Bergio International Announces Year End Results

April 16 2014 - 9:00AM

Marketwired

Bergio International Announces Year End Results

FAIRFIELD, NJ--(Marketwired - Apr 16, 2014) - Bergio

International, Inc. (OTCQB: BRGO) ("Bergio" or the "Company")

announced today its results for the year ending December 31,

2013.

For the year ended December 31st, the Company reported revenues

of $1,999,496 as compared to $2,017,614 for the same period in the

prior year. Total liabilities at December 31st, 2013 were $666,420

as compared to $1,537,582 at December 31, 2012 as the Company has

been making a concerted effort to improve its balance sheet.

Stockholders' equity at December 31st, 2013 was $1,855,311 as

compared to $1,506,796 at December 31, 2012. The net loss for 2013

was $835,740 as compared to $388,434 for 2012.

Berge Abajian, CEO of Bergio International, stated, "The

increase in the loss is partially attributed to an increase in the

provision for bad debts associated with receivables from our

Russian customer and a few other customers. Management feels that

we have had slower than expected collections due to economic

conditions, but considering our past we feel confident that

collections will be made, but felt that it was prudent to recognize

a provision in our financial statements. Our gross margins were

lower than expected due to selling certain slow-moving inventory at

substantially discounted prices. I am personally satisfied that we

were to maintain sales at same level as the prior year given the

current economic conditions. I am also satisfied with decreasing

our liabilities by approximately $900,000 as well as increasing our

stockholder's equity by approximately 20% while keeping our asset

to liability ratio at 4:1, the highest in company history."

He continued, "The Company has been preparing for our major show

in Las Vegas, which will be from May 30th to June 2nd. We are

working diligently to establish relationships with major stores

that could expand the distribution and name recognition of Bergio

products."

He added, "As stated in previous press releases, we are

reevaluating every aspect of our business, such as reducing long

term investments in projects in exchange for those with more

immediate contribution to revenue and the bottom line. We also plan

to open our first Bergio retail store in the near future. We are

also in the final stages of continuing the process of securing

non-toxic financing."

We encourage everyone to read our full results of operations

contained in our Form 10-K filed on April 15th, 2014 at

sec.gov.

About Bergio International, Inc.

Bergio International, Inc. is a leading jeweler creating a

diversified jewelry designer and manufacturer through acquisitions

and consolidation in the estimated $160 billion a year highly

fragmented independently owned jewelry industry. Bergio currently

sells its jewelry to approximately 50 jewelry retailers across the

United States. Bergio has manufacturing control over its line

through its manufacturing facility in New Jersey, as well as

subcontracts with facilities in the United States and Italy.

The information contained herein includes forward-looking

statements. These statements relate to future events or to our

future financial performance, and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially

different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking

statements. You should not place undue reliance on forward-looking

statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

our control and which could, and likely will, materially affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects our current views with

respect to future events and is subject to these and other risks,

uncertainties and assumptions relating to our operations, results

of operations, growth strategy and liquidity. We assume no

obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results

could differ materially from those anticipated in these

forward-looking statements, even if new information becomes

available in the future.

Contact: Bergio International, Inc. Investor Relations

973-227-3230 Ext13 www.bergio.com

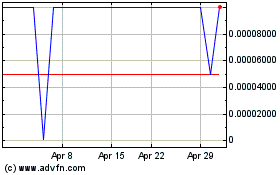

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Feb 2025 to Mar 2025

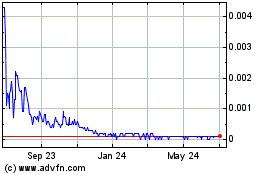

Bergio (PK) (USOTC:BRGO)

Historical Stock Chart

From Mar 2024 to Mar 2025