U.K. Balks at Wholesale Airlines Bailout, Clouding Global Recovery Efforts

March 24 2020 - 3:31PM

Dow Jones News

By Benjamin Katz and Stephen Fidler

LONDON -- The U.K. is balking at a full-scale bailout of its

airlines, telling British carriers to seek out private-sector

remedies first and making clear the uneven hurdles the global

aviation industry faces in finding ways to survive the fallout of

the new coronavirus outbreak.

Airlines around the world have furloughed workers, cut pay and

canceled flights -- some grounding nearly all of their flying

capacity -- to weather a collapse in demand by travelers and a

patchwork of travel bans by governments aimed at containing the

spreading virus. The International Air Transport Association said

earlier Tuesday it now expects airlines to lose some $252 billion

in revenue this year -- more than double a worst-case estimate of

$113 billion given earlier this month. Air traffic is expected to

drop 38% for the year, the trade body said. It doesn't expect a

fast recovery.

Amid that crisis, governments are approaching assistance for the

industry differently, making the contours of a path for a global

recovery more difficult to see. Norway, Denmark and Sweden, for

instance, have promised cash to national and regional carriers.

The French and Dutch governments have said they are prepared to

do what is necessary to secure the survival of Air France-KLM.

Germany's Deutsche Lufthansa AG is in talks with Germany and the

governments of other countries where its network airlines are based

for similar financial support.

The U.S. Congress has been considering various proposals for how

to aid airlines as well as other industries, part of a massive

stimulus package that could be finalized Tuesday. Airlines have

asked for about $58 billion in grants and loans, though

administration officials initially favored granting credit over

cash, The Wall Street Journal has reported.

China, meanwhile, has subsidized some carriers to keep them

providing some basic services.

The U.K., home to carriers like British Airways and Virgin

Atlantic, is so far going in a different direction. In a letter to

airlines and airports on Tuesday, Rishi Sunak, the country's

Chancellor of the Exchequer, akin to the Treasury secretary in the

U.S., said the government is prepared to enter into negotiations

with individual companies but only as "a last resort."

Airlines are being encouraged to first pursue all other

commercial avenues, including raising capital from existing

investors or renegotiating payment terms with financial

stakeholders, according to the letter.

In the U.K, trade bodies have been calling for an injection of

cash. Virgin Atlantic, part owned by Delta Air Lines Inc., had

previously called for the government to provide as much as 7.5

billion pounds ($8.8 billion) for the sector.

In his letter, Mr. Sunak outlined measures he has previously

announced for the wider economy, including offering payroll relief,

and allowing companies with investment-grade ratings or the

equivalent to access working capital via a Bank of England loan

facility. The government is currently looking at options for

companies in the aviation sector that can't access such

financing.

The chancellor said any individual package would need to be

structured to protect taxpayers' interests. A U.K. government

official said economic relief measures outlined by Mr. Sunak last

week would apply to airlines, too, including deferred taxes.

"We are reviewing the letter from the Chancellor alongside the

measures announced last week for businesses," low-cost carrier

easyJet PLC said in a statement. "Our immediate focus is on

liquidity and protecting jobs and we are working with the

Government to make best use of these measures."

A spokeswoman for International Consolidated Airlines Group SA,

the owner of British Airways, said the company had received the

letter, but declined to comment further. A Virgin Atlantic

spokesman declined to comment.

Write to Benjamin Katz at ben.katz@wsj.com and Stephen Fidler at

stephen.fidler@wsj.com

(END) Dow Jones Newswires

March 24, 2020 15:16 ET (19:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

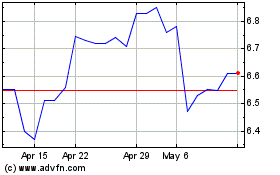

Easy Jet (QX) (USOTC:ESYJY)

Historical Stock Chart

From Oct 2024 to Nov 2024

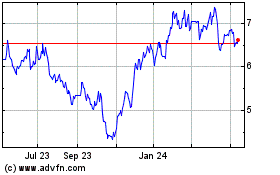

Easy Jet (QX) (USOTC:ESYJY)

Historical Stock Chart

From Nov 2023 to Nov 2024