General Environmental Management Inc. (GEM) (OTCBB: GEVI), a

company specializing in the treatment and disposal of non-hazardous

wastewater, today announced its financial results for the three

months ended March 31, 2010. The company reported first-quarter

GAAP (generally accepted accounting principles) earnings per share

(EPS) at $0.30. For the first time in Company history, GEM has

recorded a quarterly net income. Total net income for the quarter

was calculated at $4,477,955.

Revenues for the first quarter are strictly from the Southern

California Waste Water (SCWW) subsidiary, due to the

discontinuation of all other segments of the GEM hazardous waste

business during the first quarter of 2010. Revenues topped $1.46

million, up 28% from $1.14 million for the same time period in

2009. The new company direction to a primarily non-hazardous

wastewater treatment driven business model provides the foundation

to build a strong enterprise.

First quarter gross profits for 2010 were $172,769, down from

$272,437 reported for the same time period in 2009. This reduction

in 2010 gross profits is primarily attributed to a $150,000

one-time remediation expense to improve the facility in Santa

Paula. Future quarterly results will not have recurring expenses

from the facility's improvements. Monetary gain on the sale of the

GEM Delaware facility and its subsidiaries equaled $8.687

million.

GEM operating expenses includes a non-cash charge in the first

quarter totaling $380,000 related to the issuance of S-8 shares for

business development. The current weighted average shares of common

stock outstanding, basic, and diluted is 15,057,653.

Chief Executive Officer of GEM Timothy Koziol stated, “We are

pleased with the results shown in our first quarter. For the first

time in the Company’s inception we have positive net income. I

firmly believe that the decision to pursue the non-hazardous

wastewater strategy has been a wise one and look forward to

building and developing our business model. While our financial

statements only include the revenue through SCWW as footnotes, we

expect that our 2nd quarter results will be more clearly defined as

the non-hazardous wastewater treatment becomes our sole revenue

source.”

GENERAL ENVIRONMENTAL

MANAGEMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

March 31, December 31, 2010 2009 (Unaudited) ASSETS CURRENT

ASSETS: Cash in bank $ 241,239 $ 466,891

Accounts receivable, net of

allowance for doubtful accounts of $10,000 and $10,000,

respectively

1,053,424 974,340 Prepaid expenses and other current assets 167,726

56,196 Total Current Assets 1,462,389 1,497,427

Property and Equipment – Net of accumulated depreciation

$465,470 and $153,448, respectively 12,616,260 12,662,494

Restricted cash 900,151 900,122 Permits and franchises 1,409,081

1,455,534 Deferred financing fees 163,942 158,898 Deposits 475,759

184,920 Assets of GEM Delaware held for sale - 2,922,639 Due from

buyer – MTS 1,089,341 1,089,341 TOTAL ASSETS $

18,116,923 $ 20,871,375 LIABILITIES AND

STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $

2,115,138 $ 2,176,801 Accrued expenses 1,500,747 1,277,662 Payable

to related party 931,726 765,628 Current portion of acquisition

notes payable 564,534 1,072,974

Current portion of long-term

obligations

4,049,236 4,822,719 Current portion of financing agreement

6,777,027 4,903,775 Total Current Liabilities

15,938,408 15,019,559 LONG-TERM LIABILITIES :

Financing agreements, net of current portion - 7,558,005

Long-term obligations, net of

current portion

3,783,919 3,238,420 Acquisition Notes Payable, net of current

portion 8,171,674 7,921,674 Derivative liabilities -

2,921,552 Total Long-Term Liabilities 11,955,593

21,639,651 STOCKHOLDERS’ EQUITY Common stock, $.001

par value, 1,000,000,000 shares authorized, 21,995,153 and

14,557,653 shares issued and outstanding 22,008 14,570 Additional

paid in capital 56,247,236 54,721,872 Accumulated deficit

(66,046,322 ) (70,524,277 ) Total Stockholders' Equity (9,977,078 )

(15,787,835 ) TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY $

18,116,923 $ 20,871,375

GENERAL ENVIRONMENTAL

MANAGEMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

Three months ended March 31, 2010 March 31, 2009

REVENUES $ 1,458,706 $ - COST OF REVENUES 1,285,937

- GROSS PROFIT 172,769 - OPERATING

EXPENSES 2,588,949 2,103,598 OPERATING LOSS

(2,416,180 ) (2,103,598 ) OTHER INCOME (EXPENSE): Interest

and financing costs –net (868,880 ) (887,528 ) Other non-operating

income - 8,265 Loss on extinguishment of debt (1,800,861 ) - Gain

on extinguishment derivative financial instruments 1,709,042

552,512 LOSS FROM CONTINUING OPERATIONS (3,376,879 )

(2,430,349 ) DISCONTINUED OPERATIONS: Gain (Loss) from discontinued

operations (407,298 ) 889,114 Gain on sale of GEM Delaware

8,687,132 - 8,279,834 889,114 INCOME

(LOSS) BEFORE PROVISION FOR INCOME TAXES 4,902,955 (1,541,235 )

PROVISION FOR INCOME TAXES (425,000 ) - NET INCOME (LOSS)

4,477,955 (1,541,235 ) Net income (loss) per common

share: Basic $ .30 $ (.12 ) Weighted average shares

of common stock outstanding: Basic 15,057,653 12,691,420

About General Environmental Management, Inc.

General Environmental Management, Inc. (www.go-gem.com) owns and

operates a non-hazardous wastewater treatment facility, Southern

California Waste Water (www.scww.com), in Santa Paula, Calif., as

well as provides various environmental services and solutions. GEM

is headquartered in Pomona, Calif.

FORWARD-LOOKING STATEMENTS

This press release may include "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical facts,

included in this press release that address activities, events or

development that the company expects, believes or anticipates will

or may occur in the future are forward-looking statements. These

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company,

which may cause the Company's actual results to differ materially

from those implied or expressed by the forward-looking statements.

The Company assumes no duty whatsoever to update these

forward-looking statements or to conform them to future events or

developments.

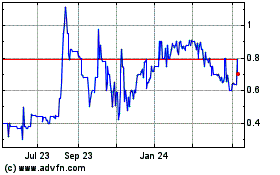

General Enterprise Ventu... (PK) (USOTC:GEVI)

Historical Stock Chart

From Nov 2024 to Dec 2024

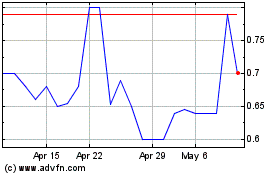

General Enterprise Ventu... (PK) (USOTC:GEVI)

Historical Stock Chart

From Dec 2023 to Dec 2024