagree. The failure

by management to apply these funds effectively could harm our business and financial condition. Pending their use, we may invest the net proceeds in a manner that does not produce income or that loses value.

Our common stock price may be more volatile as a result of this Rights Offering.

Historically, the market price of our common stock has fluctuated over a wide range for a variety of reasons, including company-specific factors and industry-wide conditions and events. The price of the common stock

that will prevail in the market after this Rights Offering may be higher or lower than the Actual Subscription Price depending on many factors, some of which are beyond our control and may not be directly related to our operating performance.

Financings that may be available to us under current market conditions frequently involve sales at prices below the prices at which our common stock currently trades on the OTC Pink Sheets, as well as the issuance of warrants or convertible equity that

require exercise or conversion prices that are calculated in the future at a discount to the then market price of our common stock.

We cannot assure you that the trading price of our common stock will not decline after you exercise your Subscription Rights. If that occurs, you may have bought shares of common stock in the rights offering at a price

greater than the prevailing market price and could have an immediate unrealized loss. Moreover, we cannot assure you that, following the purchase of common stock in the rights offering, you will be able to sell your common stock at a price equal to or

greater than the Actual Subscription Price, and you may lose all or part of your investment in our common stock. Until shares of common stock are delivered upon expiration of the Rights Offering, you will not be able to sell the shares of our common

stock that you purchase in the Rights Offering. Shares of our common stock purchased in the rights offering will be issued as soon as practicable after the rights offering has expired, payment for the shares subscribed for has cleared, and all

prorating calculations and reductions contemplated by the terms of the rights offering have been effected. We will not pay you interest on funds delivered to the Subscription Agent pursuant to your exercise of Subscription Rights.

We may amend or modify the terms of the Rights Offering at any time before the expiration of the Rights Offering in a way that could adversely affect your investment.

Our Board of Directors reserves the right to amend or modify the terms of the Rights Offering. The amendments or modifications may be made for any reason and may adversely affect your Subscription Rights. These changes

may include, for example, changes to the Subscription Price or other matters that may induce greater participation by our stockholders in the Rights Offering. If we make any fundamental change (such as subscription price or the shares available to

purchase pursuant to the basic right) to the terms of the Rights Offering after the date of effectiveness of this prospectus, we will file a post-effective amendment to the registration statement in which this prospectus is included and offer

subscribers the opportunity to cancel their subscriptions. In such event, we will issue subscription refunds to each stockholder subscribing to purchase shares in the rights offering and recirculate an amended prospectus after the post-effective

amendment is declared effective with the Commission. If we extend the Expiration Date in connection with any post-effective amendment, we will allow holders of Subscription Rights a reasonable period of additional time to make new investment decisions

on the basis of the new information set forth in the prospectus that will form a part of the post-effective amendment. In such event, we will issue a press release announcing the changes to the rights offering and the new Expiration Date. Even if an

amendment does not rise to the level that is fundamental and would thus require us to offer to return your subscription payment, the amendment may nonetheless adversely affect your rights and any prospective return on your investment.

You may not be able to immediately resell any shares of our common stock that you purchase upon the exercise of Subscription Rights immediately upon expiration of the Rights

Offering.

If you exercise your Subscription Rights, you may not be able to resell the common stock you purchase by exercising your Subscription Rights until you (or your broker or other nominee) have received a book-entry

representing those shares. Although we will endeavor to issue the appropriate book-entries as soon as practicable after completion of this offering, there may be some delay between the Expiration Date and the time that we issue the new book-entries.

Until shares of common stock are delivered upon expiration of the Rights Offering, you will not be able to sell or transfer the common stock that you purchase in the Rights Offering. The price of our common stock as quoted on the OTC Pink Sheets may

decrease in the time period between the Expiration Date when you purchase your shares and the date you access to such shares and may have the ability to sell them.

You may not revoke your exercise of rights.

Once you exercise your subscription rights, you may not revoke or change the exercise unless we are required by law to permit revocation. Accordingly, if you exercise your subscription rights and the market price of our

common stock increases above the Estimated Subscription Price or you later learn information about us or the rights offering that you consider unfavorable to the exercise of your subscription rights, you will be committed to buying shares and may not

revoke or change your exercise.

We do not know how many stockholders will participate in the Rights Offering.

We have no other agreements or understandings with any persons or entities with respect to their exercise of rights or their participation as an underwriter, broker or dealer in the rights offering. We therefore do not

know how many other stockholders, if any, will participate in our rights offering. If the rights offering is not otherwise fully subscribed, we will not have the capital necessary to fund our contemplated uses of the net proceeds of the rights

offering and might need to look to other sources of funding for these contemplated uses. There is no assurance that these alternative sources will be available and at what cost.

Exercising the Subscription Rights limits your ability to engage in certain hedging transactions that could provide you with financial benefits.

By exercising the Subscription Rights, you are representing to us that you have not entered into any short sale or similar transaction with respect to our common stock since the Record Date for the rights offering. This

requirement prevents you from pursuing certain investment strategies that could provide you greater financial benefits than you might have realized if the Subscription Rights did not contain these requirements.

If we terminate this offering, neither we, nor the subscription agent will have any obligation to you except to promptly return your subscription payments.

We may terminate this offering at any time. If we do, neither we, nor the subscription agent will have any obligation to you with respect to Subscription Rights that you have exercised, other than to promptly return,

without interest or deduction, the subscription payment you delivered to the subscription agent.

If you do not act on a timely basis and follow subscription instructions, your exercise of Subscription Rights may be rejected.

Holders of common stock who desire to purchase shares in this offering must act on a timely basis to ensure that all required forms and payments are actually received by the subscription agent prior to 5:00 p.m. (Eastern

Time) on the Expiration Date, unless extended. If you are a beneficial owner of shares of common stock and you wish to exercise your Subscription Rights, you must act promptly to ensure that your broker, custodian bank or other nominee (including any

mobile investment platform) acts for you and that all required forms and payments are actually received by your broker, custodian bank or other nominee (including any mobile investment platform) in sufficient time to deliver such forms and payments to

the subscription agent in order to exercise your Subscription Rights by 5:00 p.m. (Eastern time) on the Expiration Date, unless extended. We will not be responsible if your broker, custodian or nominee (including any mobile investment platform) fails

to ensure that all required forms and payments are actually received by the subscription agent in a timely manner.

If you fail to complete and sign the required subscription forms, send an incorrect payment amount, or otherwise fail to follow the subscription procedures that apply to your exercise of rights, the subscription agent

may, depending on the circumstances, reject your subscription or accept it only to the extent of the payment received. Neither we, nor the subscription agent undertakes to contact you concerning an incomplete or incorrect subscription form or payment,

nor are we or the subscription agent under any obligation to correct such forms or payment. We have the sole discretion to determine whether a subscription exercise properly follows the subscription procedures.

If you pay the subscription price by uncertified check, your check may not clear in sufficient time to enable you to exercise your Subscription Rights.

Any uncertified check used to pay for the subscription price in this offering must clear prior to the Expiration Date of this offering. The clearing process may require five or more business days. If you choose to pay

the subscription price, in whole or in part, by uncertified check and your check does not clear prior to the Expiration Date of this offering, you will not have satisfied the conditions to exercise your rights and you will not receive the shares you

wish to purchase.

You may not receive all of the shares for which you subscribe pursuant to basic rights or the over-subscription right.

The Actual Subscription Price may be greater than the Estimated Subscription Price. If you sent in payment for only your maximum basic rights, the price increase will cause you to receive less than your maximum shares

subscribed for pursuant to the basic rights. For example, if you have basic rights to acquire 1,000,000 shares, you will send in $1,425 (based on the Estimated Subscription Price of $0.001425 to acquire 1,000,000 shares) as your subscription payment.

If the Actual Subscription Price is $0.0015, you will only receive 950,000 shares in the right offering. If you elected to exercise your over-subscription right, the remaining shares related to your basic rights will be purchased first using these

funds to the extent available.

Rights holders who fully exercise their basic rights will have the right, pursuant to their over-subscription rights, to purchase additional shares to the extent other rights holders do not exercise their basic rights in

full. Over-subscription rights will be allocated pro rata among rights holders who over-subscribe, based on the number of over-subscription shares for which the rights holders have subscribed. We cannot guarantee that you will receive all, or a

significant portion, of the shares for which you subscribe pursuant to your over-subscription right.

If the number of shares allocated to you is less than your subscription request, the excess funds held by the subscription agent on your behalf will be promptly returned to you, without interest or deduction, after this

offering has expired, and we will have no further obligations to you.

This offering may cause the market price of our common stock to decrease.

The subscription price, together with the number of shares of common stock we propose to issue and ultimately will issue in the rights offering, may result in an immediate decrease in the market price of our common

stock. This decrease may continue throughout and after the completion of the rights offering. If that occurs, you may have committed to buy common stock in the rights offering at a price greater than the prevailing market price of our common stock.

Further, if a substantial number of subscription rights are exercised and the subscribing holders choose to sell some or all of the shares of common stock received upon exercise of those rights, the resulting sales could depress the market price of our

common stock. There is no assurance that following the rights offering you will be able to sell your shares of common stock purchased in the rights offering at a price equal to or greater than the subscription price.

Because no minimum subscription is required and because we do not have formal commitments from our stockholders for the entire amount we seek to raise pursuant to the rights

offering, we cannot assure you of the amount of proceeds that we will receive from the rights offering.

No minimum subscription is required for consummation of the rights offering. We do not have formal commitments from our stockholders for the amount we seek to raise pursuant to the Rights Offering, and it is possible

that no other rights will be exercised in connection with the Rights Offering. As a result, we cannot assure you of the amount of proceeds that we will receive in the Rights Offering. Therefore, if you exercise all or any portion of your subscription

rights, but other stockholders do not, we may not raise the desired amount of capital in the Rights Offering, the market price of our common stock could be adversely impacted and we may find it necessary to pursue alternative means of financing, which

may be dilutive to your investment.

Your receipt of Subscription Rights may be treated as a taxable dividend to you.

The distribution of Subscription Rights in this offering should be a non-taxable stock dividend under Section 305(a) of the Internal Revenue Code of 1986. This position is not binding on the Internal Revenue Service or

the courts, however. If this offering is part of a “disproportionate distribution” under Section 305 of the Internal Revenue Code, your receipt of Subscription Rights may be treated as the receipt of a distribution equal to the fair market value of

the rights. Any such distribution treated as a disproportionate distribution would be treated as dividend income to the extent of our current and accumulated earnings and profits, with any excess being treated as a return of basis to the extent

thereof and then as capital gain. See “Material U.S. Federal Income Tax Considerations.”

Maxim, as dealer-manager, is not acting as an underwriter or placement agent of the Subscription Rights or the securities underlying the Subscription Rights.

Maxim will act as dealer-manager for this offering and, in that capacity, will provide marketing assistance in connection with the offering. Maxim is not underwriting, soliciting or placing any of the Subscription

Rights or the shares (or the common stock comprising the shares) and is not making any recommendation with respect to such Subscription Rights (including with respect to the exercise or expiration of such Subscription Rights) or shares. Maxim will not

be subject to any liability to us in rendering services to us except for an act involving bad faith, willful misconduct or gross negligence.

Because we do not have a standby purchase agreement, backstop commitment or similar arrangement in connection with this offering, the net proceeds we receive from the offering may

be less than we intend.

We have currently not entered into any standby purchase agreement, backstop commitment or similar arrangement in connection with this offering. We therefore cannot assure you that any of our stockholders will exercise

all or any part of their Subscription Rights. We do not have arrangements under which Maxim or any other investment bank, financial advisor or other entity will be obligated to sell securities not purchased in this offering. If rights holders

subscribe for fewer shares than anticipated, the net proceeds we receive from this offering could be significantly reduced. Regardless of whether this offering is fully subscribed.

We have not paid dividends and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have not paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business

and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

The Rights Offering May Result in the Reduction of the Conversion Price of the Series D Preferred Stock and Dilution to Existing Shareholders.

The conversion price for the Series D Preferred Stock is currently $0.0024. The conversion price will be lesser of $0.0024 and either (1) 85% of the average of the volume weighted average price (VWAP) during the 10

trading days immediately following the effective date and public announcement of the next reverse stock split of HCMC, (2) 80% of the lowest daily VWAP during the 5 trading days immediately preceding the date the conversion shares are either registered

for resale or may be sold pursuant to Rule 144 and (3) the per share price at which Company securities are sold in the future. If the Actual Subscription Price is less than $0.0024, the conversion price for the Series D Preferred Stock will be reduced

to such price, causing dilution to existing stockholders upon conversion of the Series D Preferred Stock.

Risks Related to Our Securities

The market price of our common stock has been and may continue to be volatile and investors could incur substantial losses.

The market price of our common stock has been volatile, and fluctuates widely in price in response to various factors, which are beyond our control. The price of our common stock is not necessarily indicative of our

operating performance or long-term business prospects. In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These

market fluctuations may also materially and adversely affect the market price of our common stock. We may continue to incur rapid and substantial increases or decreases in our stock price in the foreseeable future that do not coincide in timing with

the disclosure of news or developments by us. Accordingly, the market price of our shares of common stock may fluctuate dramatically, and may decline rapidly, after you purchase shares in this offering, irrespective of any developments in our

business. Factors such as the following could cause the market price of our common stock to fluctuate substantially:

The stock market in general experiences from time to time extreme price and volume fluctuations. Periodic and/or continuous market fluctuations could result in extreme volatility in the price of our common stock, which

could cause a decline in the value of our common stock. Price volatility may be worse if the trading volume of our common stock is low.

These broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance. In the past, following periods of volatility in the market, securities class

action litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could materially and adversely affect our business,

financial condition, results of operations and growth prospects.

Our common stock may become the target of a “short squeeze.”

In the past several weeks, securities of certain companies have increasingly experienced significant and extreme volatility in stock price due to short sellers of shares of common stock, known as a “short squeeze.” These

short squeezes have caused extreme volatility in those companies and in the market and have led to the price per share of those companies to trade at a significantly inflated rate that is disconnected from the underlying value of the company. Many

investors who have purchased shares in those companies at an inflated rate face the risk of losing a significant portion of their original investment as the price per share has declined steadily as interest in those stocks have abated. There can be no

assurance that we will not, in the future be, a target of a short squeeze, and you may lose a significant portion or all of your investment if you purchase our shares at a rate that is significantly disconnected from our underlying value.

Future sales of our common stock may depress our stock price.

As of May 11, 2021, we had 307,926,082,074 billion shares of our common stock outstanding. Approximately 285 billion of our outstanding shares are eligible for resale without restrictions. If any significant number of

these shares are sold, such sales could have a depressive effect on the market price of our stock. The remaining shares are eligible, and some of the shares underlying the restricted stock options upon issuance, will be eligible to be offered from

time to time in the public market pursuant to registration statements we have filed and Rule 144 Securities Act, and any such sale of these shares may have a depressive effect as well. We are unable to predict the effect, if any, that the sale of

shares, or the availability of shares for future sale, will have on the market price of the shares prevailing from time to time. Sales of substantial amounts of shares in the public market, or the perception that such sales could occur, could depress

prevailing market prices for the shares. Such sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price, which we deem appropriate.

Costs incurred because we are a public company may affect our profitability.

As a public company, we incur significant legal, accounting, and other expenses, and we are subject to the SEC’s rules and regulations relating to public disclosure that generally involve a substantial expenditure of

financial resources. In addition, the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, requires changes in corporate governance practices of public companies. We expect that full compliance with such rules and

regulations will significantly increase our legal and financial compliance costs and make some activities more time-consuming and costly, which may negatively impact our financial results. To the extent our earnings suffer as a result of the financial

impact of our SEC reporting or compliance costs, our ability to develop an active trading market for our securities could be harmed.

We do not expect to pay dividends for the foreseeable future, and we may never pay dividends.

We currently intend to retain any future earnings to support the development and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will