Statement of Beneficial Ownership (sc 13d)

May 31 2022 - 7:35AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. __)

DAYBREAK OIL AND GAS, INC.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

239559 107

(CUSIP Number)

Iain Mickle

Boutin Jones Inc.

555 Capitol Mall, Suite 1500

Sacramento, CA 95814

(916) 321-4444

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 25, 2022

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.[]

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the act (however, see the Notes).

SCHEDULE 13D

CUSIP No. 239559 107

1 Name of Reporting Person: I.R.S. Identification Nos. of Above Person (entities only):

Gaelic Resources Ltd. 38-4121145

2 Check the Appropriate Box if a Member of a Group (See Instructions):

(a) []

(b) [x]

3 SEC Use Only:

4 Source of Funds (See Instruction):

PF

5 Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): []

6 Citizenship or Place of Organization:

Isle of Man

7 Sole Voting Power:

Number of Shares

Beneficially Owned by

Each

Reporting Person With 160,964,489

8 Shared Voting Power:

--

9 Sole Dispositive Power:

160,964,489

10 Shared Dispositive Power:

--

11 Aggregate Amount Beneficially Owned by Each Reporting Person:

160,964,489

12 Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) []

13 Percent of Class Represented by Amount in Row (11):

41.85

14 Type of Reporting Person (See Instructions):

HC

1 Based on 384,656,468 shares of Issuer's common stock outstanding as of May 26, 2022, as reported in Issuer's Current Report on Form 8-K filed with the Securities and Exchange Commission on May 26, 2022.

SCHEDULE 13D

Item 1. Security and Issuer.

This Schedule 13D relates to the shares of Common Stock, par value $0.001 per share, of Daybreak Oil and Gas, Inc., a Washington corporation ("Issuer"). The principal executive office of Issuer is located at 1101 N. Argonne Road, Suite A 211, Spokane Valley, WA 99212.

Item 2. Identity and Background.

(a)-(b) This Schedule 13D is being filed by Gaelic Resources Ltd., a private company incorporated under the laws of the Isle of Man ("Reporting Person"). The principal place of business of Reporting Person is 14 Albert Street Douglas, IM1 2QA, Isle of Man.

Information regarding each director and executive officer of Reporting Person is set forth on Schedule I attached hereto.

(c) The principal business of Reporting Person is oil and gas holding company.

(d) During the last five years, neither Reporting Person nor, to the best knowledge of Reporting Person, any of the other persons set forth on Schedule I attached hereto, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, neither Reporting Person nor, to the best knowledge of Reporting Person, any of the other persons set forth on Schedule I attached hereto, has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Reporting Person is organized in the Isle of Man.

Item 3. Source and Amount of Funds or Other Consideration.

The information set forth or incorporated by reference in Item 4 of this Schedule 13D is incorporated by reference into this Item 3.

As described in Item 4 below, the securities reported on this Schedule 13D reflect the consummation of the Equity Exchange (as defined below) contemplated by the Exchange Agreement (as defined below) and the transactions consummated in connection therewith.

Item 4. Purpose of Transaction.

On October 20, 2021, and subsequently amended on February 22, 2022 and May 24, 2022, Issuer, Reporting Person, and Reporting Person's wholly-owned subsidiary, Reabold California LLC, a California limited liability company ("Reabold"), entered into an Equity Exchange Agreement (the "Exchange Agreement") with Issuer, pursuant to which Issuer acquired 100% of the membership interests of Reabold in exchange for the issuance to Reporting Person of 160,964,489 shares of Issuer's Common Stock, par value $0.001 per share (the "Exchange Shares"). The Closing (as defined in the Equity Exchange Agreement) occurred on May 25, 2022. As a result of the Closing, Reabold became a wholly-owned subsidiary of Issuer and Reporting Person became the owner of the Exchange Shares and, thus, the majority shareholder of Issuer (the foregoing transaction and the transactions contemplated thereby, the "Equity Exchange").

The shares of Common Stock reported herein were acquired solely for investment purposes. Except as set forth above, Reporting Person has no present plans or intentions which would result in or relate to any of the transactions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Darren Williams, a member of the board of directors of Reporting Person, serves as a member of the board of directors of Issuer and, in such capacity, may have influence over the corporate activities of the Issuer, including activities which may relate to items described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Reporting Person reserves the right to acquire, or dispose of, additional securities of Issuer in the ordinary course of their business, to the extent deemed advisable in light of its general investment and trading policies, market conditions or other factors

Item 5. Interests in Securities of the Issuer

(a) Reporting Person beneficially owns 160,964,489 shares of Issuer's Common Stock, which shares constituted 41.85% of the outstanding shares of Issuer as of May 26, 2022.

(b) Reporting Person has sole power to vote, and the sole power to dispose of, all 160,964,489 Shares.

(c) Not applicable

(d) Not applicable

(e) Not applicable

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

On May 25, 2022, Reporting Person and Issuer closed the transactions contemplated by the Exchange Agreement described in Item 4 above. The Exchange Agreement is filed as Exhibit A hereto and incorporated herein by reference.

In connection with the Exchange Agreement, Reporting Person and Issuer entered into (i) that certain Registration Rights Agreement, dated as of May 25, 2022, by and among Issuer, Reporting Person and the Investors (as defined therein), setting forth the rights of Reporting Person with respect to the future registration of the Exchange Shares and the other shares of Issuer's common stock referenced therein (the "Registration Rights Agreement"), and (ii) that certain Voting Agreement, dated as of May 25, 2022, by and among Issuer, Reporting Person and James F. Westmoreland ("Westmoreland"), pursuant to which Reporting Person and Westmoreland each agree to vote all of their shares of Common Stock for specified designees, including Darren Williams (an individual designated by Reporting Person), to serve on the board of directors of Issuer (the "Voting Agreement"). The Registration Rights Agreement is filed as Exhibit B hereto and incorporated herein by reference, and the Voting Agreement is filed as Exhibit C hereto and incorporated herein by reference.

Item 7. Exhibits

EXHIBIT A Equity Exchange Agreement dated October 20, 2021, by and among Daybreak Oil and Gas, Inc., Reabold California LLC, and Gaelic Resources Ltd. (included as Annex A to the Schedule 14A filed by Daybreak Oil and Gas, Inc. on April 21, 2022 and incorporated herein by reference) (the "Proxy Statement").

EXHIBIT B Registration Rights Agreement, by and among Daybreak Oil and Gas, Inc., Gaelic Resources Ltd., and the Investors (as defined therein) (included as Annex A to the Proxy Statement and incorporated herein by reference).

EXHIBIT C Voting Agreement, by and among Daybreak Oil and Gas, Inc., Gaelic Resources Ltd., and James F. Westmoreland (included as Annex A to the Proxy Statement and incorporated herein by reference).

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: May 27, 2022

GAELIC RESOURCES LTD.

By: /s/ Sachin Oza

Sachin Oza

Co-CEO

SCHEDULE I

Executive Officers and Directors of Reporting Person.

The name and principal occupation of each director and executive officer of Reporting Person are set forth below. The address for each person listed below is c/o Gaelic Resources Ltd., 14 Albert Street Douglas, IM1 2QA, Isle of Man. All executive officers and directors listed are citizens of the United Kingdom.

OFFICERS:

Sachin Oza Oil and Gas Executive

Stephen Williams Oil and Gas Executive

DIRECTORS:

Sachin Oza Oil and Gas Executive

Stephen Williams Oil and Gas Executive

Except as set forth in this Schedule 13D, to the best knowledge of Reporting Person, none of the individuals listed above beneficially owns any Shares.

This regulatory filing also includes additional resources:

schedule13d.pdf

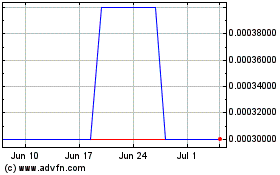

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Sep 2024 to Oct 2024

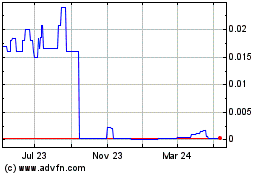

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Oct 2023 to Oct 2024