Aperam To Focus On Profitability, Not Volume - CEO

February 28 2012 - 10:19AM

Dow Jones News

Stainless-steel maker Aperam (056997440.LU) is focused on

improving profits rather than increasing volumes, as it aims to

convince investors it can become profitable independent of volatile

nickel prices, its new chief executive said Tuesday.

"In the current market environment, our strategy focuses on cost

reduction and product improvement and not on increasing production

capacity. I think this is the biggest difference with our

competitors," said Philippe Darmayan, who replaced Bernard Fontana

in December.

The European stainless steel market has been troubled by

overcapacity and fierce competition. However, the EUR2.7 billion

takeover of Inoxum, German steel company ThyssenKrupp's (TKA.XE)

stainless steel division, by Finnish Outokumpu (OUT1V.HE) helped

ease concerns.

The European market for stainless steel is now dominated by

three players--Outokumpu, Aperam and Spain's Acerinox (ACX.MC).

Aperam operates in more than 30 countries and has six main

plants located in France, Belgium and Brazil. The flat

stainless-steel capacity in Brazil and Europe is 2.5 million metric

tons. Last year, Aperam shipped a total 1.749 million tons and had

revenues of $6.3 billion.

"We felt that [Inoxum] didn't fit with our strategy of focusing

on cost control and reduction of overcapacity in order to become

profitable," Darmayan said, explaining why Aperam didn't mull a

deal.

But Darmayan expects Aperam to benefit from the merger, which

could help reduce overcapacity, adding however that any improvement

in Aperam's results depends more on its efforts to cut costs by

$350 million by 2013. In 2011, costs were reduced by $176

million.

Aperam, which listed in Amsterdam in January 2011 after being

spun-off by former parent ArcelorMittal (MT.AE), earlier this month

said it extended its net loss in the fourth quarter 2011 to $46

million, from $41 million in the third quarter. Sales fell to $1.44

billion from $1.52 billion.

The results were primarily affected by the decline in the price

of nickel, a key ingredient in making stainless steel. A fall in

the price of nickel makes stainless-steel buyers anticipate

consequent declines in the price of stainless steel, and so defer

purchases.

Nickel prices began to rise in December after declining in the

third and fourth quarters 2011, helping restore demand, Darmayan

said. He also said Aperam's available production capacity will be

fully used in March and April, but sustaining that would depend on

the nickel price.

The Luxembourg-based company is targeting a net profit for 2012,

but remains cautious as ongoing volatility makes it hard to predict

if it will meet its target.

Aperam was listed at EUR28 a share, but the price had dropped to

EUR10.90 at the end of 2011. Since then the stock recovered to

around EUR15, in part because of the merger between Outokumpu and

Inoxum.

Darmayan believes his company's stock is undervalued.

"With the consolidation we feel there is much more interest from

investors, but we have to make Aperam better known and show that we

can be profitable in the stainless steel market and are able to

withstand volatility in nickel prices," he said.

-By Levien de Feijter; Dow Jones Newswires; +31-20-5715200;

levien.defeijter@dowjones.com

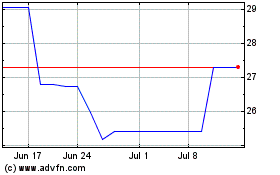

Aperam New York Registry (PK) (USOTC:APEMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

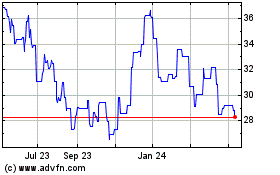

Aperam New York Registry (PK) (USOTC:APEMY)

Historical Stock Chart

From Dec 2023 to Dec 2024