Current Report Filing (8-k)

September 30 2019 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

September 26, 2019

Date

of Report (Date of earliest event reported)

Friendable, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-52917

|

98-0546715

|

|

(State

or other jurisdiction

|

(Commission

|

(IRS

Employer

|

|

of

incorporation)

|

File

Number)

|

Identification

No.)

|

1821 S Bascom Ave., Suite 353, Campbell, California

95008

(Address

of principal executive offices) (Zip Code)

(855) 473-7473

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

Item 3.02 Unregistered Sales of Equity Securities.

On

September 26, 2019, the Friendable Inc. (the “Company”)

entered into a Settlement Agreement with Integrity Media setting

the civil action known as Integrity Media, Inc. vs. Friendable,

Inc. et al., Orange County Case No. 30-2016-00867956-CU-CO-CJC.

Pursuant to the Settlement Agreement, The Company agreed to issue

to Integrity 750,000 shares of its common stock in exchange for 275

of the Company’s preferred shares held by Integrity and the

payment of $30,000 in costs. The cash payment is to be made within

in 6 months of date of the Settlement Agreement. Additionally,

Integrity will be entitled to additional shares if (i) the price of

the Company’s common stock is below $1.34 at either the 120

day or 240 day reset dates set forth in the Company’s Debt

Restructure Agreement entered into with various debt holders on

March 26, 2019 and filed on Form 8-K on April 15, 2019. Integrity

will also be entitled to a “true up” should they not be

able to realize $750,000 in proceeds from the sale of the common

shares.

Robert

Rositano, the Company’s CEO, has also personally guaranteed

the Company’s compliance with the Settlement

Agreement.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Friendable, Inc.

|

|

|

|

|

|

|

|

Date: September

30, 2019

|

By:

|

/s/ Robert Rositano Jr.

|

|

|

|

Robert

Rositano

|

|

|

|

CEO

|

|

|

|

|

|

|

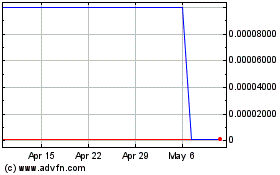

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Aug 2024 to Sep 2024

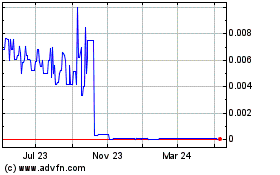

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Sep 2023 to Sep 2024