October 12, 2023 -- InvestorsHub NewsWire --

via NetworkNewsWire

Editorial Coverage: In uncertain economic times, stability

is a rare commodity. Historically, one of

the most stable

spaces during fragile economies is gold, a highly liquid

asset that carries no credit risk and preserves its value over

time. The precious metal also benefits from diverse sources of

demand: as an

investment, a reserve asset, gold

jewelry, or a technology component. These attributes mean

gold can enhance a portfolio in three ways: delivering long-term

returns, improving diversification and providing liquidity. Many

gold mining companies, including GEMXX Corp. (OTC:

GEMZ) (Profile), are seeing significant growth and

success during the recent volatile economy. Quickly graduating past

startup phase and seeing global growth in mere months, GEMXX is now

eyeing vertical integration — a noteworthy differentiator in the

gold sector. In addition to gold, the company mines ammolite, a

gemstone similar to black opal. With colored gems sparking a hot

jewelry trend, this added offering distinguishes GEMXX from many in

the gold space. Other mining companies seeing notable success in

the gold sector include Wheaton Precious Metals Corp.

(NYSE:

WPM); McEwen Mining Inc. (NYSE:

MUX); Fortitude Gold Corp.

(OTCQB:

FTCO); and Gold

Fields (NYSE:

GFI).

- Through time, gold "has proved, over

hundreds and even thousands of years, to be a reliable store of

value."

- The pending acquisition of the Yukon

Gold Project would significantly increase GEMXX's gold asset

portfolio.

- A leading producer of high-quality

finished ammolite jewelry, GEMXX is the only publicly traded

ammolite company in the world.

- GEMXX has achieved significant

milestones recently, and the company controls each stage of its

production.

Click here to view the custom infographic of

the GEMXX editorial.

Proven Reliable 'Store of Value'

A recent "U.S. News

& World Report" article stated that "gold has proved, over

hundreds and even thousands of years, to be a reliable store of

value." The article went on to note that "whatever events happen,

gold has a robust value that stays relatively consistent over time

in terms of its purchasing power." The precious metal gold can

compete against other relatively safe investments such as the U.S.

dollar and treasuries, the article notes, but "because the Fed's

efforts to combat inflation appear to be working, gold looks

increasingly attractive compared to assets like [treasuries]."

With that in mind, the astonishing progress made

by GEMXX Corp. (OTC:

GEMZ) in the past several months may prove to be

even more significant than at first glance. In 2022, the company,

which has no long-term debt, reported a 170% increase in revenues

year over year, with assets totaling $19,215,841, an increase of

more than a $1 million. GEMXX began this year with more than 1,400

acres already in its gemstone and gold resource portfolio,

including the Snow Creek gold mine site, consisting of 498 acres

with 80% mineable, and the Rosella Creek gold mine site, consisting

of 240 acres with 90% mineable.

In September, GEMXX signed a

binding letter of intent ("LOI") to acquire an initial 50%

stake in the Yukon Gold Project, which consists of 145 full Yukon

quartz claims located in Canada's Yukon Territory. "In addition to

our Snow Creek and Rosella Creek Gold deposits, the acquisition of

the Yukon Gold Project will significantly increase the company's

gold asset portfolio," said GEMXX CEO Jay Maull. "Our plan to

derisk revenues through production of the world's most sought-after

commodity is happening fast.

"By adding up to four million ounces of gold to the company's

assets, GEMXX will increase shareholder value and provide a

long-term, stable and profitable investment for years to come,"

Maull continued. "We will not only enjoy a significant reduction in

the cost of goods for our entire gold jewelry line, but this

acquisition will bring the company closer to our goal of becoming

vertically integrated."

The Ammolite Distinction

The vertical integration GEMXX is focused on

is ammolite. Along with its $300 million in gold

reserves, GEMXX has more than $600 million in ammolite

reserves, including its 360-acre Northern Block, a proven resource,

and its 217-acre Southern Blocks, both in southern Alberta, Canada.

The only publicly traded ammolite company in the world, GEMXX is a

mine-to-market gold, gemstone and jewelry producer that specializes

in this gem-quality material that is cut from the fossilized shells

of extinct sea creatures known as ammonites. Extremely rare,

ammolite is found only along the eastern slopes of the Rocky

Mountains in Alberta, Canada — where GEMXX's ammolite reserves are

located.

Leading independent market research companies such as Data

Monitor and GIA estimate the

worldwide market for luxury or premium lifestyle products,

which include gems and jewelry, at more than $90 billion annually

and growing. Ammolite sales around the world have seen

unprecedented growth over the past 20 years. Worldwide retail sales

are now estimated to top $100 million, and with colored gems

sparking a new trend in the jewelry space, that number appears

certain to increase. The organic gemstone boasts a dazzling range

of colors and patterns and is highly desired for freeform natural

cabochons and assembled jewelry pieces; the iridescent gem could be

a top contender in the growing market.

A recent Fashionisto article reported that while diamonds are

unspeakably timeless, they are losing their popularity to colored

gemstones. "Diamonds have dominated the markets for decades,

especially in engagement rings," the article states. "[But]

gemstones are back in focus to revel in their colorful glory. The

fascination and love for gemstone jewelry isn't new. Since

antiquity, they have been believed to carry talismanic properties,

divine powers and healing abilities by several civilizations. The

rising trends of these stones over diamonds show that they are

still as magnanimous and vibrant as ever.

"While gemstone jewelry isn't a new trend, it certainly is the

most sustainable one," the article concludes. "People have

preferred colored jewels since antiquity for protection, fortune,

good health and love. You can expect the similar favoritism in the

future too. The market has significantly grown in the past ten

years and expected to go even higher in the next decades."

Tried, Tested Management

The success of any company often lies in the hands of

its management

team — and GEMXX leaders have proven to be expert,

proficient and successful in what they do. GEMXX team members have

together accumulated more than 160 years in gold, gemstone and

jewelry production expertise along with extensive global operations

and sales experience. Team members possess extensive backgrounds in

every facet of the gold and gemstone business.

That expertise was tried and tested during the COVID-19

pandemic. While many companies had to ultimately scale down or

restructure, GEMXX doubled its production volume to meet demand

while continuing to grow operations and remain cash flow

positive. This often-overlooked asset — a team rich with

expertise — allows GEMXX to excel in product development, maintain

rigorous quality control measures, and maximize profitability.

GEMXX leverages its collective leadership wisdom to drive

innovation, deliver exceptional products and optimize business

strategies to achieve both short-term

and long-term objectives.

Currently the company is focused on its goal of raising $6

million in investment funding through a fully qualified Reg-A

offering. This funding will enable GEMXX to begin work on a new,

large-scale ammolite mine while also expanding current gold mine

operations as it works to meet the rising global demand for its

products. The company is also working to complete SK-1300 resource

reports on already owned gold-producing assets as well as recently

acquired gemstone resources. GEMXX management anticipates that

these reports could increase the company's resource base to as much

as $976 million and resource book value from $14.7 million to $97.6

million, or 6.6 times its current value.

In addition, GEMXX is preparing for financial audits with the

intention of initially trading on the OTCQX and ultimately

uplisting to the New York Stock Exchange or NASDAQ. That upward

movement could create more opportunities for growth and provide

even better shareholder value.

Long-term, GEMXX is committed to the sustainable and

environmentally responsible development of its resources. Mining

companies operating in Canada earn a stronger ESG score than all

other mineral-rich countries because of the country's stringent

environmental regulations, strong governance, and commitment to

safety and community.

Clearly, GEMXX has achieved significant milestones recently, and

it's worth noting that the company controls each stage of its

production, including gold mining, gemstone production, jewelry

manufacturing, and global distribution. "We are tremendously

pleased with the development of the company over the past several

months, and we are extremely excited for the anticipated

growth," said

Maull. "We look forward to updating shareholders as we move

into full gold and gemstone production. We intend to do

everything necessary to drive shareholder value."

The Quest for Mining Success

Other mining companies are also in the quest for mining

success.

Wheaton Precious Metals Corp.

(NYSE:

WPM) is the world's premier precious metals

streaming company with the highest-quality portfolio of long-life,

low-cost assets. The company's most recent

operational results included the generation of more than

$200 million of operating cash flow, primarily driven by

significant sequential improvement at the recently commissioned

expansion at its largest asset, Salobo. The company also

continues to see momentum on the corporate development front with

the addition of a new gold stream on Lumina Gold's Cangrejos

project and the expansion of our existing gold stream on Artemis

Gold's Blackwater project.

McEwen

Mining Inc. (NYSE:

MUX) is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina; in addition, it

owns approximately 52% of McEwen Copper, which owns the large,

advanced stage Los Azules copper project in Argentina. The

company just reported new assay

results from its Stock property, which is part of the

Ontario-based Fox Complex. According to the report, geological

investigations have identified two principal plunge directions (or

vectors) controlling mineralization at Stock with two additional

"intriguing results," which suggest other directions for the Stock

resource to grow.

Fortitude Gold Corp.

(OTCQB:

FTCO) is a U.S.-based gold producer targeting

projects with low operating costs, high margins and strong returns

on capital. The company has announced multiple

oxide gold drill intercepts at and near surface along the

Isabella Pearl trend. "Intercepting additional oxide gold

mineralization at and near surface along our trend speaks to the

exciting potential of finding additional gold deposits and

operational longevity at Isabella Pearl," said Fortitude Gold CEO

and president Jason Reid. "We look forward to the next round of

drilling with several goals in mind

Gold

Fields (NYSE:

GFI) is focused on becoming the preferred gold

mining company delivering sustainable, superior value. Gold

Fields announced that is has committed to driving

positive social and environmental change by embedding ambitious

targets in a new sustainability-linked loan backed by a syndicate

of 10 Australian and international banks. The sustainability-linked

indicators are the same as those being used by Gold Fields in its

five-year $1.2 billion revolving credit facility (RCF) announced in

May this year. They are also aligned to the company's strategy and

its 2030 ESG targets, which prioritize gender diversity,

decarbonization and water stewardship.

With the economy in almost constant flux, there may never be a

better time to look at investing in mining, either gold or

gemstones — or even both. With uncertainty being the one certain

thing looking forward, a space known for being stable and reliable

is a rare option.

For more information about GEMXX, please

visit GEMXX.

About NetworkNewsWire

NetworkNewsWire ("NNW") is a specialized

communications platform with a focus on financial news and content

distribution for private and public companies and the investment

community. It is one of 60+ brands

within the Dynamic Brand

Portfolio @ IBN that

delivers: (1) access to a vast network of

wire solutions via InvestorWire to efficiently and effectively reach

a myriad of target markets, demographics and diverse

industries; (2) article

and editorial

syndication to 5,000+ outlets; (3)

enhanced press

release enhancement to ensure maximum

impact; (4) social media

distribution via IBN to millions of social media

followers; and (5) a full array of

tailored corporate

communications solutions. With broad reach and a seasoned team

of contributing journalists and writers, NNW is uniquely positioned

to best serve private and public companies that want to reach a

wide audience of investors, influencers, consumers, journalists and

the general public. By cutting through the overload of information

in today's market, NNW brings its clients unparalleled recognition

and brand awareness. NNW is where breaking news, insightful content

and actionable information converge.

To receive SMS text alerts from NetworkNewsWire, text

"STOCKS" to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: https://www.NetworkNewsWire.com/Disclaimer

NetworkNewsWire

New York, NY

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is powered by IBN

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer's filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer's securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

SOURCE: NetworkNewsWire

Editorial Coverage

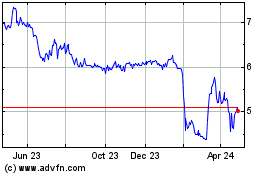

Fortitude Gold (QB) (USOTC:FTCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

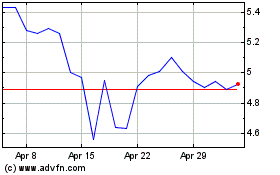

Fortitude Gold (QB) (USOTC:FTCO)

Historical Stock Chart

From Nov 2023 to Nov 2024