By Rhiannon Hoyle

SYDNEY--A planned alliance between two of the world's biggest

iron-ore producers, Brazil's Vale SA and Australia's Fortescue

Metals Group Ltd., may unravel, Fortescue Chief Executive Nev Power

said.

But Mr. Power said a failure to develop a new blend of the

companies' ores won't derail Fortescue, the world's No. 4 iron-ore

exporter, which on Friday said it would pay off another $1 billion

in debt, which was amassed when building its Australian mines.

That repayment could trigger improved returns for Fortescue

shareholders and reduces its debt-to-equity ratio to below 40%,

which was a long-held company goal.

In March, Fortescue and Vale said they wanted to create an ore

blend for sale in China, the world's largest buyer of the main

ingredient in steelmaking. The union was expected to bolster

profits and help to develop new projects.

"Sadly, that has not gone as well as we would [have hoped]," Mr.

Power said. "We're still in discussions with Vale, but I think it

is looking less and less likely we are going to be able to do that

transaction, which I think is a real shame."

Mr. Power said Fortescue-Vale talks have yet to bear fruit

because low shipping rates have leveled the playing field between

exporters in Brazil and Australia, the world's two major iron-ore

production hubs. He also said Vale had success in blending its own

ores. A Vale spokesperson couldn't immediately be reached.

The companies had hoped to start blending their ores this year,

but the iron-ore market has changed considerably in recent

months.

The price of iron ore, one of the world's most heavily traded

commodities, has nearly doubled since the beginning of 2016 due to

strong demand from Chinese steelmakers and investors. On Thursday,

it traded at $80.90 a metric ton, near its highest value in two

years, according to data provider the Steel Index.

That has increased Fortescue's ability to generate cash from the

only commodity it mines in remote northwest Australia, enabling

management to repay debt early and better protect itself against

drop in prices.

Fortescue borrowed heavily to build a vast network of mining

pits, rail lines and port infrastructure in Australia's Pilbara

region in a decadelong quest to break the dominance of Vale, Rio

Tinto PLC and BHP Billiton Ltd. in iron-ore mining. The company has

been racing to repay those loans since 2012, when a slide in

iron-ore prices forced it into emergency talks with lenders.

On Friday, Fortescue said it expects to save about $38 million a

year in interest costs from the latest $1 billion repayment, to be

made against a senior secured credit facility due in 2019. It

reduces the size of that loan to $2 billion.

Fortescue owes an additional $2.6 billion, although that debt

doesn't come due until 2022. At one time, the Perth-based company

owed about $13 billion.

The repayment also reduces the miner's gross gearing, a measure

of debt to equity, below the targeted 40% level, Mr. Power

said.

The latest repayment reduces Fortescue's gearing to 36%, said

RBC Capital Markets analyst Paul Hissey. It should "result in less

sensitivity to what is becoming a more volatile commodity price

environment," he said, and might allow Fortescue to refinance the

rest of that loan at a better rate.

Fortescue previously said it would review investor payouts once

it reached that target and Mr. Power says that will now likely

happen ahead of the company's half-year results in February.

"Our balance sheet is incredibly strong and that does give us

the opportunity to revise things like the dividend policy and make

a decision about the balance between debt repayment and dividends

going forward," he said.

A material dividend increase would put Fortescue at odds with

some of its global rivals, who have cut shareholder returns to

strengthen their balance sheets.

Mr. Power said the board would also consider expectations for

future iron-ore demand when making dividend decisions. "But, I

would have to say, right now everything looks pretty strong," he

said.

For years, Fortescue's debt pile weighed on its share price, as

it made the company more vulnerable to swings in commodity prices.

But stronger prices for iron ore progress on debt repayment have

led the company's shares to rise threefold in 2016, making it one

of the best performers on Australia's stock exchange.

Fortescue is also benefiting from higher sales and a

cost-cutting campaign. In October, the company said it shipped more

ore in the first quarter of its fiscal year--up 1% from the quarter

before and up 5% from the year-earlier period--and continued to

reduce its production costs.

The pace of growth in its shipments has been slowing, however,

since Fortescue in 2014 finished a $9.2 billion expansion that more

than tripled its iron-ore output. Mr. Power said Fortescue won't

increase production considerably until the market shows signs of a

sustainable recovery.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

December 15, 2016 22:33 ET (03:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

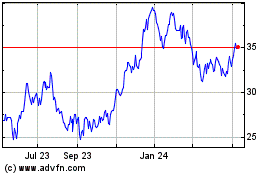

Fortescue Metal (QX) (USOTC:FSUGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

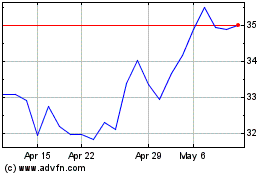

Fortescue Metal (QX) (USOTC:FSUGY)

Historical Stock Chart

From Dec 2023 to Dec 2024