Zenyatta Ventures Contracts Industrial Minerals & Graphite Specialist; Provides Progress Update on Albany Graphite Deposit

September 05 2012 - 10:30AM

Marketwired Canada

Zenyatta Ventures Ltd. ("Zenyatta" or "Company") (TSX VENTURE:ZEN) is pleased to

announce the contracting of industrial minerals specialist, Don Hains of Hains

Technology Associates and provide an update on developments at the Albany

Graphite Deposit.

Don Hains, P.Geo., MBA is an industrial minerals and marketing specialist with

more than 30 years of experience in development, use and analysis of industrial

minerals, including graphite. He has held product research and business

development responsibilities with Fiberglas Canada Inc. and Domtar Construction

Materials, and has been consulting in the field of industrial minerals, markets

and economics for the past 25 years. Assignments have ranged from valuation

reports to feasibility and market studies.

Mr. Hains obtained a Chemistry degree from Queen's University and an MBA in

Finance and Marketing from Dalhousie University. In addition to his own

practice, Don acts as the industrial minerals specialist for several major

consulting firms in Canada and is a frequent speaker at major industrial mineral

conferences, having presented papers on several different commodities.

Aubrey Eveleigh, President and CEO stated "We are very pleased to add an

individual of Don Hains' caliber to lead us toward a Preliminary Economic

Assessment of the Albany graphite deposit. A management team with strong

graphite experience is obviously a necessity for success. Don is an expert in

the analysis of geology, markets and economics for industrial minerals. He has

conducted studies on a wide range of industrial minerals projects in Canada,

United States, Europe, Africa and Asia. He is very familiar with trends in end

use technologies for major industrial minerals, including graphite, and in

process technologies for beneficiation of industrial minerals."

Metallurgical test work of the Albany graphite material at SGS Lakefield has

identified a simple (1 step) concentration process and on-going work is focused

on preparing a high purity (greater than 99.0% C) graphite product through acid

leaching. Also, positive mineralogical work shows the graphite material to be

very simple and contains insignificant amounts of sulphide and other undesirable

minerals. A further metallurgical update may be available at the end of the

month.

Aubrey Eveleigh stated "Creating a pure graphite product is about removing the

impurities or undesirable minerals. If you start with simple mineralogy, this

can be achieved much easier and less costly. Process and product development

efforts under Don Hains will focus on producing micronized, ultra-high purity

products to compete in the $13 billion synthetic graphite market."

Synthetic graphite is significantly more expensive to make but commands the

highest market prices. It can cost $3000 - $5000 per tonne (99.5% purity) to

produce but can be sold for $7000 - $9000 per tonne. Ultra-high purity (99.9%)

graphite can demand a price of $25,000 - $30,000 per tonne. Processing and

purification of natural graphite has improved greatly in recent years and

projects with initial high purity graphite, like vein-type, should require less

purification and therefore be lower cost to produce. With these advancements,

the overlap between synthetic and natural graphite applications is expected to

grow and make natural graphite more adaptable to specific new industry

requirements.

Presently, synthetic graphite is the material of choice for most traditional

uses and, more importantly, for growing applications such as Li-ion batteries,

pebble bed reactors, vanadium-redox batteries and fuel cells due to the high

purity and consistent graphite needed.

The Albany (vein-type) graphite deposit is located 30km north of the Trans

Canada Highway, power line and natural gas pipeline. A rail line is located 70km

away and an all-weather road approximately 4-5km from the graphite deposit. The

Albany deposit is near surface, underneath glacial till overburden.

Mr. Aubrey Eveleigh, P.Geo., President and CEO, is the "Qualified Person" under

NI 43-101 and has reviewed the technical information contained in this news

release.

This News Release includes certain "forward-looking statements". These

statements are based on information currently available to the Company and the

Company provides no assurance that actual results will meet management's

expectations. Forward-looking statements include estimates and statements that

describe the Company's future plans, objectives or goals, including words to the

effect that the Company or management expects a stated condition or result to

occur. Forward-looking statements may be identified by such terms as "believes",

"anticipates", "expects", "estimates", "may", "could", "would", "will", "should"

or "plan". Since forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve inherent risks

and uncertainties. Actual results relating to, among other things, results of

exploration, project development, reclamation and capital costs of the Company's

mineral properties, and the Company's financial condition and prospects, could

differ materially from those currently anticipated in such statements for many

reasons such as: changes in general economic conditions and conditions in the

financial markets; changes in demand and prices for minerals; litigation,

legislative, environmental and other judicial, regulatory, political and

competitive developments; technological and operational difficulties encountered

in connection with the activities of the Company; and other matters discussed in

this news release. This list is not exhaustive of the factors that may affect

any of the Company's forward-looking statements. These and other factors should

be considered carefully and readers should not place undue reliance on the

Company's forward-looking statements. The Company does not undertake to update

any forward-looking statement that may be made from time to time by the Company

or on its behalf, except in accordance with applicable securities laws.

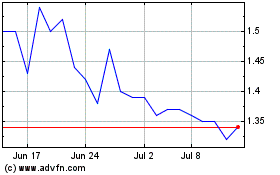

Zentek (TSXV:ZEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

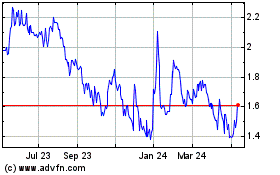

Zentek (TSXV:ZEN)

Historical Stock Chart

From Jul 2023 to Jul 2024