Rule 497(k)

File No. 333-125751

FIRST TRUST FIRST TRUST

EXCHANGE-TRADED FUND

SUMMARY PROSPECTUS

First Trust ISE-Revere Natural Gas Index Fund

Ticker Symbol: FCG

Exchange: NYSE Arca

Before you invest, you may want to review the Fund's prospectus, which contains

more information about the Fund and its risks. You can find the Fund's

prospectus and other information about the Fund, including the statement of

additional information and most recent reports to shareholders, online at

http://www.ftportfolios.com/retail/ETF/ETFfundnews.aspx?Ticker=FCG. You can also

get this information at no cost by calling (800) 621-1675 or by sending an

e-mail request to info@ftportfolios.com. The Fund's prospectus and statement of

additional information, both dated April 30, 2012, as supplemented November 13,

2012, are all incorporated by reference into this Summary Prospectus.

INVESTMENT OBJECTIVE

The First Trust ISE-Revere Natural Gas Index Fund (the "Fund") seeks investment

results that correspond generally to the price and yield (before the Fund's fees

and expenses) of an equity index called the ISE-REVERE Natural Gas Index(TM)

(the "Index").

April 30, 2012,

as supplemented

November 13, 2012

FEES AND EXPENSES OF THE FUND

The following table describes the fees and expenses you may pay if you buy and

hold Shares of the Fund. Investors purchasing and selling Shares may be subject

to costs (including customary brokerage commissions) charged by their broker.

SHAREHOLDER FEES (fees paid directly from your investment)

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) None

ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each

year as a percentage of the value of your investment)

Management Fees 0.40%

Distribution and Service (12b-1) Fees 0.00%

Other Expenses 0.23%

-----

Total Annual Fund Operating Expenses 0.63%

Fee Waiver and Expense Reimbursement (1) 0.03%

-----

Total Net Annual Fund Operating Expenses After

Fee Waiver and Expense Reimbursement 0.60%

|

EXAMPLE

The example below is intended to help you compare the cost of investing in

the Fund with the cost of investing in other funds. This example does not

take into account customary brokerage commissions that you pay when

purchasing or selling Shares of the Fund in the secondary market.

The example assumes that you invest $10,000 in the Fund for the time periods

indicated and then you retain the Shares or redeem all of your Shares at the

end of those periods. The example also assumes that your investment has a 5%

return each year and that the Fund's annual operating expenses remain at

current levels until April 30, 2013. The example assumes that the Fund

imposes a 12b-1 fee of 0.25% per annum of the Fund's average daily net assets

following April 30, 2013. Additionally, the example assumes that First

Trust's agreement to waive fees and/or pay the Fund's expenses to the extent

necessary to prevent the operating expenses of the Fund (excluding interest

expense, brokerage commissions and other trading expenses, taxes, and

extraordinary expenses) from exceeding 0.60% of average daily net assets per

year will be terminated following April 30, 2013. Although your actual costs

may be higher or lower, based on these assumptions your costs would be:

1 YEAR 3 YEARS 5 YEARS 10 YEARS

------ ------- ------- --------

$61 $243 $451 $1,050

-------------------

|

(1) First Trust has agreed to waive fees and/or pay the Fund's expenses to the

extent necessary to prevent the operating expenses of the Fund (excluding

interest expense, brokerage commissions and other trading expenses, taxes,

and extraordinary expenses) from exceeding 0.60% of its average daily net

assets per year at least until April 30, 2013. Expenses borne or fees

waived by First Trust are subject to reimbursement by the Fund for up to

three years from the date the fee was waived or expense was incurred, but

no reimbursement payment will be made by the Fund at any time if it would

result in the Fund's expenses exceeding 0.60% of its average daily net

assets per year. The agreement may be terminated by the Trust on behalf of

the Fund at any time and by First Trust only after April 30, 2013 upon 60

days' written notice.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or "turns over" its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when

Fund Shares are held in a taxable account. These costs, which are not

reflected in annual fund operating expenses or in the example, affect the

Fund's performance. During the most recent fiscal year, the Fund's portfolio

turnover rate was 43% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund will normally invest at least 90% of its net assets plus the amount of

any borrowings for investment purposes in common stocks that comprise the Index.

The Fund, using an "indexing" investment approach, attempts to replicate, before

fees and expenses, the performance of the Index. First Trust seeks a correlation

of 0.95 or better (before fees and expenses) between the Fund's performance and

the performance of the Index; a figure of 1.00 would represent perfect

correlation. First Trust will regularly monitor the Fund's tracking accuracy and

will seek to maintain an appropriate correlation.

The Index is developed and owned by the International Securities Exchange, LLC

("ISE" or the "Index Provider"), in consultation with S&P(R), which calculates

and maintains the Index. The Index is designed to objectively identify and

select those stocks from the universe of stocks of companies that are involved

in the exploration and production of natural gas, screened by stock performance

variables as well as statistical factors to optimize Index performance and

ensure the Index has significant correlation to the price of natural gas. The

Index is an equal-weighted index comprised of exchange-listed companies that

derive a substantial portion of their revenues from the exploration and

production of natural gas. The inception date of the Index was October 4, 2006.

As of March 31, 2012, there were 28 securities that comprised the Index.

The Fund intends to invest entirely in securities included in the Index;

however, there may also be instances in which the Fund may be overweighted in

certain securities in the Index, purchase securities not in the Index that are

appropriate to substitute for certain securities in the Index or utilize various

combinations of the above techniques in seeking to track the Index.

The Fund may lend securities representing up to 20% of the value of its total

assets to broker-dealers, banks and other institutions to generate additional

income. When the Fund loans its portfolio securities, it will receive, at the

inception of each loan, cash collateral equal to at least 102% (for domestic

securities) or 105% (for international securities) of the market value of the

loaned securities.

PRINCIPAL RISKS

You could lose money by investing in the Fund. An investment in the Fund is not

a deposit of a bank and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other governmental agency.

MARKET RISK. Market risk is the risk that a particular stock owned by the Fund,

Shares of the Fund or stocks in general may fall in value. Shares are subject to

market fluctuations caused by such factors as economic, political, regulatory or

market developments, changes in interest rates and perceived trends in stock

prices. Overall stock values could decline generally or could underperform other

investments.

NON-CORRELATION RISK. The Fund's return may not match the return of the Index

for a number of reasons. For example, the Fund incurs operating expenses not

applicable to the Index, and may incur costs in buying and selling securities,

especially when rebalancing the Fund's portfolio holdings to reflect changes in

the composition of the Index. In addition, the Fund's portfolio holdings may not

exactly replicate the securities included in the Index or the ratios between the

securities included in the Index.

REPLICATION MANAGEMENT RISK. The Fund is exposed to additional market risk due

to its policy of investing principally in the securities included in the Index.

As a result of this policy, securities held by the Fund will generally not be

bought or sold in response to market fluctuations, and the securities may be

issued by companies concentrated in a particular industry. Therefore, the Fund

will generally not sell a stock because the stock's issuer is in financial

trouble, unless that stock is removed or is anticipated to be removed from the

Index.

NON-DIVERSIFICATION RISK. The Fund is classified as "non-diversified" under the

Investment Company Act of 1940, as amended (the "1940 Act"). As a result, the

Fund is only limited as to the percentage of its assets which may be invested in

the securities of any one issuer by the diversification requirements imposed by

the Internal Revenue Code of 1986, as amended (the "Code"). The Fund may invest

a relatively high percentage of its assets in a limited number of issuers. As a

result, the Fund may be more susceptible to a single adverse economic or

regulatory occurrence affecting one or more of these issuers, experience

increased volatility and be highly concentrated in certain issuers.

INDEX TRACKING RISK. You should anticipate that the value of Fund Shares will

decline, more or less, in correlation with any decline in the value of the

Fund's Index.

NON-U.S. SECURITIES AND EMERGING MARKETS RISK. The Fund invests in securities of

non-U.S. issuers in the form of U.S. dollar-denominated securities of non-U.S.

issuers traded in the United States. Such securities are subject to higher

volatility than securities of domestic issuers due to possible adverse

political, social or economic developments; restrictions on foreign investment

or exchange of securities; lack of liquidity; excessive taxation; government

seizure of assets; different legal or accounting standards; and less government

supervision and regulation of exchanges in foreign countries. These risks may be

heightened for securities of companies located in, or with significant

operations in, emerging market countries.

DEPOSITARY RECEIPTS RISK. Depositary receipts may be less liquid than the

underlying shares in their primary trading market. Any distributions paid to the

holders of depositary receipts are usually subject to a fee charged by the

depositary. Holders of depositary receipts may have limited voting rights, and

investment restrictions in certain countries may adversely impact the value of

depositary receipts because such restrictions may limit the ability to convert

equity shares into depositary receipts and vice versa. Such restrictions may

cause equity shares of the underlying issuer to trade at a discount or premium

to the market price of the depositary receipts.

ENERGY COMPANIES RISK. The Fund invests in energy companies. Energy companies

include integrated oil companies that are involved in the exploration,

production and refining process, gas distributors and pipeline-related companies

and other energy companies involved with mining, producing and delivering

energy-related services and drilling. General problems of energy companies

include volatile fluctuations in price and supply of energy fuels, international

politics, terrorist attacks, reduced demand as a result of increases in energy

efficiency and energy conservation, the success of exploration projects,

clean-up and litigation costs relating to oil spills and environmental damage,

and tax and other regulatory policies of various governments. Natural disasters

such as hurricanes in the Gulf of Mexico will also impact the petroleum

industry. Oil production and refining companies are subject to extensive

federal, state and local environmental laws and regulations regarding air

emissions and the disposal of hazardous materials. In addition, recently oil

prices have been extremely volatile.

NATURAL GAS COMPANIES RISK. One of natural gas companies' primary risks is the

competitive risk associated with the prices of alternative fuels, such as coal

and oil. For example, major natural gas customers such as industrial users and

electric power generators often have the ability to switch between the use of

coal, oil or natural gas. During periods when competing fuels are less

expensive, the revenues of gas utility companies may decline with a

corresponding impact on earnings. After years of booming production, natural gas

firms have recently begun scaling back after record low prices and huge

surpluses. Weather is another risk that may affect natural gas companies. Recent

overproduction and a mild winter have contributed to a scaled back demand for

natural gas in the United States and declining stock prices for natural gas

companies. Additionally, natural gas companies are sensitive to increased

interest rates because of the capital intensive nature of their business.

Furthermore, there are additional risks and hazards that are inherent to natural

gas companies that may cause the price of natural gas to widely fluctuate. The

exploration for, and production of, natural gas is an uncertain process with

many risks. The cost of drilling, completing and operating wells for natural gas

is often uncertain, and a number of factors can delay or prevent drilling

operations or production, including:

o unexpected drilling conditions;

o pressure or irregularities in formations;

o equipment failures or repairs;

o fires or other accidents;

o adverse weather conditions;

o pipeline ruptures or spills; and

o shortages or delays in the availability of drilling rigs and the

delivery of equipment.

SMALLER COMPANY RISK. The Fund invests in small and mid capitalization

companies. Such companies may be more vulnerable to adverse general market or

economic developments, and their securities may be less liquid and may

experience greater price volatility than larger, more established companies as a

result of several factors, including limited trading volumes, products or

financial resources, management inexperience and less publicly available

information. Accordingly, such companies are generally subject to greater market

risk than larger, more established companies.

SECURITIES LENDING RISK. The Fund may engage in securities lending. Securities

lending involves the risk that the Fund may lose money because the borrower of

the Fund's loaned securities fails to return the securities in a timely manner

or at all. The Fund could also lose money in the event of a decline in the value

of the collateral provided for the loaned securities or a decline in the value

of any investments made with cash collateral. These events could also trigger

adverse tax consequences for the Fund.

ANNUAL TOTAL RETURN

The bar chart and table below illustrate the annual calendar year returns of the

Fund based on NAV for the past four years as well as the average annual Fund and

Index returns for the one year and since inception periods ended December 31,

2011. The bar chart and table provide an indication of the risks of investing in

the Fund by showing changes in the Fund's performance from year-to-year and by

showing how the Fund's average annual total returns based on NAV compare to

those of the Index, a broad-based market index and a specialized securities

market index. See "Total Return Information" for additional performance

information regarding the Fund. The Fund's performance information is accessible

on the Fund's website at www.ftportfolios.com.

Returns before taxes do not reflect the effects of any income or capital gains

taxes. All after-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of

any state or local tax. Returns after taxes on distributions reflect the taxed

return on the payment of dividends and capital gains. Returns after taxes on

distributions and sale of Shares assume you sold your Shares at period end, and,

therefore, are also adjusted for any capital gains or losses incurred. Returns

for the market indices do not include expenses, which are deducted from Fund

returns, or taxes.

Your own actual after-tax returns will depend on your specific tax situation and

may differ from what is shown here. After-tax returns are not relevant to

investors who hold Fund Shares in tax-deferred accounts such as individual

retirement accounts (IRAs) or employee-sponsored retirement plans.

FIRST TRUST ISE-REVERE NATURAL GAS INDEX FUND--TOTAL RETURNS

CALENDAR YEAR TOTAL RETURNS AS OF 12/31

Performance Year Total Return

---------------- ------------

2008 -46.57%

2009 49.21%

2010 12.22%

2011 -6.85%

|

During the four-year period ended December 31, 2011, the Fund's highest and

lowest calendar quarter returns were 34.52% and -40.35%, respectively, for the

quarters ended June 30, 2008 and December 31, 2008. The Fund's past performance

(before and after taxes) is not necessarily an indication of how the Fund will

perform in the future.

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED DECEMBER 31, 2011

1 Year Since Inception

(5/8/2007)

Return Before Taxes -6.85% -1.53%

Return After Taxes on Distributions -6.97% -1.70%

Return After Taxes on Distributions and Sale of Shares -4.44% -1.40%

ISE-REVERE Natural Gas Index(TM) -6.18% -0.83%

Russell 3000(R) Index 1.03% -1.51%

S&P Composite 1500 Energy Index 3.92% 2.99%

|

MANAGEMENT

INVESTMENT ADVISOR

First Trust Advisors L.P. ("First Trust")

PORTFOLIO MANAGERS

The Fund's portfolio is managed by a team (the "Investment Committee")

consisting of:

o Daniel J. Lindquist, Chairman of the Investment Committee and Senior

Vice President of First Trust;

o Robert F. Carey, Chief Investment Officer and Senior Vice President

of First Trust;

o Jon C. Erickson, Senior Vice President of First Trust;

o David G. McGarel, Senior Vice President of First Trust;

o Roger F. Testin, Senior Vice President of First Trust; and

o Stan Ueland, Vice President of First Trust.

Each Investment Committee member has served as a part of the portfolio

management team of the Fund since inception.

PURCHASE AND SALE OF FUND SHARES

The Fund issues and redeems Shares on a continuous basis, at NAV, only in

Creation Units consisting of 50,000 Shares. The Fund's Creation Units are issued

and redeemed principally in-kind for securities included in the Fund's

portfolio. Individual Shares may only be purchased and sold on NYSE Arca through

a broker-dealer. Shares of the Fund will trade on NYSE Arca at market prices

rather than NAV, which may cause the Shares to trade at a price greater than NAV

(premium) or less than NAV (discount).

TAX INFORMATION

The Fund's distributions are taxable and will generally be taxed as ordinary

income or capital gains.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Fund through a broker-dealer or other financial intermediary

(such as a bank), First Trust and First Trust Portfolios L.P., the Fund's

distributor, may pay the intermediary for the sale of Fund Shares and related

services. These payments may create a conflict of interest by influencing the

broker-dealer or other intermediary and your salesperson to recommend the Fund

over another investment. Ask your salesperson or visit your financial

intermediary's website for more information.

FCGSP0111312

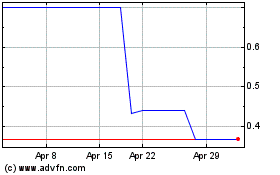

Encision (PK) (USOTC:ECIA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Encision (PK) (USOTC:ECIA)

Historical Stock Chart

From Nov 2023 to Nov 2024