BAE Systems Benefiting From Heightening Geopolitical Risk -- 2nd Update

November 13 2023 - 7:37AM

Dow Jones News

By Anthony O. Goriainoff and Mauro Orru

BAE Systems has been a top beneficiary alongside other European

arms manufacturers from the West's drive to arm Ukraine in the face

of Russia's invasion, and looks set to continue doing so as

governments spend more on military equipment.

Members of the North Atlantic Treaty Organization have been

shipping tanks, rocket launchers, air defenses, ammunition and

other military equipment to Ukraine, and are now seeking to

replenish their stockpiles through orders with defense

manufactures.

Some of its military equipment, such as the M777 howitzer, has

been widely used by Kyiv forces and, earlier this year, Ukraine

received Bradley fighting vehicles as well as Challenger 2 tanks.

BAE Systems said on Monday that it expects to report another year

of robust sales and earnings growth on the back of heightened

geopolitical risks.

Its shares rose as high as 1,116 pence in early trade, up from

the roughly 600 pence in the days prior to Russia's invasion of

Ukraine on Feb. 24 last year, giving it a current market value of

about 33.65 billion pounds ($41.14 billion), according to

FactSet.

The U.K. defense-and-aerospace group said order flow on both new

and existing programs remains strong, underpinning expectations for

good top-line growth in the coming years. Most major defense

programs were long term in the build and support phases, and as a

result of this the contracts it secures now will be executed over

many years, it said.

So far this year, the company has booked over GBP30 billion in

orders, including around $800 million for Bradley fighting vehicles

used by the U.S. Army as well as upgrades. Orders also include

around $500 million for the Archer artillery system from Sweden,

and $797 million to start full-rate production of the armored

multi-purpose vehicle--which includes prior funding for early order

materials--for the U.S. Army. It makes a range of military hardware

and software, mainly in the U.S. and U.K.

Like German peer Rheinmetall, BAE also backed its guidance for

2023. It expects sales this year to be 5% to 7% higher than the

GBP23.26 billion reported in 2022. Underlying earnings before

interest and taxes--the company's preferred profitability

metric--are seen 6% and 8% higher than the GBP2.48 billion achieved

a year earlier. Free cash flow is seen at more than GBP1.8 billion

from GBP1.95 billion in 2022.

Rheinmetall, meanwhile, targets sales in the 7.4 billion euros

and 7.6 billion euros ($7.91 billion and $8.12 billion) range, up

at least EUR1 billion from a year earlier.

At 1202 GMT, BAE shares were up 3.50 pence, or 0.3%, at 1,107

pence. The stock is up almost 30% since January.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com and Mauro Orru at

mauro.orru@wsj.com

(END) Dow Jones Newswires

November 13, 2023 07:22 ET (12:22 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

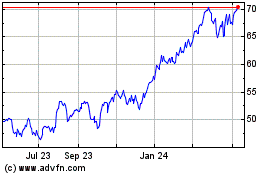

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Dec 2024 to Jan 2025

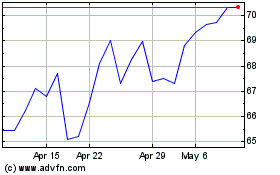

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Jan 2024 to Jan 2025