Current Report Filing (8-k)

November 22 2022 - 8:46AM

Edgar (US Regulatory)

0001389518

false

0001389518

2022-11-17

2022-11-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 17, 2022

CLUBHOUSE

MEDIA GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

333-140645 |

|

99-0364697 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

3651

Lindell Road, D517

Las

Vegas, Nevada 89103

(Address

of principal executive offices) (Zip code)

(702)

479-3016

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01.

Entry into a Material Definitive Agreement.

On November 17, 2022, Clubhouse Media Group, Inc.

(the “Company”) entered into a Debt Exchange Agreement (the “Agreement”) by and between the Company and Amir Ben-Yohanan,

the Company’s Chief Executive Officer, a member of the Company’s board of directors, and a significant stockholder of the

Company. Pursuant to the terms of the Agreement, the Company and Mr. Ben-Yohanan agreed to exchange certain outstanding indebtedness in

the amount of $1,808,167 for 4,520,417,475 shares of the Company’s common stock. Such shares were issued on November 17, 2022. As

a result of the exchange, such indebtedness was deemed repaid in full.

The Agreement contains customary representations,

warranties and covenants.

The foregoing description of the Agreement does not

purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which is filed as Exhibit 10.1 to this

Current Report on Form 8-K and which is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

On November 17, 2022, the Company issued 4,520,417,475

shares of common stock to Mr. Ben-Yohanan in exchange for the cancellation of $1,808,167 of indebtedness.

The Company claims an exemption from the registration

requirements of the Securities Act of 1933, as amended (the “Securities Act”), for the private placement of these securities

pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder because, among other things, the transaction

did not involve a public offering, the recipients are accredited investors, the recipients acquired the securities for investment and

not resale, and the Company took appropriate measures to restrict the transfer of the securities.

Item 7.01. Regulation FD Disclosure.

On November

22, 2022, the Company issued a press release announcing the conversion of $1,808,167 of debt owed by the Company to Mr. Ben-Yohanan in

exchange for 4,520,417,475 shares of the Company’s common stock.

The press release is furnished herewith as Exhibit 99.1 and is

incorporated by reference herein. The information contained in the press release is being furnished and shall not be deemed filed for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liability of that Section, and shall not be incorporated by reference into any registration statement or other document filed under the

Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements

and Exhibits

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date: November 22, 2022 |

CLUBHOUSE MEDIA GROUP, INC. |

| |

|

|

| |

By: |

/s/

Amir Ben-Yohanan |

| |

|

Amir Ben-Yohanan |

| |

|

Chief Executive Officer |

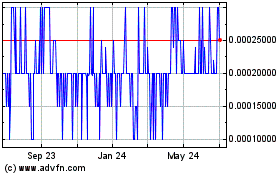

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

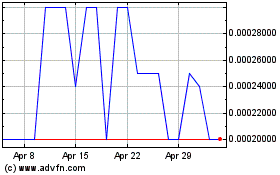

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Dec 2023 to Dec 2024