Statement of Changes in Beneficial Ownership (4)

August 06 2020 - 12:50PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Barbera Michael Vito |

2. Issuer Name and Ticker or Trading Symbol

BASANITE, INC.

[

BASA

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

1423 SW 13TH DRIVE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

7/21/2020 |

|

(Street)

BOCA RATON, FL 33486

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 7/21/2020 | | C(1) | | 400195 | A | $0.132 | 4909195 | D | |

| Common Stock | 7/21/2020 | | C(2) | | 195522 | A | $0.132 | 5104717 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Convertible Promissory Note | $0.132 | 7/21/2020 | | C (1) | | | 400195 | 6/6/2020 | 7/16/2020 | Common Stock | 400195 | $0.132 | 0 | D | |

| Convertible Promissory Note | $0.132 | 7/21/2020 | | C (2) | | | 195522 | 6/6/2020 | 10/13/2020 | Common Stock | 195522 | $0.132 | 0 | D | |

| Warrant | $0.396 | 7/21/2020 | | J (3) | | 400195 | | 7/21/2020 | 7/21/2025 | Common Stock | 400195 | $0 (3) | 400195 | D | |

| Warrant | $0.396 | 7/21/2020 | | J (4) | | 195522 | | 7/21/2020 | 7/21/2025 | Common Stock | 195522 | $0 (4) | 195522 | D | |

| Explanation of Responses: |

| (1) | On July 21, 2020, the Reporting Person converted a previously disclosed $50,000 12% Convertible Promissory Note (including $2,439.53 of accrued, unpaid interest) initially issued on January 16, 2020 (the "January Note") at a conversion price of $0.132. Pursuant to the terms of the January Note, the conversion price was calculated at 80% of the Issuer's closing trading price on June 5, 2020, which was $0.165. All such shares are "restricted securities" as defined by the Securities Act of 1933, as amended (the "Securities Act"). |

| (2) | On July 21, 2020, the Reporting Person converted a previously disclosed $25,000 12% Convertible Promissory Note (including $590.41 of accrued, unpaid interest) initially issued on April 13, 2020 (the "April Note") at a conversion price of $0.132. Pursuant to the terms of the April Note, the conversion price was calculated at 80% of the Issuer's closing trading price on June 5, 2020, which was $0.165. All such shares are "restricted securities" as defined by the Securities Act. |

| (3) | Pursuant to the terms of the January Note, as of the conversion date the Reporting Person was issued a five-year Warrant to Purchase Common Stock for up to 400,195 shares of the Issuer's common stock with an exercise price of $0.396, or three times the conversion price of the January Note. |

| (4) | Pursuant to the terms of the April Note, as of the conversion date the Reporting Person was issued a five-year Warrant to Purchase Common Stock for up to 195,522 shares of the Issuer's common stock with an exercise price of $0.396, or three times the conversion price of the April Note. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Barbera Michael Vito

1423 SW 13TH DRIVE

BOCA RATON, FL 33486 | X |

|

|

|

Signatures

|

| /s/ Michael Vito Barbera | | 8/6/2020 |

| **Signature of Reporting Person | Date |

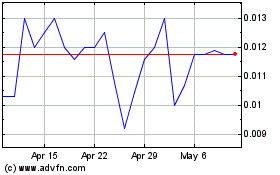

Basanite (QB) (USOTC:BASA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Basanite (QB) (USOTC:BASA)

Historical Stock Chart

From Sep 2023 to Sep 2024