UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

April

5, 2018 (April 1, 2018)

Date

of Report (Date of earliest event reported)

Blue

Sphere Corporation

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55127

|

|

98-0550257

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer Identification

No.)

|

301

McCullough Drive, 4th Floor, Charlotte, North Carolina 28262

(Address

of principal executive offices) (Zip Code)

704-909-2806

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

☐

|

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

☒

|

|

Emerging

growth company

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As

used in this Current Report, all references to the terms “we”, “us”, “our”, “Blue Sphere”

or the “Company” refer to Blue Sphere Corporation and its wholly-owned subsidiaries, unless the context clearly requires

otherwise.

Item

5.02

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

Effective

April 1, 2018, Mr. Ran Daniel resigned from his position as the Company’s Chief Financial Officer. Mr. Daniel will continue

to provide transitional support and financial and reporting services as an advisor to the Company through April 30, 2018.

The

Company’s Board of Directors appointed Mr. Yossi Keret to serve as the Company’s Chief Financial Officer effective

as of April 1, 2018, and approved and authorized the Company to enter into the CFO Agreement (defined below) with Mr. Keret.

The

Company entered into a Services Agreement dated as of April 1, 2018 (the “CFO Agreement”) with Mr. Keret to serve

as its Chief Financial Officer. The CFO Agreement provides that Mr. Keret will serve for an initial term beginning April 1, 2018

and ending on April 1, 2020 (the “Initial Term”), which may be renewed by the mutual agreement of Mr. Keret and the

Company for additional one (1) year periods following the Initial Term. Mr. Keret’s responsibilities under the CFO Agreement

will include those customarily associated with such position to be provided on a full-time basis, including reporting responsibilities

under applicable federal, state and local laws and regulations.

The

CFO Agreement provides that Mr. Keret will receive an initial base salary of $16,000 per month, and a stipend for vehicle expenses

equal to $1,500 per month, payable in New Israeli Shekel (NIS) at an exchange rate no lower than 3.5 NIS to 1 USD. Mr. Keret’s

base salary will be subject to adjustment each year following the Initial Term, upon mutual agreement of the parties. The base

salary is Mr. Keret’s sole compensation under the CFO Agreement; however, the Company may, in its sole discretion, award

bonuses or other compensation to Mr. Keret from time to time. Further, Mr. Keret is entitled to receive incentive equity compensation

under the Company’s 2016 Stock Incentive Plan, or any successor plan which may be adopted by the Company’s Board of

Directors.

Subject

to other customary terms and conditions of such agreements, Mr. Keret shall not, during the term of the CFO Agreement or for twelve

(12) months thereafter, work for or obtain a financial interest in a direct competitor of the Company or solicit the Company’s

employees, consultants or customers. Further, the CFO Agreement may be terminated by any party with 90 days’ prior written

notice, or by the Company immediately for cause or in the event of the death or disability of Mr. Keret. Under the CFO Agreement,

termination for cause includes (i) the filing and conviction of any indictment for any crime, felony or offense in any jurisdiction;

(ii) a breach of any of the material terms or conditions of the CFO Agreement not cured within fourteen (14) days; (iii) any negligent,

fraudulent or bad faith act or omission concerning or toward the Company, or any act or omission designed to harm the Company;

(iv) any act of fraud or embezzlement of funds of the Company; or (v) falsification of the Company’s records or reports

or any other willful misconduct.

The

foregoing summary of the CFO Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the

full text of the CFO Agreement, which is filed as Exhibit 10.1 hereto, and incorporated herein by reference.

The

business experience of Mr. Keret is set forth below:

Yossi

Keret

- Since April 1, 2018, Mr. Keret has served as the Company’s Chief Financial Officer. From August 2015 to October

2017, Mr. Keret served as the Chief Executive Officer, Managing Director and as a Director of Weebit-Nano Ltd. (ASX:WBT). From

October 1996 to October 2015, Mr. Keret served as the Chief Financial Officer of numerous public and private companies, including

Eric Cohen Books Ltd. & Burlington English Ltd., Daimler Financial Services Israel Ltd., Pluristem Life Systems Inc. (NASDAQ:PST),

M.L.L Software and Computers Industries Ltd. (TASE:MLL), and Top Image Systems Ltd. (NASDAQ:TISA). Mr. Keret commenced his career

at Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young International. Mr.

Keret has served on the Board of Directors of Wize Pharma Inc. since November 2017. Mr. Keret holds a B.A. from Haifa University

in Economics and Accounting and is a Certified Public Accountant in Israel. Our Board of Directors believes Mr. Keret’s

qualifications to serve as our Chief Financial Officer include his extensive chief executive, chief financial executive and board

experience, and his expertise in reporting and finance-related activities for international operations.

Mr.

Keret has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation

S-K, has no family relationships required to be disclosed pursuant to Item 404(d) of Regulation S-K, and, except as otherwise

described herein, the Company has not entered into or adopted a material plan or arrangement to which such officer participates

or is a party.

Item

9.01

Financial

Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

BLUE

SPHERE CORPORATION

|

|

|

|

|

|

|

|

Date:

April 5, 2018

|

By:

|

/s/ Shlomi Palas

|

|

|

|

|

Shlomi

Palas

|

|

|

|

|

President

and Chief Executive Officer

|

|

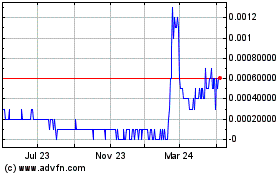

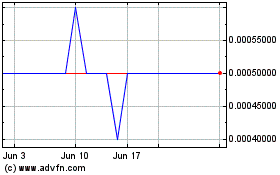

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Nov 2023 to Nov 2024