UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549 |

| |

| SCHEDULE

13G |

| |

Information to Be Included in Statements Filed

Pursuant to § 240.13d-1 (b), (c) and (d) and Amendments Thereto Filed Pursuant to § 240.13d-2

Under the Securities Exchange Act of 1934

(Amendment No. 1)* |

| |

| DiDi

Global Inc. |

| (Name

of Issuer) |

| |

| Class A

Ordinary Shares, par value of $0.00002 per share |

| (Title

of Class of Securities) |

| |

| G2758H

105 |

| (CUSIP

Number) |

| |

| December 31,

2022 |

| (Date

of Event Which Requires Filing of this Statement) |

| |

| Check

the appropriate box to designate the rule pursuant to which this Schedule is filed: |

| |

| ¨

Rule 13d-1(b) |

| |

| ¨

Rule 13d-1(c) |

| |

| x

Rule 13d-1(d) |

| |

| * The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided

in a prior cover page. |

| |

| The

information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act (however, see the Notes). |

| 1 |

NAMES

OF REPORTING PERSONS

Will Wei Cheng |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

People’s Republic of China |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

92,408,067 (1) |

| 6 |

SHARED

VOTING POWER

26,152,107 (2) |

| 7 |

SOLE

DISPOSITIVE POWER

31,156,189 (3) |

| 8 |

SHARED

DISPOSITIVE POWER

109,276,198 (4) |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

78,384,741 (5) |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

6.5%. (6) Represents

32.4% of the total outstanding voting power. (7) |

| 12 |

TYPE

OF REPORTING PERSON

IN |

| |

|

|

|

| (1) | Represents

(i) 18,693,713 Class B ordinary shares held by Xiaocheng Investments Limited (beneficially

owned by Will Wei Cheng, or Mr. Cheng, through a trust, of which Mr. Cheng is the

settlor and Mr. Cheng and his family members are the beneficiaries) that Mr. Cheng

has sole voting power over, (ii) 23,839,899 Class A ordinary shares held by certain

existing shareholders who have granted voting proxies to Mr. Cheng, and (iii) 49,874,455

Class B ordinary shares held by Steady Prominent Limited, or Steady Prominent, that

Mr. Cheng has sole voting power over. |

| (2) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding Investment Limited,

or Oriental Holding, and (ii) 4,621,106 Class A ordinary shares held by New Amigo

Holding Limited, or New Amigo. Each of Oriental Holding and New Amigo is ultimately owned

by a trust and Mr. Cheng may be deemed to beneficially own, in terms of voting power

by virtue of his membership on the respective advisory committees of such trusts, which have

the sole power to make all decisions relating to the voting and disposal of the shares held

by Oriental Holding and New Amigo. Mr. Cheng shares voting and disposal rights of the

shares held by the Oriental Holding and New Amigo with other members on the respective advisory

committees. |

| (3) | Represents

31,156,189 Class B ordinary shares held by Xiaocheng Investments Limited. |

| (4) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding, (ii) 4,621,106

Class A ordinary shares held by New Amigo, and (iii) 83,124,091 Class B ordinary

shares held by Steady Prominent. Mr. Cheng may be deemed to beneficially own, in terms

of dispositive power, of the shares held by these entities by virtue of his membership on

the respective advisory committees of the trusts that wholly owns these entities. Mr. Cheng

shares disposal rights of the shares held by Oriental Holding, New Amigo and Steady Prominent

with other members on the respective advisory committees. |

| (5) | Represents

(i) 31,156,189 Class B ordinary shares held by Xiaocheng Investments Limited, and

(ii) 47,228,552 Class B ordinary shares held by Steady Prominent in which Mr. Cheng

has an indirect economic interest. The number of shares here represents the shares beneficially

owned by Mr. Cheng in terms of economic interest, which is not the same as the shares

that Mr. Cheng has voting or dispositive power over as illustrated in Notes (1) to

(4) above. |

| (6) | The

percentage of class of securities is calculated by dividing the ordinary shares beneficially

owned by the Reporting Person in terms of economic interests by the sum of the total number

of ordinary shares outstanding as of December 31, 2022. |

| (7) | The

percentage of voting power is calculated by dividing the voting power beneficially owned

by the Reporting Person by the voting power of all of the Issuer’s holders of Class A

ordinary shares and Class B ordinary shares as a single class as of December 31,

2022. Each holder of Class A ordinary shares is entitled to one vote per share and each

holder of Class B Shares is entitled to ten votes per share on all matters submitted

to them for a vote. |

| 1 |

NAMES

OF REPORTING PERSONS

Jean Qing Liu |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Hong Kong, People’s Republic

of China |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

48,767,668 (1) |

| 6 |

SHARED

VOTING POWER

26,152,107 (2) |

| 7 |

SOLE

DISPOSITIVE POWER

3,055,556 (3) |

| 8 |

SHARED

DISPOSITIVE POWER

109,276,198 (4) |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

19,172,128 (5) |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.6% (6). Represents

22.6% of the total outstanding voting power. (7) |

| 12 |

TYPE

OF REPORTING PERSON

IN |

| |

|

|

|

| (1) | Represents

(i) 3,055,556 Class B ordinary shares held by Investor Link Investments Limited

(beneficially owned by Jean Qing Liu, or Ms. Liu, through a trust, of which Ms. Liu

is the settlor and Ms. Liu and her family members are the beneficiaries), (ii) 12,462,476

Class B ordinary shares held by Xiaocheng Investments Limited over which Mr. Cheng

has granted a voting proxy to Ms. Liu, and (iii) 33,249,636 Class B ordinary

shares held by Steady Prominent that Ms. Liu has sole voting power over. |

| (2) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding, and (ii) 4,621,106

Class A ordinary shares held by New Amigo. Ms. Liu may be deemed to beneficially

own, in terms of voting power, of the shares held by these entities by virtue of her membership

on the respective advisory committees of the trusts that wholly owns these entities. Ms. Liu

shares voting and disposal rights of the shares held by Oriental Holding and New Amigo with

other members on the respective advisory committees. |

| (3) | Represents

3,055,556 Class B ordinary shares held by Investor Link Investments Limited. |

| (4) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding, (ii) 4,621,106

Class A ordinary shares held by New Amigo, and (iii) 83,124,091 Class B ordinary

shares held by Steady Prominent. Ms. Liu may be deemed to beneficially own, in terms

of dispositive power, of the shares held by these entities by virtue of her membership on

the respective advisory committees of the trusts that wholly owns these entities. Ms. Liu

shares disposal rights of the shares held by Oriental Holding, New Amigo and Steady Prominent

with other members on the respective advisory committees. |

| (5) | Represents

(i) 3,055,556 Class B ordinary shares held by Investor Link Investments Limited,

and (ii) 16,116,572 Class B ordinary shares held by Steady Prominent in which Ms. Liu

has an indirect economic interest. The number of shares here represents the shares beneficially

owned by Ms. Liu in terms of economic interest, which is not the same as the shares

that Ms. Liu has voting or dispositive power over as illustrated in Notes (1) to

(4) above. |

| (6) | The

percentage of class of securities is calculated by dividing the ordinary shares beneficially

owned by the Reporting Person in terms of economic interests by the sum of the total number

of ordinary shares outstanding as of December 31, 2022. |

| (7) | The

percentage of voting power is calculated by dividing the voting power beneficially owned

by the Reporting Person by the voting power of all of the Issuer’s holders of Class A

ordinary shares and Class B ordinary shares as a single class as of December 31,

2022. Each holder of Class A ordinary shares is entitled to one vote per share and each

holder of Class B Shares is entitled to ten votes per share on all matters submitted

to them for a vote. |

| 1 |

NAMES

OF REPORTING PERSONS

Stephen Jingshi Zhu |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Hong Kong, People’s Republic

of China |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

0 |

| 6 |

SHARED

VOTING POWER

26,152,107 (1) |

| 7 |

SOLE

DISPOSITIVE POWER

0 |

| 8 |

SHARED

DISPOSITIVE POWER

109,276,198 (2) |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

9,620,410 (3) |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.8%. (4) Represents

1.2% of the total outstanding voting power. (5) |

| 12 |

TYPE

OF REPORTING PERSON

IN |

| |

|

|

|

| (1) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding, and (ii) 4,621,106

Class A ordinary shares held by New Amigo. Stephen Jingshi Zhu (“Mr. Zhu”)

may be deemed to beneficially own, in terms of voting power, of the shares held by these

entities, by virtue of his membership on the respective advisory committees of the trusts

that wholly owns these entities. Mr. Zhu shares voting and disposal rights of the shares

held by Oriental Holding and New Amigo with other members on the respective advisory committees. |

| (2) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding, (ii) 4,621,106

Class A ordinary shares held by New Amigo, and (iii) 83,124,091 Class B ordinary

shares held by Steady Prominent. Mr. Zhu may be deemed to beneficially own, in terms

of dispositive power of the shares held by these entities by virtue of his membership on

the respective advisory committees of the trusts that wholly owns these entities. Mr. Zhu

shares disposal rights of the shares held by Oriental Holding, New Amigo and Steady Prominent

with other members on the respective advisory committee. |

| (3) | Represents

9,620,410 Class B ordinary shares held by Steady Prominent in which Mr. Zhu has

an indirect economic interest. However, Mr. Zhu does not hold voting power of such shares

because he has granted Mr. Cheng and Ms. Liu proxies to vote such shares on his

behalf. The number of shares here represents the shares beneficially owned by Mr. Zhu

in terms of economic interest, which is not the same as the shares that Mr. Zhu has

voting or dispositive power over as illustrated in Notes (1) and (2) above. |

| (4) | The

percentage of class of securities is calculated by dividing the ordinary shares beneficially

owned by the Reporting Person in terms of economic interests by the sum of the total number

of ordinary shares outstanding as of December 31, 2022. |

| (5) | The

percentage of voting power is calculated by dividing the voting power beneficially owned

by the Reporting Person by the voting power of all of the Issuer’s holders of Class A

ordinary shares and Class B ordinary shares as a single class as of December 31,

2022. Each holder of Class A ordinary shares is entitled to one vote per share and each

holder of Class B Shares is entitled to ten votes per share on all matters submitted

to them for a vote. |

| 1 |

NAMES

OF REPORTING PERSONS

Xiaocheng Investments Limited |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b)

¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

31,156,189 |

| 6 |

SHARED

VOTING POWER

0 |

| 7 |

SOLE

DISPOSITIVE POWER

31,156,189 |

| 8 |

SHARED

DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,156,189 |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

2.6%.* The voting power of the shares

beneficially owned represent 13.7% of the total outstanding voting power. ** |

| 12 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

* The percentage of class of securities

is calculated by dividing the ordinary shares beneficially owned by the Reporting Person in terms of economic interests by the sum of

the total number of ordinary shares outstanding as of December 31, 2022.

** The percentage of voting power is

calculated by dividing the voting power beneficially owned by the Reporting Person by the voting power of all of the Issuer’s holders

of Class A ordinary shares and Class B ordinary shares as a single class as of December 31, 2022. Each holder of Class A

ordinary shares is entitled to one vote per share and each holder of Class B ordinary shares is entitled to ten votes per share

on all matters submitted to them for a vote.

| 1 |

NAMES

OF REPORTING PERSONS

Investor Link Investments Limited |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b)

¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

3,055,556 |

| 6 |

SHARED

VOTING POWER

0 |

| 7 |

SOLE

DISPOSITIVE POWER

3,055,556 |

| 8 |

SHARED

DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,055,556 |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.3%.* The voting power of the shares

beneficially owned represent 1.3% of the total outstanding voting power. ** |

| 12 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

* The percentage of class of securities

is calculated by dividing the ordinary shares beneficially owned by the Reporting Person in terms of economic interests by the sum of

the total number of ordinary shares outstanding as of December 31, 2022.

** The percentage of voting power is

calculated by dividing the voting power beneficially owned by the Reporting Person by the voting power of all of the Issuer’s holders

of Class A ordinary shares and Class B ordinary shares as a single class as of December 31, 2022. Each holder of Class A

ordinary shares is entitled to one vote per share and each holder of Class B ordinary shares is entitled to ten votes per share

on all matters submitted to them for a vote.

| 1 |

NAMES

OF REPORTING PERSONS

Steady Prominent Limited |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b)

¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

83,124,091 |

| 6 |

SHARED

VOTING POWER

0 |

| 7 |

SOLE

DISPOSITIVE POWER

83,124,091 |

| 8 |

SHARED

DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

83,124,091 |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

6.8%.* The voting power of the shares

beneficially owned represent 36.6% of the total outstanding voting power. ** |

| 12 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

* The percentage of class of securities

is calculated by dividing the ordinary shares beneficially owned by the Reporting Person in terms of economic interests by the sum of

the total number of ordinary shares outstanding as of December 31, 2022.

** The percentage of voting power is

calculated by dividing the voting power beneficially owned by the Reporting Person by the voting power of all of the Issuer’s holders

of Class A ordinary shares and Class B ordinary shares as a single class as of December 31, 2022. Each holder of Class A

ordinary shares is entitled to one vote per share and each holder of Class B ordinary shares is entitled to ten votes per share

on all matters submitted to them for a vote.

| 1 |

NAMES

OF REPORTING PERSONS

Oriental Holding Investment Limited |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b)

¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

21,531,001 |

| 6 |

SHARED

VOTING POWER

0 |

| 7 |

SOLE

DISPOSITIVE POWER

21,531,001 |

| 8 |

SHARED

DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

21,531,001 |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.8%. *The voting power of the shares

beneficially owned represent 0.9% of the total outstanding voting power. ** |

| 12 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

* The percentage of class of securities

is calculated by dividing the ordinary shares beneficially owned by the Reporting Person in terms of economic interests by the sum of

the total number of ordinary shares outstanding as of December 31, 2022.

** The percentage of voting power is

calculated by dividing the voting power beneficially owned by the Reporting Person by the voting power of all of the Issuer’s holders

of Class A ordinary shares and Class B ordinary shares as a single class as of December 31, 2022. Each holder of Class A

ordinary shares is entitled to one vote per share and each holder of Class B ordinary shares is entitled to ten votes per share

on all matters submitted to them for a vote.

| 1 |

NAMES

OF REPORTING PERSONS

New Amigo Holding Limited |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b)

¨ |

| 3 |

SEC

USE ONLY

|

| 4 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: |

5 |

SOLE

VOTING POWER

4,621,106 |

| 6 |

SHARED

VOTING POWER

0 |

| 7 |

SOLE

DISPOSITIVE POWER

4,621,106 |

| 8 |

SHARED

DISPOSITIVE POWER

0 |

| 9 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,621,106 |

| 10 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨ |

| 11 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.4%.* The voting power of the shares

beneficially owned represent 0.2% of the total outstanding voting power. ** |

| 12 |

TYPE

OF REPORTING PERSON

CO |

| |

|

|

|

* The percentage of class of securities

is calculated by dividing the ordinary shares beneficially owned by the Reporting Person in terms of economic interests by the sum of

the total number of ordinary shares outstanding as of December 31, 2022.

** The percentage of voting power is

calculated by dividing the voting power beneficially owned by the Reporting Person by the voting power of all of the Issuer’s holders

of Class A ordinary shares and Class B ordinary shares as a single class as of December 31, 2022. Each holder of Class A

ordinary shares is entitled to one vote per share and each holder of Class B ordinary shares is entitled to ten votes per share

on all matters submitted to them for a vote.

| ITEM 1(a). | NAME OF ISSUER: |

DiDi Global Inc.

| ITEM 1(b). | ADDRESS OF ISSUER’S PRINCIPAL

EXECUTIVE OFFICES: |

No. 1 Block B, Shangdong

Digital Valley

No. 8 Dongbeiwang West

Road

Haidian District, Beijing

People’s Republic of

China

| ITEM 2(a). | NAME OF PERSON FILING: |

Will Wei Cheng

Jean Qing Liu

Stephen Jingshi Zhu

Xiaocheng Investments Limited

Investor Link Investments

Limited

Steady Prominent Limited

Oriental Holding Investment

Limited

New Amigo Holding Limited

| ITEM 2(b). | ADDRESS OF PRINCIPAL BUSINESS

OFFICE, OR, IF NONE, RESIDENCE: |

Will Wei Cheng

DiDi Global Inc.

No. 1 Block B, Shangdong

Digital Valley

No. 8 Dongbeiwang West

Road

Haidian District, Beijing

People’s Republic of

China

Jean Qing Liu

DiDi Global Inc.

No. 1 Block B, Shangdong

Digital Valley

No. 8 Dongbeiwang West

Road

Haidian District, Beijing

People’s Republic of

China

Stephen Jingshi Zhu

DiDi Global Inc.

No. 1 Block B, Shangdong

Digital Valley

No. 8 Dongbeiwang West

Road

Haidian District, Beijing

People’s Republic of

China

Xiaocheng Investments

Limited

Sertus Incorporation (BVI)

Limited

Sertus Chambers, P.O. Box

905

Quastisky Building, Road

Town, Tortola

British Virgin Islands

Investor Link Investments

Limited

Vistra Corporate Services

Centre

Wickhams Cay II, Road Town

Tortola, VG1110

British Virgin Islands

Steady Prominent Limited

Sertus Chambers, P.O. Box

905

Quastisky Building

Road Town, Tortola

British Virgin Islands

Oriental Holding Investment

Limited

Coastal Building, Wickham’s

Cay II

P.O. Box 2221, Road

Town, Tortola

British Virgin Islands

New Amigo Holding Limited

Coastal Building, Wickham’s

Cay II

P.O. Box 2221, Road

Town, Tortola

British Virgin Islands

Will Wei Cheng – People’s

Republic of China

Jean Qing Liu – Hong

Kong, People’s Republic of China

Stephen Jingshi Zhu –

Hong Kong, People’s Republic of China

Xiaocheng Investments Limited

– British Virgin Islands

Investor Link Investments

Limited – British Virgin Islands

Steady Prominent Limited

– British Virgin Islands

Oriental Holding Investment

Limited – British Virgin Islands

New Amigo Holding Limited

– British Virgin Islands

| ITEM 2(d). | TITLE OF CLASS OF SECURITIES: |

Ordinary

shares, par value of $0.00002 per

share

The

Issuer’s ordinary shares consist of Class A ordinary shares and Class B ordinary shares. Holders of Class A ordinary

shares and Class B ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share

is entitled to one vote, and each Class B ordinary share is entitled to ten votes. Each Class B

ordinary share is convertible at the option of the holder into one Class A

ordinary share, whereas Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

G2758H 105

| ITEM 3. | If

this statement is filed pursuant to §§ 240.13d-1(b), or 240.13d-2(b) or (c),

check whether the persons filing is a: |

Not applicable

The

following information with respect to the ownership of the ordinary shares of par value of $0.00002

per share of the Issuer by each of the reporting persons is provided as of December 31, 2022. The table below is prepared

based on 1,214,505,793 ordinary shares (consisting of 1,097,169,957 Class A ordinary shares and 117,335,836 Class B ordinary

shares) of the Issuer outstanding as of December 31, 2022.

| Reporting

Person | |

Amount

beneficially

owned in

terms of

economic

interests: | | |

Percent

of

class*: | | |

Percent

of

aggregate

voting

power**: | | |

Sole

power to

vote or direct

the vote: | | |

Shared

power to

vote or to

direct the

vote: | | |

Sole

power to

dispose or to

direct the

disposition

of: | | |

Shared

power to

dispose or to

direct the

disposition

of: | |

| Will

Wei Cheng | |

| 78,384,741 | (1) | |

| 6.5 | % | |

| 32.4 | % | |

| 92,408,067 | (2) | |

| 26,152,107 | (3) | |

| 31,156,189 | (4) | |

| 109,276,198 | (5) |

| Jean

Qing Liu | |

| 19,172,128 | (6) | |

| 1.6 | % | |

| 22.6 | % | |

| 48,767,668 | (7) | |

| 26,152,107 | (3) | |

| 3,055,556 | (8) | |

| 109,276,198 | (5) |

| Stephen

Jingshi Zhu | |

| 9,620,410 | (9) | |

| 0.8 | % | |

| 1.2 | % | |

| 0 | | |

| 26,152,107 | (3) | |

| 0 | | |

| 109,276,198 | (5) |

| Xiaocheng

Investments Limited | |

| 31,156,189 | (1) | |

| 2.6 | % | |

| 13.7 | % | |

| 31,156,189 | | |

| 0 | | |

| 31,156,189 | | |

| 0 | |

| Investor

Link Investments Limited | |

| 3,055,556 | (6) | |

| 0.3 | % | |

| 1.3 | % | |

| 3,055,556 | | |

| 0 | | |

| 3,055,556 | | |

| 0 | |

| Steady

Prominent Limited | |

| 83,124,091 | (2) | |

| 6.8 | % | |

| 36.6 | % | |

| 83,124,091 | | |

| 0 | | |

| 83,124,091 | | |

| 0 | |

| Oriental

Holding Investment Limited | |

| 21,531,001 | (3) | |

| 1.8 | % | |

| 0.9 | % | |

| 21,531,001 | | |

| 0 | | |

| 21,531,001 | | |

| 0 | |

| New

Amigo Holding Limited | |

| 4,621,106 | (3) | |

| 0.4 | % | |

| 0.2 | % | |

| 4,621,106 | | |

| 0 | | |

| 4,621,106 | | |

| 0 | |

| * | The

percentage of class of securities is calculated by dividing the number of shares beneficially

owned by the Reporting Person in terms of economic interests by the sum of the total number

of ordinary shares outstanding as of December 31, 2022. |

| ** | The

percentage of voting power is calculated by dividing the voting power beneficially owned

by the Reporting Person by the voting power of all of the Issuer’s holders of Class A

ordinary shares and Class B ordinary shares as a single class as of December 31,

2022. Each holder of Class A ordinary shares is

entitled to one vote per share and each holder of Class B ordinary shares is entitled

to ten votes per share on all matters submitted to them for a vote. |

| (1) | Represents (i) 31,156,189 Class B

ordinary shares held by Xiaocheng Investments Limited, and (ii) 47,228,552 Class B

ordinary shares held by Steady Prominent in which Mr. Cheng has an indirect economic

interest. |

Xiaocheng Investments Limited

is beneficially owned by Mr. Cheng through a trust, of which Mr. Cheng is the settlor and Mr. Cheng and his family members

are the beneficiaries.

| (2) | Represents (i) 18,693,713 Class B

ordinary shares held by Xiaocheng Investments Limited that Mr. Cheng has sole voting

power over, (ii) 23,839,899 Class A ordinary shares held by certain existing shareholders

who have granted voting proxies to Mr. Cheng, and (iii) 49,874,455 Class B

ordinary shares held by Steady Prominent that Mr. Cheng has sole voting power over. |

Mr. Cheng has granted

a voting proxy to Ms. Liu in connection with 12,462,476 Class B ordinary shares held by Xiaocheng Investments Limited, and

Mr. Cheng’s beneficial ownership in terms of voting power does not take into account the portion of the shares that are subject

to such voting proxy.

Steady

Prominent is ultimately wholly owned by a trust and the advisory committee of the trust, current members being Mr. Cheng, Ms. Liu

and Mr. Zhu, has the sole power to make all decisions relating to the voting and disposal of the shares held by Steady Prominent.

Mr. Cheng, Ms. Liu and Mr. Zhu have agreed to certain proxy and voting arrangements

in connection with their respective voting power over the shares held by Steady Prominent.

| (3) | Represents

(i) 21,531,001 Class A ordinary shares held by Oriental Holding, and (ii) 4,621,106

Class A ordinary shares held by New Amigo. Each of Mr. Cheng, Ms. Liu and

Mr. Zhu may be deemed to beneficially own, in terms of voting power, by virtue of his/her

membership on the respective advisory committees of such trusts, which have the sole power

to make all decisions relating to the voting and disposal of the shares held by Oriental

Holding and New Amigo. Mr. Cheng, Ms. Liu and Mr. Zhu share voting rights

of the shares held by Oriental Holding and New Amigo with each other as current members of

the advisory committees. |

| (4) | Represents 31,156,189 Class B ordinary

shares held by Xiaocheng Investments Limited that Mr. Cheng has sole dispositive power

over. |

| (5) | Represents (i) 21,531,001 Class A

ordinary shares held by Oriental Holding, (ii) 4,621,106 Class A ordinary shares

held by New Amigo, and (iii) 83,124,091 Class B ordinary shares held by Steady

Prominent. Each of Mr. Cheng, Ms. Liu and Mr. Zhu may be deemed to beneficially

own, in terms of dispositive power, of the shares held by these entities by virtue of his/her

membership on the respective advisory committees of the trusts that wholly owns these entities.

Mr. Cheng, Ms. Liu and Mr. Zhu share disposal rights of the shares held by

Oriental Holding, New Amigo and Steady Prominent with each other as current members of the

advisory committees. |

| (6) | Represents (i) 3,055,556 Class B

ordinary shares held by Investor Link Investments Limited, and (ii) 16,116,572 Class B

ordinary shares held by Steady Prominent in which Ms. Liu has an indirect economic interest. |

Investor Link Investments

Limited is beneficially owned by Ms. Liu through a trust, of which Ms. Liu is the settlor and Ms. Liu and her family

members are the beneficiaries.

| (7) | Represents (i) 3,055,556 Class B

ordinary shares held by Investor Link Investments Limited, (ii) 12,462,476 Class B

ordinary shares held by Xiaocheng Investments Limited over which Mr. Cheng has granted

a voting proxy to Ms. Liu, and (iii) 33,249,636 Class B ordinary shares held

by Steady Prominent that Ms. Liu has sole voting power over. |

| (8) | Represents 3,055,556 Class B ordinary

shares held by Investor Link Investments Limited. |

| (9) | Represents 9,620,410 Class B ordinary

shares held by Steady Prominent in which Mr. Zhu has an indirect economic interest.

However, Mr. Zhu does not hold voting power of such shares because he has granted Mr. Cheng

and Ms. Liu proxies to vote such shares on his behalf. |

| ITEM 5. | OWNERSHIP OF FIVE PERCENT OR LESS

OF A CLASS |

Not applicable

| ITEM 6. | OWNERSHIP OF MORE THAN FIVE PERCENT

ON BEHALF OF ANOTHER PERSON |

Not applicable

| ITEM 7. | IDENTIFICATION AND CLASSIFICATION

OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT HOLDING COMPANY

OR CONTROL PERSON |

Not applicable

| ITEM 8. | IDENTIFICATION AND CLASSIFICATION

OF MEMBERS OF THE GROUP |

Not applicable

| ITEM 9. | NOTICE OF DISSOLUTION OF GROUP |

Not applicable

Not applicable

LIST

OF EXHIBITS

SIGNATURE

After reasonable

inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated: March 15, 2023

| Will Wei Cheng |

|

/s/

Will Wei Cheng |

| |

|

|

| |

|

|

| Jean Qing Liu |

|

/s/

Jean Qing Liu |

| |

|

|

| |

|

|

| Stephen Jingshi Zhu |

|

/s/

Stephen Jingshi Zhu |

| |

|

|

| |

|

|

| Xiaocheng Investments Limited |

|

By: |

/s/

Will Wei Cheng |

|

|

Name: |

Will Wei Cheng |

|

|

Title: |

Director |

| |

|

|

| |

|

|

| Investor Link Investments Limited |

|

By: |

/s/ Jean Qing

Liu |

|

|

Name: |

Jean Qing Liu |

|

|

Title: |

Director |

| |

|

|

| |

|

|

| Steady Prominent Limited |

|

By: S.B. Vanwall Ltd., its sole director |

| |

|

|

|

|

By: |

/s/ Hui Wai

Ling |

|

|

Name: |

Hui Wai Ling |

|

|

Title: |

Authorized signatory of S.B. Vanwall Ltd. |

| |

|

|

| |

|

|

| Oriental Holding Investment Limited |

|

By: S.B. Vanwall Ltd., its sole director |

| |

|

|

|

|

By: |

/s/ Hui Wai

Ling |

|

|

Name: |

Hui Wai Ling |

|

|

Title: |

Authorized signatory of S.B. Vanwall Ltd. |

| |

|

|

| |

|

|

| New Amigo Holding Limited |

|

By: S.B. Vanwall Ltd., its sole director |

| |

|

|

|

|

By: |

/s/ Hui Wai

Ling |

|

|

Name: |

Hui Wai Ling |

|

|

Title: |

Authorized signatory of S.B. Vanwall Ltd. |

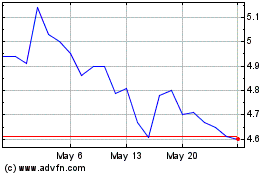

DiDi Global (PK) (USOTC:DIDIY)

Historical Stock Chart

From Nov 2024 to Dec 2024

DiDi Global (PK) (USOTC:DIDIY)

Historical Stock Chart

From Dec 2023 to Dec 2024