UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2016

Commission

File Number: 001-35132

BOX

SHIPS INC.

(Name

of Registrant)

15

Karamanli Ave., GR 166 73, Voula, Greece

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Special

Meeting of Shareholders

Box

Ships Inc. (the “Company”) has announced that its special meeting of shareholders, originally scheduled to be held

on January 27, 2016 has been adjourned to February 12, 2016 (the “Special Meeting”). In that regard, attached hereto

as Exhibits 99.1, 99.2 and 99.3 are copies of (i) the Amended and Restated Notice of Special Meeting, (ii) Amended and Restated

Proxy Statement, and (iii) Form of Proxy Card, respectively.

The

Company’s Annual Report on Form 20-F (the “Annual Report”), which contains the Company’s audited financial

statements for the year ended December 31, 2014, as well as copies of the Proxy Statement and form of Proxy Card for the Special

Meeting, are being posted on the Company’s website at http://www.box-ships.com/agm-materials.php. Please note that the form

of Proxy Card on the website is for information purposes only and cannot be used to vote.

SUBMITTED

HEREWITH:

| Exhibit

Number |

|

Description

of Exhibit |

| |

|

|

| 99.1 |

|

Amended and Restated

Notice of Special Meeting of Stockholders |

| |

|

|

| 99.2 |

|

Amended and Restated

Proxy Statement |

| |

|

|

| 99.3 |

|

Form of Proxy Card,

incorporated by reference to Exhibit 99.3 of the Company’s Report on Form 6-K, filed with the Securities and Exchange

Commission on December 24, 2015 |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

BOX SHIPS INC. |

| |

|

|

| Date: January 14, 2016 |

By: |

/s/

GEORGE SKRIMIZEAS |

| |

|

George Skrimizeas |

| |

|

Chief Operating Officer |

Exhibit 99.1

BOX

SHIPS INC.

15

Karamanli Ave.

166

73, Voula, Greece

AMENDED

AND RESTATED

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

TO

BE HELD ON FEBRUARY 12, 2016

To

the Shareholders of Box Ships Inc.:

A

Special Meeting of Shareholders (the “Special Meeting”) of Box Ships Inc., a corporation organized under the laws

of the Republic of the Marshall Islands (the “Company” or “Box Ships”) will be held on February 12, 2016

at the principal executive offices of Box Ships Inc. at 15 Karamanli Ave., 166 73, Voula, Greece, at 2:00 pm Greek time/7:00 am

Eastern Standard Time. The purpose of the Special Meeting is as follows:

| |

1. |

To

grant discretionary authority to the Company’s board of directors to (A) amend the Amended and Restated Articles of

Incorporation of the Company to effect one or more consolidations of the issued and outstanding shares of common stock, pursuant

to which the shares of common stock would be combined and reclassified into one share of common stock ratios within the range

from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”) and (B) determine whether to arrange for the disposition

of fractional interests by shareholder entitled thereto, to pay in cash the fair value of fractions of a share of common stock

as of the time when those entitled to receive such fractions are determined, or to entitle shareholder to receive from the

Company’s transfer agent, in lieu of any fractional share, the number of shares of common stock rounded up to the next

whole number, provided that, (X) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceeds 1-for-50,

and (Y) any Reverse Stock Split is completed no later than the first anniversary of the date of the Special Meeting. |

Our

Board of Directors has fixed the close of business on December 14, 2015 as the record date for determining those shareholders

entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

Whether

or not you expect to be present, please sign, date and return the enclosed proxy card in the pre-addressed envelope provided for

that purpose as promptly as possible. No postage is required if mailed in the United States.

Please

note that this notice of the Special Meeting amends and restates the notice dated December 24, 2015, which stated that the Special

Meeting will be held on January 27, 2016. The Company has adjourned the meeting to February 12, 2016.

| |

By Order

of the Board of Directors, |

| |

/s/ Aikaterini Stoupa |

| |

Aikaterini Stoupa |

| |

Secretary |

Voula,

Greece

January

14, 2016

All

shareholders are invited to attend the Special Meeting in person. Those shareholders who are unable to attend are respectfully

urged to execute and return the proxy card enclosed with this Proxy Statement as promptly as possible. Shareholders who execute

a proxy card may nevertheless attend the Special Meeting, revoke their proxy and vote their shares in person. “Street name”

shareholders who wish to vote their shares in person will need to obtain a voting instruction form from the brokers or nominees

in whose name their shares are registered.

Exhibit 99.2

BOX SHIPS INC.

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 12, 2016

PROXY STATEMENT

TIME, DATE AND PLACE OF SPECIAL MEETING

This Proxy Statement

is furnished in connection with the solicitation by the Board of Directors of Box Ships Inc., a corporation organized under the

laws of the Republic of the Marshall Islands (the “Company” or “Box Ships”), of proxies from the holders

of our common stock, par value $0.01 per share, for use at a Special Meeting of Shareholders (the “Special Meeting”)

to be held at the principal executive offices of Box Ships Inc. at 15 Karamanli Ave., 166 73 Voula, Greece, at 2:00 pm Greek time/7:00

am Eastern Standard Time, on February 12, 2016, and at any adjournments or postponements thereof, pursuant to the enclosed Notice

of Special Meeting.

Please note that

this proxy statement for the Special Meeting amends and restates the proxy statement dated December 24, 2015, which stated that

the Special Meeting will be held on January 27, 2016. The Company has adjourned the meeting to February 12, 2016 and is providing

this amended and restated proxy statement to provide additional disclosure to the Company’s shareholders.

The approximate date

this Proxy Statement is being sent to shareholders is January 21, 2016. Shareholders should review the information provided herein

or made available in conjunction with our Special Meeting. The Notice of Special Meeting of Shareholders and related materials,

including the Company's 2014 annual report containing the Company's audited financial statements for the fiscal year ended December

31, 2014 (the "2014 Annual Report"), which accompany this proxy statement, are also available on the Company's website

at http://www.box-ships.com/agm-materials.php.

INFORMATION CONCERNING PROXY

The enclosed proxy

is solicited on behalf of our Board of Directors. The giving of a proxy does not preclude the right to vote in person should any

shareholder giving the proxy so desire. Shareholders have an unconditional right to revoke their proxy at any time prior to the

exercise thereof, either in person at the Special Meeting or by filing with our Secretary at our headquarters a written revocation

or duly executed proxy bearing a later date; no such revocation will be effective, however, until written notice of the revocation

is received by us at or prior to the Special Meeting.

The cost of preparing,

assembling and mailing this Proxy Statement, the Notice of Special Meeting and the enclosed proxy is to be borne by us. In addition

to the use of mail, our employees may solicit proxies personally and by telephone. Our employees will receive no compensation for

soliciting proxies other than their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries

to forward copies of the proxy materials to their principals and to request authority for the execution of proxies. We will reimburse

such persons for their expenses in doing so. In addition, we have engaged Alliance Advisors, LLC, 200 Broadacres Drive, 3rd

Floor, Bloomfield, New Jersey 07003 as our proxy solicitor to help us solicit proxies from brokers, banks or other nominees. We

will pay Alliance Advisors, LLC a fee of approximately $5,000, plus $2,000 in costs and expenses, relating to the solicitation

of proxies for the Special Meeting.

PURPOSE OF THE SPECIAL MEETING

At the Special Meeting, our shareholders

will consider and vote upon the following matter:

| |

1. |

To consider and vote upon a proposal to grant discretionary authority to the Company’s board of directors to (A) amend the Amended and Restated Articles of Incorporation of the Company to effect one or more consolidations of the issued and outstanding shares of common stock, pursuant to which the shares of common stock would be combined and reclassified into one share of common stock at ratios within the range from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”) and (B) determine whether to arrange for the disposition of fractional interests by shareholder entitled thereto, to pay in cash the fair value of fractions of a share of common stock as of the time when those entitled to receive such fractions are determined, or to entitle shareholder to receive from the Company’s transfer agent, in lieu of any fractional share, the number of shares of common stock rounded up to the next whole number, provided that, (X) that the Company shall not effect Reverse Stock Splits that, in the aggregate, exceeds 1-for-50, and (Y) any Reverse Stock Split is completed no later than the first anniversary of the date of the Special Meeting. |

Unless contrary instructions

are indicated on your proxy, all shares of common stock represented by valid proxies received pursuant to this solicitation (and

which have not been revoked in accordance with the procedures set forth herein) will be voted in favor of the proposal described

in the Notice of Special Meeting. The Board of Directors knows of no other business that may properly come before the Special Meeting;

however, if other matters properly come before the Special Meeting, it is intended that the persons named in the proxy will vote

thereon in accordance with their best judgment. In the event a shareholder specifies a different choice by means of the shareholder's

proxy, the shareholder’s shares will be voted in accordance with the specification so made.

OUTSTANDING VOTING SECURITIES AND VOTING

RIGHTS

Our Board of Directors

previously set the close of business on December 14, 2015 as the record date for determining which of our shareholders are entitled

to notice of and to vote at the Special Meeting. As of the record date, there were 31,010,555 shares of our common stock that are

entitled to be voted at the Special Meeting. Each share of common stock is entitled to one vote on each matter submitted to shareholders

for approval at the Special Meeting.

The attendance, in

person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Special

Meeting is necessary to constitute a quorum.

The affirmative vote

of the holders of a majority of the shares of common stock present in person or by proxy at the Special Meeting will be required

to approve the granting of discretionary authority to the Company’s board of directors to (A) amend the Amended and Restated

Articles of Incorporation of the Company to effect one or more consolidations of the issued and outstanding shares of common stock,

pursuant to which the shares of common stock would be combined and reclassified into one share of common stock at ratios within

the range from 1-for-2 up to 1-for-50 (the “Reverse Stock Split”) and (B) determine whether to arrange for the disposition

of fractional interests by shareholder entitled thereto, to pay in cash the fair value of fractions of a share of common stock

as of the time when those entitled to receive such fractions are determined, or to entitle shareholder to receive from the Company’s

transfer agent, in lieu of any fractional share, the number of shares of common stock rounded up to the next whole number, provided

that, (X) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceeds 1-for-50, and (Y) any Reverse Stock

Split is completed no later than the first anniversary of the date of the Special Meeting, and for any other proposals that may

come before the Special Meeting. If less than a majority of the outstanding shares entitled to vote is represented at the Special

Meeting, a majority of the shares so represented may adjourn the Special Meeting to another date, time or place, and notice need

not be given of the new date, time or place if the new date, time or place is announced at the meeting before an adjournment is

taken.

Prior to the Special

Meeting, we will select one or more inspectors of election for the meeting. Such inspector(s) shall determine the number of shares

of common stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall receive,

count and tabulate ballots and votes and determine the results thereof. Abstentions will be considered as shares present and entitled

to vote at the Special Meeting and will be counted as votes cast at the Special Meeting, but will not be counted as votes cast

for or against any given matter.

PROPOSAL 1: REVERSE SPLIT OF THE COMMON

STOCK OF THE COMPANY

Our board of directors

has adopted resolutions (1) declaring that submitting an amendment to the Company’s Amended and Restated Articles of

Incorporation to effect the Reverse Stock Split of our issued and outstanding Common Stock, as described below, was advisable and

(2) directing that a proposal to approve the Reverse Stock Split be submitted to the holders of our Common Stock for their

approval.

The form of the proposed

amendment to the Company’s Amended and Restated Articles of Incorporation to effect reverse stock splits of our issued and

outstanding Common Stock will be substantial as set forth on Appendix A (subject to any changes required by applicable law). Approval

of the proposal would permit (but not require) our Board of Directors to effect one or more reverse stock splits of our issued

and outstanding common stock by a ratio of not less than one-for-two and not more than one-for-fifty, with the exact ratio to be

set at a number within this range as determined by our Board of Directors in its sole discretion, provided that the Board of Directors

determines to effect the Reverse Stock Split and such amendment is filed with the appropriate authorities in the Marshall Islands

no later than one year after the date of our Special Meeting. The Company shall not effect Reverse Stock Splits that, in the

aggregate, exceeds one-for-fifty. We believe that enabling our Board of Directors to set the ratio within the stated range will

provide us with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits

for our shareholders. In determining a ratio, if any, following the receipt of shareholder approval, our Board of Directors

may consider, among other things, factors such as:

| |

· |

the continuing listing requirements of various stock exchanges; |

| |

· |

the historical trading price and trading volume of our Common Stock; |

| |

· |

the number of shares of our Common Stock outstanding; |

| |

· |

the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split on the trading market for our Common Stock; |

| |

· |

the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; and |

| |

· |

prevailing general market and economic conditions. |

Our board of directors

reserves the right to elect to abandon the Reverse Stock Split, including any or all proposed reverse stock split ratios, if it

determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders.

Depending on the ratio

for the Reverse Stock Split determined by our board of directors, no less than two and no more than fifty shares of existing Common

Stock, as determined by our board of directors, will be combined into one share of Common Stock. The Company shall not effect

Reverse Stock Splits that, in the aggregate, exceed one-for-fifty. Our Board of Directors will have the discretionary authority

to determine whether to arrange for the disposition of fractional interests by holder entitled thereto, to pay in cash the fair

value of fractions of a share as of the time when those entitled to receive such fractions are determined, or to entitle holders

to receive from the Company transfer agent, in lieu of any fractional share, the number of shares rounded up to the next whole

number. The amendment to our Articles of Incorporation to effect a Reverse Stock Split, if any, will include only the reverse

split ratio determined by our Board of Directors to be in the best interests of our shareholders and all of the other proposed

amendments at different ratios will be abandoned.

Background and Reasons for the Reverse

Stock Split; Potential Consequences of the Reverse Stock Split

Our board of directors

is submitting multiple Reverse Stock Splits to our stockholders for approval with the primary intent of increasing the market price

of our Common Stock to enhance our ability to meet the initial listing requirements of the NASDAQ Capital Market and to make our

Common Stock more attractive to a broader range of institutional and other investors. The Company currently does not have

any plans, arrangements or understandings, written or oral, to issue any of the authorized but unissued shares that would become

available as a result of the Reverse Stock Split. In addition to increasing the market price of our Common Stock, the Reverse

Stock Split would also reduce certain of our costs, as discussed below. Accordingly, for these and other reasons discussed

below, we believe that effecting the Reverse Stock Splits is in the Company’s and our stockholders’ best interests.

We believe that the

Reverse Stock Split will enhance our ability to maintain the necessary price for initial listing on the NASDAQ Capital Market. We

are contemplating the listing of our common stock on NASDAQ, although no definitive plans have been established to date. The NASDAQ

Capital Market requires, among other items, an initial bid price of least $4.00 per share and following initial listing, maintenance

of a continued price of at least $1.00 per share.

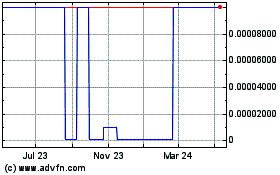

Until November 17,

2015, our common stock traded on the New York Stock Exchange (“NYSE”). The trading of our common stock was suspended

following the close of business on November 17, 2015, pursuant to Section 802.01B of the NYSE’s Listed Company Manual, because

we were not in compliance with the NYSE’s continued listing standard requiring listed companies to maintain an average global

market capitalization over a consecutive 30 trading-day period of at least $15,000,000.

In December 2014, we

received a letter from the NYSE stating that, for the previous 30 consecutive business days, the average closing price of our common

stock closed below the minimum $1.00 per share, the minimum average closing price required by the continued listing requirements

of the NYSE. In November 2015, we held our annual meeting of stockholders, at which time we requested approval from

the stockholders to approve authority of our board of directors to effectuate a reverse stock split within a range. That proposal

was not approved. We are now asking for authority to effectuate a larger reverse stock split, since the initial listing criteria

of the NASDAQ Capital Market requires a higher trading price than the current share price. In addition, to the extent necessary

under any agreements with third parties, we will effectuate a Reverse Stock Split to ensure compliance with our obligations thereunder.

Reducing

the number of outstanding shares of Common Stock should, absent other factors, increase the per share market price of the Common

Stock, although we cannot provide any assurance that we will be able to meet or maintain a bid price over the minimum initial listing

bid price requirement of NASDAQ or any other exchange. Although the board has determined that it is in the Company’s

and its shareholders’ best interests to position the Common Stock for potential listing on the NASDAQ or another stock exchange,

the board may ultimately determine to not pursue any such listing. There can be no assurance that if the Company were

to make any such application, it would result in the listing of the Common Stock on any exchange.

Additionally, we believe

that the Reverse Stock Split will make our Common Stock more attractive to a broader range of institutional and other investors,

as we have been advised that the current market price of our Common Stock may affect its acceptability to certain institutional

investors, professional investors and other members of the investing public. Many brokerage houses and institutional

investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage

individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices

may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because

brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on

higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction

costs representing a higher percentage of their total share value than would be the case if the share price were substantially

higher. We believe that the Reverse Stock Split will make our Common Stock a more attractive and cost effective investment

for many investors, which will enhance the liquidity of the holders of our Common Stock.

Reducing the number

of outstanding shares of our Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the per

share market price of our Common Stock. However, other factors, such as our financial results, market conditions and

the market perception of our business may adversely affect the market price of our Common Stock. As a result, there

can be no assurance that the Reverse Stock Splits, if completed, will result in the intended benefits described above, that the

market price of our Common Stock will increase following the Reverse Stock Splits or that the market price of our Common Stock

will not decrease in the future. Additionally, we cannot assure you that the market price per share of our Common Stock

after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our Common Stock outstanding

before the Reverse Stock Split. Accordingly, the total market capitalization of our Common Stock after the Reverse Stock

Split may be lower than the total market capitalization before the Reverse Stock Split.

Procedure for Implementing the Reverse

Stock Split

The Reverse Stock Split,

if approved by our stockholders, would become effective upon the filing or such later time as specified in the filing (the “Effective

Time”) of a certificate of amendment to our Amended and Restated Articles of Incorporation with the Registrar of Corporation

of the Marshall Islands. The exact timing of the filing of the certificate of amendment that will effect the Reverse

Stock Split will be determined by our board of directors based on its evaluation as to when such action will be the most advantageous

to the Company and our stockholders. In addition, our board of directors reserves the right, notwithstanding stockholder

approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior

to filing the amendment to the Company’s Amended and Restated Articles of Incorporation, our board of directors, in its sole

discretion, determines that it is no longer in our best interest and the best interests of our stockholders to proceed with the

Reverse Stock Split. If a certificate of amendment effecting the Reverse Stock Split has not been filed with the Registrar

of Corporations of the Marshall Islands within one year from the Special Meeting, our board of directors will abandon the Reverse

Stock Split.

Effect of the Reverse

Stock Split on Holders of Outstanding Common Stock

Depending on the ratio

for the Reverse Stock Split determined by our Board of Directors, a minimum of two and a maximum of fifty shares in aggregate of

existing common stock will be combined into one new share of common stock. Based on 31,010,555 shares of common stock

issued and outstanding as of the record date, immediately following the reverse split the Company would have approximately 15,505,278

shares of common stock issued and outstanding (without giving effect to rounding for fractional shares) if the ratio for the reverse

split is 1-for-2, approximately 1,240,423 shares of common stock issued and outstanding (without giving effect to rounding for

fractional shares) if the ratio for the reverse split is 1-for-25, and approximately 620,212 shares of common stock issued and

outstanding (without giving effect to rounding for fractional shares) if the ratio for the reverse split is 1-for-50, which is

the aggregate ratio allowed under this proposal. Any other ratios selected within such range would result in a number of shares

of common stock issued and outstanding following the transaction between 620,212 and 15,505,278 shares.

The actual number of

shares issued after giving effect to the Reverse Stock Split, if implemented, will depend on the reverse stock split ratio and

the number of reverse stock splits, if any, that are ultimately determined by our board of directors.

The Reverse Stock Split

will affect all holders of our Common Stock uniformly and will not affect any stockholder’s percentage ownership interest

in the Company, except that as described below in “— Fractional Shares,” record holders of Common Stock otherwise

entitled to a fractional share as a result of the Reverse Stock Split will be rounded up to the next whole number. In

addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment

of fractional shares).

The Reverse Stock Split

may result in some stockholders owning “odd lots” of less than 100 shares of Common Stock. Odd lot shares

may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher

than the costs of transactions in “round lots” of even multiples of 100 shares.

After the Effective

Time, our Common Stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers, which is a number

used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged for stock

certificates with the new CUSIP numbers by following the procedures described below. After the Reverse Stock Split,

we will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934, as amended. Our

Common Stock will continue to be traded on the OTCQX Market under the symbol “TEUFF”, subject to any decision of our

Board of Directors to list our securities on another market or exchange. The Reverse Stock Split is not intended as, and will not

have the effect of, a “going private transaction” as described by Rule 13e-3 under the Exchange Act.

After the effective

time of the Reverse Stock Split, the post-split market price of our common stock may be less than the pre-split price multiplied

by the Reverse Stock Split ratio. In addition, a reduction in number of shares outstanding may impair the liquidity for our common

stock, which may reduce the value of our common stock.

Authorized Shares of Common Stock

The Reverse Stock Split

will not change the number of authorized shares of the Company’s common stock under the Company’s Articles of Incorporation.

Because the number of issued and outstanding shares of common stock will decrease, the number of shares of common stock remaining

available for issuance will increase. Under our Articles of Incorporation, as amended, our authorized capital stock consists of

475,000,000 shares of common stock, par value $0.01, and 25,000,000 shares of preferred stock, par value $0.01. The Company does

not currently have any plans, proposal or arrangement to issue any of its authorized but unissued shares of common stock, other

than any shares to be issued in connection with the Company’s equity incentive plan.

By increasing the number

of authorized but unissued shares of common stock, the Reverse Stock Split could, under certain circumstances, have an anti-takeover

effect, although this is not the intent of the Board of Directors. For example, it may be possible for the Board of Directors to

delay or impede a takeover or transfer of control of the Company by causing such additional authorized but unissued shares to be

issued to holders who might side with the Board of Directors in opposing a takeover bid that the Board of Directors determines

is not in the best interests of the Company or its shareholders. The Reverse Stock Split therefore may have the effect of discouraging

unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts the reverse split

may limit the opportunity for the Company’s shareholders to dispose of their shares at the higher price generally available

in takeover attempts or that may be available under a merger proposal. The Reverse Stock Split may have the effect of permitting

the Company’s current management, including the current Board of Directors, to retain its position, and place it in a better

position to resist changes that shareholders may wish to make if they are dissatisfied with the conduct of the Company’s

business. However, the Board of Directors is not aware of any attempt to take control of the Company and the Board of Directors

has not approved the Reverse Stock Split with the intent that it be utilized as a type of anti-takeover device.

Beneficial Holders of Common Stock (i.e.

stockholders who hold in street name)

Upon the implementation

of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in

the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or

other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Common Stock in street

name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders

for processing the Reverse Stock Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian

or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other

nominees.

Registered “Book-Entry”

Holders of Common Stock (i.e. stockholders that are registered on the transfer agent’s books and records but do not hold

stock certificates)

Certain of our registered

holders of Common Stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These

stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided

with a statement reflecting the number of shares registered in their accounts.

Stockholders who hold

shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic)

to receive whole shares of post-Reverse Stock Split Common Stock, subject to adjustment for treatment of fractional shares.

Holders of Certificated Shares of Common

Stock

Stockholders holding

shares of our Common Stock in certificated form will be sent a transmittal letter by our transfer agent after the Effective Time. The

letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s) representing

shares of our Common Stock (the “Old Certificates”) to the transfer agent in exchange for certificates representing

the appropriate number of whole shares of post-Reverse Stock Split Common Stock (the “New Certificates”). No

New Certificates will be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly

completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer

or other fee to exchange his, her or its Old Certificates. Stockholders will then receive a New Certificate(s) representing

the number of whole shares of Common Stock that they are entitled as a result of the Reverse Stock Split, subject to the treatment

of fractional shares described below. Until surrendered, we will deem outstanding Old Certificates held by stockholders

to be cancelled and only to represent the number of whole shares of post-Reverse Stock Split Common Stock to which these stockholders

are entitled, subject to the treatment of fractional shares. Any Old Certificates submitted for exchange, whether because

of a sale, transfer or other disposition of stock, will automatically be exchanged for New Certificates. If an Old Certificate

has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive legends

that are on the back of the Old Certificate(s).

The Company expects

that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. No service

charges will be payable by holders of shares of Common Stock in connection with the exchange of certificates. All of such

expenses will be borne by the Company.

STOCKHOLDERS SHOULD NOT DESTROY ANY

STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional Shares

The Company does not

currently intend to issue fractional shares in connection with the Reverse Stock Split. Therefore, the Company does not expect

to issue certificates representing fractional shares. The Board of Directors will have the discretionary authority to determine

whether to arrange for the disposition of fractional interests by shareholders entitled thereto, to pay in cash the fair value

of fractions of a share as of the time when those entitled to receive such fractions are determined, or to entitle shareholders

to receive from the Company’s transfer agent, in lieu of any fractional share, the number of shares rounded up to the next

whole number.

If the Board of Directors

determines to arrange for the disposition of fractional interests by shareholders entitled thereto or to pay in cash the fair value

of fractions of a share as of the time when those entitled to receive such fractions are determined, shareholders who would otherwise

hold fractional shares because the number of shares of common stock they hold before the Reverse Stock Split is not evenly divisible

by the ratio ultimately selected by the Board of Directors will be entitled to receive cash (without interest or deduction) in

lieu of such fractional shares from either: (i) the Company, upon receipt by the transfer agent of a properly completed and duly

executed transmittal letter and, where shares are held in certificated form, upon due surrender of any certificate previously representing

a fractional share, in an amount equal to such holder's fractional share based upon the volume weighted average price of the common

stock as reported on the OTCQX Market, or other principal market of the common stock, as applicable, as of the date the Reverse

Stock Split is effected; or (ii) the transfer agent, upon receipt by the transfer agent of a properly completed and duly executed

transmittal letter and, where shares are held in certificated form, the surrender of all old certificate(s), in an amount equal

to the proceeds attributable to the sale of such fractional shares following the aggregation and sale by the transfer agent of

all fractional shares otherwise issuable. If the Board of Directors determines to dispose of fractional interests pursuant to clause

(ii) above, the Company expects that the transfer agent would conduct the sale in an orderly fashion at a reasonable pace and that

it may take several days to sell all of the aggregated fractional shares of common stock. In this event, such holders would be

entitled to an amount equal to their pro rata share of the proceeds of such sale. The Company will be responsible for any brokerage

fees or commissions related to the transfer agent's open market sales of shares that would otherwise be fractional shares.

The ownership of a

fractional share interest following the Reverse Stock Split will not give the holder any voting, dividend or other rights, except

to receive the cash payment, or, if the Board of Directors so determines, to receive the number of shares rounded up to the next

whole number, as described above.

Shareholders should

be aware that, under the escheat laws of various jurisdictions, sums due for fractional interests that are not timely claimed after

the effective time of the Reverse Stock Split may be required to be paid to the designated agent for each such jurisdiction, unless

correspondence has been received by the Company or the transfer agent concerning ownership of such funds within the time permitted

in such jurisdiction. Thereafter, if applicable, shareholders otherwise entitled to receive such funds, but who do not receive

them due to, for example, their failure to timely comply with the transfer agent's instructions, will have to seek to obtain such

funds directly from the state to which they were paid.

Effect of the Reverse Stock Split on

Employee Plans, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable Securities

Based upon the reverse

stock split ratio determined by the board of directors, proportionate adjustments are generally required to be made to the per

share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible

or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock. This

would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable

securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange

or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The

number of shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment

of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately

based upon the reverse stock split ratio determined by the board of directors, subject to our treatment of fractional shares.

Accounting Matters

The proposed amendment

to the Company’s Amended and Restated Articles of Incorporation will not affect the par value of our Common Stock per share,

which will remain $0.01 par value per share. As a result, as of the Effective Time, the stated capital attributable

to Common Stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Stock Split. Reported

per share net income or loss will be higher because there will be fewer shares of Common Stock outstanding.

Certain Federal Income Tax Consequences

of the Reverse Stock Split

The following summary

describes certain material U.S. federal income tax consequences of the Reverse Stock Split to holders of our Common Stock

Unless otherwise specifically

indicated herein, this summary addresses the tax consequences only to a beneficial owner of our Common Stock that is a citizen

or individual resident of the United States, a corporation organized in or under the laws of the United States or any state thereof

or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis in respect of our Common

Stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to exercise

primary supervision over administration of such trust and one or more U.S. persons have the authority to control all substantial

decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose

income is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder. This summary does

not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise

from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be

known by investors. This summary also does not address the tax consequences to (i) persons that may be subject

to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment

companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum

tax, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our

Common Stock as part of a position in a “straddle” or as part of a “hedging,” “conversion”

or other integrated investment transaction for federal income tax purposes, or (iii) persons that do not hold our Common Stock

as “capital assets” (generally, property held for investment).

If a partnership (or

other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Common Stock, the

U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities

of the partnership. Partnerships that hold our Common Stock, and partners in such partnerships, should consult their

own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

This summary is based

on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial

authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax

law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect

on the U.S. federal income tax consequences of the Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING

THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES

UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S. Holders

The Reverse Stock Split

should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a stockholder generally will

not recognize gain or loss on the Reverse Stock Split, except to the extent of cash, if any, received in lieu of a fractional share

interest in the post-Reverse Stock Split shares. The aggregate tax basis of the post-split shares received will be equal to the

aggregate tax basis of the pre-split shares exchanged therefore (excluding any portion of the holder’s basis allocated to

fractional shares), and the holding period of the post-split shares received will include the holding period of the pre-split shares

exchanged. A holder of the pre-split shares who receives cash will generally recognize gain or loss equal to the difference between

the portion of the tax basis of the pre-split shares allocated to the fractional share interest and the cash received. Such gain

or loss will be a capital gain or loss and will be short term if the pre-split shares were held for one year or less and long term

if held more than one year. No gain or loss will be recognized by us as a result of the Reverse Stock Split.

No Appraisal Rights

Under Marshall Islands

law and our charter documents, holders of our Common Stock will not be entitled to dissenter’s rights or appraisal rights

with respect to the Reverse Stock Split.

Board Recommendation

THE BOARD OF DIRECTORS

RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO AUTHORIZE A REVERSE

STOCK SPLIT OF OUR ISSUED AND OUTSTANDING COMMON STOCK.

MANAGEMENT

Set forth below is certain information

concerning our directors and our executive officers as of January 11, 2016:

| |

|

|

|

|

|

Term |

|

Name |

|

Age |

|

Position |

|

Expires |

| Michael Bodouroglou |

|

61 |

|

Chairman, President, Chief Executive Officer, Interim Chief Financial Officer and Class C Director |

|

2017 |

| George Skrimizeas |

|

50 |

|

Chief Operating Officer |

|

— |

| Achilleas Stergiou |

|

66 |

|

Class A Director |

|

2018 |

| Dimitar Todorov |

|

60 |

|

Class B Director |

|

2016 |

| A. Joel Walton |

|

54 |

|

Class A Director |

|

2018 |

| Athanasios Reisopoulos |

|

67 |

|

Class B Director |

|

2016 |

Michael

Bodouroglou, age 61, has served as a director of the Company and our President and Chief Executive Officer since our

inception in May 2010 and has served as our Chairman and Class C director since April 2011. Mr. Bodouroglou also has served as

our Interim Chief Financial Officer since March 2015. Mr. Bodouroglou also serves as Chairman, President and Chief Executive Officer

of Paragon Shipping. Mr. Bodouroglou has co-founded and co-managed an independent shipping group since 1993 and has served as co-managing

director of Eurocarriers and Allseas Marine S.A. (“Allseas”), which he co-founded, since 1994 and 2000, respectively.

Mr. Bodouroglou disposed of his interest in Eurocarriers in September 2006. Prior to founding Eurocarriers, Mr. Bodouroglou served

from 1984 to 1992 as technical superintendent for Thenamaris (Ships Management) Inc., where he was responsible for all technical

matters of a product tanker fleet. Mr. Bodouroglou served as technical superintendent for Manta Line, a dry cargo shipping company,

in 1983 and as technical superintendent for Styga Compania Naviera, a tanker company, from 1981 to 1983. Mr. Bodouroglou graduated

from the University of Newcastle-upon-Tyne in the United Kingdom with a Bachelor of Science in Marine Engineering, with honors,

in 1977, and received a Masters of Science in Naval Architecture in 1978. Mr. Bodouroglou is a member of the Cayman Islands Shipowners'

Advisory Council, the DNV GL Greek Committee and the Lloyd's Register Hellenic Advisory Committee. He is also a member of China

Classification Society Mediterranean Committee (CCS), the RINA Hellenic Advisory Committee (Registro Italiano Navale) and the Greek

Committee of Nippon Kaiji Kyokai (ClassNK). He is also a member of the Board of the Swedish P&I Club and the Union of Greek

Shipowners. Mr. Bodouroglou is the Honorary Consul for the Slovak Republic in Piraeus, the President of the Hellenic Australian

Business Council (HABC) and an Honorary Fellow of the Institute of Chartered Shipbrokers.

George

Skrimizeas, age 50, has been our Chief Operating Officer since July 2013. Mr. Skrimizeas has been general manager

of Allseas since May 2006. Mr. Skrimizeas has also been the Chief Operating Officer of Paragon Shipping Inc. since June 2006. From

1996 to 2006, Mr. Skrimizeas has held various positions in Allseas, Eurocarriers and their affiliates, including general manager,

accounts and human resources manager, and finance and administration manager. Mr. Skrimizeas worked as accounts manager for ChartWorld

Shipping from 1995 to 1996 and as accounts and administration manager for Arktos Investments Inc. from 1994 to 1995. From 1988

to 1994, Mr. Skrimizeas was accounts and administration manager for Candia Shipping Co. S.A. and accountant and chief accounting

officer—deputy human resources manager in their Athens, Romania, Hong Kong and London offices. Mr. Skrimizeas received his

Bachelor of Science degree in Business Administration from the University of Piraeus, Greece in 1988 and completed the coursework

necessary to obtain his Masters of Science in Finance from the University of Leicester, in the United Kingdom, in 2002. Mr. Skrimizeas

is a member of the Hellenic Chamber of Economics, the Hellenic Management Association, the Hellenic Association of Chief Executive

Officers, Governor of the International Propeller Club - Port of Piraeus, Greece and member of the Business Advisory Committee

of the ICMA center Henley Business school in the U.K. (Msc in International Shipping and Finance).

Achilleas

Stergiou, age 66, has served as a Class A non-executive director of the Company since April 2011. From 2002 to November

2010, Mr. Stergiou served as the managing director of Metrostar Management Corp. From 1995 to 2001, Mr. Stergiou served as the

Vice President, Head of the Piraeus Greek Representative Office of J.P. Morgan-Chase Manhattan Bank, focusing on the bank's shipping

finance activity from 1998 to 2001 and performing shipping and private banking duties for the bank from 1995 to 1998. From 1990

to 1995, Mr. Stergiou served as Treasurer of Tsakos Shipping & Trading S.A. and from 1985 to 1990, Mr. Stergiou served as Investment

Manager of Star Maritime S.A. – G.S. Livanos Group. From 1980 to 1995, Mr. Stergiou was a Registered Stockbroker at Merrill

Lynch, Pierce, Fenner & Smith. Mr. Stergiou has served on the board of directors of Eleftheros Typos and Atlas Securities Co.

He has also served as a member of the Investment Committees of Hermes Mutual Fund, a wholly-owned subsidiary of Commercial Bank

of Greece, and Interinvest Mutual Fund. Mr. Stergiou graduated from the Hellenic School of Economics and Business Science with

a degree in Accounting in 1975. He also holds a Master in Business Administration with a concentration in finance from McGill University,

Montreal Canada.

Dimitar

Todorov, age 60, has served as a Class B non-executive director of the Company since April 2011. Since 2003, Mr. Todorov

has been the Executive Director and a member of the board of directors of Odessos Shiprepair Yard S.A., a shiprepair and conversion

yard in Bulgaria on the Black Sea. The main activities and responsibilities of Mr. Todorov in this position are general and commercial

management of the yard, management of repair contracts, promotion of various investment projects, development of strategies and

the pursuit of joint ventures with other entities. Mr. Todorov has served since 1980 in various other positions at Odessos Shiprepair

Yard S.A., such as Technologist, Shiprepair Manager, Manager of Workshop, Head of the Production Department, Head of the Commercial

Department and Commercial Director. Mr. Todorov graduated from the Technical University of Varna, Bulgaria as a Marine Engineer

with a specialty in Ship's Machines and Equipment. Mr. Todorov has extensive technical experience and competence in the shiprepair

business.

A.

Joel Walton, age 54, has served as a Class A non-executive director of the Company since April 2011. Since May 2004, Mr.

Walton has been the chief executive officer of the Maritime Authority of the Cayman Islands which also owns and operates the Cayman

Registry. Prior to May 2004, Mr. Walton served in various posts within the Cayman Islands public sector, including that of Deputy

Financial Secretary of the Cayman Islands for 11 years. Mr. Walton has also held appointments on a number of boards and committees

in the Cayman public and private sectors, including: chairman of the Maritime Sector Consultative Committee; deputy chairman of

the Cayman Islands Monetary Authority; chairman of the Cayman Islands Health Services Authority; chairman of the Company Sector

Consultative Committee; deputy chairman of the Cayman Islands Public Service Pensions Board; and deputy chairman of the Cayman

Islands Stock Exchange Authority. Mr. Walton has also held other board appointments, including with the Caribbean Utilities Company,

Ltd., a Toronto Stock Exchange listed company and with the Caribbean Development Bank. Mr. Walton obtained a Bachelor of Administration

(Hons) degree with a specialization in finance from Brock University, Canada in 1983 and an MBA with a concentration in finance

and strategic planning from the University of Windsor, Ontario in 1988.

Athanasios

Reisopoulos, age 67, has served as a Class B non-executive director of the Company since June 2014. Mr. Reisopoulos

has been the Vice President, head of Business and Market Development for the Region East Mediterranean, Black & Caspian Seas

of DNV GL, Piraeus, since November 2013. Mr. Reisopoulos has served as the Vice President, Area Manager for South Europe of Germanischer

Lloyd Hellas MEPE from 2002 to 2013 and as the Principal Surveyor and Area Manager for Africa of Germanischer Lloyd South Africa,

Pty Ltd. Durban, South Africa from 1996 to 2002. From 1980 to 1996 Mr. Reisopoulos has served as H & M Surveyor, ISO 9000 Lead

Auditor, Tutor for ISM, GL's Internal Auditor and ISMA Lead Auditor in Germanischer Lloyd, Hellas E.P.E. From 1977 to 1980 Mr.

Reisopoulos was a Surveyor/Assessor for Euromarine Ltd., Piraeus, Greece. From 1975 to 1977 Mr. Reisopoulos served as Naval Architect/Quality

Control Expert for Naval Shipyard, Simonstown, South Africa and from 1971 to 1972 as a Naval Architect in Howaldswerke Deutsche

Werft in Kiel Germany. Mr. Reisopoulos received his Diploma in Naval Architecture from the Technical University of Kiel, Germany

in 1973 and his Diploma in Mechanical Engineering from the Technical University of Hamburg, Germany in 1975.

CORPORATE GOVERNANCE

Board Responsibilities, Structure and Requirements

Our Board of Directors

oversees, counsels and directs management in our long-term interests and those of our shareholders. The Board’s responsibilities

include:

| |

· |

Evaluating the performance of, and selecting, our President and Chief Executive Officer and our other executive officers; |

| |

· |

Reviewing and approving our major financial objectives and strategic and operating plans, business risks and actions; |

| |

· |

Overseeing the conduct of our business to evaluate whether the business is being effectively managed; and |

| |

· |

Overseeing the processes for maintaining the integrity of our financial statements and other publicly disclosed information in compliance with law. |

Michael Bodouroglou

serves as both Chairman of the Board and as our President and Chief Executive Officer. The Board believes that the combined role

of Chairman of the Board and President and Chief Executive Officer is the appropriate leadership structure for us at this time.

This leadership model provides efficient and effective leadership of our business, and the Board believes Mr. Bodouroglou is the

appropriate person to lead both our Board and the management of our business.

We encourage our directors

to attend formal training programs in areas relevant to the discharge of their duties as directors. We reimburse directors for

all expenses they incur in attending such programs.

All of our directors

are expected to comply with our Code of Business Conduct and Ethics and our Insider Trading Policy.

Meetings and Committees of the Board

of Directors

Our board of directors

consists of the five directors named above in the Management section. Our board of directors is elected annually on a staggered

basis, and each director elected holds office for a three-year term or until his successor shall have been duly elected and qualified,

except in the event of his death, resignation, removal or the earlier termination of his term of office. The term of our Class

A directors, Messrs. Achilleas Stergiou and A. Joel Walton, expires at our 2018 annual general meeting of shareholders, the term

of our Class B directors, Mr. Dimitar Todorov and Mr. Athanasios Reisopoulos, expires at our 2016 annual general meeting of shareholders,

and the term of our Class C director, Mr. Michael Bodouroglou, expires at our 2017 annual general meeting of shareholders.

The Board and its

committees meet throughout the year generally on a quarterly schedule, and hold special meetings and act by written consent from

time to time as appropriate. During the fiscal year ended December 31, 2015, our Board of Directors held 11 meetings and also approved

certain actions by unanimous written consent. All of our directors attended at least 75% of the meetings of the Board of Directors

and applicable committees on which they served. We strongly encourage all directors to attend our annual meeting of Shareholders,

but we have no specific policy requiring attendance by directors at such meetings.

The Board delegates

various responsibilities and authority to different Board committees. Committees regularly report on their activities and actions

to the full Board. The committees of the Board of Directors are the audit committee, the compensation committee, the nominating

and corporate governance committee, and the conflicts committee. Our Board or the applicable committee has adopted written charters

for the audit, compensation, nominating and corporate governance committees and has adopted corporate governance guidelines that

address the composition and duties of the Board and its committees. The charters for the audit, compensation, and nominating and

corporate governance committees are posted in the “Corporate Profile – Charters of Committees” section of our

website at www.box-ships.com, and each is available in print, without charge, to any shareholder. Each of the committees

has the authority to retain independent advisors and consultants, with all fees and expenses to be paid by us.

Audit Committee

Our

audit committee consists of Messrs. Reisopoulos, Todorov, Walton and Stergiou. Our board of directors has also designated Mr. Stergiou

as an "audit committee financial expert," as such term is defined in Item 407 of Regulation S-K promulgated by the SEC.

The audit committee, among other things, reviews our external financial reporting, engages our external auditors and oversees our

internal audit activities and procedures and the adequacy of our internal accounting controls.

Compensation Committee

Our compensation committee

consists of Messrs. Reisopoulos, Todorov, Walton and Stergiou. The compensation committee is responsible for establishing

the compensation and benefits of our executive officers and making recommendations to the board of directors regarding the compensation

of our non-employee directors, reviewing and making recommendations to the board of directors regarding our compensation policies,

and overseeing our 2011 Equity Incentive Plan.

Nominating and Corporate Governance

Committee

Our nominating and

corporate governance committee consists of Messrs. Reisopoulos, Todorov, Walton and Stergiou. The nominating and corporate

governance committee is responsible for recommending to the board of directors nominees for director and directors for appointment

to committees of the board of directors, advising the board of directors with regard to corporate governance practices and recommending

director compensation. Shareholders may also nominate directors in accordance with procedures set forth in our amended and restated

bylaws.

In connection with

the selection and nomination process, the nominating committee, along with the full Board of Directors, shall consider and determine

the desired experience, mix of skills and other qualities necessary to assure appropriate Board composition, taking into account

the current Board members and the specific needs of the Company and the Board. The criteria for selecting directors includes such

factors as (i) the candidate’s ability to comprehend the Company’s strategic goals and to help guide the Company towards

the accomplishment of those goals; (ii) the history of the candidate in conducting his/her personal and professional affairs with

the utmost integrity and observing the highest standards of values, character and ethics; (iii) the candidate's time availability

for in-person participation at Board and committee meetings; (iv) the candidate’s judgment and business experience with related

businesses or other organizations of comparable size; (v) the knowledge and skills the candidate would add to the Board and its

committees, including the candidate's knowledge of the rules and regulations of the SEC and the NASDAQ Stock Market, and accounting

and financial reporting requirements; (vi) the candidate's ability to satisfy the criteria for independence established by the

SEC and the NASDAQ Stock Market; and (vii) the interplay of the candidate's experience with the experience of other Board members.

Conflicts Committee

Our

conflicts committee is comprised of directors who are neither officers nor directors of Paragon Shipping and who do not have a

financial interest, including through a family or employment relationship, in any proposed transactions. The conflicts committee

is comprised of Messrs. Reisopoulos, Todorov, Walton and Stergiou. The conflicts committee, which we are required to maintain pursuant

to the terms of our code of ethics, is intended to provide a mechanism for independent assessment of whether proposed arrangements

with Paragon Shipping, Mr. Michael Bodouroglou, and any entity controlled by Mr. Bodouroglou, and their respective affiliates,

or proposed modifications to arrangements with Paragon Shipping, Mr. Bodouroglou, any entities controlled by Mr. Bodouroglou and

their respective affiliates, are fair and reasonable to us. The board of directors is not obligated to seek approval of the conflicts

committee on any matter; however, the board of directors may submit such proposed arrangements or modifications to the conflicts

committee.

For

matters presented to it, the conflicts committee determines if the resolution of the conflict of interest is fair and reasonable

to us. Any matters approved by the conflicts committee are conclusively deemed to be fair and reasonable to us, taking into account

the totality of the relationship between the parties involved, including other transactions that may be particularly favorable

or advantageous to us. Our board of directors has the power to override a determination by the committee. However, a determination

by directors who were interested in the transaction would be subject to Section 58 of the Marshall Islands Business Corporation

Act, which provides that the transaction may be void or voidable unless the material facts of the interested directors' interests

are known or disclosed to the board of directors and the board of directors approves the transaction by a vote sufficient for such

purpose without counting the vote of the interested directors, or if the vote of the disinterested directors is insufficient, by

unanimous vote of the disinterested directors.

Compensation Committee Interlocks and

Insider Participation

None of the members

of our compensation committee (i) has ever been an officer or employee of us, (ii) had any relationship requiring disclosure by

us under SEC rules, or (iii) is an executive officer of another entity where one of our executive officers serves on the Board

of Directors.

Director Independence

We are not required

to have any independent members of the Board of Directors. The Board of Directors has evaluated whether each of Messrs. Reisopoulos,

Todorov, Walton and Stergiou is an “independent director” within the meaning of the listing requirements of NASDAQ.

The NASDAQ independence definition includes a series of objective tests, such as that the director is not our employee and has

not engaged in various types of business dealings with us. In addition, the Board of Directors made a subjective determination

as to each of Messrs. Reisopoulos, Todorov, Walton and Stergiou that no relationships exist which, in the opinion of the Board

of Directors, would interfere with the exercise of his independent judgment in carrying out the responsibilities of a director.

In making this determination, the Board of Directors reviewed and discussed information provided by each of Messrs. Reisopoulos,

Todorov, Walton and Stergiou with regard to his business and personal activities as they may relate to us and our management. After

reviewing the information presented to it, our Board of Directors has determined that each of Messrs. Reisopoulos, Todorov, Walton

and Stergiou is “independent” within the meaning of such rules. Our independent directors will meet in executive session

as often as necessary to fulfill their duties, but no less frequently than annually.

Shareholder Communication with the Board

of Directors

Although our Board

of Directors has not adopted a formal procedure for shareholders to communicate in writing with members of the Board of Directors,

any such communications received by the Company will be forwarded to our Board of Directors. Because our Board of Directors is

relatively small, and our shares of common stock are not widely held, the Company has not deemed it necessary to adopt a formal

communication procedure at this time.

Corporate Governance Guidelines

The Board has adopted

Corporate Governance Guidelines. The corporate governance committee is responsible for overseeing these guidelines and making recommendations

to the Board concerning corporate governance matters. Among other matters, the guidelines address the following items concerning

the Board and its committees:

| |

· |

Director qualifications generally and guidelines on the composition of the Board and its committees; |

| |

· |

Director responsibilities and the standards for carrying out such responsibilities; |

| |

· |

Board committee requirements; |

| |

· |

Director access to management and independent advisors; |

| |

· |

Director orientation and continuing education requirements; and |

| |

· |

CEO evaluation, management succession and CEO compensation. |

Role of Board in Risk Oversight

We have a risk management

process in which management is responsible for managing our risks and the Board and its committees provide review and oversight

in connection with these efforts. Risks are identified, assessed and managed on an ongoing basis by management and addressed during

periodic senior management meetings, resulting in both Board and committee discussions and public disclosure, as appropriate. The

Board is responsible for overseeing management in the execution of its risk management responsibilities and for reviewing our approach

to risk management. The Board administers this risk oversight function either through the full Board or through one of its standing

committees, each of which examines various components of our enterprise risks as part of its responsibilities. An overall review

of risk is inherent in the Board’s consideration of our long and short term strategies, acquisitions and significant financial

matters. The audit committee oversees financial risks (including risks associated with accounting, financial reporting, enterprise

resource planning, and collectability of receivables), legal and compliance risks and other risk management functions. The other

Board committees are involved in the risk assessment process as needed.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our Board of Directors

is responsible for the review and approval of “related party transactions” between us and our executive officers, directors

or other related persons. Under SEC rules, a related person is a director, officer, nominee for director or 5% or greater shareholder

of us since the beginning of our last fiscal year and their immediate family members.

Related person transactions

must be approved by the board of directors or by the conflicts committee, which will approve the transaction only if they determine

that it is in the best interests of our company. In considering the transaction, the board of directors or conflicts committee

will consider all relevant factors, including as applicable (i) the related person's interest in the transaction; (ii) the approximate

dollar value of the amount involved in the transaction; (iii) the approximate dollar value of the amount of the related person's

interest in the transaction without regard to the amount of any profit or loss; (iv) our business rationale for entering into the

transaction; (v) the alternatives to entering into a related person transaction; (vi) whether the transaction is on terms no less

favorable to us than terms that could have been reached with an unrelated third party; (vii) the potential for the transaction

to lead to an actual or apparent conflict of interest and any safeguards imposed to prevent such actual or apparent conflicts;

(viii) the overall fairness of the transaction to us; and (ix) any other information regarding the transaction or the related person

in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular

transaction. If a director is involved in the transaction, he or she will not cast a vote regarding the transaction.

Management

Agreements with Allseas

We

have entered into separate management agreements with Allseas for each of the vessels in our fleet, pursuant to which Allseas is

responsible for the commercial and technical management functions of our fleet. Effective January 2, 2015, we and Allseas mutually

agreed to terminate a portion of the services that were provided by Allseas under the terms of the original management agreements,

which were taken over by Seacommercial Shipping Services S.A. (“Seacommercial”), on substantially similar terms, as

discussed further below. Allseas will be still responsible for the commercial management which includes, among other things, operations

and freight collection services, obtaining insurance for our vessels and finance and accounting functions. Technical management

services include, among other things, arranging for and managing crews, vessel maintenance, dry-docking, repairs, insurance, maintaining

regulatory and classification society compliance and providing technical support.

Under

the terms of the management agreements, Allseas has agreed to use its best efforts to provide technical and commercial management

services upon our request in a commercially reasonable manner and may provide these services directly to us or subcontract for

certain of these services with other entities. Allseas has in-house technical management capabilities, which it continues to expand.

Allseas remains responsible for any subcontracted services under the management agreements. We have agreed to indemnify Allseas

for losses it incurs in connection with the provision of these services, excluding losses caused by the gross negligence or willful

misconduct of Allseas or its employees or agents. Allseas has agreed to indemnify us for our losses caused by its gross negligence

or willful misconduct.

Each

management agreement has an initial term of five years and automatically renews for additional five-year periods, unless in each

case, at least 30 days' advance notice of termination is given by either party.

Under

the management agreements, Allseas is entitled to a technical management fee of €648.93 per vessel, per day (or $706 per vessel,

per day using an exchange rate of $1.0887:€1.00, the U.S. dollar/Euro exchange rate as of December 31, 2015), for the twelve

months commencing June 1, 2015, payable on a monthly basis in advance, pro rata either for the calendar days these vessels are

owned by us if the vessels are second-hand purchases, or from the date of the memorandum of agreement if the vessels are purchased

directly from a shipyard. The technical management fee is adjusted annually based on the Eurozone inflation rate. Allseas is also

entitled to (i) a superintendent fee of €500 per day (or $544 per day using an exchange rate of $1.0887:€1.00, the U.S.

dollar/Euro exchange rate as of December 31, 2015), for each day in excess of five days per calendar year for which a superintendent

performed on site inspection; and (ii) a lump sum fee of $15,000 for pre-delivery services, including legal fees, crewing and manning

fees, manual preparation costs and other expenses related to preparing the vessel for delivery, rendered during the period from

the date a memorandum of agreement is signed for the purchase of any such vessel until the delivery date.

Under

the terms of the management agreements, Allseas is entitled to terminate a particular agreement if any moneys payable under the

agreement have not been received within 10 days of such payment having been requested by Allseas or if, after receipt of Allseas

objection thereto, we proceed to employ the vessel subject to the agreement in a trade or in a manner that is, in Allseas opinion,

likely to be detrimental to its reputation as a manager or prejudicial to its commercial interest. Under the terms of the management

agreements, we are also entitled to terminate a particular agreement if any moneys payable to us under the agreement are not paid

or accounted for in full by Allseas or Allseas repeatedly neglects or fails to perform its principal duties to meet its material

obligations under the agreement.

In

addition, the management agreements may be terminated if (i) we cease to be the owner of the vessel by reason of a sale thereof;