Dragon Capital Group Corporation (Pink Sheets:DRGV), a holding

company of emerging high-tech companies in China, reported that its

unaudited consolidated revenue for the year ended December 31, 2007

was approximately $47.8 million, an increase of 13% from $42.3

million for 2006. Gross profit on an unaudited basis for 2007

increased 53% to $4.6 million, compared with gross profit of $3.0

million for 2006. For the fourth quarter of 2007, the company's

consolidated revenue was $14.3 million, an increase of 14% from

$12.5 million for the comparable quarter in 2006 and a sequential

improvement of 21% from $11.8 million for the third quarter of

2007. On a consolidated basis, the company reported a net loss of

approximately $53,000 for fiscal year 2007. The net loss for 2007

included non-cash expenses of $1.8 million related to consulting

fees. Excluding this $1.8 million non-cash expenses, net income for

2007 was $1.7 million or $0.01 earnings per share. At the end of

fiscal year 2007, the company substantially improved its balance

sheet as total assets rose to approximately $14.5 million, up 36%

from $10.6 million at the end of 2006. Shareholder equity rose to

$8.1 million at the end of 2007, as compared to $5 million at the

end of 2006. The company has published its fiscal 2007 year-end

financial statements with financial notes, which are available for

public viewing at http://www.pinksheets.com. Chief Executive

Officer of Dragon Capital, Lawrence Wang, stated, "Dragon Capital

has demonstrated solid year-over year growth in revenue. Gross

profit as a percentage of revenue also increased to 10% for year

2007 from 7% for 2006. Looking forward in 2008, Dragon anticipates

continued revenue growth not only from existing business

operations, but from strategic acquisitions in companies with

technology that is complimentary to ours." About Dragon Capital

Group Corporation Dragon Capital Group Corporation is a holding

company serving as a business incubator for emerging Chinese

businesses. Dragon currently controls seven subsidiaries, four of

which operate in high-tech, IT products and services and management

consulting. Three of the subsidiaries are growing strong recurring

revenue streams from electronics hardware distribution and network

integration. Dragon's wholly owned management firm, Shanghai Dragon

Capital, established in 2005, assists private Chinese technological

enterprises to go public in the U.S. capital markets. The company's

other three subsidiaries, still in the emerging stage, are focused

on wireless Internet applications, mobile business solutions,

software development, enterprise management, computerized

automations, systems integration and network integration. For more

information, visit http://www.dragoncapital.us. A profile for

investors can be accessed at

http://www.hawkassociates.com/profile/drgv.cfm. For investor

relations information, contact Frank Hawkins, Hawk Associates, at

(305) 451-1888, e-mail: Dragon.Capital@hawkassociates.com. An

online investor kit including press releases, current price quotes,

stock charts and other valuable information for investors may be

found at http://www.hawkassociates.com and

http://www.americanmicrocaps.com. To sign up for free e-mail

notification of future releases for this company, sign up at

http://www.hawkassociates.com/about/alert/. Safe Harbor Statement

In connection with the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, Dragon Capital Group

Corporation, is hereby providing cautionary statements identifying

important factors that could cause our actual results to differ

materially from those projected in forward-looking statements (as

defined in such act). Any statements that are not historical facts

and that express, or involve discussions as to, expectations,

beliefs, plans, objectives, assumptions or future events or

performance (often, but not always, indicated through the use of

words or phrases such as "will likely result," "are expected to,"

"will continue," "is anticipated," "estimated," "intends," "plans,"

"believes" and "projects") may be forward-looking and may involve

estimates and uncertainties which could cause actual results to

differ materially from those expressed in the forward-looking

statements. These statements include, but are not limited to, our

guidance and expectations regarding revenues, net income and

earnings. In addition, any such statements are qualified in their

entirety by reference to, and are accompanied by, the following key

factors that have a direct bearing on our results of operations:

our ability to effectively integrate our acquisitions and to manage

our growth and our inability to fully realize any anticipated

benefits of acquired business; our need for additional financing

which we may not be able to obtain on acceptable terms, the

dilutive effect additional capital raising efforts in future

periods may have on our current shareholders; our dependence on

certain key personnel; the lack various legal protections in

certain agreements to which we are a party and which are material

to our operations which are customarily contained in similar

contracts prepared in the United States; the business operating

risks and new technology in the business we seek to enter into and

currently operate in; the effect of changes resulting from the

political and economic policies of the Chinese government on our

assets and operations located in the PRC; the influence of the

Chinese government over the manner in which our Chinese

subsidiaries must conduct our business activities; the limitation

on our ability to receive and use our revenues effectively as a

result of restrictions on currency exchange in China; our ability

to enforce our rights due to policies regarding the regulation of

foreign investments in China; our ability to comply with the United

States Foreign Corrupt Practices Act which could subject us to

penalties and other adverse consequences; and our ability to

establish adequate management, legal and financial controls in the

PRC. We caution that the factors described herein could cause

actual results to differ materially from those expressed in any

forward-looking statements we make and that investors should not

place undue reliance on any such forward-looking statements.

Further, any forward-looking statement speaks only as of the date

on which such statement is made, and we undertake no obligation to

update any forward-looking statement to reflect events or

circumstances after the date on which such statement is made or to

reflect the occurrence of anticipated or unanticipated events or

circumstances. New factors emerge from time to time, and it is not

possible for us to predict all of such factors. Further, we cannot

assess the impact of each such factor on our results of operations

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in

any forward-looking statements. Dragon Capital Group Corporation

(Pink Sheets:DRGV), a holding company of emerging high-tech

companies in China, reported that its unaudited consolidated

revenue for the year ended December 31, 2007 was approximately

$47.8 million, an increase of 13% from $42.3 million for 2006.

Gross profit on an unaudited basis for 2007 increased 53% to $4.6

million, compared with gross profit of $3.0 million for 2006. For

the fourth quarter of 2007, the company�s consolidated revenue was

$14.3 million, an increase of 14% from $12.5 million for the

comparable quarter in 2006 and a sequential improvement of 21% from

$11.8 million for the third quarter of 2007. On a consolidated

basis, the company reported a net loss of approximately $53,000 for

fiscal year 2007. The net loss for 2007 included non-cash expenses

of $1.8 million related to consulting fees. Excluding this $1.8

million non-cash expenses, net income for 2007 was $1.7 million or

$0.01 earnings per share. At the end of fiscal year 2007, the

company substantially improved its balance sheet as total assets

rose to approximately $14.5 million, up 36% from $10.6 million at

the end of 2006. Shareholder equity rose to $8.1 million at the end

of 2007, as compared to $5 million at the end of 2006. The company

has published its fiscal 2007 year-end financial statements with

financial notes, which are available for public viewing at

http://www.pinksheets.com. Chief Executive Officer of Dragon

Capital, Lawrence Wang, stated, �Dragon Capital has demonstrated

solid year-over year growth in revenue. Gross profit as a

percentage of revenue also increased to 10% for year 2007 from 7%

for 2006. Looking forward in 2008, Dragon anticipates continued

revenue growth not only from existing business operations, but from

strategic acquisitions in companies with technology that is

complimentary to ours.� About Dragon Capital Group Corporation

Dragon Capital Group Corporation is a holding company serving as a

business incubator for emerging Chinese businesses. Dragon

currently controls seven subsidiaries, four of which operate in

high-tech, IT products and services and management consulting.

Three of the subsidiaries are growing strong recurring revenue

streams from electronics hardware distribution and network

integration. Dragon�s wholly owned management firm, Shanghai Dragon

Capital, established in 2005, assists private Chinese technological

enterprises to go public in the U.S. capital markets. The company�s

other three subsidiaries, still in the emerging stage, are focused

on wireless Internet applications, mobile business solutions,

software development, enterprise management, computerized

automations, systems integration and network integration. For more

information, visit http://www.dragoncapital.us. A profile for

investors can be accessed at

http://www.hawkassociates.com/profile/drgv.cfm. For investor

relations information, contact Frank Hawkins, Hawk Associates, at

(305) 451-1888, e-mail: Dragon.Capital@hawkassociates.com. An

online investor kit including press releases, current price quotes,

stock charts and other valuable information for investors may be

found at http://www.hawkassociates.com and

http://www.americanmicrocaps.com. To sign up for free e-mail

notification of future releases for this company, sign up at

http://www.hawkassociates.com/about/alert/. Safe Harbor Statement

In connection with the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, Dragon Capital Group

Corporation, is hereby providing cautionary statements identifying

important factors that could cause our actual results to differ

materially from those projected in forward-looking statements (as

defined in such act). Any statements that are not historical facts

and that express, or involve discussions as to, expectations,

beliefs, plans, objectives, assumptions or future events or

performance (often, but not always, indicated through the use of

words or phrases such as "will likely result," "are expected to,"

"will continue," "is anticipated," "estimated," "intends," "plans,"

"believes" and "projects") may be forward-looking and may involve

estimates and uncertainties which could cause actual results to

differ materially from those expressed in the forward-looking

statements. These statements include, but are not limited to, our

guidance and expectations regarding revenues, net income and

earnings. In addition, any such statements are qualified in their

entirety by reference to, and are accompanied by, the following key

factors that have a direct bearing on our results of operations:

our ability to effectively integrate our acquisitions and to manage

our growth and our inability to fully realize any anticipated

benefits of acquired business; our need for additional financing

which we may not be able to obtain on acceptable terms, the

dilutive effect additional capital raising efforts in future

periods may have on our current shareholders; our dependence on

certain key personnel; the lack various legal protections in

certain agreements to which we are a party and which are material

to our operations which are customarily contained in similar

contracts prepared in the United States; the business operating

risks and new technology in the business we seek to enter into and

currently operate in; the effect of changes resulting from the

political and economic policies of the Chinese government on our

assets and operations located in the PRC; the influence of the

Chinese government over the manner in which our Chinese

subsidiaries must conduct our business activities; the limitation

on our ability to receive and use our revenues effectively as a

result of restrictions on currency exchange in China; our ability

to enforce our rights due to policies regarding the regulation of

foreign investments in China; our ability to comply with the United

States Foreign Corrupt Practices Act which could subject us to

penalties and other adverse consequences; and our ability to

establish adequate management, legal and financial controls in the

PRC. We caution that the factors described herein could cause

actual results to differ materially from those expressed in any

forward-looking statements we make and that investors should not

place undue reliance on any such forward-looking statements.

Further, any forward-looking statement speaks only as of the date

on which such statement is made, and we undertake no obligation to

update any forward-looking statement to reflect events or

circumstances after the date on which such statement is made or to

reflect the occurrence of anticipated or unanticipated events or

circumstances. New factors emerge from time to time, and it is not

possible for us to predict all of such factors. Further, we cannot

assess the impact of each such factor on our results of operations

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those contained in

any forward-looking statements.

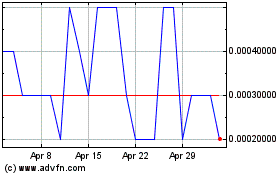

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jun 2024 to Jul 2024

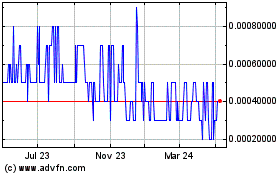

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Jul 2023 to Jul 2024