false

0000811222

0000811222

2023-03-01

2023-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): January 4, 2024 (March 1, 2023)

| Cardiff

Lexington Corporation |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

000-49709 |

|

84-1044583 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 3753 Howard Hughes Parkway, Suite 200, Las

Vegas, NV |

|

89169 |

| (Address of principal executive offices) |

|

(Zip Code) |

| 844

628-2100 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

On March 1, 2023, Steven Healy resigned from his

position as Chief Financial Officer of Cardiff Lexington Corporation (the “Company”). Mr. Healy’s resignation was not

due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. On March 1,

2023, the Board of Directors of the Company appointed Zia Choe to serve as Interim Chief Financial Officer of the Company.

On January 2, 2024, Ms. Choe resigned as Interim

Chief Financial Officer and the Board of Directors of the Company appointed Ms. Choe as Chief Accounting Officer of the Company. On the

same date, the Board of Directors appointed Matthew T. Shafer as Chief Financial Officer.

Ms. Choe, age 42, founded STK Financial P.C.,

a California-licensed accounting firm, in June 2021. As a managing partner, Ms. Choe has provided financial attestation, managerial consulting,

preparation of 10-Ks and 10-Qs and other high level accounting and financial services to privately and publicly held companies in the

U.S. and internationally. Prior to her appointment as Interim Chief Financial Officer, Ms. Choe served as an outside accountant for the

Company from March 2017 to March 2023. Prior to her founding of STK Financial P.C., she was an audit team leader in the accounting and

audit division at JNK Accountancy Group, LLP from September 2014 until June 2021, where she was in charge of financial attestation and

due diligence projects for acquisition deals in various industries for seven years. Ms. Choe also had seven years of operational experience

in accounting, sales and marketing at Hyundai Mobis Parts America, LLC, a subsidiary of Hyundai Motors, from March 2006 to March 2013.

Ms. Choe received a B.S. in Hospitality Management at Florida International University, and she also has higher education in accounting

at Ajou University Graduate School in South Korea.

Mr. Shafer, age 53, has over 25 years of experience

as a finance professional in roles including executive leadership, public accounting and auditing at both privately owned and publicly

traded companies on major U.S. stock exchanges. Most recently, since March 2023 he served as strategic executive engagement consultant

and advisor for the Chief Financial Officer and Chief Accounting Officer capacities during rapid growth, change and transitions at Proterra,

a publicly traded manufacturer of electric vehicles and provider of related Sass services. Prior to that, he served as a transformational

high growth Vice President of Finance at Aspire Technology Partners, a privately owned technology provider delivering custom digital infrastructures,

SaaS solutions and professional services, from May 2022 to February 2023. From October 2021 to April 2022, he served as a strategic Chief

Financial Officer of Tatum, an interim executive consultancy practice of Randstad USA, and from September 2016 to September 2021, the

held the positions of Senior Vice President, Chief Financial Officer and Treasurer of Ocean Power Technologies, Inc., a publicly traded

green technology company providing cost-effective renewable ocean energy solutions. Earlier in his career, Mr. Shafer held senior finance

positions at numerous privately owned and publicly traded companies, including, among others, Business Unit Chief Financial Officer –

for the Dentistry (OraPharma) division at Bauch Health Companies, a global publicly traded pharmaceutical company, and numerous executive

level positions at Johnson Controls International plc (formerly Tyco International), a large publicly traded multinational manufacturing

company. Mr. Shafer is a certified public accountant with a foundation in Big Four public accounting, beginning his career at Arthur Andersen

LLP. He received his Bachelor of Science degree in accounting from W. Paul Stillman School of Business at Seton Hall University and has

an MBA in finance from The Rutgers Business School at Rutgers University.

Ms. Choe and Mr. Shafer were appointed to serve

until their successors are duly elected and qualified. There are no family relationships among Ms. Choe or Mr. Shafer and the Company’s

existing directors and officers. There are no arrangements or understandings between Ms. Choe or Mr. Shafer and any other persons pursuant

to which they were selected. There has been no transaction, nor is there any currently proposed transaction, between Ms. Choe or Mr. Shafer

and the Company that would require disclosure under Item 404(a) of Regulation S-K.

On January 2, 2024, the Company entered into an

employment agreement with Ms. Choe setting forth the terms of her employment

as Chief Accounting Officer. Pursuant to the employment agreement, Ms. Choe is entitled to an annual base salary of $210,000 and

a signing bonus of 2,500 shares of the Company’s series I preferred stock. She is also eligible for an annual bonus and annual stock

option grants. Ms. Choe is also eligible to participate in all employee benefit

plans, including health insurance, commensurate with her position. The term of the employment agreement is for one (1) year with

automatic extensions for additional successive one (1) year renewal terms unless terminated by either party no later than thirty (30)

days prior to the renewal date. The employment agreement may be terminated immediately by the Company with or without cause (as such term

is defined in the employment agreement) or in the event of Ms. Choe’s death or disability, and may be terminated immediately by

Ms. Choe upon her voluntary resignation or other voluntary termination of employment. In the event of termination by the Company without

cause, Ms. Choe is entitled to the compensation and benefits described above for a period of one (1) month following termination. In the

event of termination by Ms. Choe for good reason (as defined in the employment agreement) or because Ms. Choe cannot perform her services

as result of physical or mental incapacitation, she will be eligible to receive three (3) months of base salary and medical and dental

benefits under the Company’s medical and dental plans then in effect. Ms. Choe is not entitled to receive any additional compensation

upon termination by the Company for cause or upon a voluntary termination by Ms. Choe. The

employment agreement also contains customary confidentiality provisions and restrictive covenants prohibiting Ms. Choe from owning or

operating a business that competes with the Company or soliciting the Company’s employees during the term of her employment and

for a period of twelve months following the termination of her employment.

On January 2, 2024, the Company entered into an

employment agreement with Mr. Shafer setting forth the terms of his employment

as Chief Financial Officer. Pursuant to the employment agreement, Mr. Shafer is entitled to an annual base salary of $228,000 and

a signing bonus of 5,000 shares of the Company’s series I preferred stock. He is also eligible for consideration for a one-time

achievement bonus equal to 35% of base salary within sixty (60) days upon the Company uplisting to a national securities exchange. In

addition, he is also eligible for an annual target bonus equal to 25% of base salary based on the achievement of certain performance goals

and annual stock option grants. Mr. Shafer is also eligible to participate in

all employee benefit plans, including health insurance, commensurate with his position. The term of the employment agreement is

for one (1) year with automatic extensions for additional successive one (1) year renewal terms unless terminated by either party no later

than thirty (30) days prior to the renewal date. The employment agreement may be terminated immediately by the Company with or without

cause (as such term is defined in the employment agreement) or in the event of Mr. Shafer’s death or disability, and may be terminated

immediately by Mr. Shafer upon his voluntary resignation or other voluntary termination of employment. In the event of termination by

the Company without cause, Mr. Shafer is entitled to the compensation and benefits described above for a period of three (3) months following

termination. In the event of termination by Mr. Shafer for good reason (as defined in the employment agreement) or because Mr. Shafer

cannot perform his services as result of physical or mental incapacitation, he will be eligible to receive three (3) months of base salary

and medical and dental benefits under the Company’s medical and dental plans then in effect. Mr. Shafer is not entitled to receive

any additional compensation upon termination by the Company for cause or upon a voluntary termination by Mr. Shafer. The

employment agreement also contains customary confidentiality provisions and restrictive covenants prohibiting Mr. Shafer from

owning or operating a business that competes with the Company or soliciting the Company’s employees during the term of his employment

and for a period of twelve months following the termination of his employment.

On January 3, 2024, the Company issued a

press release announcing the appointment of Mr. Shafer as Chief Financial Officer. A copy of the press release is furnished as Exhibit

99.1 to this report.

On January 4, 2024, the Company issued a

press release announcing the appointment of Ms. Choe as Chief Accounting Officer. A copy of the press release is furnished as Exhibit

99.2 to this report.

The information furnished with this Item 8.01,

including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any

other filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as expressly set

forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: January 4, 2024 |

CARDIFF LEXINGTON CORPORATION |

| |

|

| |

/s/ Alex Cunningham |

| |

Name: Alex Cunningham |

| |

Title: Chief Executive Officer |

Exhibit 99.1

Cardiff Lexington Appoints Matthew Shafer as

Chief Financial Officer

Expanding Leadership Team to Position Company

for Next Stage of Growth

FT. LAUDERDALE, FL / ACCESSWIRE / January 3,

2024 / Cardiff Lexington Corporation (OTC Pink: CDIX), an acquisition holding company focused on locating, acquiring, and building

middle market, niche companies, primarily in the healthcare industry, today announced the appointment of Matthew Shafer as Chief Financial

Officer. Mr. Shafer will oversee all aspects of Cardiff Lexington’s finance and accounting operations and play a pivotal role in

developing, implementing, and executing on the Company’s strategic growth initiatives to expand on a national scale.

Mr. Shafer has over 25 years of experience as

a finance professional in roles including executive leadership, public accounting, and auditing at both privately owned and publicly traded

companies on major U.S. stock exchanges. Most recently, he served as the Vice President of Finance at Aspire Technology Partners, a technology

provider delivering custom digital infrastructures, SaaS solutions, and professional services. Additionally, Mr. Shafer previously held

the position of Chief Financial Officer, Senior Vice President, and Treasurer of Ocean Power Technologies, a publicly traded green technology

company providing cost-effective renewable ocean energy solutions. He also served as a strategic executive engagement consultant in both

the Chief Financial Officer and Chief Accounting Officer capacities at Proterra, a provider of electric vehicles and related SaaS services,

and at Tatum, an executive consultancy division of Randstad USA, respectively. There, Mr. Shafer advised clients on growth acceleration

during periods of rapid change and handled Sarbanes-Oxley compliance issues including material weakness.

In these roles, Mr. Shafer has worked on numerous

capital markets transactions with commercial bankers and lenders, managed investor relations, treasury, tax, human resources, and IT operations,

and was responsible for all finance and accounting processes, policy, and procedures on various scales. He also has experience executing

on all phases of numerous M&A transactions and their integrations. Mr. Shafer is a certified public accountant with a foundation in

Big Four public accounting, beginning his career at Arthur Andersen LLP. He received his Bachelor of Science degree in accounting from

W. Paul Stillman School of Business at Seton Hall University and has an MBA in finance from The Rutgers Business School at Rutgers University.

Alex Cunningham, Chief Executive Officer of Cardiff

Lexington, commented, “We are excited to expand our leadership team with the addition of Matthew Shafer as our Chief Financial Officer.

Matt has an extensive background as a financial professional spanning over 25 years with numerous different positions at both private

and publicly traded companies. His experience in leaderships roles driving M&A and growth initiatives fits perfectly with our current

business strategy and adds a valuable skillset to our team. As we continue to target an uplisting to a major U.S. exchange, we look forward

to leveraging his business acumen and experience to drive growth and value for our shareholders.”

Matthew Shafer commented, “I am delighted

by this opportunity to join the Cardiff Lexington team. The Company has an innovative business model that provides premier healthcare

services to a traditionally underrepresented patient population, with room to drive considerable growth and value in the near-term. I

look forward to advancing the Company’s business strategy by contributing to its long-term growth and making a positive impact

aligned with its core values. Influencing improved patient outcomes is a key focus for us as we expand organically and inorganically

on a national scale to address this burgeoning market.”

About Cardiff Lexington Corporation:

Cardiff Lexington Corporation is focused on locating,

acquiring, and building middle market, niche companies, primarily in the healthcare industry. Fundamental to the Cardiff Lexington strategy

is the service-based partnership culture which emphasizes core values, teamwork, accountability, and performance.

A substantial majority of the Company’s

revenue is derived from Nova Ortho and Spine, PLLC, or Nova, which are regional primary specialty and ancillary care facilities throughout

Florida that provide traumatic injury victims with a full range of diagnostic and surgical services, primary care evaluations, interventional

pain management, and specialty consultation services.

For more information on Cardiff Lexington Corporation,

you may access the company’s website at https://cardifflexington.com/

Forward Looking Statements

This press release may contain information about

our views of future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based

on management’s beliefs, assumptions and expectations of the Company’s future economic performance, taking into account the

information currently available to it. These statements are not statements of historical fact. Although the Company believes the expectations

reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will

be attained. The Company does not undertake any duty to update any statements contained herein (including any forward-looking statements),

except as required by law. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not

currently known to us, that may cause the Company’s actual results, performance or financial condition to be materially different

from the expectations of future results, performance or financial position. Actual results may differ materially from the expectations

discussed in forward-looking statements. Factors that could cause actual results to differ materially from expectations include general

industry considerations, regulatory changes, changes in local or national economic conditions and other risks set forth in “Risk

Factors” included in our filings with the Securities and Exchange Commission.

Cardiff Lexington Investor Relations

investorsrelations@cardifflexington.com

(800) 628-2100 ext. 705

or

IMS Investor Relations

cardifflexington@imsinvestorrelations.com

(203) 972-9200

Exhibit 99.2

Cardiff Lexington Appoints Zia Choe as Chief

Accounting Officer

Company Establishing Experienced Finance

Team to Support Growth Strategy

FT. LAUDERDALE, FL / ACCESSWIRE / January 4,

2024 / Cardiff Lexington Corporation (OTC PINK:CDIX), an acquisition holding company focused on locating, acquiring, and building

middle market, niche companies, primarily in the healthcare industry, today announced the appointment of Zia Choe as Chief Accounting

Officer. Ms. Choe previously served as interim Chief Financial Officer at Cardiff Lexington. In her new role, Ms. Choe will work across

all constituencies to help ensure accurate and timely financial reporting, develop policies and procedures which align to enterprise-wide

business strategies and accounting professional standards, perform technical accounting diligence on prospective acquisitions, and support

on the execution of the Company's strategic growth initiatives to expand on a national scale.

Ms. Choe is a highly accomplished finance professional

with 17 years of accounting and operational experience. Most recently, Ms. Choe served as a Partner at STK Financial where she was responsible

for the financial audit and review of domestic and international clients, provided high level outsourced accounting advisory services,

performed financial due diligence for mergers and acquisitions, and assisted in the preparation of 10K and 10Q financial statements and

footnotes. Prior to this role, Ms. Choe served as Audit and Assurance Manager at JNK Accountancy Group, where she successfully conducted

financial audits in accordance with US GAAP and IFRS measures for various domestic and international clients. She also advised clients

on various topics including accounting policies, internal control, risk assessments, fraud, and new accounting standards.

Ms. Choe is a certified public accountant. She

received her Bachelor of Science degree in hospitality management from Florida International University and her Master of Science equivalent

in accounting from the AICPA Accounting Program at Ajou University in Suwon, South Korea.

Alex Cunningham, Chief Executive Officer of Cardiff

Lexington, commented, "After a period of strong performance as our interim CFO, we are pleased to announce that we have appointed

Zia Choe as Chief Accounting Officer of Cardiff Lexington. Zia's addition reflects our commitment to establishing an experienced finance

team that will support our growth strategy as we head into 2024. We believe that her extensive background in accounting, specifically

as it relates to M&A due diligence and advisory, will be a valuable addition to our business, and we expect Zia to be a key member

of the Cardiff Lexington team."

Zia Choe commented, "I'm excited to join

the Cardiff Lexington team in a permanent role as Chief Accounting Officer. As a result of my time as interim CFO, I am very familiar

with the business model and am ready to hit the ground running in 2024. This Company possesses a unique business model with a strong foothold

in Florida, which has the most personal injury claims per capita in the United States. I'm energized by the opportunity to join the Cardiff

Lexington team and look forward to contributing to the Company's long-term growth."

About Cardiff Lexington Corporation:

Cardiff Lexington Corporation is focused on locating,

acquiring, and building middle market, niche companies, primarily in the healthcare industry. Fundamental to the Cardiff Lexington strategy

is the service-based partnership culture which emphasizes core values, teamwork, accountability, and performance.

A substantial majority of the Company's revenue

is derived from Nova Ortho and Spine, PLLC, or Nova, which are regional primary specialty and ancillary care facilities throughout Florida

that provide traumatic injury victims with a full range of diagnostic and surgical services, primary care evaluations, interventional

pain management, and specialty consultation services.

For more information on Cardiff Lexington Corporation,

you may access the company's website at https://cardifflexington.com/

Forward Looking Statements

This press release may contain information about

our views of future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based

on management's beliefs, assumptions and expectations of the Company's future economic performance, taking into account the information

currently available to it. These statements are not statements of historical fact. Although the Company believes the expectations reflected

in such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained.

The Company does not undertake any duty to update any statements contained herein (including any forward-looking statements), except as

required by law. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently

known to us, that may cause the Company's actual results, performance or financial condition to be materially different from the expectations

of future results, performance or financial position. Actual results may differ materially from the expectations discussed in forward-looking

statements. Factors that could cause actual results to differ materially from expectations include general industry considerations, regulatory

changes, changes in local or national economic conditions and other risks set forth in "Risk Factors" included in our filings

with the Securities and Exchange Commission.

Cardiff Lexington Investor Relations

investorsrelations@cardifflexington.com

(800) 628-2100 ext. 705

or

IMS Investor Relations

cardifflexington@imsinvestorrelations.com

(203) 972-9200

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

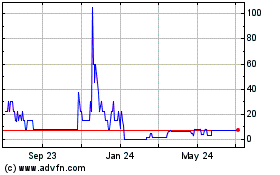

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Jan 2025 to Feb 2025

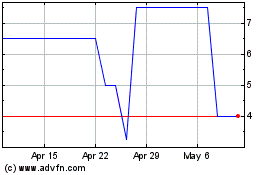

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Feb 2024 to Feb 2025