UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14F-1

Information Statement Pursuant to

Section 14(f) of the Securities

Exchange Act of 1934 and Rule 14f-1 Thereunder

FREEBUTTON, INC.

(Exact name of registrant as specified

in its corporate charter)

000-54009

(Commission File No.)

|

Nevada

|

|

20-5982715

|

|

(State of Incorporation)

|

|

(IRS Employer Identification No.)

|

7040 Avenida Encinas

Suite 104-159

Carlsbad CA 92011

(Address of principal executive offices,

including zip code)

(760) 487-7772

(Registrant’s telephone number,

including area code)

FreeButton, Inc.

7040 Avenida Encinas

Suite 104-159

Carlsbad CA 92011

Information Statement Pursuant to

Section 14(f) of the Securities

Exchange Act of 1934 and Rule 14f-1 Thereunder

General

This Information Statement is being mailed to holders of record

of shares of common stock, par value $.001 per share (“Common Stock”) of FreeButton, Inc., a Nevada corporation (“Company,”

“we,” “us” or “our”), as of June 19, 2014, pursuant to the requirements of Section 14(f)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 14f-1 promulgated thereunder, in

connection with the acquisition by the Company (the “Transaction”) of substantially all of the shares of A1 Vapors,

Inc. (“A1 Vapors”), in exchange for the issuance to A1 Vapors of 21,000,000 shares of Common Stock. The Transaction

was effected pursuant to a Share Exchange Agreement (the “Share Exchange Agreement”) between the Company and A1 Vapors

which was executed on May 23, 2014 and closed on June 19, 2014. Following the Closing, there will be a change in the majority of

the Company’s Board of Directors.

Specifically, James Lynch and Dallas Steinberger will resign

as our directors. Effective upon the resignations of Mr. Lynch and Mr. Steinberger, Bruce Storrs, Andy Diaz, Moses Lopez

and Michelle Evangelista will be appointed as members of our Board of Directors (collectively, the “Incoming Directors”).

In addition, James Lynch resigned his position as Chief Executive Officer and Chief Financial Officer, and Dallas Steinberger resigned

his positions as Chief Operating Officer, President and Secretary.

This Information Statement is being mailed on or about June

26, 2014 to all holders of record on such date. A stockholder vote is not required and will not be taken with respect to the appointment

of the Incoming Directors. You are not required to take any action with respect to the appointment of the Incoming Directors.

As of June 19, 2014, there were 33,844,260 shares of Common

Stock issued and outstanding.

We Are Not Asking You For a Proxy and

You Are Requested Not to Send Us a Proxy

This Information Statement is required by section 14(f) of

the Exchange Act and Rule 14f-1 thereunder as a result of the appointment of new directors in connection with the Transaction.

No action is required by stockholders in connection with the resignation and appointment of any director.

Change in Control

On June 19, 2014, pursuant to the Transaction, A1 Vapors became

the owner of approximately 62.05% of the Company’s outstanding Common Stock on a fully diluted basis. The Company acquired

all of A1 Vapors stock in exchange for 21,000,000 shares of the Company’s Common Stock.

As the owners of approximately 62.05% of the Company’s

outstanding shares of Common Stock, the owners of A1 Vapors have the ability to elect all of the members of the Company’s

Board of Directors (the “Board”), and through such directors control the appointment of the Company’s officers.

Immediately upon the Closing, all of the Company’s executive officers resigned and were replaced with officers named by A1

Vapors. In addition, ten days following the mailing of this Schedule 14f-1, all of the Company’s current directors will

appoint designees chosen by A1 Vapors as new directors and then all of the current directors will resign, so that the designees

chosen by A1 Vapors will constitute the entire Board. The names and biographical information of the new directors and executive

officers are set forth in this document under the heading “Directors and Executive Officers.”

A1 Vapors is a product development and marketing company catering

to the electronic vapor cigarette and accessories industry. A1 Vapors offers a variety of options to choose from to appeal to all

smokers including a diverse selection of devices and flavors. The company currently owns and operates 4 retail locations, its’

ecommerce global website, and distribution licenses with accessory manufacturers.

Security Ownership of Certain Beneficial

Owners and Management

The following table sets forth information regarding the beneficial

ownership of the shares of Common Stock as of June 19, 2014, immediately prior to the Closing, based on 33,844,260 shares outstanding

by each current director and executive officer of the Company and each person nominated to become a director following the Transaction;

all current executive officers and directors of the Company as a group (including the post-Transaction chart, only the director

nominee and not the current directors); and each person known by the Company to own beneficially more than 5% of the outstanding

shares of Common Stock.

Beneficial ownership has been determined in accordance with

applicable SEC rules, under which a person is deemed to be the beneficial owner of securities if he or she has or shares voting

power or investment power with respect to such securities or has the right to acquire beneficial ownership within 60 days.

|

Before the Closing of the Transaction

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner (1)

|

|

|

Shares Owned

|

|

|

|

Percentage of Class

|

|

|

James Lynch, CEO

|

|

|

10,800,000

|

|

|

|

31.9%

|

|

|

Dallas Steinberger, COO

|

|

|

10,800,000

|

|

|

|

31.9%

|

|

|

Officers and Directors:

|

|

|

|

|

|

|

|

|

|

James Lynch, Chairman of Board and CEO

|

|

|

10,500,000

|

|

|

|

31.9%

|

|

|

Dallas Steinberger, Director and COO

|

|

|

10,500,000

|

|

|

|

31.9%

|

|

|

Total of all Officers and Directors

|

|

|

21,000,000

|

|

|

|

63.8%

|

|

|

|

(1)

|

Unless otherwise indicated, the mailing address of the beneficial owner is FreeButton, Inc. 7040 Avenida Encinas, Suite 104-159,

Carlsbad, CA 92011.

|

Following the Closing of the Transaction

|

Name and Address of Beneficial Owner (1)

|

|

Shares Owned

|

|

|

Percentage of Class

|

|

|

OK LLC(2)

|

|

|

10,500,000

|

|

|

|

31.0%

|

|

|

Andy Diaz

|

|

|

10,500,000

|

|

|

|

31.0%

|

|

|

Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Bruce Storrs(2), Chairman and CEO

|

|

|

10,500,000.00

|

|

|

|

31.0%

|

|

|

Andy Diaz, Director

|

|

|

10,500,000.00

|

|

|

|

31.0%

|

|

|

Moses Lopez

|

|

|

–

|

|

|

|

0.0%

|

|

|

Michelle Evangelista

|

|

|

–

|

|

|

|

0.0%

|

|

|

Total of all Officers and Directors

|

|

|

21,000,000.00

|

|

|

|

62.0%

|

|

|

|

(1)

|

Unless otherwise indicated, the mailing address of the beneficial owner is FreeButton, Inc. 7040

Avenida Encinas, Suite 104-159, Carlsbad, CA 92011.

|

|

|

(2)

|

10,500,000 shares held beneficially by Bruce Storrs.

|

Directors and Executive Officers

Identification of Directors and Executive Officers

Presently, two directors serve on the Board.

Pursuant to the terms of the Transaction, Mr. Lynch and Mr. Steinberger have resigned as directors of the Company effective

on the tenth day following the mailing of this Information Statement to the stockholders of the Company. Pursuant to the terms

of the Transaction, the Board is to consist of five directors. The resignation of the Company’s current directors and appointment

of the Incoming Directors will not occur until ten days after the date on which this Information Statement is filed with the SEC

and mailed to all holders of record of Common Stock of the Company as required by Rule 14f-1 of the Exchange Act.

Prior to the Transaction

The Company’s executive officers and directors prior to

the Transaction were:

|

Name

|

Age

|

Position

|

|

James Lynch

|

46

|

Chairman, CEO and CFO

|

|

Dallas Steinberger

|

29

|

COO and Director

|

James Lynch

. Mr. Lynch has

served as the Company’s Chairman of the Board and CEO since April 2, 2012. He relinquished the duties as CEO and CFO of the

Company in June 2014, upon the appointment of Mr. Storrs (see below). Mr. Lynch has 17 years business and managerial experience

in advertising and media industry. In November 2009, James launched a boutique sales & consulting firm, Media Rhythm, representing

various media properties including over 30 magazines (Surfer, Motor Trend, Surfing, Automobile, Hot Rod, Powder, Snowboarder, Alert

Diver, Shutterbug, just to name a few), 30 websites, and 20 sponsor-able events. This firm also operates as an apparel sales rep

firm and consulting group. In the past 13 years, Mr. Lynch also served as the Vice President of national sales at Action Sports

Group, managing 7 Magazines, 12 websites, 14 events, and multiple employees. He has seen years of success creating and implementing

integrated advertising & marketing programs in Online, Print, and Event Media Properties.

Dallas Steinberger

. Mr. Steinberger

has served as the Company’s COO and Director since April 2, 2012. He relinquished the duties as COO and Director of the Company

in June 2014, upon the appointment of Mr. Diaz (see below). Mr. Steinberger has been involved in online business for the last ten

years, from online brand development, marketing and social networking to coding, design and implementation of multiple sites. He

has been an independent web design studio owner and managed the online presence for Action Sports Group, a major publisher of action

sports magazines. From 2008 to 2011 while working at Action Sports Group as the Senior Web Producer, he managed the content creation

and online publishing schedule for ten magazine sites including Surfermag.com, Powdermag.com and Bikemag.com.

Following the Transaction

The Company’s executive officers following the Closing

and directors (who will be appointed once the Waiting Period required by the Exchange Act has expired) are and will be:

|

Name

|

Age

|

Position

|

|

Bruce Storrs

|

55

|

Chairman and CEO

|

|

Andy Diaz

|

45

|

COO and Director

|

|

Moses Lopez

|

23

|

Director

|

|

Michele Evangelista

|

50

|

Director

|

Bruce Storrs.

Mr. Storrs was appointed Chief Executive

Officer of the Company effective as of the Closing. Mr. Storrs founded Advanced Scientific in 1985, which focused on selling medical,

hospital and pharmaceutical supplies to medical centers and military hospital and was sold in 1994. Between 1994 and 2002, he started

2 additional companies, Cyprus Resources and Capital Health, which were subsequently sold. Since 2002 he worked a consultant and

investor to companies in the Health & Wellness industry as well as founding Better Bodies by Chemistry, which manufactures

and distributes vitamins and supplements. He is also co-founder of Pacific Rim Distributors, a retail and wholesale company selling

and distributing medical, health and beauty products. In December, 2012, Mr. Storrs invested in A1 Vapors and joined as an advisor

to the company, and subsequently appointed as CEO to the Company in June, 2014. Mr. Storrs holds a BSBM with Wilmington National

University and has attended San Diego State University.

Andy Diaz.

Mr. Diaz was appointed as Chief Operating

Officer of the Company as of the Closing. In 2005, Mr. Diaz founded A1A Sod, Sand & Soil, Inc., growing the business from 1

to 25 employees and winning contracts with the City of Miami and the state of Florida, generating in excess of $2 million for 2013.

In 2012, Mr. Diaz co-founded A1 Vapors, opening its first retail location in Doral, Florida, and expanding to two additional retail

locations, in addition to online operations.

Moses Lopez

. Mr. Lopez will serve as Director

of the Company. Since 2002, Mr. Lopez has served in a senior sales capacity at V2 Cigs. In 2012, Mr. Lopez co-founded A1 Vapors,

and was instrumental in the initial quality control and research activities as well as establishing the Company’s online

operations. Mr. Lopez graduated from Ferguson High School.

Michele Evangelista

. Michele Evangelista will

serve as Director of the Company. Since 2012 Ms. Evangelista has served as a Medical Sales rep for Advanced Scientific Supply.

Ms. Evangelista holds a B.S. from Iona College.

Terms of Office

The Company’s proposed directors will be appointed for

a one-year term to hold officer until the next annual general meeting of the Company’s shareholders or until removed from

office in accordance with the Company’s Bylaws (“Bylaws”) and the provisions of the Nevada Revised Statutes.

The Company’s directors hold office after the expiration of his or her term until his or her successor is elected and qualified,

or until he or she resigns or are removed in accordance with the Company’s Bylaws and provisions of eh Nevada Revised Statutes.

The Company’s incoming officers will be appointed by the

Company’s Board of Directors and will hold office until removed by the Board of Directors in accordance with the Company’s

Bylaws and the provisions of the Nevada Revised Statutes.

Certain Relationships and Transactions

There are no family relationships between any of our current

directors or executive officers and the proposed Incoming Directors and Incoming Officers.

The following sets forth a summary of transactions since the

beginning of the fiscal year of 2013, or any currently proposed transaction, in which the Company was to be a participant and the

amount involved exceeded or exceeds the lesser of $120,000 or one percent of the average of the Company’s total assets at

year end for the last two completed fiscal years and in which any related person had or will have a direct or indirect material

interest (other than compensation described under “Executive Compensation” above). We believe the terms obtained or

consideration that we paid or received, as applicable, in connection with the transactions described below were comparable to terms

available or the amounts that would be paid or received, as applicable, in arm’s-length transactions.

|

|

—

|

As previously disclosed in our Current Reports on Form 8-K filed with the Commission on August 1, 2013 and March 28, 2014, respectively, on July 11, 2013, the Company entered into an Assets and Business Acquisition Agreement with Media Rhythm to acquire all of the assets in connection with the business of Media Rhythm and, subsequently, on March 5, 2014, the Company and Media Rhythm entered into the Second Agreement, whereby the Company sold, transferred and assigned to Media Rhythm all of the Media Assets.

|

|

|

—

|

At December 31, 2012, loan from our director and President, Chief Executive Officer, Secretary, James Edward Lynch, Jr., to the Company, amounted to $4,072. The loan is unsecured and non- interest-bearing with no set terms of repayment.

|

|

|

—

|

On June 26, 2012, our former President, Chief Financial Officer, Secretary and Treasurer, Anthony Pizzacalla, forgave the debts owed to him by the Company in an amount of $54,742.

|

|

|

|

|

|

|

|

Bruce Storrs and Moses Lopez, two of the proposed

Incoming Directors and Incoming Officers, are currently officers and directors of A1 Vapors. Andy Diaz, a proposed Incoming Officer,

is currently an officer of A1 Vapors.

|

In accordance with the Share Exchange Agreement, the A1 Vapor

Shareholders shall receive no less than 56.9% of the issued and outstanding Common Stock of the Company. Messrs. Storrs and Diaz

are expected to receive certain shares of Common Stock of the Company in the future after the Closing.

Other than the transactions, including the Share Exchange Agreement,

noted above, there are no transactions, since the beginning of the Company’s last fiscal year, or any currently proposed

transaction, in which the Company was or is to be a participant and the amount involved exceeds the lesser of $120,000 or one percent

of the average of the Company’s total assets at year-end for the last three completed fiscal years, and in which any of the

current directors or officers or the incoming directors and officers had or will have a direct or material interest. There is no

material plan, contract or arrangement (whether or not written) to which any of the current directors or officers or the incoming

directors and officers is a party or in which they participate that is entered into or material amendment in connection with our

appointment of any of the current directors or officers or the incoming directors or officers or modification thereto, under any

such plan, contract or arrangement in connection with our appointment of any of the current directors or officers or the incoming

directors and officers.

Review, Approval or Ratification of Transactions

with Related Persons

Although we have adopted a Code of Ethics, we still rely on

our Board to review related party transactions on an ongoing basis to prevent conflicts of interest. Our Board reviews a transaction

in light of the affiliations of the director, officer, or employee and the affiliations of such person’s immediate family.

Transactions are presented to our Board for approval before they are entered into or, if that is not possible, for ratification

after the transaction has occurred. If our Board finds that a conflict of interest exists, then it will determine the appropriate

remedial action, if any. Our Board approves or ratifies a transaction if it determines that the transaction is consistent with

the best interests of the Company.

Director Independence

During the fiscal year ended December 31, 2013, we did not have

any independent directors on our Board of Directors. Of our proposed Incoming Directors, only Ms. Evangelista is expected to be

independent. We evaluate independence by the standards for director independence established by applicable laws, rules and listing

standards including without limitation, the standards for independent directors established by the New York Stock Exchange, Inc.,

the NASDAQ National Market and the SEC.

Subject to some exceptions, these standards generally provide

that a director will not be independent if (a) the director is, or in the past three years has been, an employee of ours; (b) a

member of the director’s immediate family is, or in the past three years has been, an executive officer of ours; (c) the

director or a member of the director’s immediate family has received more than $120,000 per year in direct compensation from

us other than for service as a director (or for a family member, as a non-executive employee); (d) the director or a member of

the director’s immediate family is, or in the past three years has been, employed in a professional capacity by our independent

public accountants, or has worked for such firm in any capacity on our audit; (e) the director or a member of the director’s

immediate family is, or in the past three years has been, employed as an executive officer of a company where one of our executive

officers serves on the compensation committee; or (f) the director or a member of the director’s immediate family is an executive

officer of a company that makes payments to, or receives payments from, us in an amount which, in any twelve-month period during

the past three years, exceeds the greater of $1,000,000 or two percent of that other company’s consolidated gross revenues.

Involvement in Certain Legal Proceedings

Our current directors and executive officers and our incoming

directors and officers have not been involved in any of the following events during the past ten years:

|

|

1.

|

A petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

|

|

|

2.

|

Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

3.

|

Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

|

|

|

a.

|

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or

as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

|

|

|

b.

|

Engaging in any type of business practice; or

|

|

|

c

.

|

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws

|

|

|

4.

|

Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

|

|

|

5.

|

Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

|

|

|

6.

|

Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

|

|

|

7

.

|

Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

|

|

|

a

|

Any Federal or State securities or commodities law or regulation; or

|

|

|

b

|

Any law or regulation respecting financial institutions or insurance companies including, but are not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order or

|

|

|

c

|

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

8.

|

Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Meetings and Committees of the Board

Our Board of Directors held four formal meetings during the

fiscal year ended December 31, 2013. All proceedings of the Board of Directors were conducted by resolutions consented to in writing

by the directors and filed with the minutes of the proceedings of the directors. Such resolutions consented to in writing by the

directors entitled to vote on that resolution at a meeting of the directors are, according to the Nevada Revised Statutes and the

Bylaws of our Company, as valid and effective as if they had been passed at a meeting of the directors duly called and held. We

do not presently have a policy regarding director attendance at meetings.

We do not currently have standing audit, nominating or compensation

committees, or committees performing similar functions. Due to the size of our Board, our Board of Directors believes that it is

not necessary to have standing audit, nominating or compensation committees at this time because the functions of such committees

are adequately performed by our Board of Directors. We do not have an audit, nominating or compensation committee charter as we

do not currently have such committees. We do not have a policy for electing members to the Board.

After the change in the Board of Directors, it is anticipated

that the Board of Directors will form separate compensation, nominating and audit committees, with the audit committee including

an audit committee financial expert.

Audit Committee

Our Board of Directors has not established a separate audit

committee within the meaning of Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Instead, the entire Board of Directors acts as the audit committee within the meaning of Section 3(a)(58)(B) of the Exchange Act

and will continue to do so upon the appointment of the proposed directors until such time as a separate audit committee has been

established.

Section 16(a) Beneficial Ownership Reporting

Compliance

Section 16(a) of the Exchange Act requires our directors, executive

officers, and shareholders holding more than 10% of our outstanding Common Stock to file with the SEC initial reports of ownership

and reports of changes in beneficial ownership of our Common Stock. Executive officers, directors, and persons who own more than

10% of our Common Stock are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

Based solely upon a review of Forms 3, 4, and 5 delivered to

us as filed with the SEC during our most recent fiscal year, none of our executive officers and directors, and persons who own

more than 10% of our Common Stock failed to timely file the reports required pursuant to Section 16(a) of the Exchange Act.

Family Relationships

There are no family relationships between or among the directors,

executive officers or persons nominated or chosen by us to become directors or executive officers.

Nominations to the Board of Directors

Our directors take a critical role in guiding our strategic

direction and oversee the management of the Company. Board of Director candidates are considered based upon various criteria, such

as their broad-based business and professional skills and experiences, a global business and social perspective, concern for the

long-term interests of the shareholders, diversity, and personal integrity and judgment. While we seek a diversity of experience,

viewpoints and backgrounds on the Board, we have not established a formal policy regarding diversity in identifying directors.

In addition, directors must have time available to devote to

Board activities and to enhance their knowledge in the growing business. Accordingly, we seek to attract and retain highly qualified

directors who have sufficient time to attend to their substantial duties and responsibilities to the Company.

In carrying out its responsibilities, the Board of Directors

will consider candidates suggested by shareholders. If a shareholder wishes to formally place a candidate’s name in nomination,

however, such shareholder must do so in accordance with the provisions of the Company’s Bylaws. Suggestions for candidates

to be evaluated by the proposed directors must be sent to the Board of Directors, c/o FreeButton, 7040 Avenida Encinas, Suite 104-159,

Carlsbad CA 92011. The Board has determined not to adopt a formal methodology for communications from shareholders.

Board Leadership Structure and Role on

Risk Oversight

Mr. James Lynch currently serves as the Company’s Chief

Executive Officer, President and a Director. In accordance with the proposed Exchange, Mr. Storrs will serve as our Chief Executive

Officer and Chairman. The proposed Incoming Directors will continue to evaluate the Company’s leadership structure and modify

such structure as appropriate based on the size, resources, and operations of the Company.

Subsequent to the Closing, it is anticipated that the Board

of Directors will establish procedures to determine an appropriate role for the Board of Directors in the Company’s risk

oversight function. Our Board of Directors are exclusively involved in the general oversight of risks that could affect our Company.

Board Compensation

We have no standard arrangement to compensate directors for

their services in their capacity as directors. Directors are not paid for meetings attended. All travel and lodging expenses associated

with corporate matters are reimbursed by us, if and when incurred.

Executive Compensation

The following is a summary of the compensation table sets forth

all compensation awarded to, earned by, or paid to the named executive officers during the years ended December 31, 2013 and 2012.

Summary Compensation of Named Executive

Officers

|

Name and Principal Position

|

|

Fiscal Year

|

|

Salary ($)

|

|

|

Bonus ($)

|

|

|

Stock Awards

($)

|

|

|

Option Awards

($)

|

|

|

All Other Compensation ($)

|

|

|

Total

($)

|

|

|

James Edward Lynch, Jr.

|

|

2013

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

96,000

|

(3)

|

|

|

96,000

|

|

|

President, Chief Executive Officer, Secretary

|

|

2012(1)

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

25,000

|

(3)

|

|

|

25,000

|

|

|

Dallas James Steinberger

|

|

2013

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

36,500

|

(4)

|

|

|

36,500

|

|

|

Chief Operating Officer, Vice President and Treasurer

|

|

2012(2)

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

20,000

|

(4)

|

|

|

20,000

|

|

|

Anthony Pizzacalla(5)

|

|

2013

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Former President, Chief Financial Officer, Secretary and Treasurer

|

|

2012

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

(1)

|

Represents Mr. Lynch’s compensation from August 2, 2012 through December 31, 2012.

|

|

|

(2)

|

Represents Mr. Steinberger’s compensation from August 2, 2012 through December 31, 2012.

|

|

|

(3)

|

Represents management fee paid to Mr. Lynch.

|

|

|

(4)

|

Represents management fee paid to Mr. Steinberger.

|

|

|

(5)

|

Mr. Pizzacalla served as our President, Chief Financial Officer, Secretary and Treasurer since inception and resigned as from such position on August 2, 2012 upon the closing of the change of control as further described in Item 1 of this Annual Report on Form 10-K. Mr. Pizzacalla’s resignation was not a result of any disagreement with the Company on any matters relating to the Company’s operations, policies (including accounting or financial policies) or practices.

|

Outstanding Equity Awards at Fiscal Year

End

None of our executive officers received any equity awards, including,

options, restricted stock, performance awards or other equity incentives during the fiscal year ended December 31, 2013 and 2012.

Compensation of Directors

During the fiscal years ended December 31, 2013 and 2012, the

former sole director Anthony Pizzacalla and the current directors James Edward Lynch, Jr. and Dallas James Steinberger did not

receive any compensation solely for services as a director.

Our directors James Edward Lynch, Jr. and Dallas James Steinberger

did not receive any compensation solely for services as a director. It is our current policy that our directors are reimbursed

for reasonable out-of-pocket expenses incurred in attending each board of directors meeting or meeting of a committee of the board

of directors.

Compensation Committee Interlocks and

Insider Participation

During fiscal years 2013 and 2012, we did not have a standing

compensation committee. Our Board was responsible for the functions that would otherwise be handled by the compensation committee.

Our two sole directors conducted deliberations concerning executive officer compensation, including directors who were also executive

officers.

Security Ownership of Principal Shareholders,

Directors, and Officers

The following table sets forth certain information with respect

to the beneficial ownership of our voting securities by (i) each director and named executive officer, (ii) all executive officers

and directors as a group; and (iii) each shareholder known to be the beneficial owner of 5% or more of the outstanding common stock

of the Company as of April 11, 2014.

Beneficial ownership is determined in accordance with the rules

of the SEC. Generally, a person is considered to beneficially own securities: (i) over which such person, directly or indirectly,

exercises sole or shared voting or investment power, and (ii) of which such person has the right to acquire beneficial ownership

at any time within 60 days (such as through exercise of stock options or warrants). For purposes of computing the percentage of

outstanding shares held by each person or group of persons, any shares that such person or persons has the right to acquire within

60 days of June 19, 2014 are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the percentage

ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission

of beneficial ownership. Unless otherwise indicated below, the address of each person listed in the table below is c/o FreeButton,

Inc., 7040 Avenida Encinas, Suite 104-159, Carlsbad, CA 92011.

The following sets forth the proposed beneficial ownership information

before and after the closing of the Exchange Transaction:

Before the Closing of the Transaction

|

Name and Address of Beneficial Owner (1)

|

|

Shares Owned

|

|

|

Percentage of Class

|

|

|

James Lynch, CEO

|

|

|

10,800,000

|

|

|

|

31.9%

|

|

|

Dallas Steinberger, COO

|

|

|

10,800,000

|

|

|

|

31.9%

|

|

|

Officers and Directors:

|

|

|

|

|

|

|

|

|

|

James Lynch, Chairman of Board and CEO

|

|

|

10,500,000

|

|

|

|

31.9%

|

|

|

Dallas Steinberger, Director and COO

|

|

|

10,500,000

|

|

|

|

31.9%

|

|

|

Total of all Officers and Directors

|

|

|

21,000,000

|

|

|

|

63.8%

|

|

|

|

(1)

|

Based on 33,844,260 shares of common stock issued and outstanding as of June 19, 2014.

|

Following the Closing of the Transaction

|

Name and Address of Beneficial Owner (1)

|

|

Shares Owned

|

|

|

Percentage of Class

|

|

|

OK LLC(2)

|

|

|

10,500,000

|

|

|

|

31.0%

|

|

|

Andy Diaz

|

|

|

10,500,000

|

|

|

|

31.0%

|

|

|

Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Bruce Storrs(2), Chairman and CEO

|

|

|

10,500,000.00

|

|

|

|

31.0%

|

|

|

Andy Diaz, Director

|

|

|

10,500,000.00

|

|

|

|

31.0%

|

|

|

Moses Lopez

|

|

|

–

|

|

|

|

0.0%

|

|

|

Michelle Evangelista

|

|

|

–

|

|

|

|

0.0%

|

|

|

Total of all Officers and Directors

|

|

|

21,000,000.00

|

|

|

|

62.0%

|

|

|

|

(1)

|

Based on 33,844,260 shares of common stock issued and outstanding as of June 19, 2014.

|

|

|

(2)

|

10,500,000 shares held beneficially by Bruce Storrs.

|

Other Information

We file periodic reports, proxy statements, and other documents

with the SEC. You may obtain a copy of these reports by accessing the SEC’s website at http://www.sec.gov. You may also send

communications to the Board of Directors at 7040 Avenida Encinas, Suite 104-159, Carlsbad, CA 92011.

Signatures

Pursuant to the requirements of Section 13 or 15(d) of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Carlsbad, State of Florida on June 19, 2014.

|

|

FREEBUTTON, INC.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ James Lynch

|

|

|

|

James Lynch, CEO and Chairman

|

|

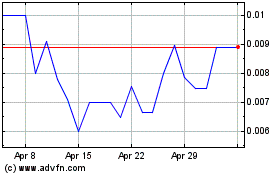

A 1 (PK) (USOTC:AWON)

Historical Stock Chart

From Apr 2024 to May 2024

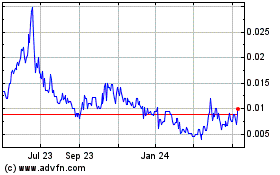

A 1 (PK) (USOTC:AWON)

Historical Stock Chart

From May 2023 to May 2024