Dragon Capital Group Corp. Reports Record Financial Results for the First Nine Months of 2008

January 06 2009 - 11:16AM

Marketwired

Dragon Capital Group Corp. (PINKSHEETS: DRGV), a leading holding

company of emerging high-tech companies in China, announced today

the company's financial results for the third quarter of fiscal

2008 ended September 30, 2008.

Financial Highlights:

Revenue for the third quarter of 2008 ended September 30, 2008

were $11.44 million, slightly lower than revenue of approximately

$11.79 million in the third quarter ended September 30, 2007. Cost

of goods sold for the third quarter of 2008 were $10.73 million, a

decrease from $11.11 million compared to the third quarter of 2007.

Net income for the third quarter of 2008 ended September 30, 2008

increased to approximately $265,000 as compared to a loss of

approximately $288,000. This increase in net income was largely

attributable to a significant improvement in operating expenses

which declined when compared to the third quarter of 2007 by

approximately $439,000 to approximately $318,000.

Nine-Month Financial Results

Revenue for the first nine months of 2008 reached $34.17

million, a slight increase when compared to revenue of $33.44

million for the same period of 2007. Cost of goods sold for the

first nine months of 2008 were $31.87 million, a slight increase

when compared to $31.50 million for the first nine months of 2007.

Operating expenses for the first nine months of 2008 were $1.16

million, a decrease of 48.24% compared to the first nine months of

2007. This is largely attributable to a substantial decrease in

non-cash compensation when compared to the same period in 2007. For

the nine months ended September 30, 2008, net income increased to

approximately $730,000 from a net loss of approximately $864,000 in

2007.

Balance Sheet

At September 30, 2008, total assets were $16.65 million, an

increase of over 15.19% from $14.46 million at December 31, 2007.

This increase was partially attributable to an increase in accounts

receivables and an increase in inventory. At September 30, 2008,

shareholder equity reached $9.37 million and total current assets

reached $16.01 million with working capital of approximately $9.74

million.

Mr. Lawrence Wang, CEO of Dragon Capital Group, stated, "Dragon

posted stable, strong sales in a challenging environment. More

importantly we have achieved profitability through a significant

reduction in overall operating expenses. We are committed to

increasing overall performance in this difficult economic

environment and believe the high-tech industry within China still

has tremendous growth potential for the future. We continue to look

to reduce costs and achieve higher operating efficiencies which we

believe can extend our profitability into the coming years. We

remain committed to seeking opportunistic acquisitions to grow our

business as we work diligently to increase our shareholder

value."

About Dragon Capital Group Corporation

Dragon Capital Group Corporation is a holding company serving as

a business incubator for emerging Chinese businesses. Dragon

currently controls seven subsidiaries operating in high-tech, IT

products and services and management consulting. Three of the

subsidiaries are growing strong recurring revenue streams from

electronics hardware distribution and network integration. The

company's other three subsidiaries, still in the emergent stage,

are focused on wireless Internet applications, mobile business

solutions, software development, enterprise management,

computerized automations systems integration and network

integration. For more information, visit,

http://www.dragoncapital.us.

Safe Harbor Statement

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are based on current expectations

or beliefs, including, but not limited to, statements concerning

the company's operations, financial performance and, condition. For

this purpose, statements that are not statements of historical fact

may be deemed to be forward-looking statements. The company

cautions that these statements by their nature involve risks and

uncertainties, and actual results may differ materially depending

on a variety of important factors, including, but not limited to,

the impact of competitive products, pricing and new technology;

changes in consumer preferences and tastes; and effectiveness of

marketing; changes in laws and regulations; fluctuations in costs

of production, and other factors as those discussed in the

company's reports filed with the Securities and Exchange Commission

from time to time. In addition, the company disclaims any

obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof.

Contact: Investor Relations: Gary Liu Tel: 954-363-7333 ext.

318

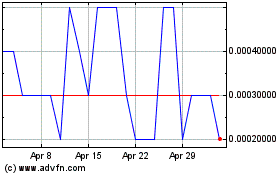

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jun 2024 to Jul 2024

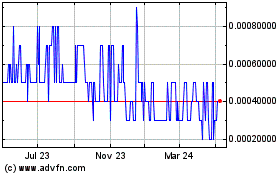

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jul 2023 to Jul 2024