By Patricia Kowsmann and Paul J. Davies

German banking giant Deutsche Bank AG will likely depend on an

obscure but valuable accounting quirk to make a deal for smaller

rival Commerzbank AG workable.

Deutsche Bank has told investors and others close to the bank

that it hopes European Central Bank supervisors will allow wide

latitude to use the accounting treatment -- known as negative

goodwill, or "badwill" -- as part of a takeover, people familiar

with the talks said.

The two banks have been in formal talks since March over a

potential merger, spurred on by the German government. There is no

guarantee a deal will happen. Both banks are viewed skeptically by

investors and trade at deep discounts to their book value,

reflecting poor profits and lingering doubts about the quality of

some assets.

A combined bank could recognize a onetime profit of more than

EUR16 billion, or more than $18 billion, using badwill, according

to analyst estimates. That profit would be crucial for maintaining

the combined entity's capital ratios, which regulators are likely

to increase as a condition of approving a deal.

The badwill number could vary greatly depending on the valuation

paid for Commerzbank. It could also shrink if Deutsche Bank, after

it executes a deal, decides Commerzbank's assets are worth less

than their current book value. The less badwill that is generated,

the more fresh capital from shareholders could be needed.

Deutsche Bank shareholders, who since 2008 have injected more

than EUR30 billion of capital into the bank, are resistant to put

in much more. Even with a hefty badwill gain, the combined bank

will need fresh cash to lay off employees and close unwanted

operations. Asset disposals -- such as selling Deutsche Bank's

asset management arm DWS, or Commerzbank's Polish operations known

as mBank -- could also be used to raise cash.

"This is not free money that can be used to fund restructuring

costs or clean up the balance sheet or return to shareholders,"

Jeremy Sigee, analyst at Exane BNP Paribas, wrote in a recent note.

"Every penny of it is needed to keep the regulatory capital ratios

where they started."

Badwill lets buyers book a profit if they buy a target for less

than net-asset value, or book value, which is the difference

between a firm's assets and liabilities. If a target company is

sold for less than its stated book value, then the buyer can treat

the difference as a gain.

It doesn't happen often because buyers normally pay more than a

company's book value. In those cases, the excess paid is recorded

as an asset called goodwill, or the value of the intangible bits

that may have inspired the deal in the first place, such as the

target firm's brand value.

In Commerzbank's case, the shares trade at about a third of book

value, so even at a hefty premium to the share price, Deutsche Bank

will pay far less than book value.

The shares that Deutsche would likely issue to Commerzbank

shareholders to pay for the deal, plus the badwill gain, would add

up to roughly the amount of equity that Deutsche Bank needs to

support the Commerzbank assets it takes onto its balance sheet,

according to analyst estimates.

The ECB is also expected to increase the enlarged bank's minimum

required capital to protect against integration and restructuring

risks, and because the lender will become more systemically

important -- it would be the second largest in the eurozone by

assets after BNP Paribas.

There are roadblocks to booking badwill profits. For one,

Deutsche Bank will have to review the valuation of Commerzbank's

assets and some may have to be marked down. That would cut into the

combined group's final gain.

Jon Peace, a Credit Suisse analyst, thinks even after large

badwill gains, Deutsche will need to raise about EUR8 billion in

fresh capital from shareholders. This money could fund about EUR5

billion of restructuring costs and an estimated EUR3 billion in

write-downs to the value of bonds owned by Commerzbank, many of

which are Italian government bonds that currently aren't marked to

market, but held at historic cost.

"If Deutsche wants to pay for some of its restructuring costs up

front, it still needs to raise capital," Mr. Peace said.

Regulators keep a close eye on badwill calculations, and it will

be up to the ECB to determine the amount of badwill to include in

the bank's capital ratios. Recent European bank acquisitions have

taken advantage of this accounting tool, but involved gains in the

hundreds of millions of euros.

Not every cheap bank takeover generates badwill. When Spain's

Bankia SA took over Banco Mare Nostrum SA in 2017, it appeared as

if the deal would bring in EUR1.2 billion of badwill. But after

Bankia revalued the books, a mixture of asset write-downs and

liability increases erased all of that.

In 2008, U.K.'s Lloyds Banking Group PLC generated GBP11.2

billion of badwill gains from its takeover of mortgage lender HBOS

PLC. But the deal turned out to be disastrous because HBOS's loan

book was much worse than thought. The badwill profits, booked in

2009, were more than wiped out by nearly GBP17 billion in

impairments on bad loans and the group was bailed out by the

government.

--Jenny Strasburg contributed to this article.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com and Paul

J. Davies at paul.davies@wsj.com

(END) Dow Jones Newswires

April 14, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

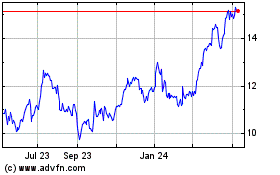

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Sep 2024 to Oct 2024

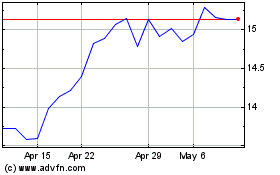

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Oct 2023 to Oct 2024