Current Report Filing (8-k)

October 21 2020 - 1:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

|

|

|

|

|

|

Date

of Report (Date of earliest event reported):

|

October 20, 2020

|

|

|

|

GIVEMEPOWER CORPORATION

(Exact name of registrant

as specified in its charter)

|

Nevada

|

File Number: 333-67318

|

87-0291528

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS

Employer Identification No.)

|

|

370 Amapola Ave., Suite 200A,

Torrance, CA 90501

|

|

(Address of principal executive

offices) (Zip Code)

|

|

(310) 895-1839

|

|

(Registrant’s telephone number,

including area code)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Forward-Looking

Statements

This report contains

forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”) and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). The

Securities and Exchange Commission encourages companies to disclose

forward-looking information so that investors can better understand a company’s

future prospects and make informed investment decisions. This report and other

written and oral statements that we make from time to time contain such forward-looking

statements that set out anticipated results based on management’s plans and

assumptions regarding future events or performance. We have tried, wherever

possible, to identify such statements by using words such as “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will” and

similar expressions in connection with any discussion of future operating or

financial performance. In particular, these include statements relating to

future actions, future performance or results of current and anticipated sales

efforts, expenses, the outcome of contingencies, such as legal proceedings, and

financial results. Factors that could cause our actual results of operations

and financial condition to differ materially are discussed in greater detail

under Risk Factors section of this report.

We caution that the

factors described herein and other factors could cause our actual results of

operations and financial condition to differ materially from those expressed in

any forward-looking statements we make and that investors should not place

undue reliance on any such forward-looking statements. Further, any

forward-looking statement speaks only as of the date on which such statement is

made, and we undertake no obligation to update any forward-looking statement to

reflect events or circumstances after the date on which such statement is made

or to reflect the occurrence of anticipated or unanticipated events or

circumstances. New factors emerge from time to time, and it is not possible for

us to predict all of such factors. Further, we cannot assess the impact of each

such factor on our results of operations or the extent to which any factor, or

combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements.

Item 2.01 - Completion of Acquisition or Disposition

of Assets.

On

September 16, 2020, as part of its sales of unregistered securities to certain

corporation, GiveMePower Corporation acquired 100% interest in, and control of

Community Economic Development Capital, LLC (“CED Capital”), a California

Limited Liability Company, and 97% of the issued and outstanding shares of

Cannabinoid Biosciences, Inc. (“CBDX”), a California corporation.

CBDX

is a biopharmaceutical company, which intends to engage in the discovery,

development, and commercialization of cures and novel therapeutics from

proprietary cannabinoid, cannabidiol, endocannabinoids, phytocannabinoids, and

synthetic cannabinoids product platform suitable for specific treatments in a

broad range of disease areas.

CED

Capital is a specialty real estate holding company for specialized assets

including, affordable housing, opportunity zones properties, medical real

estate investments, hemp and cannabis farms, dispensaries facilities, CBD

related commercial facilities, industrial and commercial real estate, and other

real estate related services.

|

|

|

|

Item

3.02

|

Unregistered Sales of Equity Securities

|

On September 15,

2020, GiveMePower Corporation (the “Company”) entered into a stock purchase

agreement with certain corporation related to our President and CEO with

respect to the private placement of 1,000,000 shares of its preferred stock at

a purchase price of $3 in cash and a transfer of 100% interest in, and control

of Community Economic Development Capital, LLC (a California Limited Liability

Company), and 97% of the issued and outstanding common stock of Cannabinoid

Biosciences, Inc. (“CBDX”), a California corporation.

On

October 20, 2020, Corporation (the “Company”) entered into a stock purchase

agreement with Poverty Solutions, Inc. with respect to the private placement of

5,000,000 shares of its common stock at an aggregate purchase price of $20,000

in cash.

On October 20, 2020, Corporation (the

“Company”) entered into a Conditional Sign-On Bonus Agreement with its

President and CEO, Mr. Frank I Igwealor under which the Company issued 10

million shares of the Company common stock to Mr. Igwealor for agreeing to

become the President and CEO of the Company starting January 1, 2020 to

present.

The issuance of shares to Kid Castle

Educational Corporation, Frank I Igwealor and Poverty Solutions Inc. were

completed in reliance on Rule 506 of Regulation D of the Securities Act of 1933,

recognizing that these parties were all accredited investors, as defined under

Rule 501 of Regulation D of the Securities Act of 1933. All securities issued

were issued as restricted securities and were endorsed with a restrictive legend

confirming that the securities could not be resold without registration under

the Securities Act of 1933 or an applicable exemption from the registration

requirements of the Securities Act of 1933. No general solicitation or general

advertising was conducted in connection with the sales of the shares.

The subscription agreement executed

between us and Kid Castle Educational Corporation included statements that the

securities had not been registered pursuant to the Securities Act of

1933 and that the securities may not be offered or sold in the United

States unless the securities are registered under the Securities Act of

1933 or pursuant to an exemption from the Securities Act of 1933. Kid

Castle Educational Corporation agreed by execution of the subscription agreement

for the shares: (i) to resell the securities purchased only in accordance with

the provisions of Regulation S, pursuant to registration under

the Securities Act of 1933 or pursuant to an exemption from

registration under the Securities Act of 1933; (ii) that we are required

to refuse to register any sale of the securities purchased unless the transfer

is in accordance with the provisions of Regulation S, pursuant to registration

under the Securities Act of 1933 or pursuant to an exemption from

registration under the Securities Act of 1933; and (iii) not to engage in

hedging transactions with regards to the securities purchased unless in

compliance with the Securities Act of 1933. All securities issued were

endorsed with a restrictive legend confirming that the securities had been

issued pursuant to Regulation S of the Securities Act of 1933 and

could not be resold without registration under the Securities Act of

1933 or an applicable exemption from the registration requirements of

the Securities Act of 1933.

|

Item 9.01.

|

Financial Statements and

Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Securities Purchase Agreement dated September 16, 2020

|

|

10.2

|

|

Securities Purchase Agreement dated October 20, 2020

|

|

10.3

|

|

SIGN ON Bonus Agreement dated October 20, 2020

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

GiveMePower

Corporation

|

Dated:

|

October

20, 2020 By:

|

/s/

Frank I Igwealor

|

|

|

|

Frank

I Igwealor, CPA, JD, CMA, CFM

|

|

|

|

President

and CEO

|

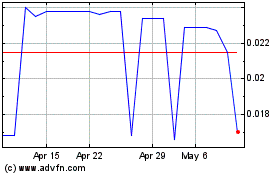

Give Me Power (PK) (USOTC:GMPW)

Historical Stock Chart

From Aug 2024 to Sep 2024

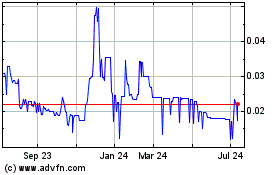

Give Me Power (PK) (USOTC:GMPW)

Historical Stock Chart

From Sep 2023 to Sep 2024