Stock Market Alert's performance stock list includes: Dragon

Capital Group Corp (PINKSHEETS: DRGV), Microsoft (NASDAQ: MSFT),

Applied Materials Inc. (NASDAQ: AMAT) and Google Inc. (NASDAQ:

GOOG).

Breaking News: Dragon Capital Group (PINKSHEETS: DRGV)

subsidiary receives award for technology achievement by Shanghai

Municipal Government for development of city gas pipeline risk

assessment system. The company recently announced in August that

revenue for the first six months of 2009 reached $26.9 million,

increasing by 20% from the $22.3 million recorded in the first six

months of 2008.

Now the company, a leading holding company of emerging high-tech

companies in China, issued a press release yesterday after the

markets closed announcing that its subsidiary, Shanghai Yastand

Information Technology Company, Limited ("Shanghai Yastand"), has

received an award for technology achievement from Shanghai

Municipal Government for developing a city gas pipeline risk

assessment system. In addition, Shanghai Yastand has renewed its

agreement with Shanghai North Gas Company, Limited to fully

implement the pipeline risk assessment system which monitors

Shanghai North Gas's 5,280-kilometer underground gas pipelines in

north metropolitan areas of Shanghai.

Chairman and CEO, Lawrence Wang, stated, "We are very excited

about the potential of this technology which we intend to market to

numerous metropolitan areas in China. We believe there is a vast

untapped market for this technology and we intend to aggressively

pursue this opportunity. We intend to actively market our system

and technology in over 2,000 metropolitan areas in China in the

next few years which could have a substantial positive impact on

our company's operating results should we prove to be

successful."

The new risk monitoring system will allow Shanghai North Gas

Company to monitor any potential breakdown in the underground gas

pipelines by detecting gas leakages without the need for additional

expenses and works. The new system will provide tremendous economic

and environmental benefits by detecting early stage gas leaks

enabling quick repair responses to significantly reduce gas losses.

Shanghai Yastand developed this system in 2005 and obtained

copyrights from National Copyright Bureau of China in 2006.

In August 20, 2009, the company reported announced its financial

results for the second quarter ended June 30, 2009. Financial

highlights included: Revenue for the second quarter ended June 30,

2009 was $15.0 million, a 27% increase over the $11.8 million

recorded in the second quarter of 2008. Cost of goods sold for the

second quarter of 2009 were $14.1 million compared to $11.2 million

in the second quarter of 2008. Net income from continuing

operations for the second quarter of 2009 was $124,500, increasing

from the $31,000 recorded in the first quarter of 2009. Net income

in the second quarter of 2008 was approximately $215,000. This

decrease in net income was largely attributable to an increase in

selling expenses as a result of the challenging economic

environment.

Revenue for the first six months of 2009 reached $26.9 million,

increasing by 20% from the $22.3 million recorded in the first six

months of 2008. For the first six months of 2009, net income from

continuing operations was $155,400 down from $450,800 in the first

six months of 2008 and mainly attributed to higher selling expenses

in 2009.

At June 30, 2009, total assets were $14.6 million compared to

$15.9 million at December 31, 2008. At June 30, 2009, shareholder

equity was $7.1 million and total current assets were $14.3 million

with working capital of approximately $7.8 million.

The stock closed yesterday at a Penny a share.

For an in-depth profile of Dragon Capital Group, visit

http://www.wallstreetenews.com/view-company-profiles.php?profile=DRGV_072109.

To receive FREE Mobile Stock Alerts formatted especially for

your cell phone, text the word "press" in the subject line to

68494. *** This free service can be discontinued at any time by

replying to any one of the alerts with the word "stop"

Microsoft (NASDAQ: MSFT) down 0.5% on 40.7 million shares

traded. Microsoft is the worldwide leader in software, services and

solutions that help people and businesses realize their full

potential.

Applied Materials, Inc. (NASDAQ: AMAT) up 0.3% on 20.9 million

shares traded. Applied Materials, Inc. is the global leader in

Nanomanufacturing Technology(TM) solutions with a broad portfolio

of innovative equipment, services and software products for the

fabrication of semiconductor chips, flat panel displays, solar

photovoltaic cells, flexible electronics and energy-efficient

glass.

Google Inc. (NASDAQ: GOOG) down 0.6% on 1.8 million shares

traded. Google's innovative search technologies connect millions of

people around the world with information every day.

This advertisement is provided by Wall Street Enews, a division

of Stock Market Alerts LLC, an electronic broadcaster and publisher

of this release, and hereafter referred to as "the company." The

company also maintains a contractual, working relationship with

Wall Street Capital Funding LLC. and its Wall Street News Alert

brand. For current services performed for Dragon Capital Group Corp

(PINKSHEETS: DRGV), China Direct Industries, Inc. ("China Direct

Industries"), Sunwin International Neutraceuticals, Inc., China

America Holdings and China Armco Metals, Inc., the company has been

compensated a total of Three Hundred Thousand Dollars (Two Hundred

and Fifty Thousand dollars for current services and Fifty Thousand

dollars for previous services) by China Direct Investments Inc., a

Florida corporation, and a wholly owned subsidiary of China Direct.

The company does not hold any shares of the stock. Because the

company received compensation for its services, there is an

inherent conflict of interest in the company statements and

opinions and such statements and opinions cannot be considered

independent.

The information contained in this press release is for

informational purposes only, and not to be construed as an offer to

sell or solicitation of an offer to buy any security. The company

makes no representation or warranty relating to the validity of the

facts presented nor does the company represent or warrant that all

material facts necessary to make an investment decision are

presented above. Stock Market Alerts LLC is an advertising company

and therefore, this release should be viewed for informational

purposes only.

The company relies exclusively on information gathered on the

public company, such as public filings, press releases and its web

sites. Investors should use the advertising information contained

in this release as a starting point for conducting additional

research on the public company in order to allow the investor to

form his or her own opinion regarding the public company. Factual

statements contained in this publication are made as of the date

stated and they are subject to change without notice. The company

is not a registered investment adviser, broker or a dealer.

Investing in the public company that this release is providing

service for should be reviewed as speculative and a high-risk and

may result in the loss of some or all of any investment.

This release may contain statements that constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E the Securities

Exchange Act of 1934, as amended. The words "may," "would," "will,"

"expect," "estimate," "anticipate," "believe," "intend," and

similar expressions and variations thereof are intended to identify

forward-looking statements.

PINKSHEETS:DRGV NASDAQ:MSFT NASDAQ:AMAT NASDAQ:GOOG

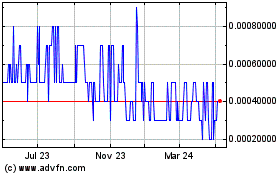

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jun 2024 to Jul 2024

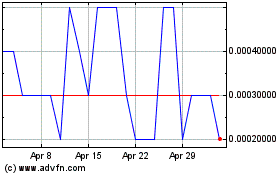

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jul 2023 to Jul 2024